Get the free G 510/1

Show details

PCS_4_APRIL_2022_G510_14pp_mrg 20/01/2022 16:36 Page 35G 510/1 Google Chrome: Top Tips & TricksINDEX GHIFrom Form Filling to Unit Conversions, Discover Chromes Handy Features! This article shows you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign g 5101

Edit your g 5101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your g 5101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing g 5101 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit g 5101. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

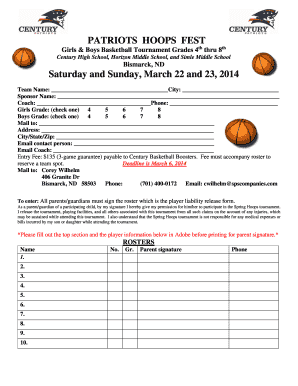

How to fill out g 5101

How to fill out g 5101

01

Obtain Form G 5101 from the official website or your local office.

02

Review the instructions included with the form carefully.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide any required identification numbers, such as Social Security Number or Tax ID.

05

Complete the sections relating to the purpose of the form, ensuring all necessary details are included.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form as directed, either by mail or electronically.

Who needs g 5101?

01

Individuals or entities applying for specific government services or benefits related to G 5101.

02

People needing to provide documentation for legal or financial processes that require this specific form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my g 5101 directly from Gmail?

g 5101 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit g 5101 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing g 5101 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit g 5101 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing g 5101.

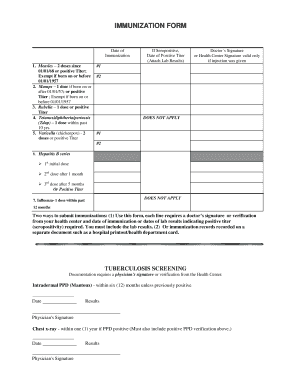

What is g 5101?

Form G 5101 is a tax form used for reporting certain financial information to the relevant tax authority.

Who is required to file g 5101?

Individuals or entities that meet specific income thresholds or financial criteria set by the tax authority are required to file Form G 5101.

How to fill out g 5101?

To fill out Form G 5101, you need to gather your financial records, follow the instructions provided with the form, and accurately input the required information into the form sections.

What is the purpose of g 5101?

The purpose of Form G 5101 is to ensure compliance with tax regulations by collecting necessary financial data to assess tax liabilities.

What information must be reported on g 5101?

Form G 5101 typically requires the reporting of income, deductions, credits, and other financial details relevant to the taxpayer's financial situation.

Fill out your g 5101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

G 5101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.