Get the free Your Deposit Accounts - cups cs cmu

Show details

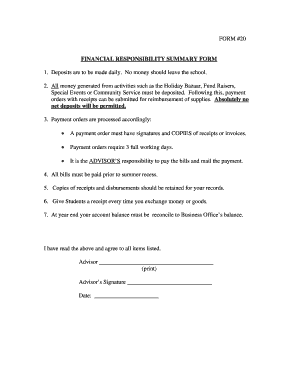

Important Information Regarding

Your Deposit AccountsWelcome to UMB Bank. We appreciate your choosing to have a deposit account at one of our UMB depository financial institutions. This is your Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your deposit accounts

Edit your your deposit accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your deposit accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your deposit accounts online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit your deposit accounts. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your deposit accounts

How to fill out your deposit accounts:

01

Gather necessary documents: Start by collecting all the required documents for opening a deposit account. This typically includes proof of identity (such as a valid passport or driver's license) and proof of address (such as a utility bill or bank statement).

02

Choose the type of deposit account: Determine the type of deposit account that suits your financial goals and needs. There are various options available, including savings accounts, fixed deposit accounts, and money market accounts. Consider factors such as interest rates, account fees, and accessibility before making a decision.

03

Visit your chosen bank or financial institution: Once you have decided on the type of deposit account, visit your chosen bank or financial institution in person. Alternatively, you may complete the account-opening process online if the option is available.

04

Provide the necessary information: Fill out an account opening form and provide the required information. This typically includes personal details (such as full name, date of birth, and contact information), employment details (such as occupation and employer), and financial information (such as your income and assets).

05

Submit your identification and address proof: Present your identification and address proof documents as required by your bank or financial institution. These documents help verify your identity and address, ensuring compliance with anti-money laundering regulations.

06

Review account terms and conditions: Carefully read and understand the terms and conditions associated with your deposit account. Pay close attention to details regarding interest rates, account maintenance fees, withdrawal limits, and any other important guidelines.

07

Make an initial deposit: Most deposit accounts require an initial deposit to activate the account. This amount varies depending on the type of account and the bank's policies. Depositing this amount during the account opening process will ensure your account is active and ready to use.

08

Set up account preferences: If applicable, specify any account preferences or specifications during the account setup process. This may include opting for online banking services, requesting the issuance of a debit card, or selecting additional features like automatic savings transfers.

Who needs your deposit accounts?

01

Individuals saving for short- or long-term goals: Deposit accounts are suitable for anyone who wants to save money for various purposes. Whether you are saving for a vacation, buying a house, or planning for retirement, deposit accounts can help you grow your savings over time.

02

Students and young adults: Deposit accounts are particularly useful for students and young adults who are just starting to manage their finances. These accounts provide a secure place to store money, earn interest, and develop responsible saving habits.

03

Small business owners: Deposit accounts are essential for small business owners who want to separate their personal and business finances. These accounts offer features like business checking and savings options, allowing owners to manage their finances more efficiently.

04

Organizations and non-profits: Deposit accounts are also beneficial for organizations, charities, and non-profit entities. They provide a secure place to store funds and earn interest while ensuring proper financial management and accountability.

In summary, anyone looking to save money, manage their finances, or separate personal and business funds can benefit from deposit accounts. These accounts offer a safe and reliable way to store money, earn interest, and achieve various financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send your deposit accounts for eSignature?

Once your your deposit accounts is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get your deposit accounts?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific your deposit accounts and other forms. Find the template you need and change it using powerful tools.

How do I fill out your deposit accounts on an Android device?

Use the pdfFiller mobile app and complete your your deposit accounts and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is your deposit accounts?

Deposit accounts are financial accounts in which money is deposited, held, and withdrawn by the account holder.

Who is required to file your deposit accounts?

Businesses and individuals who have deposit accounts are required to file reports on their accounts.

How to fill out your deposit accounts?

Deposit accounts can be filled out by providing information on the account holder, the financial institution, and the transactions made on the account.

What is the purpose of your deposit accounts?

The purpose of deposit accounts is to securely hold and manage funds for individuals or businesses.

What information must be reported on your deposit accounts?

Information such as account holder name, account number, transaction history, balance, and interest earned must be reported on deposit accounts.

Fill out your your deposit accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Deposit Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.