CA Schedule P (541) 2024-2025 free printable template

Show details

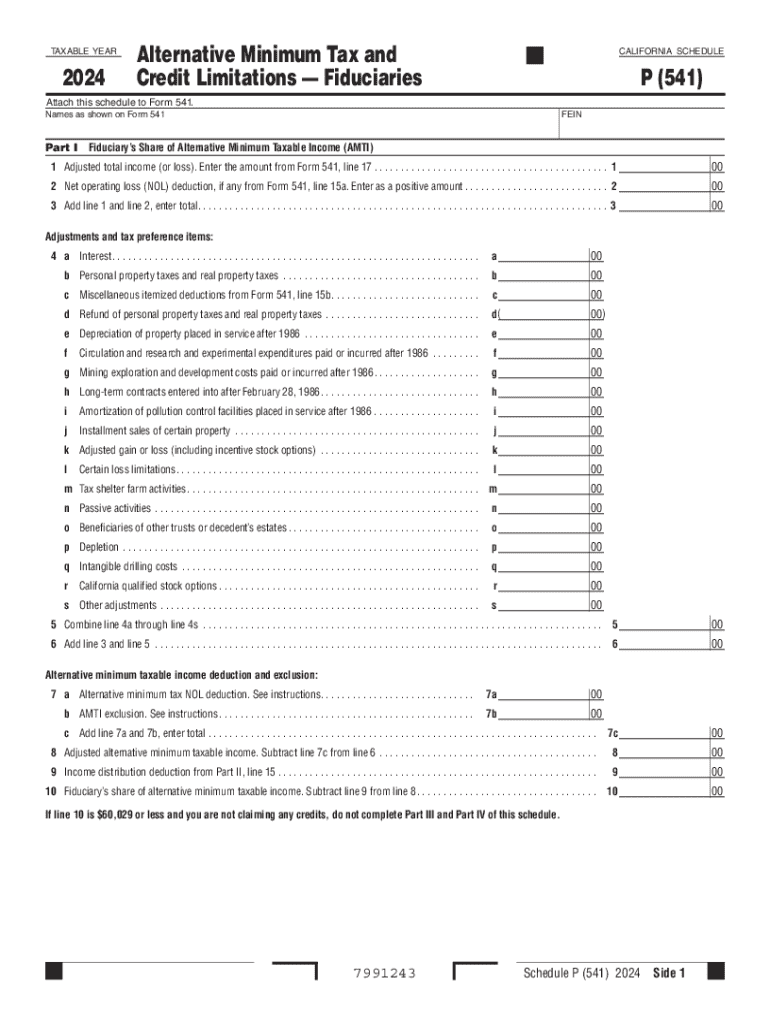

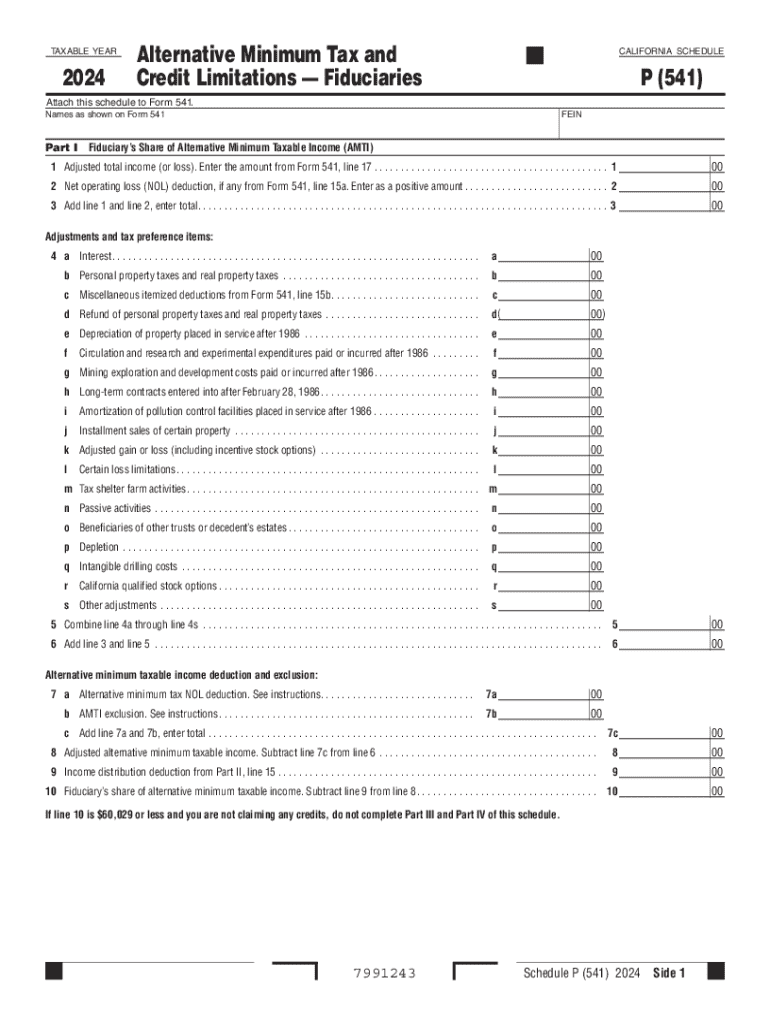

This document is used by fiduciaries to report alternative minimum taxable income and related adjustments for the taxable year 2024, including calculations for various tax credits and deductions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Schedule P 541

Edit your CA Schedule P 541 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Schedule P 541 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA Schedule P 541 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA Schedule P 541. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Schedule P (541) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA Schedule P 541

How to fill out california schedule p 541

01

Obtain Form 541 (California Partnership Return of Income) from the California Franchise Tax Board website.

02

Complete the identifying information, including the partnership's name, address, and federal employer identification number (FEIN).

03

Fill out the income section, reporting the partnership's total income, losses, and deductions.

04

Complete Schedule P (California APPORTIONMENT AND ALLOCATION OF INCOME) to properly allocate income that is sourced both in and out of California.

05

Calculate the partners' distributive shares of income, deductions, and credits.

06

Confirm that all necessary supporting schedules and forms are included with the return.

07

Sign and date the return before submission, either by mail or electronically.

Who needs california schedule p 541?

01

Partnerships conducting business in California that need to report their income, losses, and distributions to the state.

02

Partners who need to report distributive shares of income on their personal state returns.

03

Any partnership eligible for California tax treatment under the state's laws.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 541 tax?

Publication 541 provides supplemental federal income tax information for partnerships and partners. It supplements the information provided in the instructions for Form 1065, U. S. Return of Partnership Income, and the Partner's Instructions for Schedule K-1 (Form 1065).

What is a Schedule D 541 in California?

Use Schedule D (541), Capital Gain or Loss, to report gains and losses from the sale or exchange of capital assets by an estate or trust. Generally, California law follows federal law.

What is 540 Schedule P?

Use Schedule P (540), Alternative Minimum Tax and Credit Limitations – Residents, to determine if: You owe AMT. Your credits must be reduced or eliminated entirely. Your credits may be limited even if you do not owe AMT, so be sure to complete Side 1 and Side 2 of Schedule P (540).

What is the alternative minimum tax in California?

California tax law gives special treatment to some types of income and allows special deductions and credits for some types of expenses. Corporations that benefit from these laws may have to pay an alternative minimum tax (AMT), at a rate of 6.65%, in addition to the minimum franchise tax. ( Sec. 23455(d), Rev.

What is Form 541?

Form 541, California Fiduciary Income Tax Return. Form 541-A, Trust Accumulation of Charitable Amounts. Used to report a charitable or other deduction under IRC Section 642(c), or for charitable or split-interest trust.

Who must file Form 541?

The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000. An alternative minimum tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA Schedule P 541 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CA Schedule P 541 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send CA Schedule P 541 for eSignature?

Once your CA Schedule P 541 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the CA Schedule P 541 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your CA Schedule P 541 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is california schedule p 541?

California Schedule P (541) is a form used by nonresident partners and shareholders to report income and calculate California tax owed for their share of income from partnerships and S corporations operating in California.

Who is required to file california schedule p 541?

Nonresident partners of partnerships and shareholders of S corporations that derive income from California sources are required to file California Schedule P (541).

How to fill out california schedule p 541?

To fill out California Schedule P (541), taxpayers should begin by gathering all necessary income information from the partnership or S corporation. They should then complete the form by entering their share of California-source income and deductions as instructed on the form, ensuring accuracy to avoid penalties.

What is the purpose of california schedule p 541?

The purpose of California Schedule P (541) is to allow nonresident partners and S corporation shareholders to report their share of income from California sources and compute the appropriate California tax liability.

What information must be reported on california schedule p 541?

On California Schedule P (541), taxpayers must report their share of income, deductions, and credits from partnerships and S corporations that operate in California, including any adjustments required for California tax purposes.

Fill out your CA Schedule P 541 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Schedule P 541 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.