IRS 7200 2020 free printable template

Show details

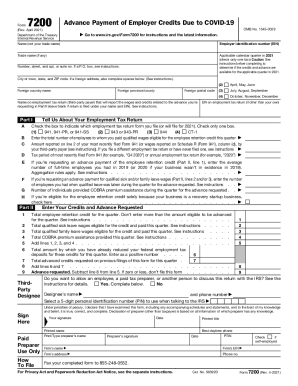

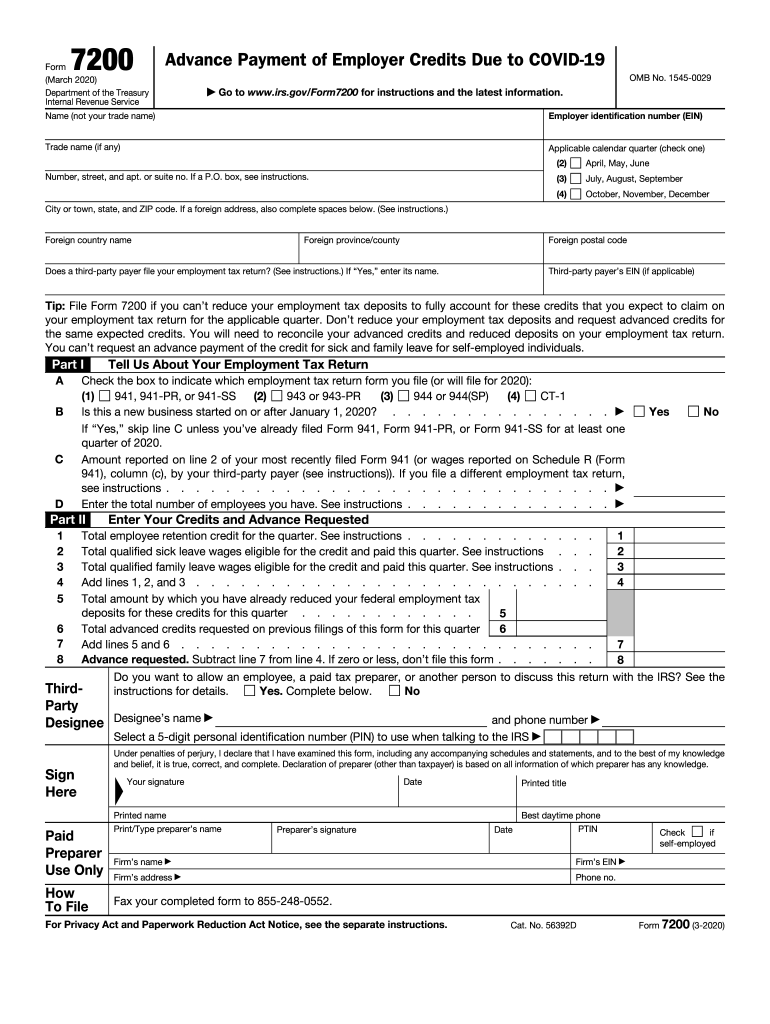

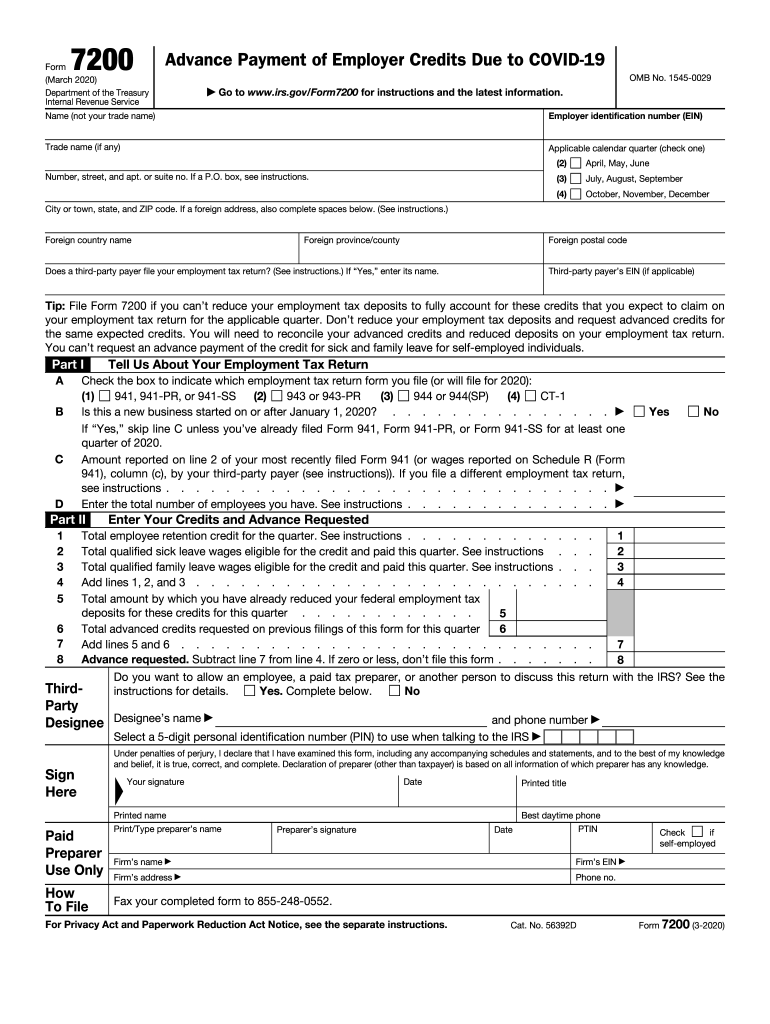

7200Form (March 2020) Department of the Treasury Internal Revenue ServiceAdvance Payment of Employer Credits Due to COVID-19 OMB No. 15450029 Go to www.irs.gov/Form7200 for instructions and the latest

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your form 7200 2020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 7200 2020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 7200 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit advance form 7200. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IRS 7200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 7200 2020

How to fill out form 7200:

01

Download the form: You can find form 7200 on the Internal Revenue Service (IRS) website. It is available in a PDF format that can be downloaded and printed.

02

Provide your basic information: In section 1, you will be required to fill in your employer identification number (EIN) or social security number (SSN), your name, and your contact information.

03

Fill in the applicable tax year and quarter: Section 2 of the form requires you to indicate the tax year and quarter for which you are requesting an advance payment of the employer's share of social security tax.

04

Determine the total qualified wages and credits: In section 3, you need to calculate the total qualified wages and credits for each quarter. This information is necessary to determine the amount of the advance payment you are requesting.

05

Calculate the requested advance payment: Section 4 guides you through the process of calculating the advance payment by multiplying the total qualified wages and credits by the applicable percentage.

06

Enter any previously requested advance payments: In section 5, you must provide details about any advance payments you have already requested and received for the specified tax year and quarter.

07

Sign and date the form: Verify your information, sign, and date the form in section 6.

Who needs form 7200:

01

Employers seeking to request an advance payment of the employer's share of social security tax, due to reduced employment as a result of the COVID-19 pandemic.

02

Self-employed individuals who qualify for the qualified sick leave equivalent credit or the qualified family leave equivalent credit under the Families First Coronavirus Response Act.

03

Employers who are eligible for the Employee Retention Credit and are seeking an advance payment of the credit.

Please note that it is always recommended to consult with a tax professional or refer to the IRS guidelines for specific eligibility requirements and instructions on filling out form 7200.

Fill advance 7200 form : Try Risk Free

People Also Ask about form 7200

Can you file form 7200 electronically?

Is the IRS still accepting form 7200?

How to fill out 7200 form?

What is the 7200 form used for?

What is the turnaround time for form 7200?

When should form 7200 be completed?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 7200?

Form 7200 is required to be filed by employers who are making an advance payment of the Employer’s Share of the Social Security and Medicare Taxes.

What is the purpose of form 7200?

Form 7200 is used to request an advance payment of the employer's share of the payroll taxes. This form is used when an employer does not have enough funds available to pay the taxes due. It is also used to request a decrease in the amount of taxes that have been deposited.

When is the deadline to file form 7200 in 2023?

The deadline to file Form 7200 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of form 7200?

There is no penalty for the late filing of Form 7200. However, the employer may be subject to an IRS penalty if the employer fails to deposit taxes in a timely manner.

What information must be reported on form 7200?

Form 7200, also known as the Advance Payment of Employer Credits Due to COVID-19, is used to request advance payment of several employer tax credits that were introduced to help businesses during the COVID-19 pandemic. The form requires the following information to be reported:

1. Employer identification number (EIN) or social security number (SSN)

2. Basic information about the employer, including the legal name, trade name (if applicable), and address

3. Contact name, phone number, and email address

4. The calendar quarter for which the advance payment is being requested

5. The total number of employees for whom wages are being reported for the requested quarter

6. The amount of qualified wages paid to employees for the requested quarter

7. The total amount of eligible employer qualified health plan expenses allocated to the requested quarter

8. The total amount of employer eligible qualified wages for the requested quarter

Note that specific details about the tax credits being claimed and their eligibility criteria can be found in the instructions for Form 7200 provided by the IRS.

What is form 7200?

Form 7200 is a tax form used by employers to request an advance payment of the employer tax credits that are available under the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The form is specifically designed for employers who are unable to fund these tax credits by reducing their employment tax deposits.

How to fill out form 7200?

To fill out Form 7200, which is the Advance Payment of Employer Credits Due to COVID-19, follow the steps below:

1. Download the form: Visit the official Internal Revenue Service (IRS) website and search for Form 7200. Download the form in PDF format.

2. Identify the employer information: Provide the employer's name, address, and Employer Identification Number (EIN) at the top of the form. Check the box if the employer is a governmental entity.

3. Determine the calendar quarter: Write the calendar quarter for which the form is being filed (e.g., Q1 for January-March) and the year.

4. Calculate the credits: Determine the credits for which you are eligible. The form provides space for multiple credits, including the refundable portion of the sick and family leave credits, employee retention credit, and other qualified wages.

5. Enter the requested information: In Part I, enter the credit you are claiming for each calendar quarter. Fill in the details like the average number of full-time employees, qualified wages, and the applicable credit amounts.

6. Include additional information: If there are any variances between the previously claimed credits and the current form, include an explanation in Part II.

7. Calculate the total amount of credits requested: Sum up the credits claimed in Part I and put the total amount in line 4.

8. Determine the requested advance amount: Calculate the expected refundable credits for the anticipated quarter or look at Line 2 of your most recently filed Form 941. Subtract any deposits already made from the expected credits to get the requested advance amount.

9. Sign and date the form: The employer or an authorized representative must sign and date the form.

10. Submit the form: Send the completed Form 7200 to the IRS by either mail or fax, using the information provided on the form. Retain the copy of the form for your records.

Please note, it is important to consult with a tax professional or refer to the official IRS instructions for Form 7200 to ensure accuracy and understanding of the specific requirements.

How do I modify my form 7200 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your advance form 7200 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in 7200 form without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing credit form 7200 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I fill out advance payment employer form 7200 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your employer form 7200. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your form 7200 2020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

7200 Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 7200 pdf

Related to 7200

If you believe that this page should be taken down, please follow our DMCA take down process

here

.