Get the free Beneficiary Designation / Change Form

Get, Create, Make and Sign beneficiary designation change form

How to edit beneficiary designation change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation change form

How to fill out beneficiary designation change form

Who needs beneficiary designation change form?

Your Comprehensive Guide to the Beneficiary Designation Change Form

Understanding beneficiary designation

A beneficiary designation refers to the legal appointment of individuals or entities to receive benefits from a financial account or insurance policy upon the account holder’s death. This designation is crucial, as it overrides the directives laid out in a will, ensuring that the named beneficiaries receive the intended assets directly.

Updating your beneficiary designation is vital for numerous reasons. Firstly, it can significantly affect the distribution of your estate and financial resources, potentially bypassing probate. Secondly, it is essential for legal clarity; failing to keep this information current can lead to disputes among heirs and beneficiaries, thereby complicating an already challenging emotional process.

Who needs a beneficiary designation change form?

Anyone who holds life insurance policies, retirement accounts such as a 401(k) or IRA, or any assets that allow for a designated beneficiary should consider this form. By filling out the beneficiary designation change form, individuals ensure that their assets are distributed according to their current wishes, particularly after significant life events like marriage, divorce, or the birth of a child.

Moreover, individuals with trusts may also need to adjust their beneficiary designations as these legal instruments often specify primary and contingent beneficiaries. Keeping these designations aligned with your current situation is critical in safeguarding your estate.

Preparing to use the beneficiary designation change form

Before you embark on filling out the beneficiary designation change form, gather all necessary documentation. This includes current beneficiary information, identification requirements, and any relevant policy or account numbers. Having this information at hand streamlines the process and helps avoid potential delays.

Additionally, it's wise to discuss your intended changes with family members, especially if a change in beneficiary might have implications on their benefits or inheritance. Understanding the tax consequences or emotional ramifications of such decisions can also greatly inform how you proceed with your beneficiary designations.

Steps to complete the beneficiary designation change form

Start by downloading the beneficiary designation change form from pdfFiller. It’s vital to ensure that the file format is compatible with your device for easy access and completion. Take care to download this form from a legitimate source to avoid issues down the line.

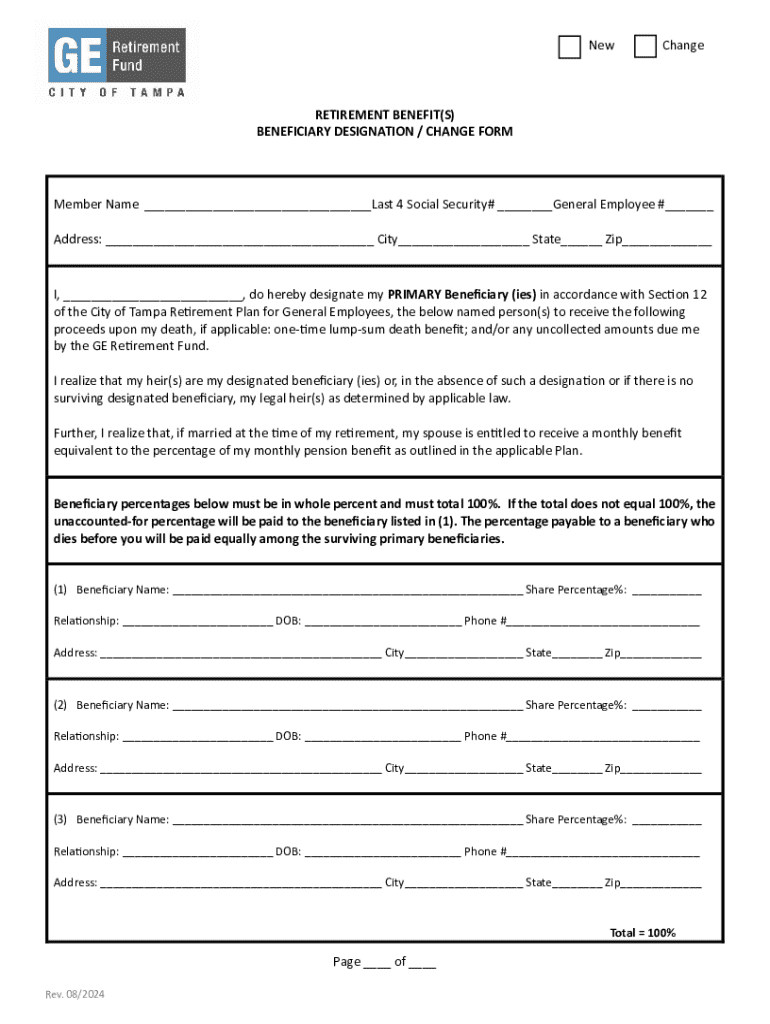

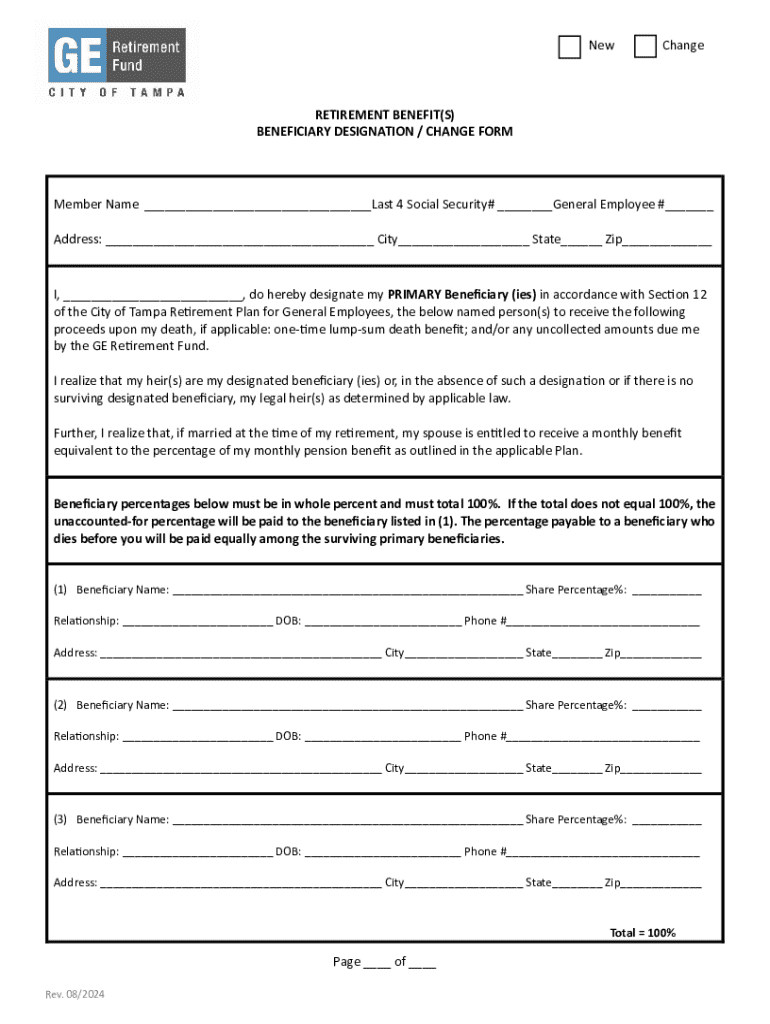

Once you have the form, fill in your personal information as the policy or account holder. Provide details of the existing beneficiaries as well as new beneficiary information. Double-check that all names are spelled correctly and any contact information is up-to-date to ensure there are no delays in processing your changes.

Submitting the beneficiary designation change form

Once completed, submitting the beneficiary designation change form can be done through several methods. For those opting for electronic submission, pdfFiller provides an efficient platform. By utilizing the eSigning feature, you can quickly and securely sign your form without the hassle of printing or scanning.

Alternatively, if you prefer traditional methods, you can also submit the form by mail. Make sure to address the envelope correctly and follow reliable mailing practices, like certified mail, ensuring you have proof of delivery. Alternatively, email submission is straightforward, but ensure that your document is in an accessible format and that you confirm receipt from the recipient.

After submitting your form

After submission, you should anticipate receiving confirmation regarding the processing of your beneficiary designation change form. Processing times can vary based on the institution, but it's essential to follow up to ensure the changes are accurately reflected on your accounts.

You can track your submission by contacting the insurance company or financial institution directly. Knowing who to reach out to and how to find your specific reference number is vital in managing follow-ups and ensuring your changes have been applied.

Keep your beneficiary designation updated

Regularly reviewing and updating your beneficiary designation is crucial for maintaining the relevance of your estate plan. Life events such as marriage, divorce, or the birth of children can significantly impact whom you wish to designate as beneficiaries. Therefore, set reminders to check these designations periodically.

To effectively keep records, ensure that any documentation related to beneficiary designations is stored securely. Digital copies should be easily accessible but also protected with strong passwords or encryption to safeguard sensitive information.

Resources and tools available on pdfFiller

pdfFiller offers an array of interactive tools for document editing, making the completion of your beneficiary designation change form feel less daunting. Utilize templates specific to various scenarios, ensuring you have the knowledge needed for nuanced situations. Should you encounter challenges, pdfFiller’s customer support can provide the necessary assistance, enabling you to manage your documents efficiently.

Whether you're creating a change form for a family member or yourself, having access to reliable resources can guide you in making informed decisions while effectively managing your documentation needs.

Additional considerations for specific situations

In unique circumstances, such as when businesses are involved or minors are named as beneficiaries, special instructions are required. Businesses should have their legal designations carefully documented, ensuring full understanding of implications for corporate assets. For minor beneficiaries, establishing a trust may be necessary until they reach adulthood, ensuring assets are managed responsibly.

Furthermore, it’s critical to understand state-specific regulations. Different states impose varying laws surrounding beneficiary designations; thus, being informed can help avoid any legal pitfalls and ensure that your designations are both effective and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation change form to be eSigned by others?

How can I get beneficiary designation change form?

How do I make edits in beneficiary designation change form without leaving Chrome?

What is beneficiary designation change form?

Who is required to file beneficiary designation change form?

How to fill out beneficiary designation change form?

What is the purpose of beneficiary designation change form?

What information must be reported on beneficiary designation change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.