Get the free LETTER: Mortgage Payoff 2nd Mtg template

Show details

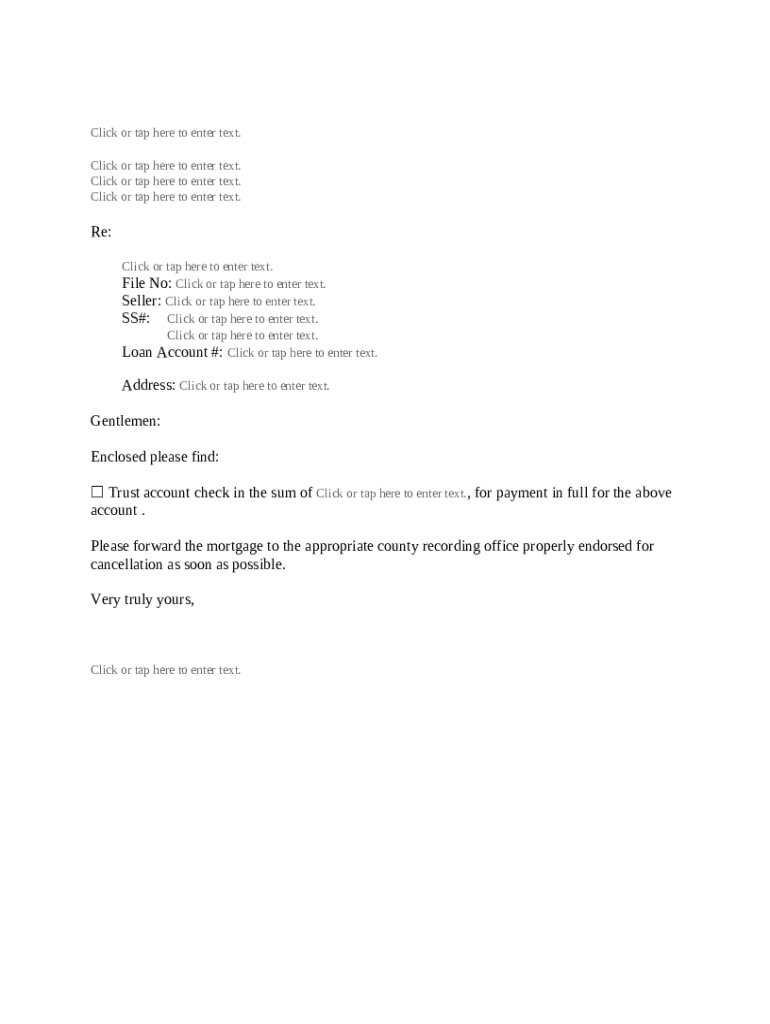

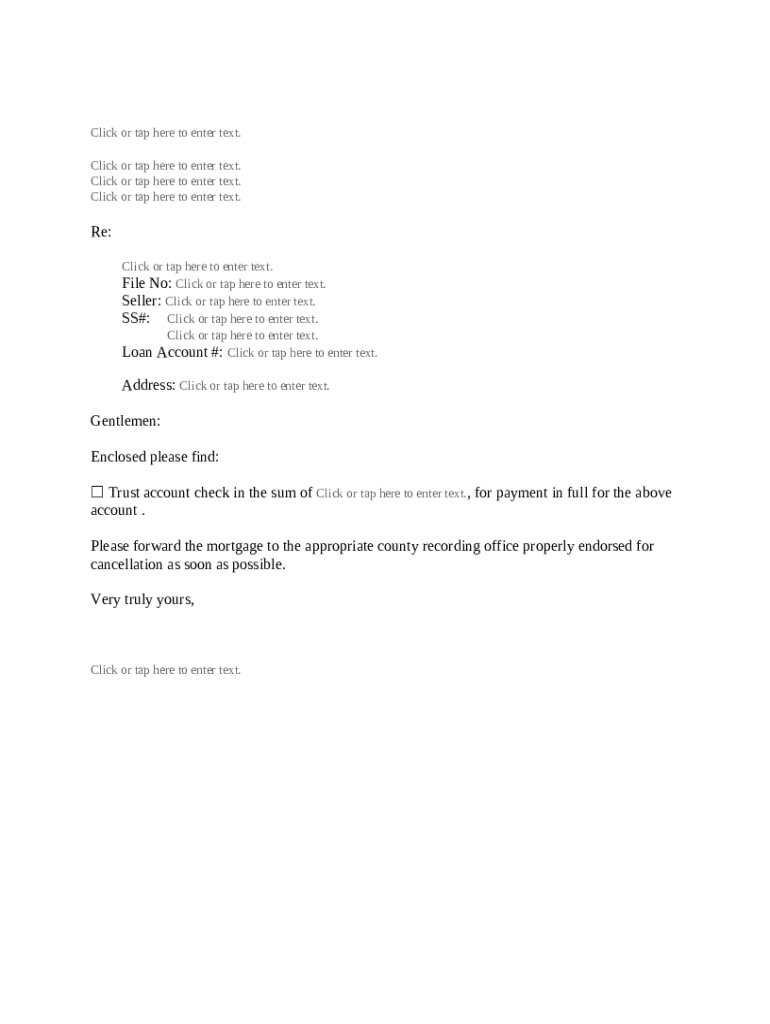

A letter regarding payment in full for the mortgage at issue. The letter may be customized to suit your needs.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter mortgage payoff 2nd

A letter mortgage payoff 2nd is a formal document used to request the payoff amount for a second mortgage.

pdfFiller scores top ratings on review platforms

It is the best PDF editor I have come across, great utility and features

It is everything that I needed and more. Thank you

great amazaing support staff karl is the best!!

This is the easiest program for completing PDF forms.

I've tried others and had very frustrating results. Yours has been sooooo easy and user friendly.

It has been very helfull and easy to use, very friendly!

Who needs letter mortgage payoff 2nd?

Explore how professionals across industries use pdfFiller.

How to complete a letter mortgage payoff 2nd form form

How does a letter of mortgage payoff work?

A letter of mortgage payoff is an official document that outlines the amount owed on a mortgage and indicates that the borrower intends to pay off the loan. This form facilitates communication with lenders and ensures that they have the necessary information to process the payoff accurately. Understanding this document is crucial for efficient mortgage cancellation procedures.

What are the key components of the mortgage payoff letter?

-

This unique identifier helps track your mortgage within the lender’s system.

-

Details about the mortgage holder, including names and contact information.

-

The mortgage account number provided by the lender is essential for identification.

Each of these fields plays a crucial role in ensuring the lender processes the mortgage payoff efficiently. Structuring the letter correctly is paramount to avoid delays.

How do you fill out the mortgage payoff letter?

Filling out a mortgage payoff letter can be straightforward if you follow a few key steps. Start by entering your personal information, followed by the lender's details and the specific amounts involved. Example entries would include your name, address, and the exact payoff amount, ensuring accuracy to prevent any discrepancies.

-

Ensure you have your mortgage details handy for reference.

-

Include all necessary fields like File Number, Seller Information, and Loan Account Number.

-

Double-check all entries to avoid any common mistakes that could delay processing.

What steps should you take before submitting the letter?

Before submitting your mortgage payoff letter, it’s important to review and edit the document carefully. Using tools like pdfFiller can greatly assist in this process, allowing you to easily edit any part of the document and ensure all necessary components are intact.

-

Ensure the information is clear and comprehensible, with no jargon that could confuse the lender.

-

Consider collaborating with your team via pdfFiller to finalize the document.

-

Go through your entries one last time to make sure everything is accurate before sending.

How to submit your mortgage payoff letter effectively?

Submitting your mortgage payoff letter can be done through various channels depending on your lender's preferences. Best practices include sending the letter via certified mail or secure email to ensure it reaches the correct department. After submission, it is wise to follow up to track the processing of your request.

-

Decide between mail, email, or fax based on your lender’s requirements.

-

Maintain a copy of the letter and any confirmation received from the lender for your files.

-

Schedule a follow-up call to check on the status of your mortgage payoff.

How can you manage your mortgage documents with pdfFiller?

Managing your mortgage documents can be made easier with pdfFiller’s document management capabilities. You can securely store your mortgage documents, access them from anywhere, and enjoy options for eSigning and sharing with the click of a button. Keeping copies of all mortgage-related correspondence is vital for your records.

-

Use pdfFiller to maintain a secure online archive of your mortgage documents.

-

Sign documents electronically, improving efficiency and legal compliance.

-

Easily share your mortgage payoff letter with your lender or team members.

What other considerations should you keep in mind?

It's important to be aware of local and state compliance when completing a mortgage payoff letter. Each region may have specific legal implications related to mortgage payoff procedures. Consulting with a mortgage professional may be beneficial to ensure that you're fulfilling all obligations and protecting your interests.

-

Understand the regulations in your area that may affect your mortgage.

-

Consult with professionals to navigate potential legal risks and obligations.

-

Reach out to mortgage experts if you have questions about the process.

How to fill out the letter mortgage payoff 2nd

-

1.Open the letter mortgage payoff 2nd template on pdfFiller.

-

2.Start by entering the date at the top of the document.

-

3.Fill in your personal information, including your full name and address.

-

4.Next, provide the lender's information in the designated area, including their name and address.

-

5.Clearly state the intent of the letter by including a subject line, such as 'Request for Payoff Amount of Second Mortgage.'

-

6.In the body of the letter, briefly explain that you are requesting the payoff amount for your second mortgage, including the account number for reference.

-

7.Request a specific deadline for receiving the payoff information to expedite the process, if applicable.

-

8.Finally, sign the letter and include your printed name, and any necessary contact information.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.