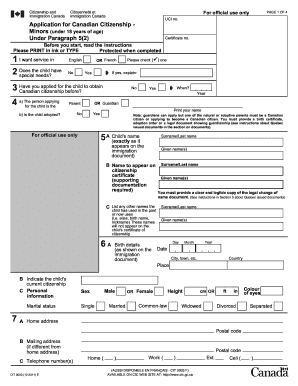

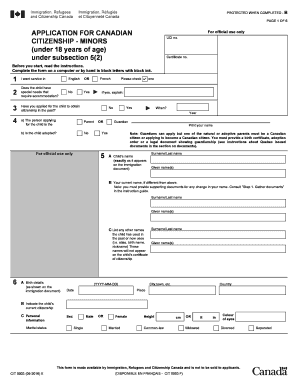

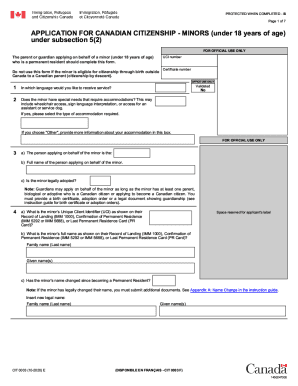

Canada CIT 0407e 2015 free printable template

Show details

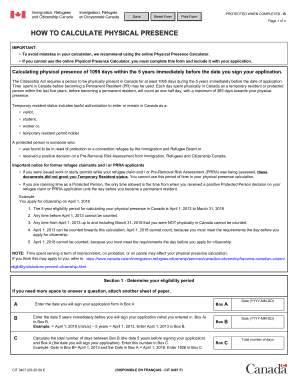

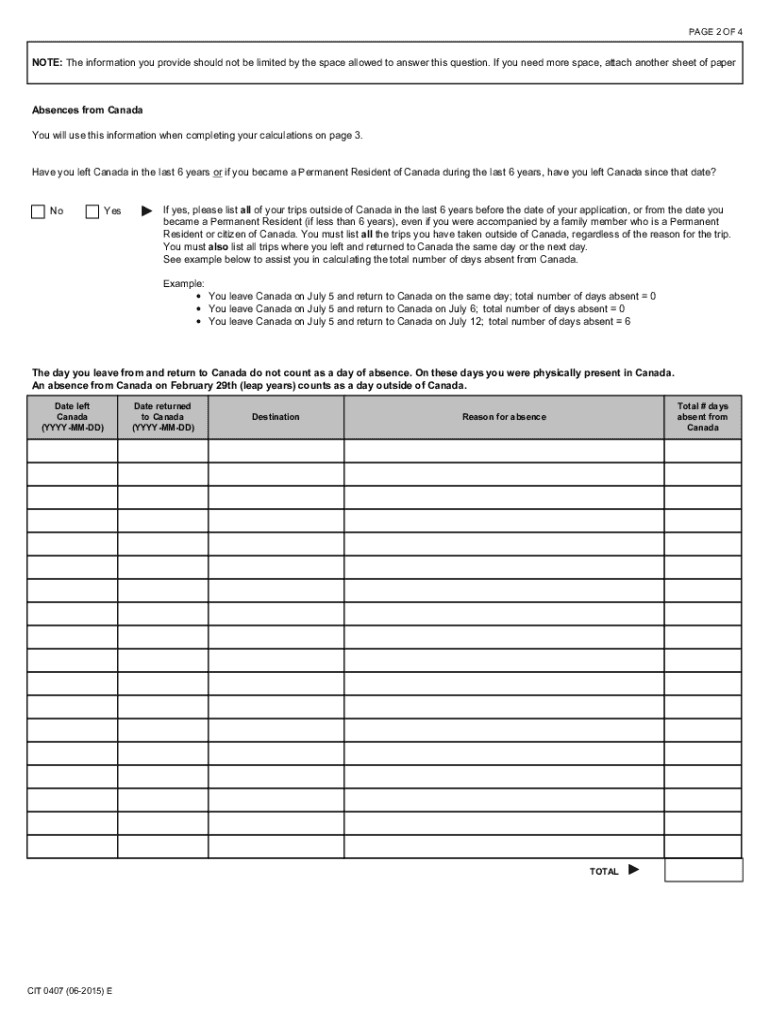

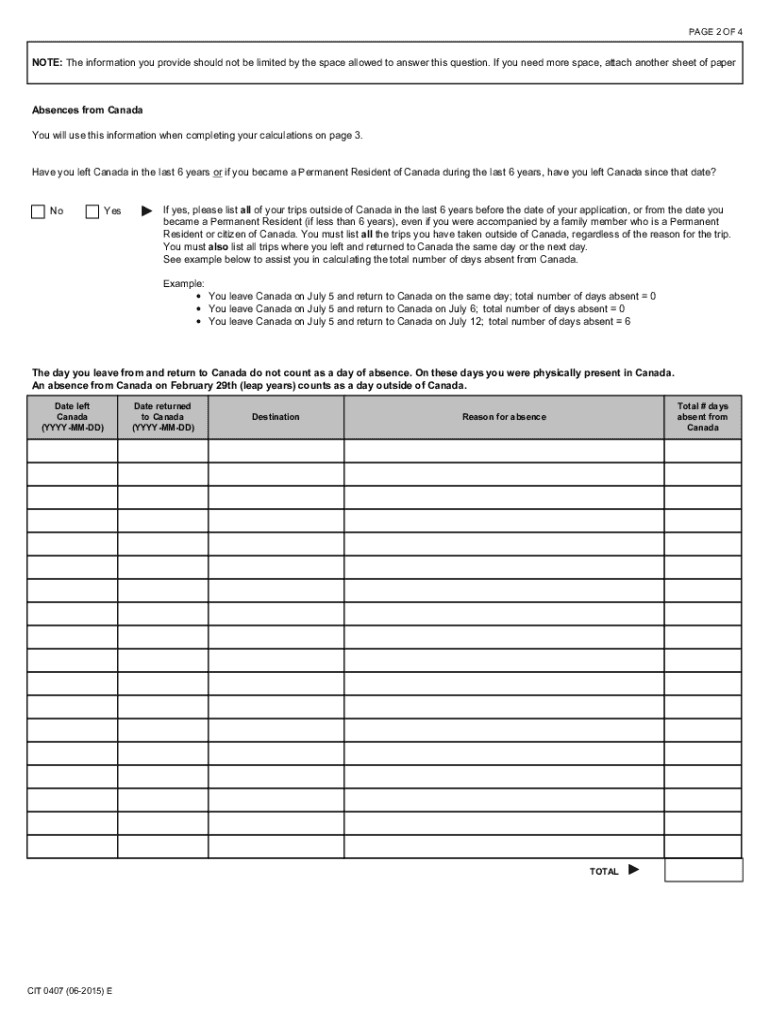

PROTECTED WHEN COMPLETED B PAGE 1 OF 4 HOW TO CALCULATE PHYSICAL PRESENCE IMPORTANT: Due to the possibility of mistakes when making a manual physical presence calculation, please be advised that you

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada CIT 0407e

Edit your Canada CIT 0407e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CIT 0407e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada CIT 0407e online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada CIT 0407e. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CIT 0407e Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CIT 0407e

How to fill out Canada CIT 0407e

01

Download the Canada CIT 0407e form from the official Canada Revenue Agency (CRA) website.

02

Read the form instructions carefully to understand the requirements.

03

Gather all necessary documentation, such as financial records and identification.

04

Start filling out the form by providing your business information at the top section.

05

Complete the income section by reporting all relevant revenue.

06

Fill out the expense section, detailing all allowable business expenses.

07

Review the specific tax deductions applicable to your situation and fill them out accurately.

08

Ensure to include any additional schedules or annexes if required for your specific case.

09

Double-check all entries for accuracy and completeness.

10

Sign and date the form before submission.

Who needs Canada CIT 0407e?

01

Any business or organization in Canada that is required to report their income tax obligations.

02

Corporations that need to file their tax return for the fiscal year.

03

Partnerships that require a tax return for the income earned during the year.

04

Non-profit organizations that need to fulfill reporting requirements to maintain their status.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate physical presence for protected person?

Time spent in Canada before becoming a Permanent Resident (PR) may be used. Each day spent physically in Canada as a temporary resident or protected person within the last five years, before becoming a permanent resident, will count as one half day, with a maximum of 365 days towards your physical presence.

Can I live outside of Canada as a permanent resident?

When you become a Permanent Resident, there are some circumstances where you can live overseas and maintain your Permanent Resident status in Canada. To maintain your status as a permanent resident, you must live in Canada for at least 2 years - 730 days - within a 5 year period.

How long can you stay out of Canada if you are a permanent resident?

If you haven't been in Canada for at least 730 days during the last five years, you may lose your PR status.

How do you prove physical presence in Canada?

This can be your passport. If you don't have a passport, you need to include 2 other identity documents. For example, you could use your Ontario health card and your driver's licence. You can't use your permanent resident card as one of your identity documents.

What is 5 year eligibility period?

The five (5) year eligibility period includes the time since the minor became a permanent resident and each day that the minor was physically present in Canada as an authorized temporary resident or protected person before they became a permanent resident, if applicable.

What happens if you stay out of Canada for longer than 6 months?

Residency visa or permit: If you stay in a country beyond the period allowed by a typical tourist visa (usually three to six months) for reasons such as retirement abroad, you'll need a residency visa or permit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the Canada CIT 0407e in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Canada CIT 0407e and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit Canada CIT 0407e on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Canada CIT 0407e.

How do I complete Canada CIT 0407e on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your Canada CIT 0407e. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Canada CIT 0407e?

Canada CIT 0407e is a tax form used for filing certain corporate income tax returns in Canada, specifically for non-resident corporations that earn income from Canadian sources.

Who is required to file Canada CIT 0407e?

Non-resident corporations that earn income from Canadian sources and are not exempt from taxation in Canada are required to file Canada CIT 0407e.

How to fill out Canada CIT 0407e?

To fill out Canada CIT 0407e, one must provide accurate financial information regarding Canadian-source income, deductions, and tax calculations, ensuring that all relevant sections of the form are completed accurately.

What is the purpose of Canada CIT 0407e?

The purpose of Canada CIT 0407e is to report income earned by non-resident corporations in Canada and to calculate the appropriate amount of Canadian taxes owed by those corporations.

What information must be reported on Canada CIT 0407e?

The information that must be reported on Canada CIT 0407e includes the corporation's income, deductible expenses, total income tax payable, and any other pertinent financial data related to Canadian operations.

Fill out your Canada CIT 0407e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada CIT 0407e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.