Get the free Affidavit of Title- Mortgagor template

Show details

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

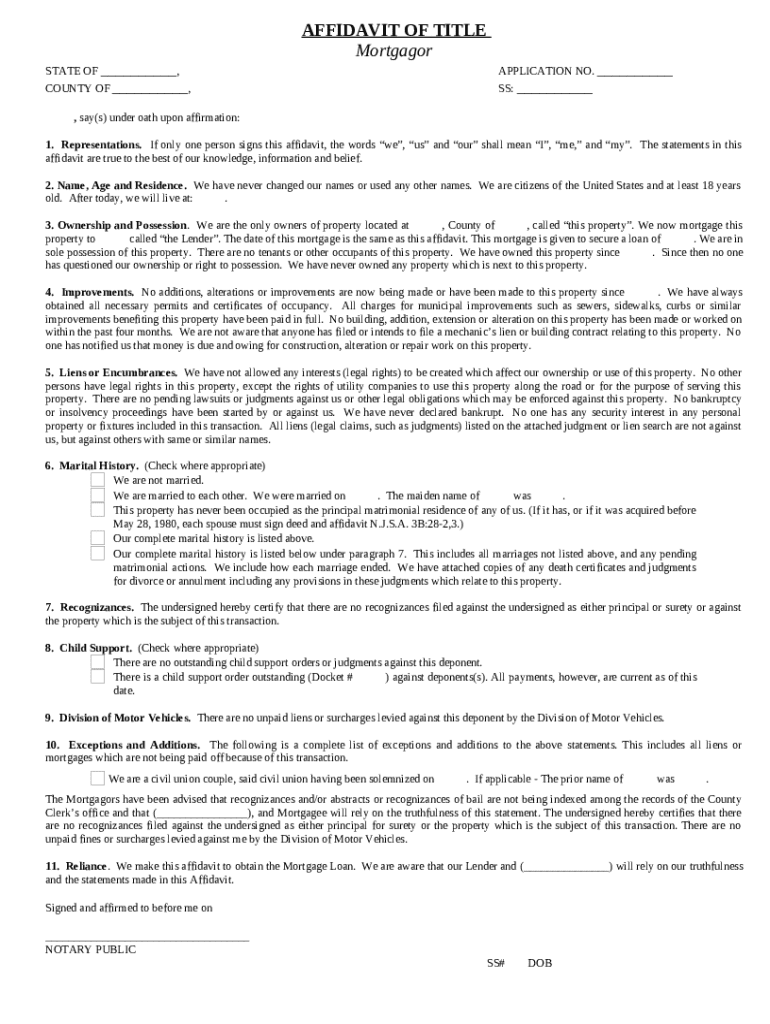

What is affidavit of title- mortgagor

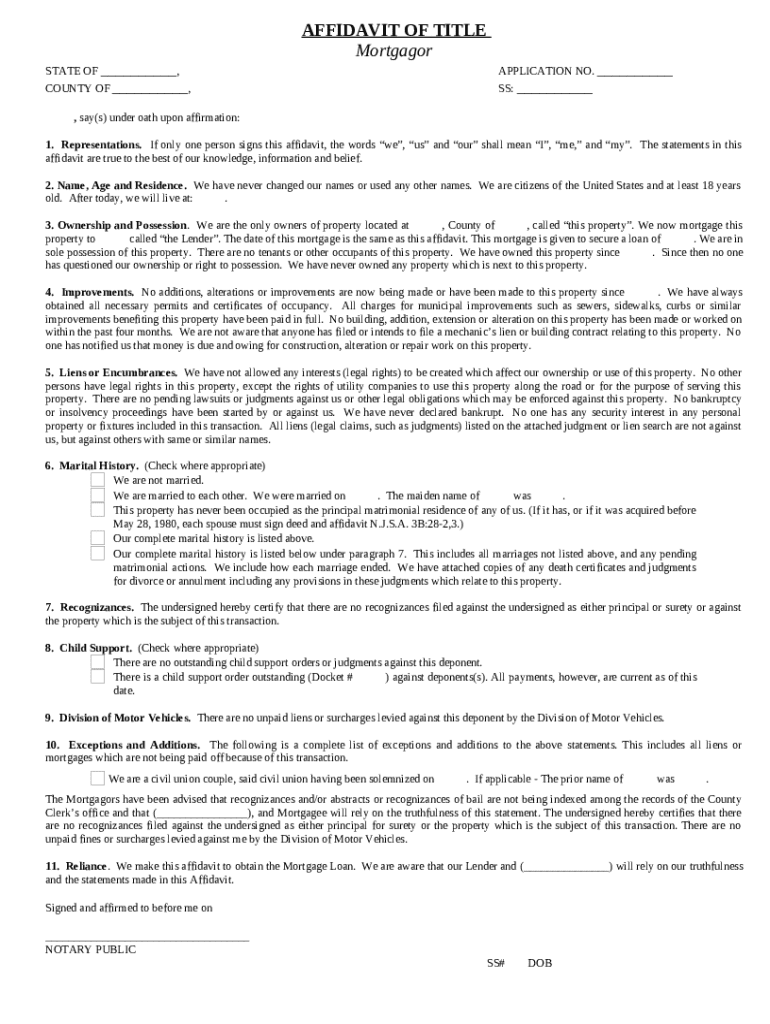

An affidavit of title-mortgagor is a legal document in which the mortgagor affirms their ownership of a property and that there are no undisclosed liens or encumbrances against it.

pdfFiller scores top ratings on review platforms

Really good programme. Much appreciated.

Very easy program to work with and edit if you need to make changes and also cost effective, you don't have to pay the realtor half the rent by doing it yourself.

excellent tool for filling in information on forms

I have just been informed by my college that I can't use this format. After paying for it and working with it for months, they prefer I use a format with expandable boxes for each indicator. This is a user friendly method but my only difficulty as been that the only information I can add to the PDF is what fits in the fixed boxes. This would be a suggestion in the formatting of this PDF.

I have been able to sign and complete my documents with little or no problems. It gets easier as I work with it.

The forms are quick and easy to fill out! Thanks!

Who needs affidavit of title- mortgagor?

Explore how professionals across industries use pdfFiller.

Affidavit of Title - Mortgagor Form Guide on pdfFiller

What is an affidavit of title?

An affidavit of title is a sworn statement affirming the ownership of a property and disclosing any relevant details that may affect the title. It serves as a critical document in real estate transactions, providing assurance to potential buyers and lenders that the property is being sold free of undisclosed liens or claims. This form is essential for mortgagors to demonstrate their legal right to sell the property.

Why is the affidavit significant?

The significance of the affidavit lies in its role in safeguarding buyers against potential financial loss. It serves both as a legal document and a disclosure tool that mitigates risks during property transactions. By revealing the facts about ownership, liens, and property claims, it directly impacts the buyer's confidence and the overall validity of the sale.

What are the key components of an affidavit of title?

-

Filling out accurate owner and marital status information verifies the person signing the affidavit is legally allowed to sell the property.

-

Providing current and accurate contact details helps facilitate communication throughout the transaction process.

-

A thorough description of the property, including its legal description and address, is necessary to properly identify it in the affidavit.

-

Detailing who currently resides in the property ensures transparency concerning any tenant agreements or occupancy claims.

-

Finally, the affidavit must be signed by the affiant (the person making the statement) and notarized to confirm its authenticity.

How do you fill out the affidavit of title?

When filling out the affidavit of title, accurate data entry is crucial. Start by gathering all necessary information and documents that pertain to your property ownership and any liens. Each section of the form should be completed with care to avoid errors that could complicate the selling process.

Step-by-step guide to completing the affidavit

-

Begin by providing your full name and marital status; ensure clarity for legal purification.

-

Double-check all contact information for accuracy to avoid communication issues later on.

-

Ensure your property description is extensive and includes all necessary legal phrasing.

-

Affirm your ownership specifics clearly, demonstrating your legal claim to the property.

-

Record any significant changes made to the property that could impact its value or appeal.

-

Complete the process with an official signature and obtain notarization to uphold legal standards.

What are common errors when completing the affidavit?

-

Common inaccuracies include misspellings or incorrect numerical information regarding the property.

-

Neglecting to include required details can lead to significant delays in the transaction process.

-

It's advisable to consult legal or real estate professionals if you face complexities when completing the affidavit.

How to manage affidavits with pdfFiller?

pdfFiller offers tools to streamline the management of your affidavit of title. With its easy-to-use interface, you can edit, sign, and collaborate on your documents from any device. The platform facilitates electronic signatures and secures your affidavits by storing them in the cloud, ensuring easy retrieval when needed.

-

Ensure your affidavit is accurate and formatted correctly with pdfFiller's editing tools available anytime.

-

Utilize the convenient eSigning feature to get your signature on the document instantly.

-

Work together with your team in real time to manage affidavits efficiently.

-

Store your documents in the cloud, facilitating secure access and sharing options.

How to fill out the affidavit of title- mortgagor

-

1.Open the PDF form in pdfFiller.

-

2.Begin at the top section, where you'll need to input your personal information, including your name and address.

-

3.Next, locate the section for property details where you will enter the legal description of the property in question.

-

4.Fill in the information related to the mortgage, including the lender's name and the amount of the mortgage.

-

5.Proceed to the part where you affirm your ownership, ensuring you clearly state that you are the legal owner and that there are no undisclosed liens against the property.

-

6.If necessary, attach any supporting documents that may validate your ownership or mortgage details.

-

7.Finally, review the filled document for accuracy, and electronically sign it where indicated to complete the affidavit.

-

8.Download or print the completed affidavit for your records and submission to the relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.