Get the free What does Wealth Management do with - cups cs cmu

Show details

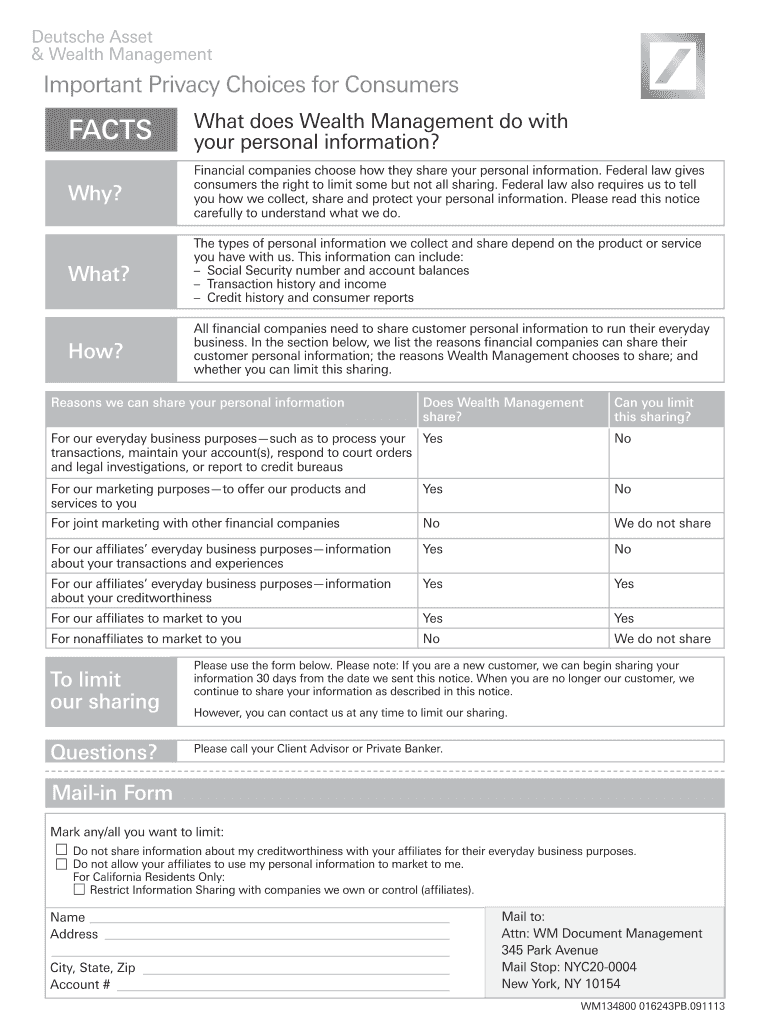

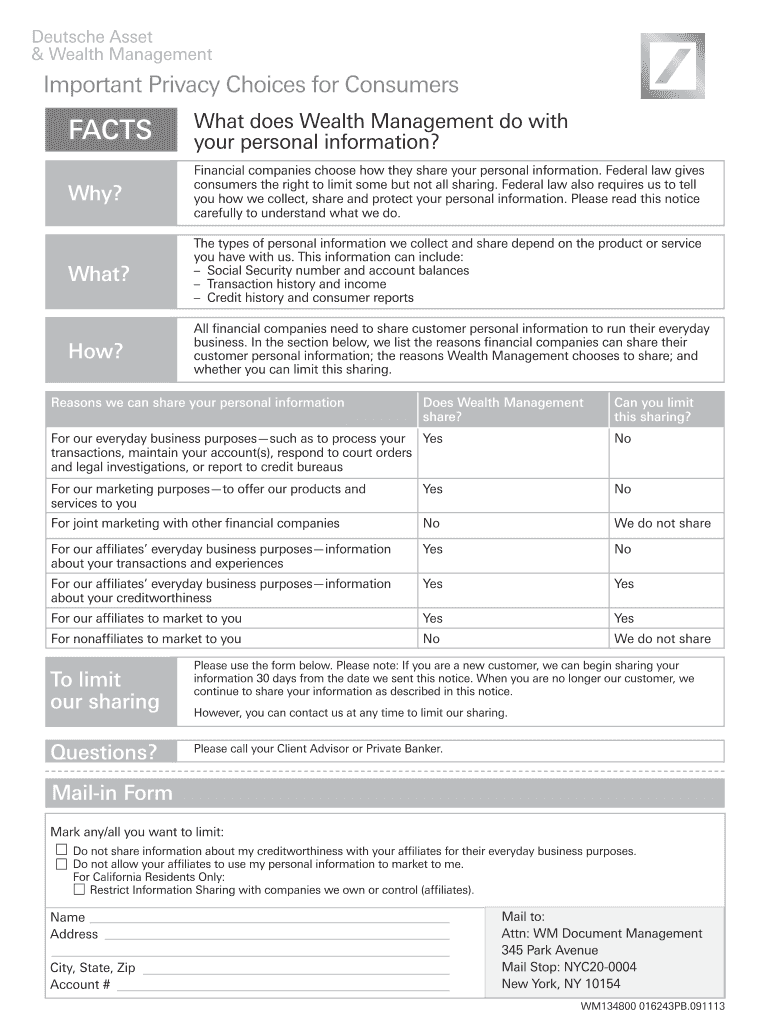

Deutsche Asset & Wealth Management Important Privacy Choices for Consumers FACTS What does Wealth Management do with your personal information? Why? Financial companies choose how they share your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what does wealth management

Edit your what does wealth management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what does wealth management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what does wealth management online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what does wealth management. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what does wealth management

How to fill out what does wealth management?

01

Define your financial goals: Start by clearly identifying your short-term and long-term financial objectives. This could include saving for retirement, building an emergency fund, or purchasing a new property.

02

Assess your current financial situation: Take stock of your current assets, liabilities, income, and expenses. Understand your cash flow and net worth. This analysis will provide a foundation for developing a wealth management plan.

03

Determine your risk tolerance: Assess your comfort level with investment risk. This will guide the asset allocation strategy within your wealth management plan. Consider factors such as your age, financial obligations, and investment goals.

04

Seek professional advice: Engage with a qualified wealth management professional or financial advisor. They can provide expertise and guidance tailored to your specific financial situation. They will help you develop a comprehensive wealth management plan.

05

Develop a diversified investment portfolio: Work with your financial advisor to build a diversified investment portfolio aligned with your risk tolerance and long-term goals. Diversification helps mitigate risk and maximize returns. Consider investments in various asset classes such as stocks, bonds, real estate, and mutual funds.

06

Monitor and review regularly: Regularly review and monitor your investment portfolio to ensure it remains aligned with your goals. Periodically revisit your financial plan with your advisor, especially when there are significant life events or changes in your financial circumstances.

Who needs wealth management?

01

High-net-worth individuals: Individuals with substantial assets often require wealth management to preserve and grow their wealth, mitigate tax obligations, and plan for estate transfer.

02

Business owners: Entrepreneurs and business owners may need wealth management services to optimize their personal finances, manage business succession planning, and ensure a smooth transition when exiting the business.

03

Professionals and executives: Professionals, such as doctors, lawyers, or executives, with high income and complex financial situations can benefit from wealth management. It helps them manage their finances, reduce tax liabilities, and plan for retirement.

04

Individuals planning for retirement: Wealth management is crucial for individuals approaching retirement age. It helps ensure a comfortable retirement by creating a comprehensive plan that considers factors like social security, pension, and investment income.

05

Individuals with specific financial goals: Anyone with specific financial goals, such as saving for education, purchasing a home, or starting a business, can benefit from wealth management. It provides a structured approach to achieve these goals while considering individual circumstances and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is what does wealth management?

Wealth management is the process of managing a person's financial assets and investments to achieve specific financial goals.

Who is required to file what does wealth management?

Individuals or entities with significant financial assets or investments may be required to file a wealth management plan.

How to fill out what does wealth management?

To fill out a wealth management plan, individuals or entities should gather information about their financial assets, investments, and financial goals.

What is the purpose of what does wealth management?

The purpose of wealth management is to help individuals or entities effectively manage their financial assets and investments to achieve their financial goals.

What information must be reported on what does wealth management?

Information such as financial assets, investments, income, expenses, and financial goals must be reported on a wealth management plan.

How do I make changes in what does wealth management?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your what does wealth management to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit what does wealth management in Chrome?

what does wealth management can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my what does wealth management in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your what does wealth management and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your what does wealth management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Does Wealth Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.