Get the free Breakdown Reimbursement Claim Form

Get, Create, Make and Sign breakdown reimbursement claim form

How to edit breakdown reimbursement claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out breakdown reimbursement claim form

How to fill out breakdown reimbursement claim form

Who needs breakdown reimbursement claim form?

A comprehensive guide to filling out the breakdown reimbursement claim form

Understanding breakdown reimbursement claims

Breakdown reimbursement claims enable vehicle owners to recoup costs related to unforeseen vehicle breakdowns. This process is crucial because it alleviates financial stress incurred due to unexpected expenses like towing and repairs. Understanding the intricacies of the breakdown reimbursement claim form is vital for any vehicle owner, as these claims can often be a means to recover funds that would otherwise be out of pocket.

Common scenarios prompting these claims include tire blowouts on the highway, mechanical failures in remote locations, or battery issues that leave you stranded. Each of these situations can lead to expenses that may qualify for reimbursement, making knowledge of the claim process invaluable.

Preparing to fill out the breakdown reimbursement claim form

Before diving into the claim form, gathering the necessary documentation is essential. This step ensures that you have all required information at your fingertips, facilitating a smoother submission process. The primary documentation includes receipts and proof of expenses incurred during the breakdown incident, as well as your policy number and other claim information.

Verifying your eligibility for reimbursement is also crucial. Ensure that your insurance policy covers breakdown services. If your coverage is unclear, don't hesitate to contact your insurance provider for clarification.

Step-by-step instructions for completing the breakdown reimbursement claim form

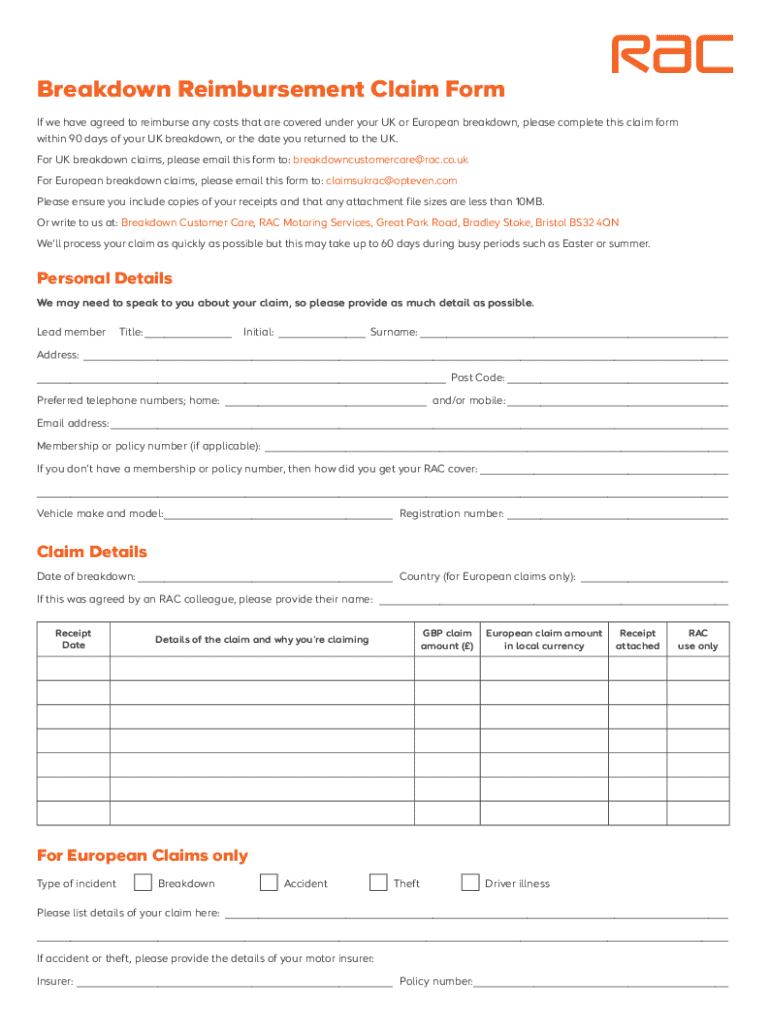

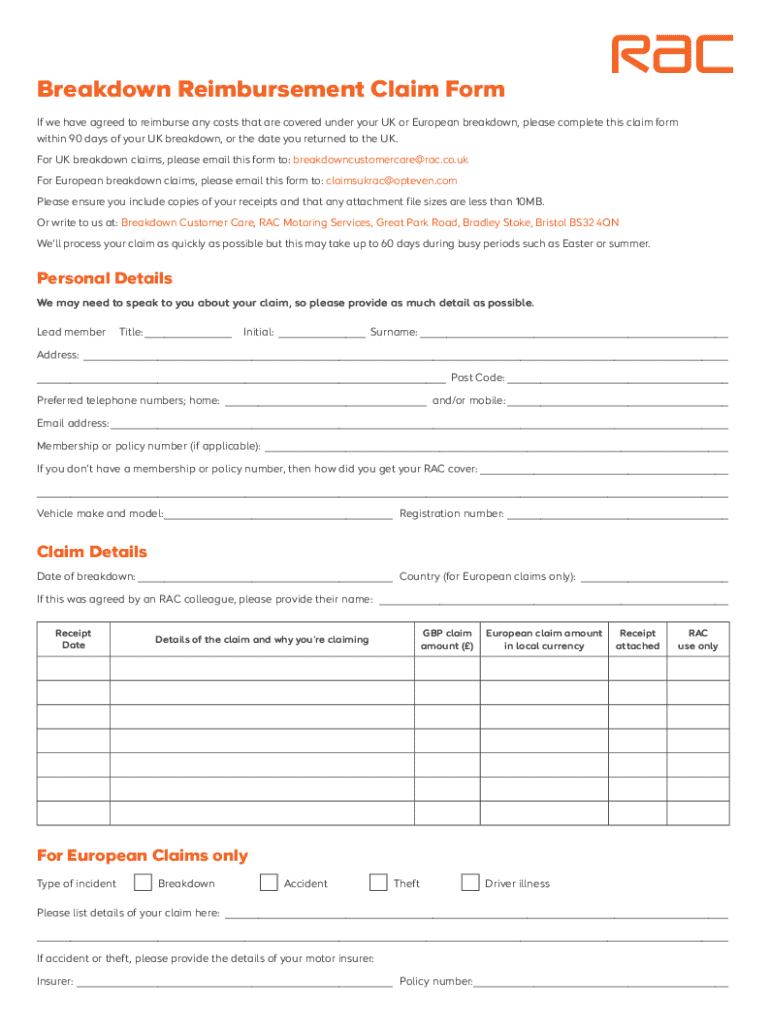

Filling out the breakdown reimbursement claim form may seem daunting, but it can be efficiently tackled with a systematic approach. Start by filling out Section 1, where you'll provide your personal information. This typically includes your full name, address, and contact details, ensuring the insurance provider can reach you easily regarding your claim.

Next, move to Section 2, which focuses on the specifics of the breakdown incident. Document the date and location where the breakdown occurred. It's essential to describe the nature of the breakdown clearly and detail what assistance you needed. In Section 3, you'll itemize costs incurred during your incident, such as towing fees and repair costs. Listing each expense along with corresponding receipts provides transparency and supports your claim.

Lastly, in Section 4, don't forget to read the declaration carefully and add your signature. This step validates that the information provided is truthful and complete. eSigning your document is a simple and secure option via platforms like pdfFiller.

Editing and customizing your claim form

Utilizing pdfFiller's editing tools can significantly improve your experience with the breakdown reimbursement claim form. You can add notes or annotations for extra clarity where necessary, ensuring the surroundings of your claims are well-understood. The platform’s cloud features allow you to save and access forms seamlessly, enabling you to revisit your claim history whenever needed.

Consider customizing your claim form to suit your specific circumstances. Tailoring your descriptions and organizing your documentation in a coherent manner boosts the likelihood of a successful claim.

Submitting your breakdown reimbursement claim

Once your form is complete, it’s time to submit your claim. You generally have the option to mail your documents or submit them online. Each method has its benefits, but online submissions tend to be faster. Regardless of your submission choice, ensure that you follow your insurance provider's specific requirements and preferred method for optimal processing.

Best practices for ensuring receipt of your claim involve keeping copies of everything you send and confirming with your provider that they've received your submission. Additionally, tracking your claim status is crucial. Many providers offer online portals where you can monitor the progress of your claim and any updates surrounding its processing.

Common mistakes to avoid

Submitting a breakdown reimbursement claim can sometimes be fraught with pitfalls. Common mistakes include providing incomplete information, which can lead to delays, or even outright denial of your claim. Be meticulous when completing the form and avoid leaving sections blank. Another major oversight is forgetting signatures; always ensure that your form is signed where required.

Moreover, maintain copies of all submitted documents. Not only does this practice provide a fallback in case of inquiries, but it also serves as proof of what you sent originally.

FAQs about breakdown reimbursement claims

Queries related to breakdown reimbursement claims are common among vehicle owners. A frequent concern is what to do if a claim is denied. In such instances, reviewing your policy for specific exclusions or contacting customer support can provide clarity and potential resolutions.

Claimants often wonder how long it will take to receive reimbursement. The timeframe often varies by provider but is generally within a few weeks of claim approval, provided all documentation is in order. Another common inquiry is whether it's possible to submit a claim for a breakdown occurring outside your coverage period; usually, claims outside your coverage will not be honored, emphasizing the importance of reviewing policy details actively.

Utilizing pdfFiller for efficient document management

pdfFiller offers remarkable advantages in document management for breakdown reimbursement claims. With its cloud-based solutions, users can keep their claims organized, collaborate with team members for added support, and store crucial documents securely for future reference. This digital organization streamlines the entire claims process.

Accessing past claims can also prove useful, especially for individuals needing to submit multiple claims or referencing prior expenses. The centralized platform allows for seamless document retrieval and management, eliminating the hassle associated with physical paperwork.

Exploring related forms and templates

Beyond the breakdown reimbursement claim form, vehicle owners may also need to familiarize themselves with other relevant documents. Other types of reimbursement claim forms exist for various circumstances, including rental reimbursements or general vehicle expenses. Keeping maintenance records and service logs is equally critical, as these documents support your claims and show diligent vehicle upkeep.

Insurance claim templates are often available online, which can serve as additional resources when drafting claims. Utilizing these tools can further enhance accuracy and expedience in your claim process.

Expert tips for a successful reimbursement experience

Achieving a smooth reimbursement experience comes down to the details. Keeping a detailed record of all communications related to your claim is vital; this can include notes from phone calls or email exchanges with customer support representatives. Understanding your specific policy coverage for breakdown assistance prepares you for any questions that may arise during the claims process.

If your claim is complex, do not hesitate to consult with customer support. These professionals can guide you through the process, ensuring that your submission has the best chance of success. With the right preparation and the support of tools like pdfFiller, you can navigate the reimbursement process with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my breakdown reimbursement claim form in Gmail?

How can I modify breakdown reimbursement claim form without leaving Google Drive?

How do I edit breakdown reimbursement claim form on an iOS device?

What is breakdown reimbursement claim form?

Who is required to file breakdown reimbursement claim form?

How to fill out breakdown reimbursement claim form?

What is the purpose of breakdown reimbursement claim form?

What information must be reported on breakdown reimbursement claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.