Get the free Motor Fuel Taxation, Energy Conservation,

Show details

Motor Fuel Taxation, Energy Conservation, and Economic Development: A Regional ApproachRichard England 2006Lincoln Institute of Land Policy Working PaperThe findings and conclusions of this paper

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel taxation energy

Edit your motor fuel taxation energy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel taxation energy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor fuel taxation energy online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit motor fuel taxation energy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

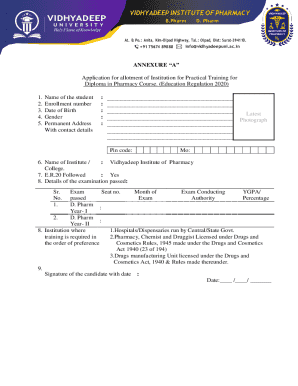

How to fill out motor fuel taxation energy

How to fill out motor fuel taxation energy

01

Gather all necessary documents such as vehicle registration, receipts for fuel purchases, and previous tax filings.

02

Identify the applicable regulations and guidelines for motor fuel taxation in your jurisdiction.

03

Fill out the required forms accurately, ensuring that all information matches your gathered documents.

04

Calculate the total amount of fuel used and the corresponding taxes owed based on your fuel purchases.

05

Double-check all entries for accuracy before submission.

06

Submit the completed forms and required payments by the deadline to avoid penalties.

Who needs motor fuel taxation energy?

01

Commercial vehicle operators who utilize fuel for business operations.

02

Individuals or businesses that operate vehicles subject to fuel taxes.

03

Transport companies seeking to reclaim fuel tax for business-related fuel usage.

04

State and local governments requiring accurate fuel tax reporting for revenue purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find motor fuel taxation energy?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the motor fuel taxation energy. Open it immediately and start altering it with sophisticated capabilities.

How do I execute motor fuel taxation energy online?

With pdfFiller, you may easily complete and sign motor fuel taxation energy online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out motor fuel taxation energy on an Android device?

Use the pdfFiller mobile app to complete your motor fuel taxation energy on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is motor fuel taxation energy?

Motor fuel taxation energy refers to the taxes levied on the sale and use of motor fuels such as gasoline and diesel. These taxes are typically imposed by federal, state, and local governments to generate revenue for transportation infrastructure and other public services.

Who is required to file motor fuel taxation energy?

Individuals or businesses that produce, distribute, or sell motor fuels are generally required to file motor fuel taxation energy reports. This includes fuel manufacturers, wholesalers, and retailers.

How to fill out motor fuel taxation energy?

To fill out motor fuel taxation energy, individuals or businesses must complete the specified tax form provided by their state or federal tax authority, providing accurate information about fuel purchases, sales, and tax liability. Supporting documentation may also be required.

What is the purpose of motor fuel taxation energy?

The purpose of motor fuel taxation energy is to fund transportation infrastructure projects, maintain roads, support public transit systems, and ensure the overall maintenance and development of transportation services.

What information must be reported on motor fuel taxation energy?

Reported information typically includes the amount of fuel purchased, sold, or distributed; the applicable tax rates; total taxes due; exemptions claimed; and any other relevant transactions involving motor fuel.

Fill out your motor fuel taxation energy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Taxation Energy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.