Get the free Notice of Wrap-around Mortgage Financing

Show details

Este aviso proporciona información sobre el financiamiento de hipoteca envolvente que está gravado por un gravamen superior, de acuerdo con el Código de Finanzas de Texas y el Código de Propiedad

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of wrap-around mortgage

Edit your notice of wrap-around mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of wrap-around mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of wrap-around mortgage online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit notice of wrap-around mortgage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

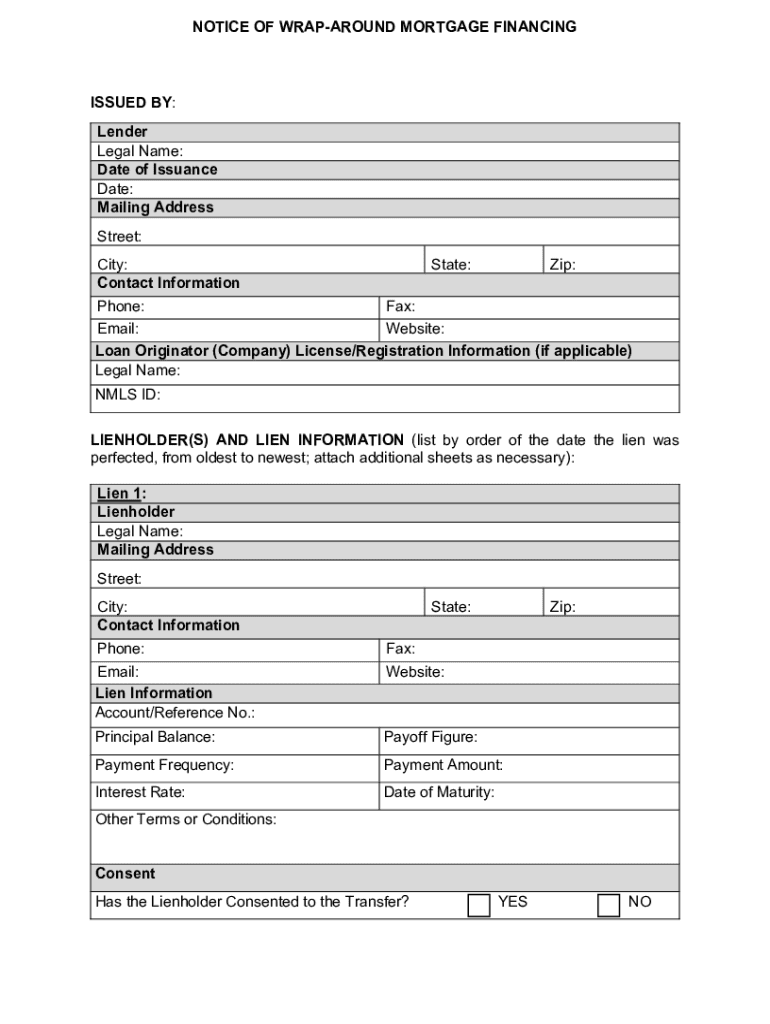

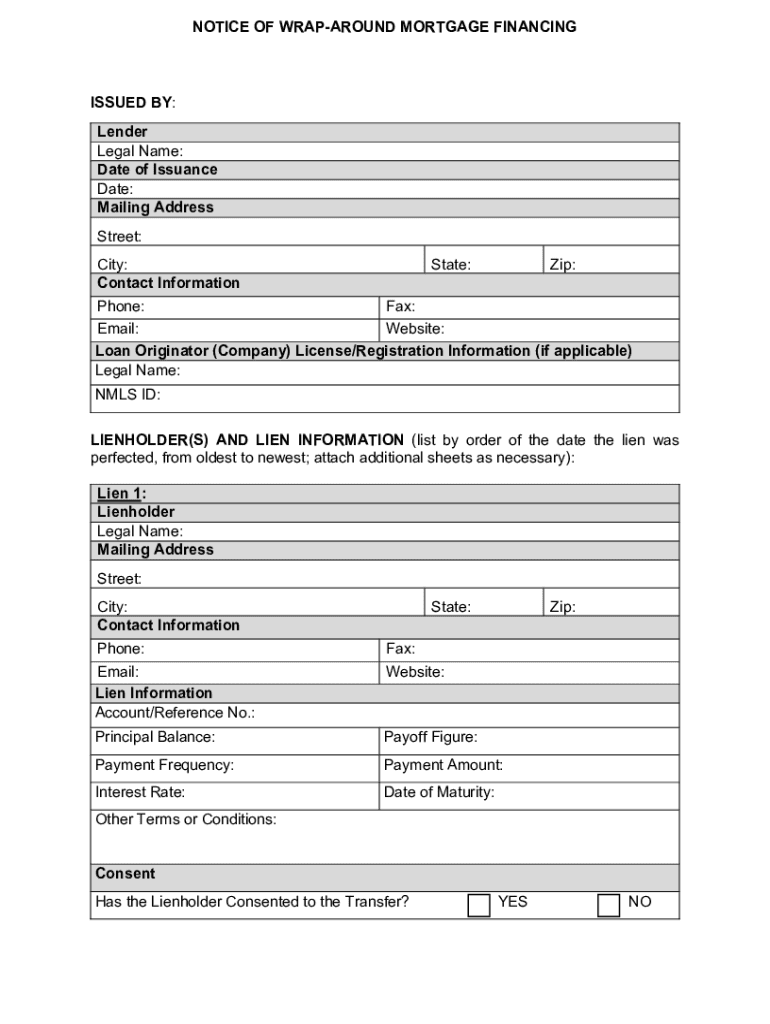

How to fill out notice of wrap-around mortgage

How to fill out notice of wrap-around mortgage

01

Begin by obtaining a blank notice of wrap-around mortgage form from your local real estate office or legal website.

02

Fill in the names and addresses of the mortgagee (lender) and mortgagor (borrower) at the top of the form.

03

Enter the date the wrap-around mortgage agreement is being executed.

04

Clearly describe the property involved in the mortgage, including its legal description.

05

Specify the terms of the wrap-around mortgage, including the principal amount, interest rate, payment schedule, and maturity date.

06

Include any additional conditions or stipulations related to the mortgage, such as responsibilities for maintenance and taxes.

07

Sign and date the document in the designated areas, ensuring that both parties are present for the signatures.

08

Have the document notarized to add legal validity.

09

File the notice with the appropriate county recorder's office to make it a matter of public record.

Who needs notice of wrap-around mortgage?

01

Individuals or entities involved in real estate transactions where a wrap-around mortgage is used.

02

Homebuyers who are acquiring a property with an existing mortgage that they will pay while the original mortgage remains in place.

03

Sellers who want to offer financing to buyers without paying off their existing mortgage.

04

Real estate investors looking for alternative financing options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice of wrap-around mortgage in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your notice of wrap-around mortgage and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit notice of wrap-around mortgage on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign notice of wrap-around mortgage on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete notice of wrap-around mortgage on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your notice of wrap-around mortgage. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is notice of wrap-around mortgage?

A notice of wrap-around mortgage is a legal document that indicates an agreement between a borrower and a lender in which the lender assumes responsibility for an existing mortgage while providing a new mortgage that 'wraps around' the original loan.

Who is required to file notice of wrap-around mortgage?

Typically, the lender or the borrower, depending on the jurisdiction, is required to file a notice of wrap-around mortgage to formalize the agreement and inform other parties of the wrap-around arrangement.

How to fill out notice of wrap-around mortgage?

To fill out a notice of wrap-around mortgage, you need to include the names of the parties involved, a description of the property, details of the original mortgage, the terms of the wrap-around mortgage, and signatures of the involved parties.

What is the purpose of notice of wrap-around mortgage?

The purpose of a notice of wrap-around mortgage is to provide public notice of the wrap-around mortgage agreement, protect the rights of the lender, and inform potential buyers or investors about existing encumbrances on the property.

What information must be reported on notice of wrap-around mortgage?

The information that must be reported includes the names of the borrower and lender, property description, original mortgage details (including outstanding balance), terms of the wrap-around mortgage, interest rates, and any pertinent contractual obligations.

Fill out your notice of wrap-around mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Wrap-Around Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.