IRS 7200 2021 free printable template

Show details

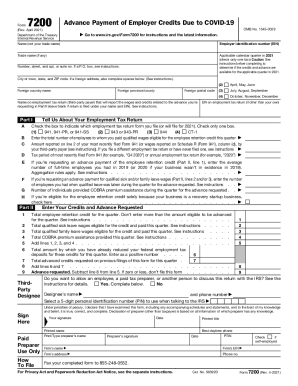

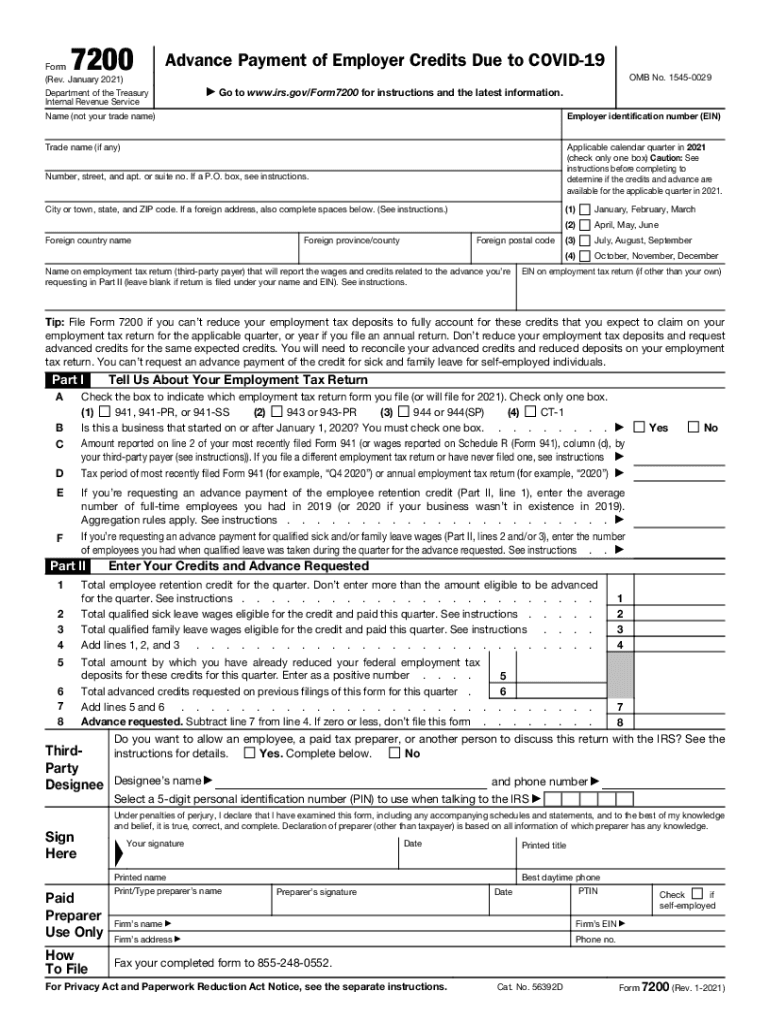

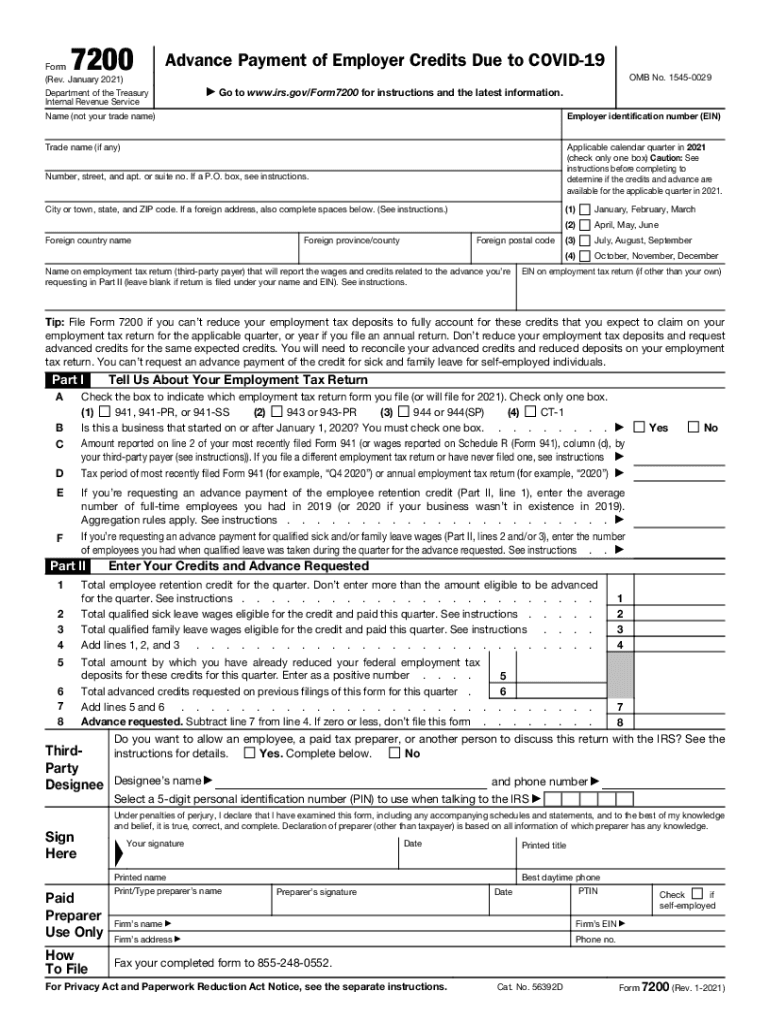

7200Form (Rev. January 2021) Department of the Treasury Internal Revenue ServiceAdvance Payment of Employer Credits Due to COVID-19 OMB No. 15450029 Go to www.irs.gov/Form7200 for instructions and

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 7200

Edit your IRS 7200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 7200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 7200 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 7200. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 7200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 7200

How to fill out IRS 7200

01

Obtain IRS Form 7200 from the IRS website or your tax professional.

02

Fill in your name, Social Security Number (SSN), and address at the top of the form.

03

Indicate the calendar quarter for which you are applying for the advance payment.

04

Calculate your eligible employee retention credit or paid sick leave and family leave credits for the applicable period.

05

Complete the sections for the number of employees and the amounts eligible for credit.

06

Sign and date the form.

07

Send the completed form to the address specified in the instructions, which is usually to the appropriate IRS office.

Who needs IRS 7200?

01

Employers that retained employees during the COVID-19 pandemic.

02

Self-employed individuals who qualify for sick leave or family leave credits.

03

Businesses seeking an advance payment of the employee retention credit.

Fill

form

: Try Risk Free

People Also Ask about

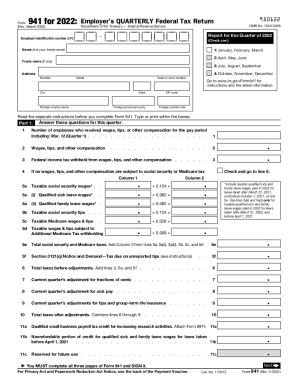

Is there a worksheet for the employee retention credit?

The simple answer to this question is the Employee Retention Credit Worksheet 2021. ERC Worksheet 2021 was created by the IRS to assist companies in calculating the tax credits for which they are qualified. The worksheet is not required by the IRS to be attached to Form 941.

What is Form 7200 for dummies?

Form 7200 is a form that was introduced in the midst of the many programs offered to help businesses during COVID-19. It is used to request an advance payment of the tax credits for qualified sick and qualified family leave wages, and the employee retention credit.

How long does it take IRS to process Form 7200?

For more details, see the IRS page About Form 7200. The IRS is estimating a 2-week processing time, and you will receive the tax credit refund directly from the IRS, not Patriot.

How do you file Form 7200?

How to File Form 7200 Electronically with TaxBandits? 1 Enter Your Employer Details. 2 Choose Applicable calendar quarter. 3 Choose your Employment Tax Return Type. 4 Enter your Credits and Advance Requested. 5 Send it to the IRS by FAX.

How do you calculate employee retention credit?

Calculating the Employee Retention Credit For 2021, the Employee Retention Credit is equal to 70% of qualified employee wages paid in a calendar quarter. Eligible wages per employee max out at $10,000 per calendar quarter in 2021, so the maximum credit for eligible wages paid to any employee during 2021 is $28,000.

Can I file Form 7200 2022?

Please note the Form 7200 fax line will be shut down after January 31, 2022 and IRS will no longer be accepting Form 7200 submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 7200?

With pdfFiller, the editing process is straightforward. Open your IRS 7200 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my IRS 7200 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your IRS 7200 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out IRS 7200 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your IRS 7200. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is IRS 7200?

IRS Form 7200 is a form used by employers to request an advance payment of the Employee Retention Credit (ERC) and certain credits for qualified sick and family leave wages under the Families First Coronavirus Response Act (FFCRA).

Who is required to file IRS 7200?

Employers who are eligible for the Employee Retention Credit and certain credits for qualified sick and family leave wages under FFCRA are required to file IRS Form 7200.

How to fill out IRS 7200?

To fill out IRS 7200, employers need to provide their contact information, details regarding eligible wages, the amounts of credits being requested, and other relevant information as specified on the form.

What is the purpose of IRS 7200?

The purpose of IRS Form 7200 is to allow businesses to claim advance payments of certain tax credits related to COVID-19, specifically the Employee Retention Credit and credits for sick and family leave provided under FFCRA.

What information must be reported on IRS 7200?

The information that must be reported on IRS 7200 includes the employer's name, address, phone number, EIN, payroll period information, amount of qualified wages, and the total amount of credits being requested.

Fill out your IRS 7200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 7200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.