Get the free Verification of Receipt and Reading of Handbook

Get, Create, Make and Sign verification of receipt and

Editing verification of receipt and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of receipt and

How to fill out verification of receipt and

Who needs verification of receipt and?

Verification of receipt and form: A comprehensive guide

Understanding receipt verification

Receipt verification is the process of confirming the authenticity, accuracy, and completeness of receipts and forms. This practice is vital for both personal and business transactions, ensuring that records are error-free and compliant with legal standards.

Verifying receipts and forms not only prevents potential financial discrepancies but also aids in maintaining trust within business relationships. For individuals and organizations, proper verification serves as a critical first step in managing expenses, processing reimbursements, and fulfilling accounting requirements.

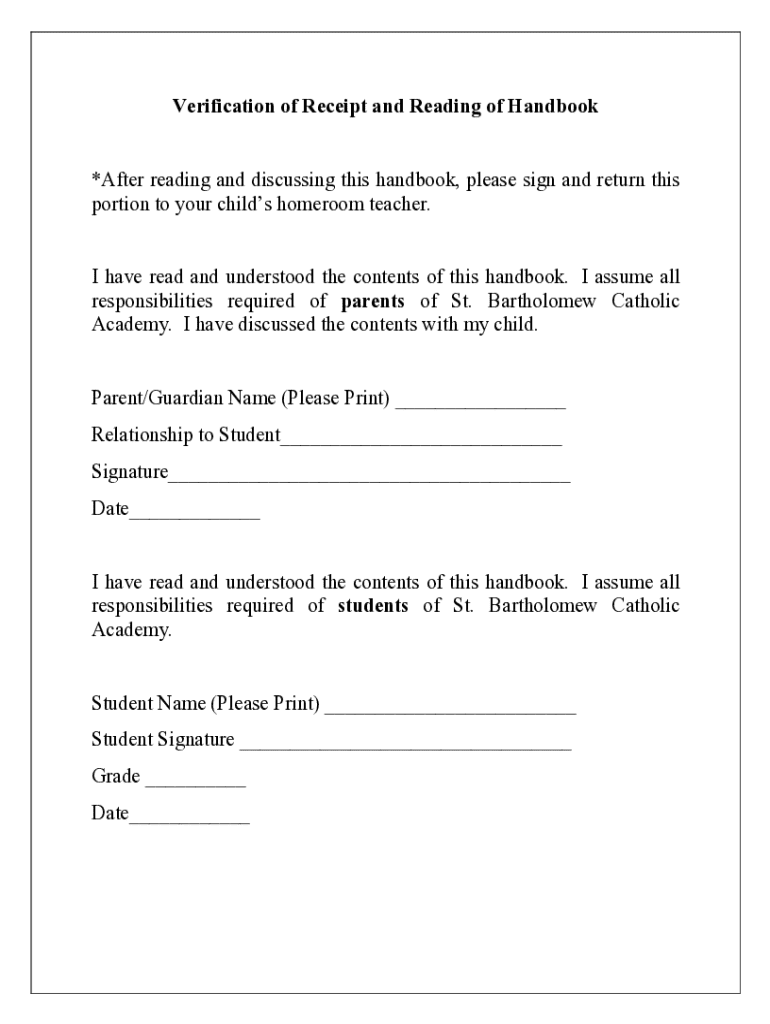

Key components of a receipt or form

Each receipt or form contains specific elements that facilitate its verification. Recognizing these standard components is crucial for effective verification.

Typically, receipts will feature the transaction date, a detailed list of items purchased or services rendered, the payment method (like credit card, cash, etc.), and the vendor’s signature or contact information. These details are essential in establishing trust and verifying transactions.

Forms, on the other hand, have their own set of essential fields that must be accurately filled out. These fields often include personal information areas such as name and address, a dedicated signature field, and crucial dates and reference numbers necessary for processing.

Step-by-step process for verification

The process of verifying receipts and forms involves several systematic steps to ensure accuracy and authenticity. Following a clear methodology will enhance the likelihood of spotting errors or discrepancies.

Step 1: Initial review of the document

Begin with a thorough review of the document. Check for completeness by verifying that all necessary information is present. Identify any missing fields that could lead to potential issues down the line.

Step 2: Cross-checking with original sources

The next step involves cross-checking the receipt or form with the original transaction records. Use spreadsheets, accounting software, or mobile apps that track expenses for a more efficient comparison.

Step 3: Authenticating signatures and dates

It's crucial to validate signatures and check the accuracy of transaction dates. Look for discrepancies that might indicate issues with authenticity or correctness, especially if a signature appears inconsistent with past records.

Step 4: Utilizing technology for verification

Modern technological advancements simplify the verification process. Tools like pdfFiller allow users to edit, sign, and manage documents seamlessly. Utilizing cloud-based platforms ensures you can access and verify documents from anywhere.

Best practices for effective verification

Implementing best practices significantly increases the efficiency of verifying receipts and forms. Maintaining organized records is foundational, whether digital or physical.

Regular updates and audits of documentation practices ensure that inaccuracies are minimized. It is also critical for teams involved in document verification to have clear communication pathways.

Common challenges and solutions

Despite the best efforts, challenges in document verification may arise. Common issues include discrepancies and missing documents.

To handle discrepancies in documents, immediately document inconsistencies and check original transaction sources for clarification. Establishing a follow-up procedure is vital for addressing and resolving any issues.

Interactive tools for users

Leveraging interactive tools enhances the efficiency of verifying receipts and forms. pdfFiller offers robust features specifically designed for these tasks.

Users can seamlessly upload documents, edit them, and utilize e-signature functionality, which tracks changes and approvals in an organized manner.

Team collaboration and document sharing

Efficient document verification often requires collaboration among team members. Utilizing platforms like pdfFiller maximizes team-based verification through strategic document sharing.

Setting specific permissions and access levels ensures security while allowing team members to contribute effectively. Features for tracking changes and revisions further enhance the team’s ability to manage documentation collectively.

FAQs about receipt and form verification

Addressing common questions around receipt and form verification can aid users in navigating the verification process more effectively.

Common questions include: How do I handle missing information? What are my options if I discover an error? Answers to these inquiries can make the verification experience much smoother.

Industry-specific considerations

Verification standards can vary significantly by industry, necessitating tailored approaches in different fields.

For instance, healthcare forms may require specific compliance standards related to patient privacy, while finance transactions need strict adherence to regulations for records. Understanding industry-specific nuances is key to successful verification.

Feedback and error reporting

Establishing reliable methods for reporting discrepancies enhances the verification process. Regular feedback loops allow for continuous improvement and accuracy.

Encouraging teams to provide feedback on verification processes helps identify gaps and fosters a culture of accountability and accuracy.

Conclusion: The importance of accurate verification

Accurate verification of receipts and forms is essential for efficient financial management and compliance. By following the outlined steps and implementing best practices, users can significantly reduce the risk of errors and discrepancies.

Tools like pdfFiller streamline the verification process, providing users with the ability to access, edit, and sign documents efficiently. Leveraging such technology will not only enhance personal and business transactions but also create a foundation of trust and accuracy in documentation.

Additional insights

Exploring trends in document verification technology unveils a future where processes are increasingly automated and integrated. Enhanced security measures and artificial intelligence may soon redefine verification standards.

As industries evolve, the importance of maintaining updated practices and tools will continue to grow, further emphasizing platforms like pdfFiller that facilitate powerful management of receipts and forms in a shared digital environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit verification of receipt and from Google Drive?

How do I make edits in verification of receipt and without leaving Chrome?

Can I edit verification of receipt and on an iOS device?

What is verification of receipt?

Who is required to file verification of receipt?

How to fill out verification of receipt?

What is the purpose of verification of receipt?

What information must be reported on verification of receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.