Last updated on Feb 17, 2026

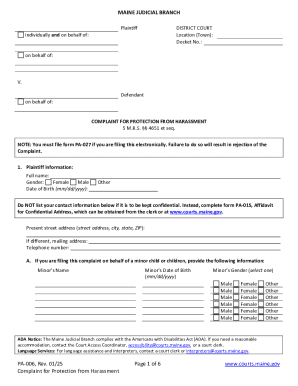

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Ind...

Show details

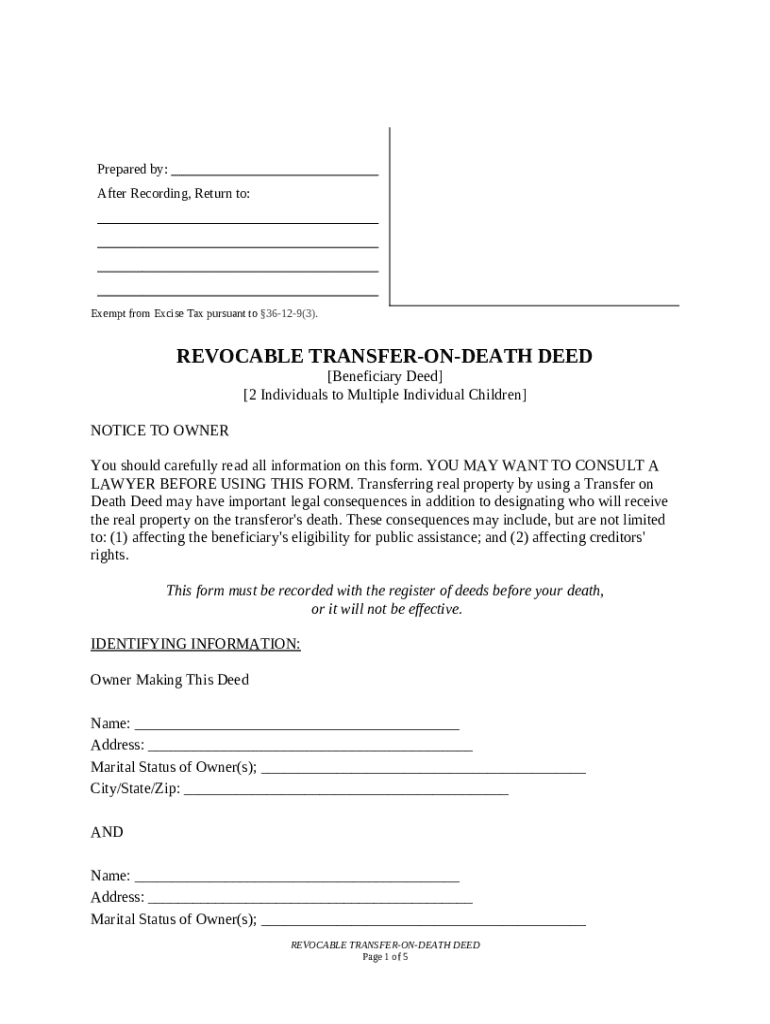

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to designate beneficiaries who will inherit the property automatically upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

I am happy by using PDF file (save, retrieve & rewrite

Not yet finished with my first doc. Need more time b4 making comments about product

It has been pretty good expect a funny billing experience

Great Product for the money and saves me alot of time!

So far so good. Was very helpful in completing government report on non-fillable .pdf document. That was the original purchase purpose. Now trying out modification / repair of existing fillable forms.

You can search for fillable forms and save them to your work space, edit them, save them print them. Helpful for completing YE forms

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

What is a transfer on death deed?

A Transfer on Death Deed is a legal instrument that allows property owners to designate beneficiaries who will inherit their property upon their death, thus bypassing the probate process. This method of transfer is simple and can provide direct benefits to the heirs without the need for a long and often costly court procedure.

-

Definition and purpose of a Transfer on Death Deed: It simplifies the transfer of property after the owner's demise.

-

Legal implications for property transfer: Ensures that the property transfers directly to beneficiaries.

-

Comparison with other estate planning tools: Unlike wills, the deed avoids probate and can be quicker.

What legal considerations should you make before using the form?

Before finalizing a Transfer on Death Deed form, it's crucial to understand the legal implications. Consulting with a lawyer is recommended to ensure compliance with state laws and personal circumstances.

-

Importance of consulting a lawyer: A legal professional can guide specific requirements pertinent to your situation.

-

Potential effects on beneficiary eligibility for public assistance: Transfer of property may affect benefits.

-

Impact on creditors' rights and obligations: Transfers could influence creditor claims against the estate.

How do you fill out the transfer on death deed form?

Filling out the Transfer on Death Deed form correctly is essential to ensure its validity. Each key section must be carefully filled out and understood.

-

Key sections of the form to complete: Include identifying details about the property and the owner.

-

Detailed instructions for filling out identifying information: Ensure accurate spelling and specifics to avoid issues.

-

Marital status and its significance in property transfer: This may affect joint ownership and beneficiary rights.

-

Recording district and legal description requirements: Be precise with the property’s legal description.

How do you designate beneficiaries?

When designating beneficiaries in your Transfer on Death Deed, clear instructions will help avoid confusion in the future. Naming both primary and alternate beneficiaries is crucial.

-

Instructions for naming primary beneficiaries: Clearly state who will inherit the property.

-

Information needed for alternate beneficiaries: Here, outline backup options in case the primary cannot inherit.

-

Understanding ownership shares among beneficiaries: Specify how the property value should be divided.

What are the steps to record the transfer on death deed?

Recording the Transfer on Death Deed is a critical step that formalizes the transfer. This typically involves filing the completed form with a local government office.

-

Steps to record the deed with the register of deeds: Follow local procedures for filing.

-

Time frame for recording and its consequences: Delays in recording could lead to complications.

-

State-specific requirements for recording: Be aware that laws vary significantly by region.

What are potential pitfalls and common mistakes?

Being aware of common mistakes can prevent severe issues in the future. Here's what to watch out for when dealing with your form.

-

Common errors when filling out the form: Incorrect information can invalidate the deed.

-

Issues that may arise if the form is not recorded properly: Failing to record could nullify the transfer.

-

Consultation steps if complications occur: Seek legal assistance at the first sign of trouble.

How can you use pdfFiller for your transfer on death deed?

pdfFiller offers a robust platform for creating and managing your Transfer on Death Deed form efficiently. This tool enables easy editing and electronic signing, streamlining the process.

-

Overview of pdfFiller's features for form creation and editing: Comprehensive tools simplify the document lifecycle.

-

How to use pdfFiller’s tools to fill out and eSign documents: Intuitive design ensures a user-friendly experience.

-

Benefits of managing important documents in the cloud: Ensure secure access and sharing from anywhere.

What are post-completion steps?

After successfully recording your Transfer on Death Deed, it’s essential to follow up with some important tasks to ensure everything is in order.

-

What to do after the Transfer on Death Deed is recorded: Keep all original documents in a safe place.

-

Keeping your beneficiaries informed: Notify them about the deed for transparency.

-

Updating the deed for future changes in beneficiaries: Review and adjust as needed to reflect changes.

How to fill out the transfer on death deed

-

1.Obtain a blank transfer on death deed form from a legal resource or online documentation service like pdfFiller.

-

2.Begin by entering the full name and address of the current property owner at the top of the form.

-

3.Include a detailed description of the property being transferred, including the legal description, parcel number, and physical address.

-

4.List the beneficiaries by entering their full names and relationship to the owner; specify if multiple beneficiaries will share ownership.

-

5.Check any relevant boxes regarding joint ownership or alternative beneficiaries if applicable.

-

6.Review all entered information for accuracy and completeness to ensure there are no errors.

-

7.Sign the document in front of a notary public or witnesses as required by state law to validate the deed.

-

8.Make copies of the signed and notarized document for your records and for the beneficiaries, if necessary.

-

9.Finally, file the transfer on death deed with the appropriate county office to ensure it is legally recorded.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.