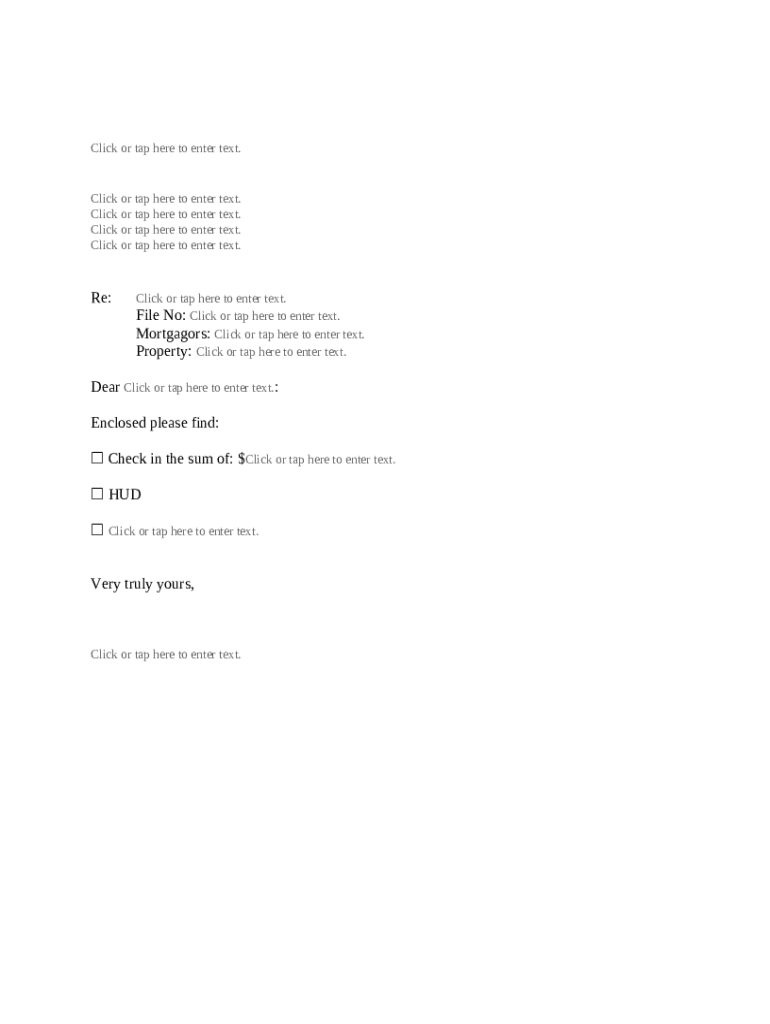

Get the free Letter: Mortgage Broker Payment template

Show details

A letter for Mortgage Broker Fee Payment. The letter may be customized to suit your needs.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter mortgage broker payment

A letter mortgage broker payment is a formal communication outlining the fees and commission owed to a mortgage broker for their services in securing a mortgage.

pdfFiller scores top ratings on review platforms

For our small office, this has been a great product with a professional support system.

I like the easy of signing contracts and tax forms easily as I am a contract worker.

Wonderful Program and People to work with

new to service so for i have been pleased with PDFfiller looking forward to using in the future

Has many great tools, but a little difficult to navigate, not clear instructions. I am sure I am not utilizing half of the features, it is trial and effort, not all successes, but slowly figuring things out.

Very quick response from customer support.

Who needs letter mortgage broker payment?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Using the Letter Mortgage Broker Payment Form

How to fill out a letter mortgage broker payment form

Using a letter mortgage broker payment form may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Start by accessing the form, understanding its components, filling out the necessary information, and ensuring compliance with local regulations to streamline your mortgage experience.

Understanding the letter mortgage broker payment form

A letter mortgage broker payment form is an essential document in the mortgage application process. It acts as a formal request regarding mortgage payments made through a broker, ensuring all parties are aligned on financial agreements. Key components include borrower information, payment amounts, and terms agreed upon, providing clarity and legal grounding for both lenders and borrowers.

Why is the letter mortgage broker payment form important?

This form is vital in ensuring transparency in mortgage transactions. By documenting payment agreements, it minimizes misunderstandings and errors between involved parties, thus preventing potential legal disputes. Additionally, it helps to streamline communication during the mortgage process.

Key components of the form

-

Name, contact information, and other personal identifiers are crucial for record-keeping.

-

Details about the mortgage broker, including licensing information and contact details.

-

Vital information regarding the property being financed, including address and value.

-

Clearly defined payment amounts, due dates, and any late fee policies.

How to access and edit your form via pdfFiller

pdfFiller provides an easy platform to access and edit your letter mortgage broker payment form. Users can seamlessly navigate to the relevant documents with just a few clicks, utilizing the platform’s interactive tools for an efficient experience.

Step-by-step guide to accessing the form on pdfFiller

-

Create an account or log in to your existing pdfFiller account.

-

Utilize the search bar to locate the letter mortgage broker payment form quickly.

-

Once located, click on the form to begin editing.

Exploring editing functionalities provided by pdfFiller

pdfFiller’s editing functionalities allow users to modify text, add fields, and include signatures where necessary. This flexibility enables users to customize their letter mortgage broker payment forms to fit personal needs and ensure all required information is clearly presented.

Features for seamless form management

-

Users can securely sign the form and secure the integrity of the document.

-

Share documents with others for feedback or joint completion, thus enhancing teamwork.

-

Manage your documents from anywhere, ensuring easy access and retrieval.

Filling out the letter mortgage broker payment form: a detailed walkthrough

Filling out the letter mortgage broker payment form accurately is critical for a successful transaction. Users must identify required fields and fill them in meticulously to reduce the risk of delays or rejections.

Identifying required fields

-

Full names and contact information of all parties involved are necessary to process the request.

-

Accurate property address and identification to ensure the correct property is referenced.

Tips for accurately entering financial information

-

Double-check all monetary values and ensure they are clearly legible to avoid processing delays.

-

Ensure all amounts match related documentation for accuracy and compliance.

Importance of clear communication in the covering letter sections

Including a covering letter with clear and concise communication is essential. This letter should summarize the intent of the payment and serve as an introduction to the form, offering context for the lender and broker involved.

Compliance considerations and best practices

Ensuring compliance with local regulations is non-negotiable when filling out your letter mortgage broker payment form. Familiarizing oneself with federal and state laws can prevent costly mistakes.

Local regulations affecting the letter mortgage broker payment form

Different states may have distinct laws governing mortgage transactions. It’s essential to validate which local regulations apply to your transaction to avoid future complications.

Standard compliance measures to be aware of

-

Ensure you collect all necessary documents required for your filing.

-

Timeliness can greatly affect the approval of your mortgage application.

Recommended best practices for honesty and transparency

Being honest and transparent in all documentation can foster trust with brokers and lenders. This practice can also mitigate legal implications down the line if any discrepancies arise.

Common pitfalls when using the letter mortgage broker payment form

Many users encounter frequent mistakes that may delay their mortgage processing. Awareness of these common pitfalls can help streamline the completion of your form.

Common mistakes made by users

-

Leaving out critical fields can lead to immediate rejection of the application.

-

Submitting wrong payment amounts can complicate the payment process and cause delays.

How pdfFiller can help overcome these challenges

pdfFiller offers user-friendly tools that guide applicants through each step of filling out the letter mortgage broker payment form. With real-time editing suggestions and document checks, these challenges can be significantly mitigated.

Finalizing your letter mortgage broker payment form

Thoroughly reviewing your letter mortgage broker payment form before submission is essential. Taking time to validate entries can prevent even minor errors, which can be costly down the line.

Understanding the importance of thorough reviewing

A final check can ensure that all required fields are filled and that information aligns with supporting documents, facilitating smooth processing.

Steps to validate your entries

-

Match the information on your form with other documents to verify accuracy.

-

Consider having someone else review your form for errors.

How to securely send your form after completion

Once your letter mortgage broker payment form is finalized, ensure you send it securely. Utilizing pdfFiller’s secure submission tools can facilitate this process and protect sensitive information.

Support and assistance options

If you encounter issues while using the letter mortgage broker payment form, pdfFiller offers multiple support options. From community forums to professional assistance, users can find the help they need.

Where to find help on pdfFiller for the letter mortgage broker payment form

-

Access a rich resource of articles and guides on using pdfFiller.

-

Reach out to customer service for personalized assistance with your form.

Community forums and customer support resources

One can engage with a community of users who share similar experiences, gaining insight into optimizing form usage through collaborative discussion.

Contacting professional services for personalized assistance

For users seeking individualized support, professional services can assist in navigating the completion of the letter mortgage broker payment form, ensuring all complexities are addressed.

About the author

The author of this guide has an extensive background in mortgage documentation, bringing years of experience to assist users in navigating various forms and requirements effectively. Their insights and knowledge provide reliable guidance for anyone preparing to use the letter mortgage broker payment form.

Professional background in mortgage documentation

With years spent in the financial industry, the author is well-versed in the intricacies of mortgage documentation and compliance, ensuring users receive up-to-date and accurate information.

Why trust this guide for your letter mortgage broker payment needs

This guide is a synthesis of expert knowledge, real-world experience, and practical tips tailored specifically for users looking to navigate the complexities of the letter mortgage broker payment form. Trust in its comprehensive approach to enhance your mortgage documentation experience.

How to fill out the letter mortgage broker payment

-

1.Open the PDFfiller platform and log in to your account.

-

2.Upload the letter mortgage broker payment template or select one from your saved documents.

-

3.Fill in the borrower's details, including full name and contact information at the designated fields.

-

4.Input the mortgage broker's information, including name, company, and contact details.

-

5.Specify the total amount payable to the mortgage broker in the payment amount section.

-

6.Include the date of the transaction or agreement in the provided field.

-

7.If required, add a breakdown of services rendered along with their corresponding fees.

-

8.Review the entire document for accuracy, ensuring all information is correct.

-

9.Save the changes to the document and choose the option to download or print the completed letter.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.