Get the free State and Local Fiscal Recovery Funds Policy and Procedures Manual

Show details

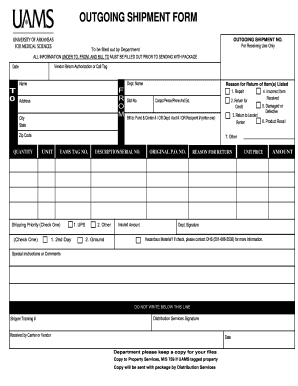

Este manual proporciona directrices sobre el manejo de los fondos de recuperación fiscal del estado y local en respuesta a la pandemia de COVID-19, detallando los usos elegibles, procesos de contratación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state and local fiscal

Edit your state and local fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state and local fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state and local fiscal online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state and local fiscal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state and local fiscal

How to fill out state and local fiscal

01

Gather all necessary financial documents and data for your state and local fiscal information.

02

Visit the official state and local fiscal websites or offices to obtain the correct forms.

03

Carefully read all instructions provided for filling out the forms.

04

Enter your revenue and expenditure figures accurately in the designated fields.

05

Include any additional notes or explanations required for clarity.

06

Review the completed forms for accuracy and completeness before submission.

07

Submit the forms by the deadline specified by your local or state authorities.

Who needs state and local fiscal?

01

Local government agencies responsible for budgeting and financial planning.

02

State government officials who manage public services and infrastructure.

03

Taxpayers who wish to understand how their taxes are utilized at the local and state levels.

04

Businesses that are involved in public contracts or financial compliance.

05

Non-profit organizations looking to assess funding sources and local economic conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit state and local fiscal from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including state and local fiscal, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in state and local fiscal?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your state and local fiscal to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete state and local fiscal on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your state and local fiscal, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is state and local fiscal?

State and local fiscal refers to the financial operations, including budgeting, revenue collection, and expenditure management, conducted by state and local governments in order to serve their citizens and fund public services.

Who is required to file state and local fiscal?

Entities such as individuals, businesses, and organizations that are subject to state and local taxes are required to file state and local fiscal documentation, which may vary based on jurisdiction and specific tax obligations.

How to fill out state and local fiscal?

To fill out state and local fiscal documents, individuals and organizations should collect all relevant financial information, follow the specific instructions provided by the state or local government tax authority, and ensure that all calculations are accurate before submission.

What is the purpose of state and local fiscal?

The purpose of state and local fiscal is to manage the financial resources of government entities, ensuring the provision of essential services, infrastructure development, and overall economic stability within the community.

What information must be reported on state and local fiscal?

Information that must be reported on state and local fiscal includes income, deductions, tax credits, property values, and any other relevant financial data as specified by local tax regulations.

Fill out your state and local fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State And Local Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.