Get the free Salary Redirection Agreement

Show details

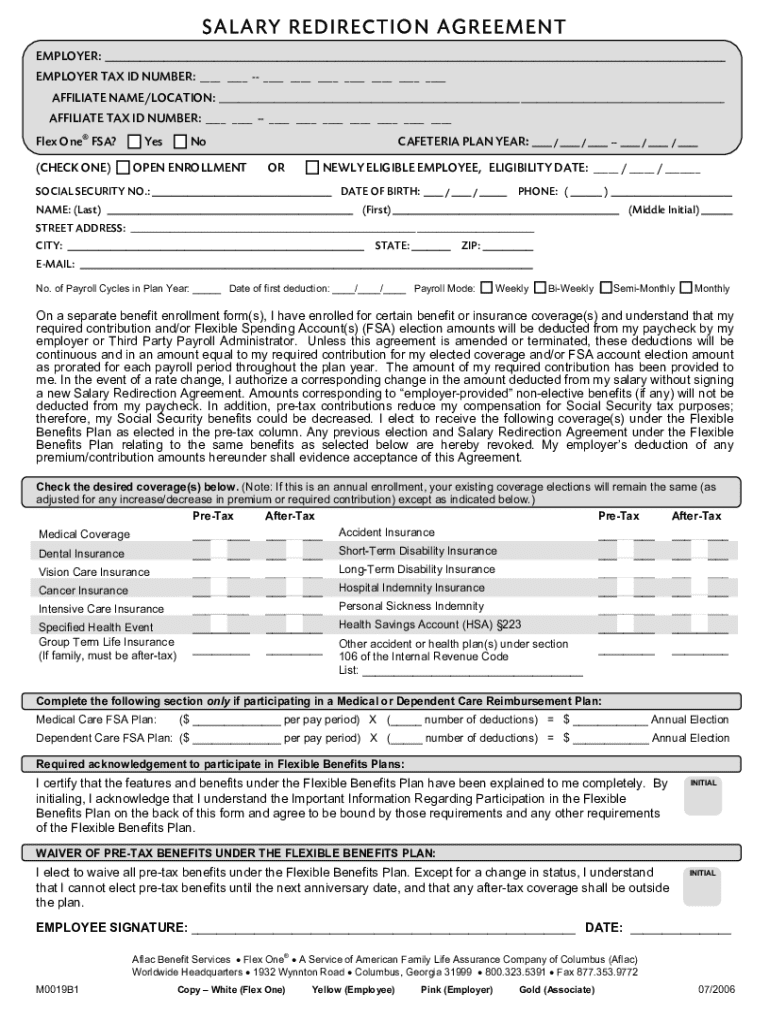

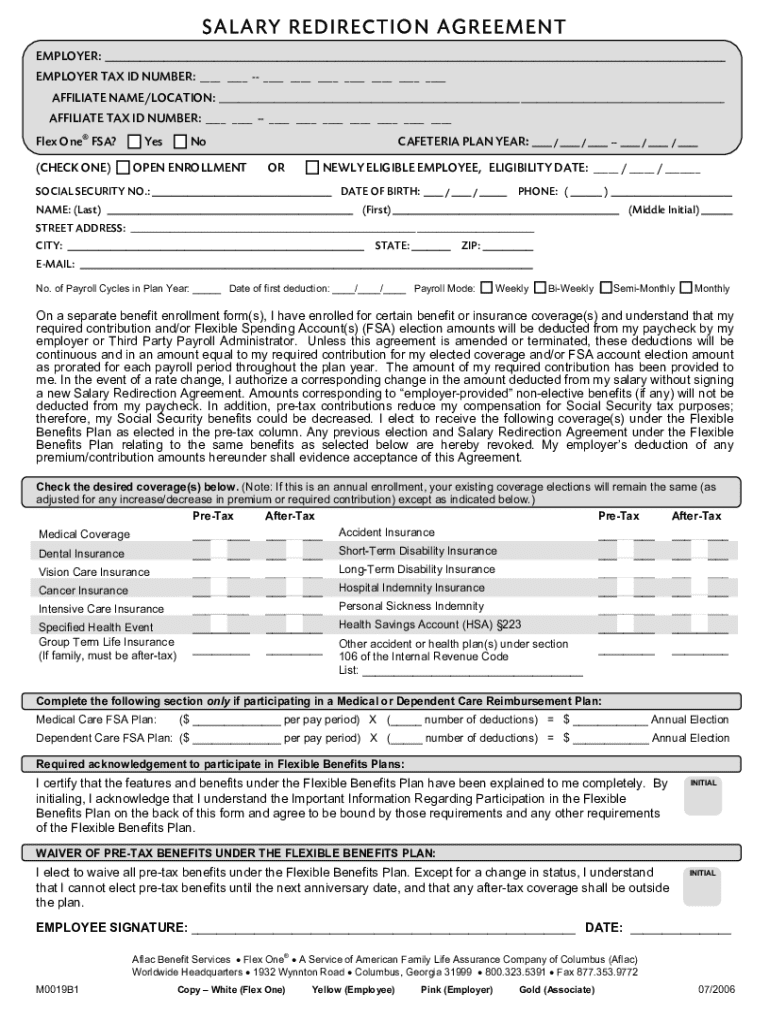

Este acuerdo permite a los empleados redirigir una parte de su salario para cubrir las contribuciones requeridas para beneficios de salud y cuenta de gastos flexibles (FSA). Los empleados proporcionan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary redirection agreement

Edit your salary redirection agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary redirection agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary redirection agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit salary redirection agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary redirection agreement

How to fill out salary redirection agreement

01

Start by obtaining the salary redirection agreement form from your HR department or online portal.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal details, including your name, employee ID, and department.

04

Specify the amount or percentage of your salary that you wish to redirect.

05

Provide the details of the account to which the funds will be redirected, ensuring accuracy in account number and bank details.

06

Review the agreement terms and conditions, ensuring you comprehend the implications of salary redirection.

07

Sign and date the agreement where indicated.

08

Submit the completed form to HR for approval.

09

Keep a copy of the agreement for your records.

Who needs salary redirection agreement?

01

Employees who wish to allocate a portion of their salary to a different bank account or savings plan.

02

Individuals who are participating in benefits programs that require salary redirection, such as retirement plans or employee stock purchase programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send salary redirection agreement for eSignature?

Once you are ready to share your salary redirection agreement, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I edit salary redirection agreement on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing salary redirection agreement right away.

How do I edit salary redirection agreement on an Android device?

With the pdfFiller Android app, you can edit, sign, and share salary redirection agreement on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is salary redirection agreement?

A salary redirection agreement is a formal document that allows an employee to redirect their earnings to a specific account or investment vehicle, often for purposes such as retirement savings or tax deferral.

Who is required to file salary redirection agreement?

Typically, employees participating in salary deferral programs, such as 401(k) or other retirement plans, are required to file a salary redirection agreement with their employer.

How to fill out salary redirection agreement?

To fill out a salary redirection agreement, an employee must provide their personal information, choose the percentage or amount of salary to redirect, and indicate the specific account or investment option for the redirected funds.

What is the purpose of salary redirection agreement?

The purpose of a salary redirection agreement is to allow employees to proactively manage their salary towards savings or investment accounts, thereby enabling tax benefits and promoting long-term financial security.

What information must be reported on salary redirection agreement?

The salary redirection agreement must generally report the employee's name, identification number, the percentage or amount of salary to be redirected, destination account details, and any applicable dates for the redirection.

Fill out your salary redirection agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Redirection Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.