Get the free Mortgage Brokers Supplemental Application

Show details

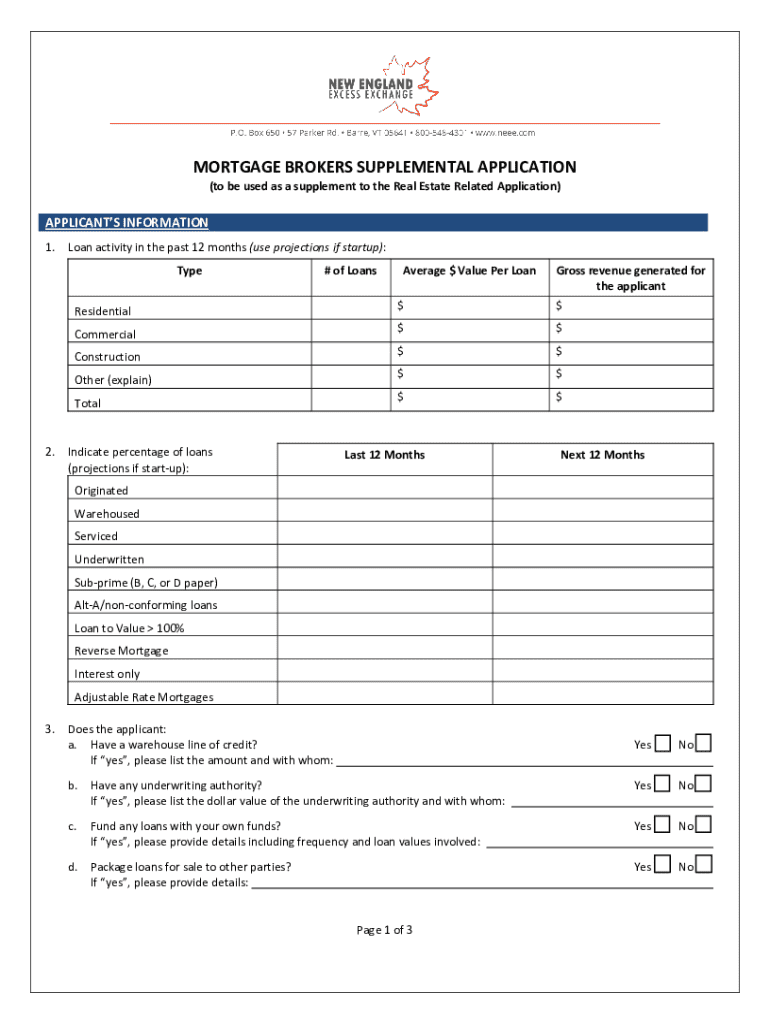

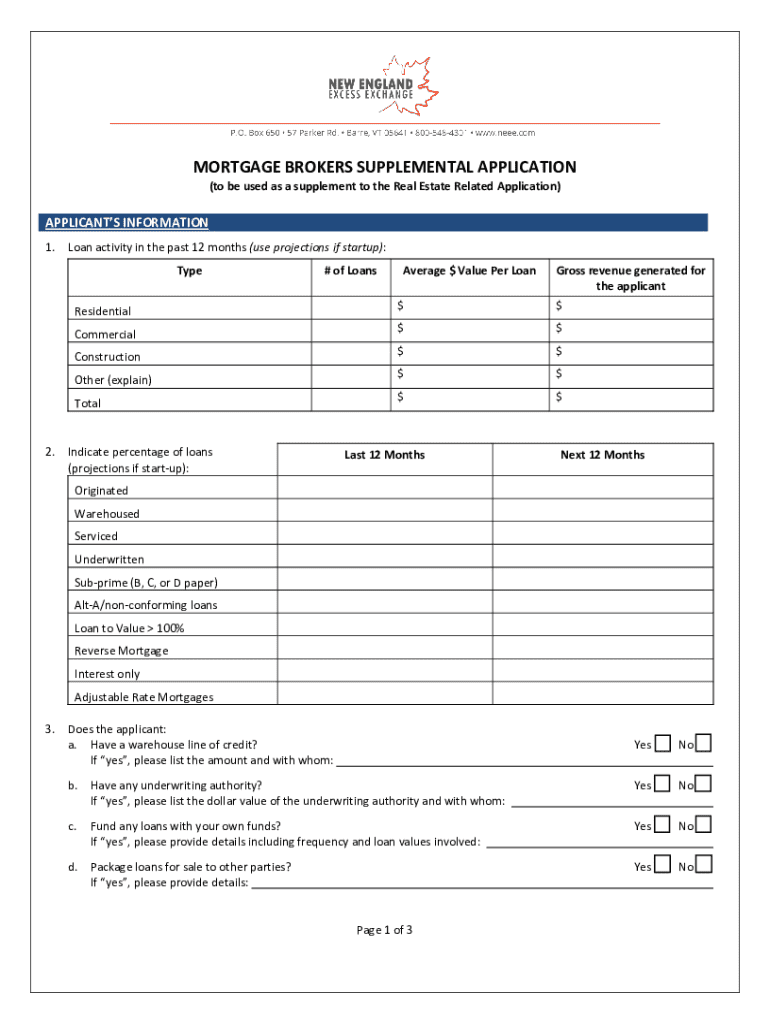

Este formulario es utilizado como un suplemento a la Solicitud Relacionada con Bienes Raíces. Se requiere la información del solicitante sobre la actividad de préstamos en los últimos 12 meses

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage brokers supplemental application

Edit your mortgage brokers supplemental application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage brokers supplemental application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage brokers supplemental application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage brokers supplemental application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage brokers supplemental application

How to fill out mortgage brokers supplemental application

01

Gather the necessary personal information including your name, address, and contact details.

02

Collect financial documents such as income statements, credit reports, and asset statements.

03

Complete the application form by providing details on your employment history and current financial obligations.

04

List specific details about the property involved in the mortgage, including its address and estimated value.

05

Review the completed application for accuracy and completeness before submission.

06

Submit the application to the mortgage broker along with any required supporting documents.

Who needs mortgage brokers supplemental application?

01

Individuals seeking a mortgage who are working with a mortgage broker.

02

Borrowers who need to provide additional financial information beyond the standard application.

03

Homebuyers with unique financial situations that require additional documentation for approval.

04

Anyone looking to refinance or secure a new loan with the assistance of a mortgage broker.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage brokers supplemental application to be eSigned by others?

To distribute your mortgage brokers supplemental application, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit mortgage brokers supplemental application online?

The editing procedure is simple with pdfFiller. Open your mortgage brokers supplemental application in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit mortgage brokers supplemental application straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit mortgage brokers supplemental application.

What is mortgage brokers supplemental application?

A mortgage brokers supplemental application is an additional form that mortgage brokers use to provide supplementary information required by lenders or regulatory authorities beyond the standard application.

Who is required to file mortgage brokers supplemental application?

Mortgage brokers who are seeking to obtain a license or approval to operate, or those who are required by a lender or regulatory body to provide extra information, are required to file a mortgage brokers supplemental application.

How to fill out mortgage brokers supplemental application?

To fill out a mortgage brokers supplemental application, complete all required fields honestly and accurately, provide any supporting documentation as required, and ensure the application is signed and dated before submission.

What is the purpose of mortgage brokers supplemental application?

The purpose of a mortgage brokers supplemental application is to gather additional data that may be necessary for assessing the broker's qualifications, financial stability, and compliance with relevant laws and regulations.

What information must be reported on mortgage brokers supplemental application?

The mortgage brokers supplemental application may require information such as the broker's business structure, financial statements, ownership details, professional experience, and disclosures related to any legal or compliance issues.

Fill out your mortgage brokers supplemental application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Brokers Supplemental Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.