Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

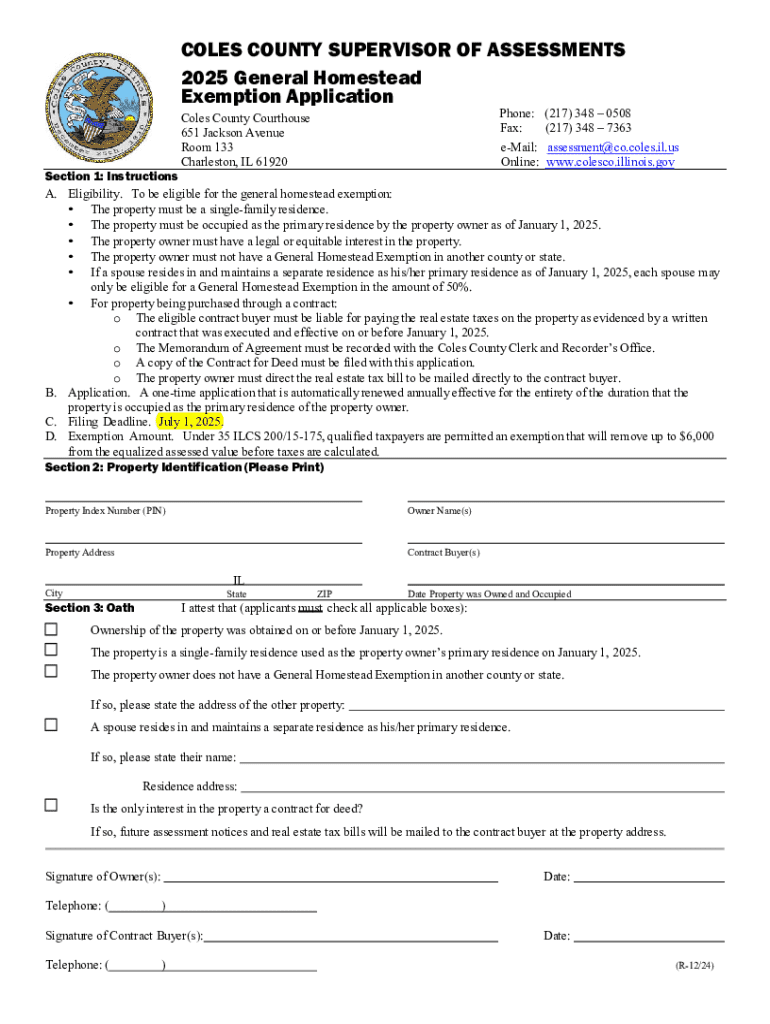

How to fill out 2025 general homestead exemption

Who needs 2025 general homestead exemption?

Your Complete Guide to the 2025 General Homestead Exemption Form

Understanding the homestead exemption

A homestead exemption is a law that provides property tax relief to homeowners by reducing the taxable value of their principal residence. This exemption can significantly lower an individual’s property tax bill, making homeownership more affordable. Designed for homeowners, it not only offers tax benefits but also contributes to the long-term stability of neighborhoods by encouraging residents to stay in their homes.

Eligibility criteria for the 2025 general homestead exemption

To qualify for the 2025 General Homestead Exemption, homeowners must fulfill certain criteria. Generally, applicants must be the owner and occupy the property as their primary residence, and they must file the application by the specified deadline, which can vary by state.

For specific exemptions, such as those for the elderly or disabled, additional conditions apply. For instance, you may need to provide proof of age or disability, as well as documentation confirming your ownership and occupancy status. It's crucial to understand these distinctions to ensure eligibility.

Detailed instructions for filling out the 2025 general homestead exemption form

Completing the 2025 General Homestead Exemption Form accurately is critical to securing your property tax benefits. The process involves several steps, starting with gathering the necessary personal information, including your name, social security number, and contact information. Next, you’ll need to provide details about your property, such as its address and tax identification number.

You may also need to disclose income information if it pertains to eligibility criteria that consider financial situations. Ensure that all entries are legible and consistent with other records to prevent processing delays.

Managing your application

Once you have completed the form, submitting your homestead exemption application is your next step. Many states allow online filing through platforms like pdfFiller, where you can securely submit your documents. Alternatively, you may also consider mailing your application or visiting your local tax office to submit it in person.

Tracking the status of your application will help ensure you receive the benefits without delay. Processing times can vary widely depending on your local government, so knowing when to follow up can make a difference.

Understanding the impacts of the homestead exemption

The effect of the homestead exemption on property taxes can be significant. By lowering the taxable value of your home, it helps reduce the overall tax burden, enabling you to allocate funds toward other essential expenses. For example, if your home is valued at $200,000 and you qualify for a $25,000 exemption, your taxable value drops to $175,000, leading to substantial savings.

Moreover, the homestead cap can further restrain tax increases in subsequent years, which means that even if property values rise, your assessment will not exceed a certain threshold. This provides homeowners with long-term predictability regarding their tax obligations.

Frequently asked questions about the homestead exemption

Many homeowners have questions about the homestead exemption process. One common inquiry is whether individuals need to reapply for the exemption every year. In most cases, once you are approved, you do not need to resubmit; however, some states require annual verification. Understanding the rules specific to your state can avoid confusion.

Another frequent concern is what happens if you miss the filing deadline. Most jurisdictions allow late applications, but penalties could apply. It can affect your ability to access the exemption benefits for that year, so it is important to be aware of the deadlines.

Resources for homestead exemption applicants

To facilitate your claims for the homestead exemption, a range of resources is available. Online forms like the 2025 General Homestead Exemption Form can be found on platforms such as pdfFiller, where users can easily edit, sign, and submit documents. Additionally, local government websites offer guidelines specifically tailored to your state’s requirements.

Furthermore, many local tax offices host workshops and seminars to educate homeowners about homestead exemptions. These gatherings can prove invaluable for clarifying doubts and enhancing your understanding of the exemption process.

Additional considerations

Changes in property ownership can often raise questions about homestead exemptions. If a homeowner sells or inherits a property, both the new owner and the former owner may need to understand how this affects their eligibility. Typically, the new owner will need to file for their exemption.

Furthermore, state legislation regarding homestead exemptions can evolve. Changes in laws can directly impact how exemptions are calculated and who is eligible. Therefore, staying alerted about any potential legislative updates is vital for homeowners seeking benefits through the exemption.

Community engagement and feedback

Feedback from individuals who have navigated the homestead exemption process can be crucial for improvement. Homeowners are encouraged to share their experiences to promote better practices and streamline procedures. Many local governments appreciate and consider community input in reforming tax practices.

Connecting with fellow homeowners through social media channels or local community forums can also provide valuable tips and insights. Continuously engaging with these platforms can lead to a more informed homeowner community.

Navigation and contact information

Navigating the homestead exemption process can be manageable if the key steps are clear. Begin by confirming your eligibility and gathering your documents before filling out the 2025 General Homestead Exemption Form. Understanding submission methods and deadlines will further streamline your application.

Should you encounter challenges, reaching out to pdfFiller support can provide assistance with using their services. Local tax offices also serve as a resource for direct questions concerning your state-specific exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

Can I create an electronic signature for the pdffiller form in Chrome?

How do I fill out pdffiller form using my mobile device?

What is general homestead exemption?

Who is required to file general homestead exemption?

How to fill out general homestead exemption?

What is the purpose of general homestead exemption?

What information must be reported on general homestead exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.