IRS 1098 Instructions 2025-2026 free printable template

Show details

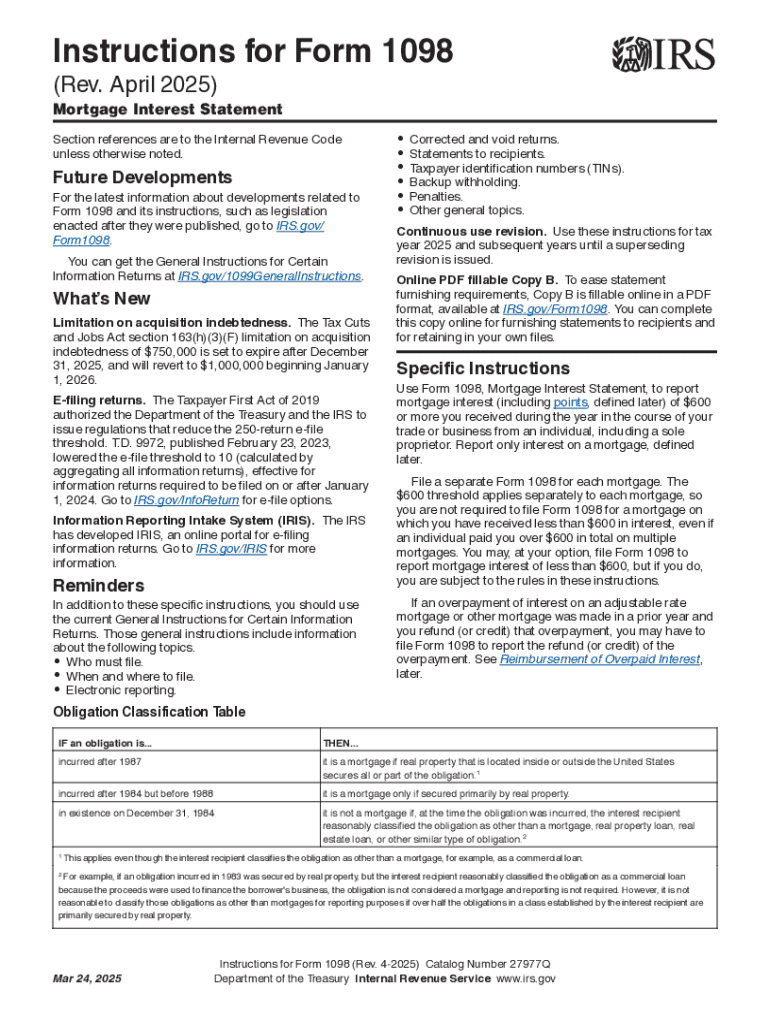

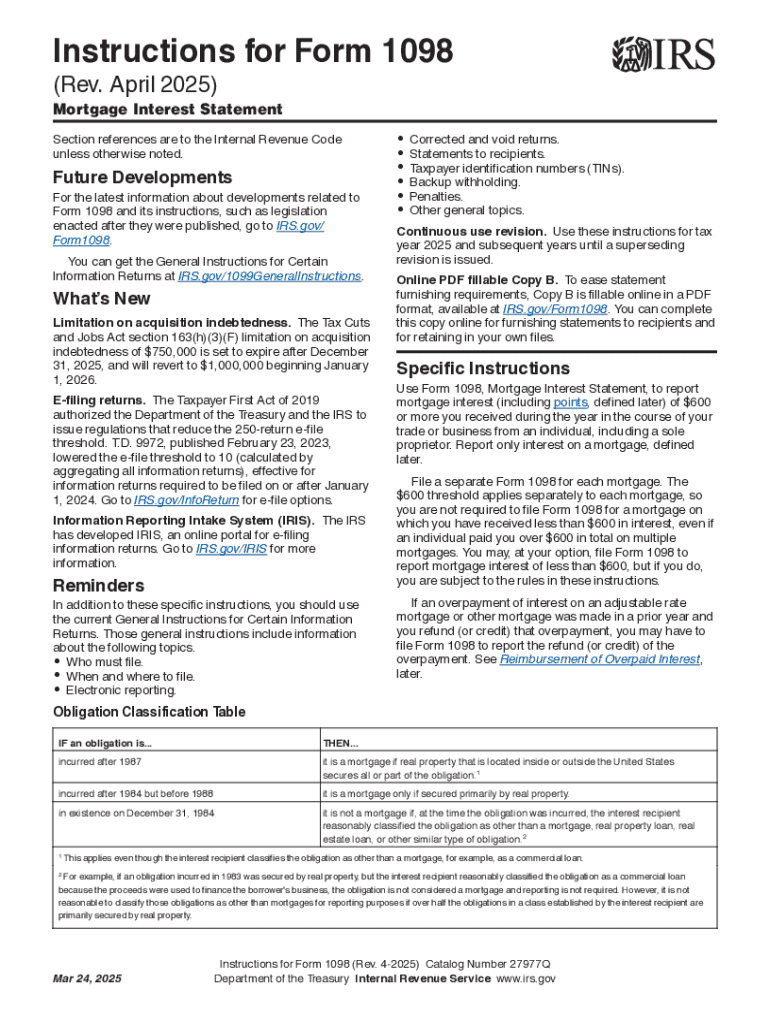

Instructions for Form 1098 provide guidelines on reporting mortgage interest paid, including details on who must file, specific instructions for reporting various types of interest, including mortgage

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1098 Instructions

Edit your IRS 1098 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1098 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1098 Instructions online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1098 Instructions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1098 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1098 Instructions

How to fill out form 1098

01

Obtain Form 1098 from the IRS website or your tax preparation software.

02

Enter the Payer's information, including name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

03

Fill out the Recipient's details, including name, address, and SSN or EIN.

04

Report the amount of interest received from the borrower in Box 1.

05

If applicable, complete Box 2 for points paid on the purchase of the principal residence.

06

Complete Box 3 if there are any mortgage insurance premiums.

07

Review the form for accuracy, ensuring all required fields are filled out.

08

Submit the completed form to the IRS and provide a copy to the recipient.

Who needs form 1098?

01

Lenders who received interest payments on a mortgage loan.

02

Financial institutions that issued mortgage loans.

03

Borrowers who paid interest on a mortgage during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Can I create my own W 9?

You can create a filled-out Form W-9 online at the IRS website.

How do I fill out my w4 for 2022?

How to fill out a W-4 Step 1: Personal information. Enter your name, address, Social Security number and tax-filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

Is there a Form W-9 for 2022?

Get the free w9 form 2018-2022. If you are providing Form W-9 to an FFI to document a joint account each holder of the account that is a U.S. person must provide a Form W-9.

Who is required to fill out a W9 form?

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or “freelancer.” Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

Will there be a new w4 for 2022?

Final versions of the 2022 Form W-4, Employee's Withholding Certificate, Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments, and Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions, were released by the IRS.

What is the current W9 form?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

What year is the latest W 9 form?

Fill Tax Form W9 2020 – 2021 online. Filling W-9 form in 2022 and send to IRS.

Can I file 1040 by myself?

Answer: Yes, you can file an original Form 1040 series tax return electronically using any filing status.

Where do I get IRS form and instructions?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

When was the W-4 form updated?

The “new” Form W-4, Employee's Withholding Certificate, is an updated version of the previous Form W-4, Employee's Withholding Allowance Certificate. The IRS launched this form in 2020, removing withholding allowances. The new IRS W-4 complements the changes to the tax law that took effect in 2018.

Has the w4 form changed?

Allowances are no longer used for the redesigned Form W-4. This change is meant to increase transparency, simplicity, and accuracy of the form. In the past, the value of a withholding allowance was tied to the amount of the personal exemption.

How do I get IRS form and instructions?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Where can I get a hard copy of 1040 instructions?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Is there a new W-4 form for 2022?

The 2022 Form W-4, Employee's Withholding Certificate, has not yet been released by the IRS. As soon as a new form is released we will notify you. Until then, you may use the 2021 W-4 version to make any changes to your withholdings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 1098 Instructions in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your IRS 1098 Instructions, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete IRS 1098 Instructions on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 1098 Instructions. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete IRS 1098 Instructions on an Android device?

On an Android device, use the pdfFiller mobile app to finish your IRS 1098 Instructions. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

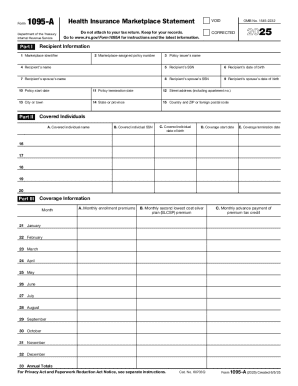

What is form 1098?

Form 1098 is a tax form used to report mortgage interest payments, student loan interest, and other expenses related to real estate or educational loans to the IRS.

Who is required to file form 1098?

Lenders, including banks and financial institutions, who receive mortgage interest payments of $600 or more during the tax year are required to file Form 1098.

How to fill out form 1098?

To fill out Form 1098, provide information such as the borrower's name, address, Social Security number, the mortgage interest received, and any mortgage insurance premiums. Accurate and complete details must be entered as per the IRS guidelines.

What is the purpose of form 1098?

The purpose of Form 1098 is to report interest payments and other relevant financial data related to mortgage or student loans to the IRS, allowing borrowers to claim potential tax deductions.

What information must be reported on form 1098?

Information that must be reported on Form 1098 includes the borrower's name, tax identification number, address, the amount of interest paid, any mortgage insurance premiums, and the lender's information.

Fill out your IRS 1098 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1098 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.