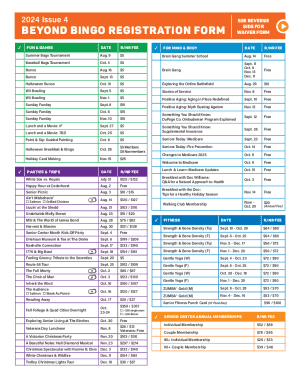

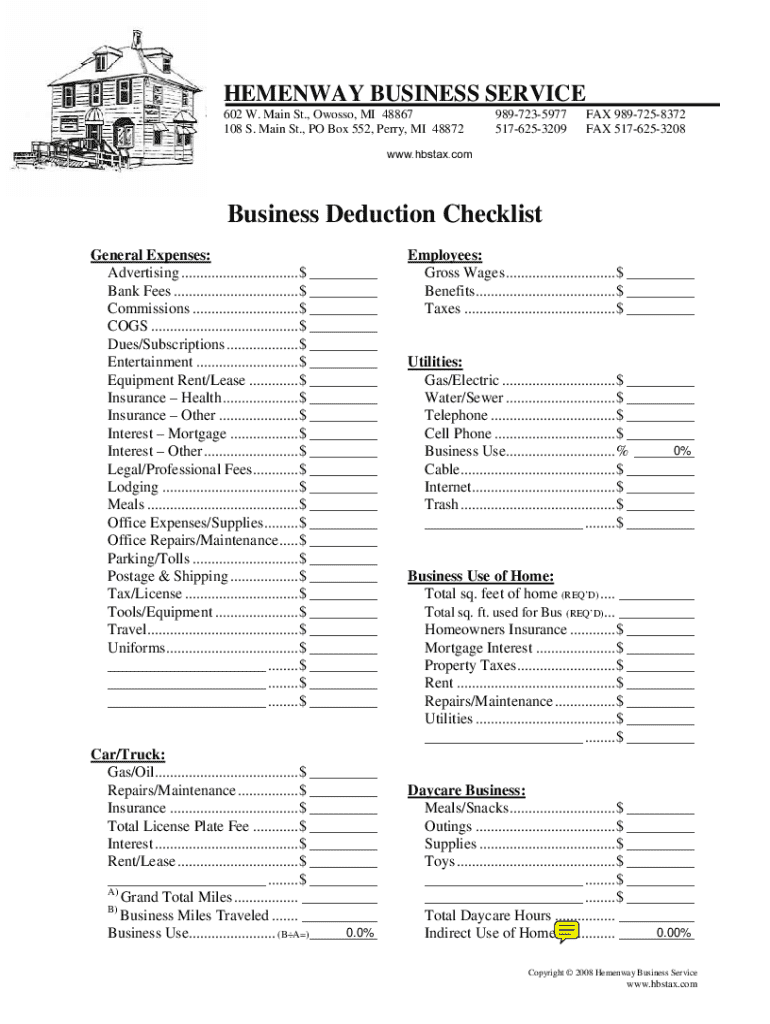

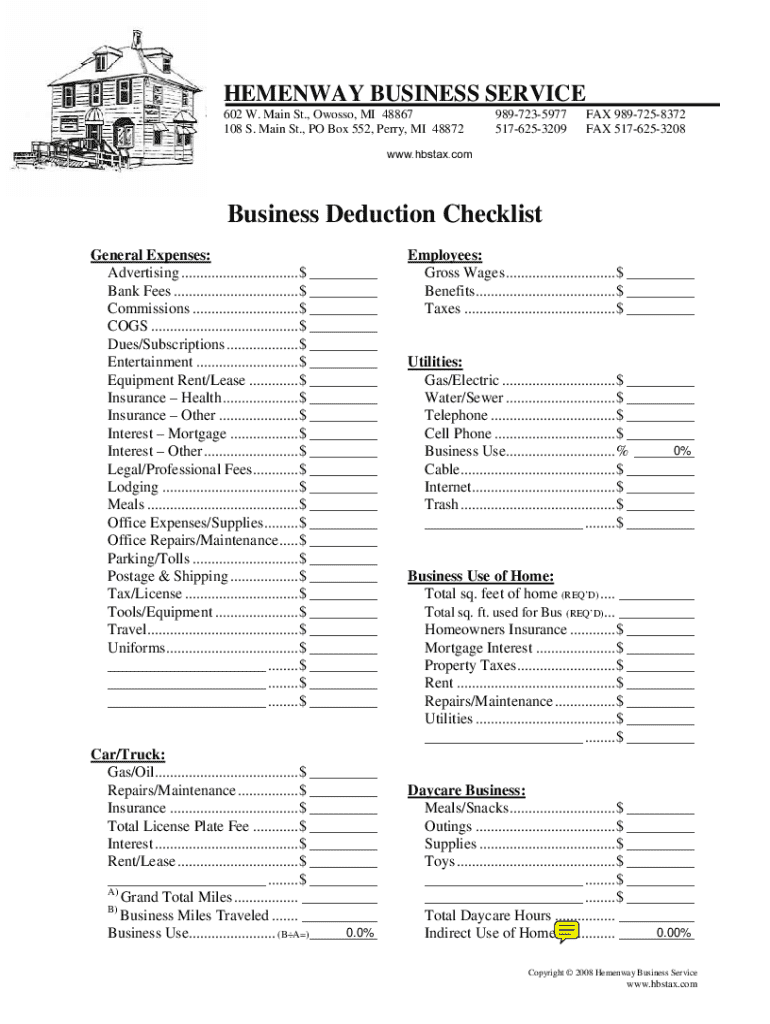

Get the free Business Deduction Checklist

Show details

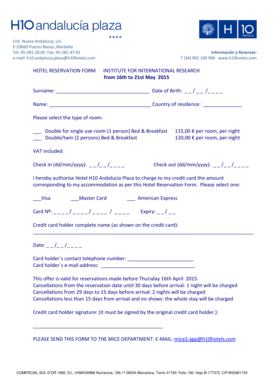

Este documento es una lista de verificación para deducciones comerciales que incluye varias categorías de gastos como publicidad, tarifas bancarias, comisiones, costos de bienes vendidos, y más,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business deduction checklist

Edit your business deduction checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business deduction checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business deduction checklist online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business deduction checklist. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business deduction checklist

How to fill out business deduction checklist

01

Gather all relevant financial documents, including receipts, invoices, and bank statements.

02

Identify and categorize your business expenses, such as travel, office supplies, and utilities.

03

Use the checklist to ensure you include all possible deductions.

04

Fill in each category with the respective amounts spent for the tax year.

05

Review the checklist for completeness and accuracy.

06

Keep signed copies and relevant documentation organized for future reference.

Who needs business deduction checklist?

01

Small business owners looking to maximize their tax deductions.

02

Freelancers and self-employed individuals who incur business-related costs.

03

Accountants and tax preparers assisting clients with tax preparation.

04

Corporations and partnerships needing to track deductible business expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the business deduction checklist electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your business deduction checklist and you'll be done in minutes.

How do I fill out the business deduction checklist form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign business deduction checklist and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit business deduction checklist on an Android device?

The pdfFiller app for Android allows you to edit PDF files like business deduction checklist. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is business deduction checklist?

A business deduction checklist is a tool used by business owners to keep track of eligible expenses that can be deducted from their taxable income, helping to reduce their overall tax burden.

Who is required to file business deduction checklist?

Business owners, freelancers, and self-employed individuals are required to file a business deduction checklist to accurately report their deductible expenses when preparing their tax returns.

How to fill out business deduction checklist?

To fill out a business deduction checklist, one should compile all relevant receipts and documentation for business-related expenses, categorize each expense, and list them accurately in the provided format, ensuring to comply with IRS guidelines.

What is the purpose of business deduction checklist?

The purpose of a business deduction checklist is to streamline the process of identifying and documenting deductible expenses, ensuring that business owners do not miss opportunities to lower their taxable income.

What information must be reported on business deduction checklist?

The information that must be reported on a business deduction checklist includes categories of expenses (such as office supplies, travel, meals, and utilities), the amount spent on each category, and supporting documentation, such as receipts and invoices.

Fill out your business deduction checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Deduction Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.