Get the free Wisconsin Installments Fixed Rate Promissory Note Secured by Commercial Real Estate ...

Show details

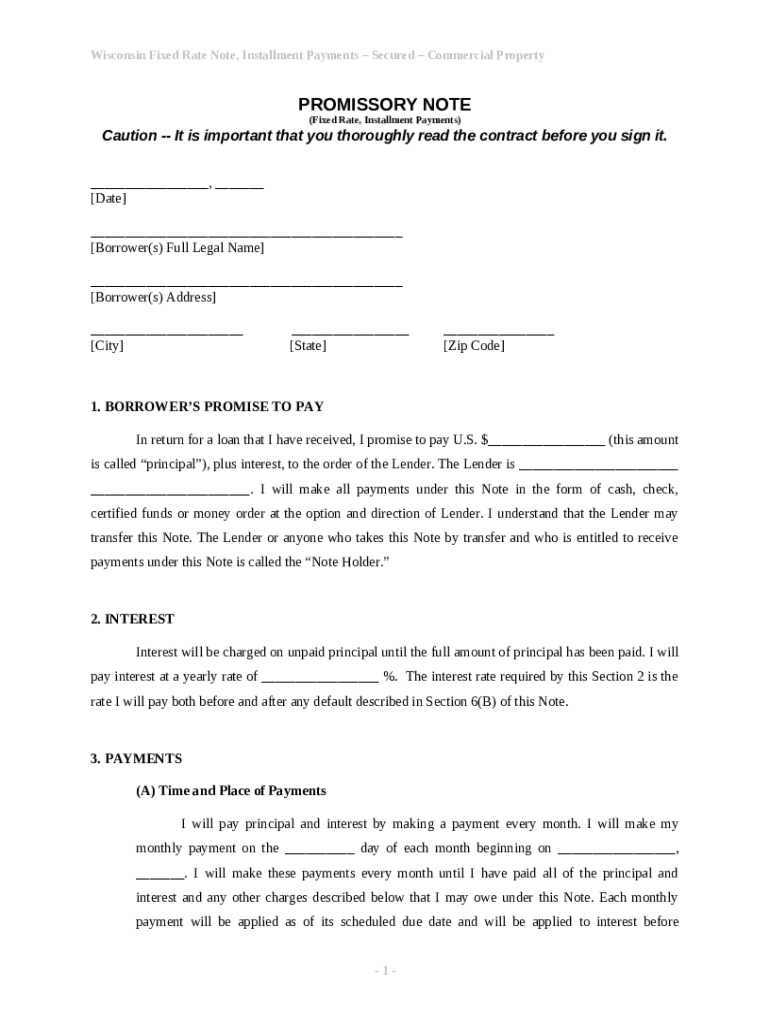

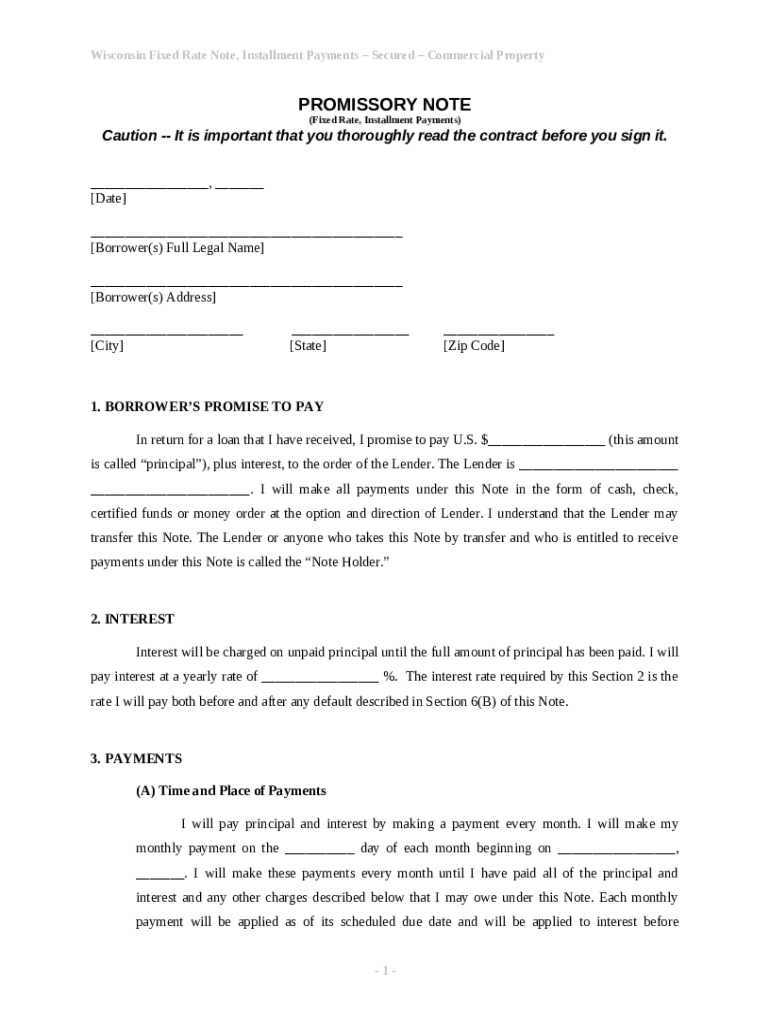

This is a Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is wisconsin installments fixed rate

Wisconsin installments fixed rate refers to a loan repayment option in Wisconsin where borrowers pay back their loans in fixed monthly installments over a set period.

pdfFiller scores top ratings on review platforms

It is convenient, but I would like further training.

I use PDF Filler for various work and school projects.

Been great though tricky to align different lines in a table.

It made the process of creation easy. Totally impressed!!!

easy to use, tool bars were intuitive. straightforward saving and printing. I like it a lot.

I was looking for 2012 version of Form 941, and only place I was able to find a fillable form for that year was PDFfiller.

Who needs wisconsin installments fixed rate?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Wisconsin Installments Fixed Rate Form

How to fill out a Wisconsin installments fixed rate form?

Filling out a Wisconsin installments fixed rate form involves detailed information on the payment scheme, which typically includes the borrower's details, loan amount, and interest rates. Ensure you complete all relevant sections to avoid potential complications.

Understanding the promissory note and its importance

A promissory note is a financial document in which one party promises in writing to pay a determinate sum of money to the other. This document serves to clarify the loan terms, making it an essential component of fixed-rate installment payments in Wisconsin.

-

A formal agreement that outlines the borrower's obligation to repay a loan to the lender under specified terms.

-

Typically includes the principal amount, interest rate, repayment schedule, and consequences of default.

-

In Wisconsin, understanding the terms of fixed-rate payments protects both the borrower and lender from unexpected changes in payment amounts.

What is the legal framework surrounding installment payments in Wisconsin?

Wisconsin has a comprehensive legal framework governing installment payments that dictates how agreements must be structured to be enforceable. This framework ensures protection for both borrowers and lenders, emphasizing the importance of adhering to local regulations.

-

Wisconsin law stipulates specific requirements for the validity and enforceability of installment contracts.

-

These regulations may include stipulations on interest rates, late fees, and the requirement for clear, accessible language in contracts.

-

This compliance not only protects the rights of all parties involved but also minimizes the risk of legal disputes.

How to fill out the fixed rate installment promissory note

Completing a fixed-rate installment promissory note requires careful attention to detail, particularly regarding the information you provide.

Navigating the form fields

-

This information must match official documents to ensure the legitimacy of the agreement.

-

Clearly state how much is borrowed and at what interest rate to avoid confusion during repayment.

-

Establish specific dates for payments to ensure both parties understand the repayment schedule.

-

Include the lender's full name and contact details for effective communication post-agreement.

Common mistakes to avoid when completing the form

-

Incomplete forms can lead to miscommunication and legal issues later on.

-

Double-check all numerical entries to ensure accuracy.

-

It's crucial to understand your obligations before signing any document.

Managing your fixed rate installment payments

Understanding the loan repayment process is vital for maintaining a healthy financial standing. Utilize tools to track payments and due dates effectively.

-

Having a clear grasp of how the repayment schedule works helps prevent missed payments.

-

Leverage pdfFiller’s functions to manage your documents and payments seamlessly.

-

Tools such as reminders and payment trackers can simplify managing installment payments.

What are the interest implications on fixed rate installments?

Interest rates on fixed-rate installment loans remain constant, which can greatly benefit borrowers by providing predictable payment amounts.

-

Interest is usually calculated based on the principal balance and agreed-upon rate, maintained throughout the loan term.

-

Defaulting on payments may incur fees or negatively affect your credit score, emphasizing timely payments.

-

Consistent payments prevent penalties and additional interest fees, contributing to overall loan cost management.

What happens in case of a transfer of note?

When a promissory note is transferred, the new holder assumes the rights defined in the agreement. Understanding these implications is essential for borrowers.

-

This usually involves a formal assignment and must comply with Wisconsin regulations.

-

The new holder typically inherits all rights and obligations under the original agreement.

-

The borrower must be informed of the transfer and any changes that may occur from it.

How to utilize pdfFiller’s features for document management?

pdfFiller streamlines the process of document management, making it easy to edit, sign, and collaborate on your fixed-rate promissory note.

-

Utilize pdfFiller's editing tools to fill out your document and add eSignatures without printing.

-

Share documents with other parties for review or signature using collaborative features.

-

With cloud storage, you can manage and access your documents from any location, ensuring convenience.

How to fill out the wisconsin installments fixed rate

-

1.Begin by accessing the wisconsin installments fixed rate form on pdfFiller.

-

2.Select the option to create a new document and upload the necessary file if you have one.

-

3.Navigate through the document and identify the sections requiring your personal information.

-

4.Fill in your name, address, and other required identification details in the designated fields.

-

5.Input your financial details, including the amount you wish to borrow and the duration of the installment plan.

-

6.Review the fixed interest rate applicable to the loan and ensure it is correctly entered.

-

7.Check for any specific conditions or agreements attached to your installment plan in the related sections.

-

8.Carefully read through the entire document to ensure all information is accurate and complete.

-

9.Once all fields are filled, sign the document electronically where indicated.

-

10.Save the completed document and download it for your records before submitting it to the relevant institution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.