Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out ach authorization form

Who needs ach authorization form?

Understanding the ACH Authorization Form: A Complete Guide

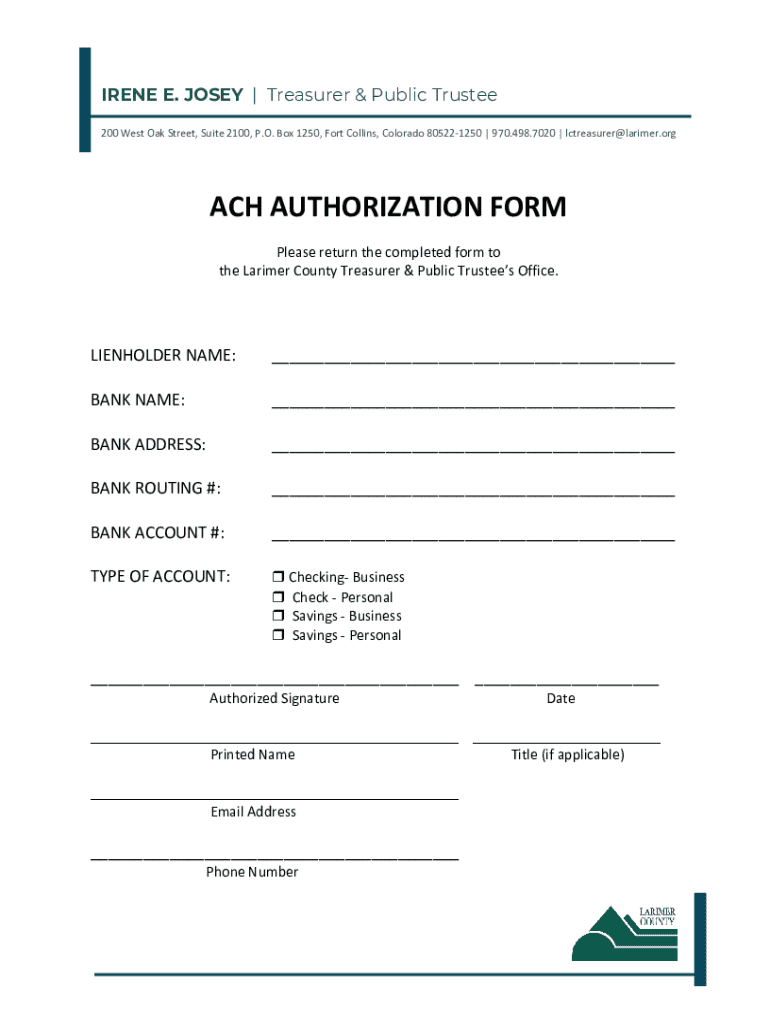

ACH authorization form overview

An ACH authorization form is a document that allows individuals or businesses to authorize payments to be automatically deducted from their bank account or credited into it through the Automated Clearing House (ACH) network. This network facilitates electronic funds transfers, making it a crucial element in modern financial transactions.

The ACH network is essential for both individual and business transactions, streamlining direct deposits, bill payments, and other forms of electronic payments. The key components of an ACH authorization form include:

Importance of ACH authorization forms

Understanding the importance of ACH authorization forms is vital for anyone involved in electronic transactions. These forms carry significant legal weight, providing documented proof that a payer has consented to the transfer of funds. In addition to their legal significance, ACH transactions offer numerous benefits.

These benefits include:

ACH authorization forms are commonly used for recurring payments, such as subscriptions, bill payments, and employee direct deposits, making them invaluable for both businesses and consumers.

How to fill out an ACH authorization form

Filling out an ACH authorization form correctly is crucial to ensure smooth transactions. Here’s a step-by-step guide to help you complete it accurately:

To avoid common mistakes, ensure you double-check all account numbers and confirm that all signatures are present.

Editing and customizing your ACH authorization form

Customization of your ACH authorization form can enhance your branding or make the form more user-friendly. Using tools like pdfFiller allows you to edit the form conveniently.

Key features include:

Signing your ACH authorization form

The signature on your ACH authorization form signifies your consent and is crucial for its validity. You have options for signing, including traditional ink signatures and digital signatures.

To eSign using pdfFiller, follow these steps:

eSigning offers advantages over traditional signing methods, such as quicker processing times and the ability to store documents securely online.

Managing and storing your ACH authorization form

Proper management of your ACH authorization form is essential for compliance and organizational purposes. Here are best practices to follow:

Frequently asked questions about ACH authorization forms

As users engage with ACH authorization forms, questions arise frequently. Here are some common inquiries and answers:

Need help? Get support

If you encounter issues while filling out your ACH authorization form or have questions about the process, customer support through pdfFiller is available to assist you.

You can access customer support via various options:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pdffiller form?

How do I execute pdffiller form online?

Can I edit pdffiller form on an Android device?

What is ach authorization form?

Who is required to file ach authorization form?

How to fill out ach authorization form?

What is the purpose of ach authorization form?

What information must be reported on ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.