Get the free Wells Fargo Business Credit, Inc

Show details

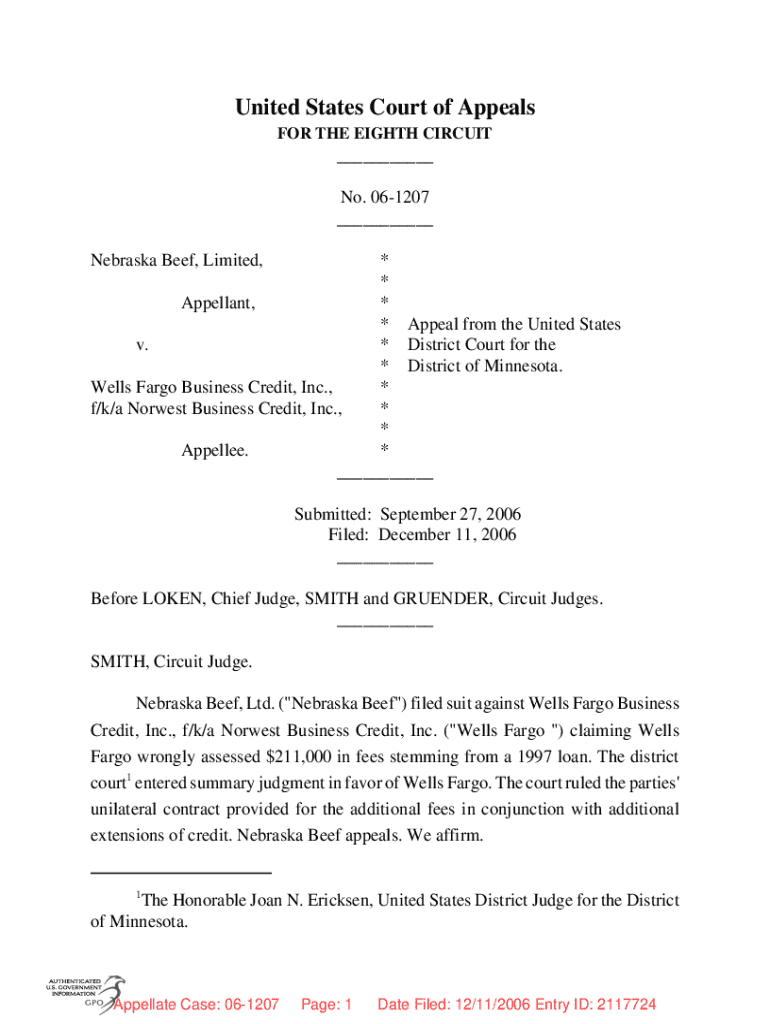

United States Court of Appeals FOR THE EIGHTH CIRCUIT___ No. 061207 ___ Nebraska Beef, Limited,* * Appellant, * * Appeal from the United States v. * District Court for the * District of Minnesota.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wells fargo business credit

Edit your wells fargo business credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wells fargo business credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wells fargo business credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wells fargo business credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wells fargo business credit

How to fill out wells fargo business credit

01

Gather necessary documents: Identify and collect all required documentation such as business licenses, tax identification number, and financial statements.

02

Visit the Wells Fargo website: Navigate to the Wells Fargo business credit card section to explore options available.

03

Choose the right card: Review the different business credit card options and select the one that best fits your business needs.

04

Complete the application form: Fill out the online application form with accurate information about your business, including revenue and number of employees.

05

Provide personal information: Enter personal details of the business owner, such as name, address, Social Security number, and contact information.

06

Submit the application: Review all provided information for accuracy and submit the application through the Wells Fargo portal.

07

Await approval: Check the status of your application and wait for Wells Fargo to review and approve your request.

08

Receive your card: If approved, you will receive your Wells Fargo business credit card in the mail.

Who needs wells fargo business credit?

01

Small business owners seeking to build credit for their business.

02

Entrepreneurs who require financing for startup costs or operational expenses.

03

Businesses that want to separate personal and business expenses for better financial management.

04

Companies looking for rewards or benefits associated with business spending.

05

Business travelers needing a credit card for travel expenses and related benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wells fargo business credit to be eSigned by others?

wells fargo business credit is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete wells fargo business credit online?

pdfFiller has made filling out and eSigning wells fargo business credit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in wells fargo business credit?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your wells fargo business credit to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is Wells Fargo business credit?

Wells Fargo business credit refers to credit products and services offered by Wells Fargo primarily designed for business use, including business credit cards, lines of credit, and loans that help businesses manage cash flow, make purchases, and invest in growth.

Who is required to file Wells Fargo business credit?

Businesses that have applied for or use Wells Fargo business credit products typically need to file for business credit, which includes providing personal and business financial information, tax identification, and other documentation to verify creditworthiness.

How to fill out Wells Fargo business credit?

To fill out an application for Wells Fargo business credit, you need to provide personal and business information, including the legal name of the business, address, tax ID, revenue, number of employees, and details about your business ownership and financial history.

What is the purpose of Wells Fargo business credit?

The purpose of Wells Fargo business credit is to provide businesses with access to financing, allowing them to manage expenses, invest in growth initiatives, purchase inventory, and cover operational costs without impacting their personal finances.

What information must be reported on Wells Fargo business credit?

Information that must be reported on Wells Fargo business credit includes business name, contact details, financial statements, credit history, industry type, and any outstanding debts to evaluate creditworthiness and risk.

Fill out your wells fargo business credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Business Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.