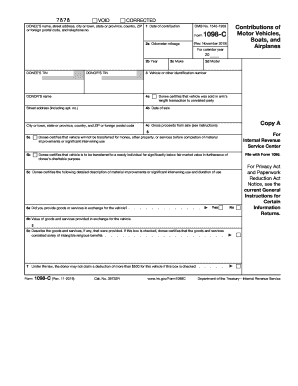

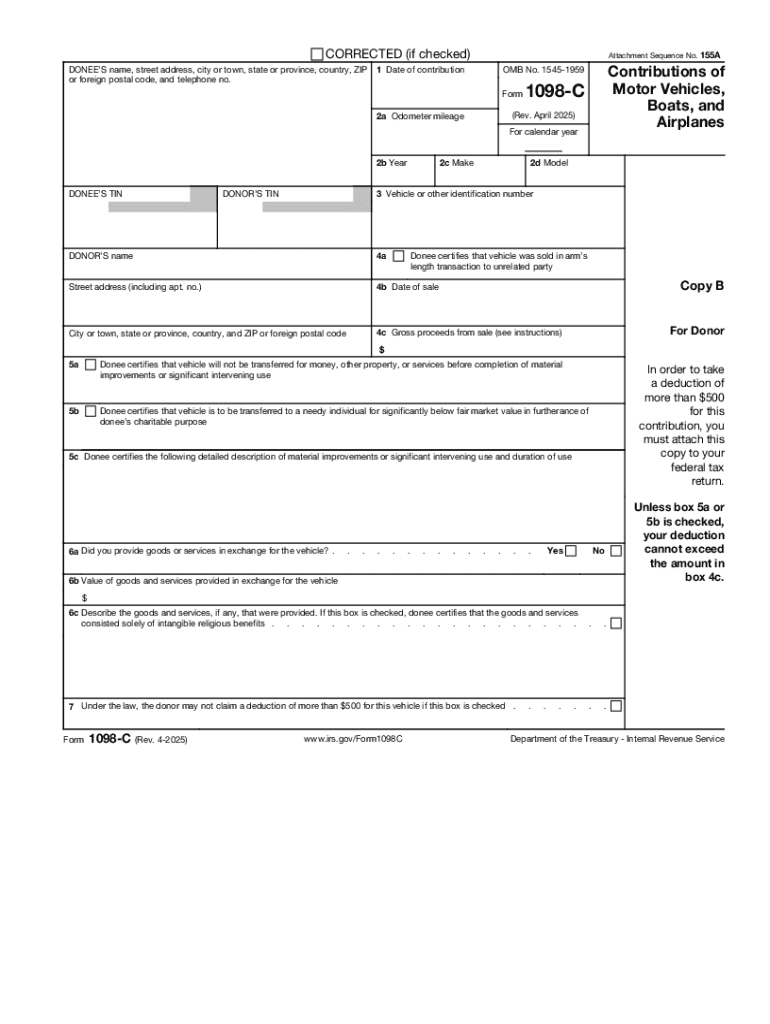

IRS 1098-C 2025 free printable template

Show details

This form is used to report contributions of motor vehicles, boats, and airplanes to the IRS, including details such as donation date, vehicle information, and the value of the contribution.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1098-C

How to edit IRS 1098-C

How to fill out IRS 1098-C

Instructions and Help about IRS 1098-C

How to edit IRS 1098-C

To edit IRS 1098-C, utilize a reliable PDF editor such as pdfFiller. This tool allows you to seamlessly modify your form, ensuring all information is accurate before submission. Simply upload the form, make the necessary changes, and save or print your edited document.

How to fill out IRS 1098-C

Filling out IRS 1098-C requires gathering detailed information about the vehicle donation if you are the organization receiving the donation. Start by entering your organization's name, address, and Employer Identification Number (EIN) in the designated fields. Next, accurately record the donor's information and vehicle details, including the vehicle identification number (VIN) and the fair market value of the vehicle at the time of donation. Finally, ensure that you sign and date the form, certifying that the information provided is correct.

Latest updates to IRS 1098-C

Latest updates to IRS 1098-C

Be aware that updates to the IRS 1098-C may occur annually, typically reflecting changes in tax laws or reporting requirements. Always check the IRS website for the most current version and any relevant instructions that accompany the form.

All You Need to Know About IRS 1098-C

What is IRS 1098-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1098-C

What is IRS 1098-C?

IRS 1098-C is a tax form used by qualified organizations to report the receipt of donated vehicles, boats, or airplanes. This form provides the necessary information for the donor to claim a tax deduction for their charitable contribution.

What is the purpose of this form?

The purpose of IRS 1098-C is to document and provide evidence of a vehicle donation, enabling the donor to claim a tax deduction appropriately. It is critical for ensuring compliance with IRS rules regarding charitable contributions in the context of personal tax returns.

Who needs the form?

Qualified charitable organizations that receive vehicle donations must complete IRS 1098-C. Additionally, the form is necessary for donors who wish to claim deductions on their federal tax returns for contributions of vehicles with a fair market value exceeding $500.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1098-C if the vehicle’s fair market value is less than $500, as a simpler reporting process may apply. Additionally, certain religious and government entities are exempt from filing this form for their donations.

Components of the form

IRS 1098-C consists of multiple parts, including sections for the recipient organization’s information, donor’s details, and specifics regarding the donated property. Key components include the fair market value, acknowledgment of receipt, and essential signatures. Accuracy in each section is crucial for ensuring the form is valid and compliant.

Due date

IRS 1098-C must be submitted to the IRS and provided to the donor by the last day of February if filing by mail, or March 31 if filing electronically. Timely filing is essential to avoid penalties and ensure that donors can utilize the form for their tax deductions.

What payments and purchases are reported?

IRS 1098-C is specifically designed to report the donation of vehicles, which may include cars, trucks, boats, and airplanes. It does not cover cash donations or donations of property other than vehicles, which must be reported using different IRS forms.

How many copies of the form should I complete?

Organizations must complete two copies of IRS 1098-C: one for the donor and one to submit with their tax return to the IRS. Additional copies may be necessary if the organization has multiple donors or vehicles being reported.

What are the penalties for not issuing the form?

Failing to issue IRS 1098-C can result in penalties for the organization, which may include fines assessed for each instance of non-compliance. This underscores the importance of timely and accurate reporting for both the organization and the donor to ensure adherence to IRS guidelines.

What information do you need when you file the form?

When filing IRS 1098-C, you need the donor's name, address, Social Security number, and the vehicle’s details, including make, model, year, and VIN. Additionally, you must report the fair market value and any other relevant transaction information.

Is the form accompanied by other forms?

IRS 1098-C may need to be accompanied by other forms, such as IRS 8283 for non-cash charitable contributions, especially if the fair market value exceeds $500. Ensure to check the requirements based on the specific circumstances of the donation.

Where do I send the form?

Send IRS 1098-C forms to the IRS at the address listed in the form's instructions. Additionally, provide the donor with their copy of the form for their records, ensuring compliance with IRS filing requirements.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

So far the limited need I have to fill out forms has been totally satisfied with this application.

good

easy to use

I've only used the site briefly and it seems user friendly.

Thank you so very very much for the…

Thank you so very very much for the prompt assistance. Am stressed due to deadline I have to meet today to Labor Law requirement in my country for my foreign workers.

I will try d payment issues later as it is more complicated matters involved

The app and customer support is great!

The app itself is great, no doubt. Recently I encountered some problems with logging in and contacted the support team and they resolve my problem in 10 minutes. Outstanding customer support! 10/10

SO far, so good...with some aggravations for navigating what I want to do.

See what our users say