Get the free Importer Identity Form

Get, Create, Make and Sign importer identity form

How to edit importer identity form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out importer identity form

How to fill out importer identity form

Who needs importer identity form?

Importer Identity Form: A Comprehensive Guide

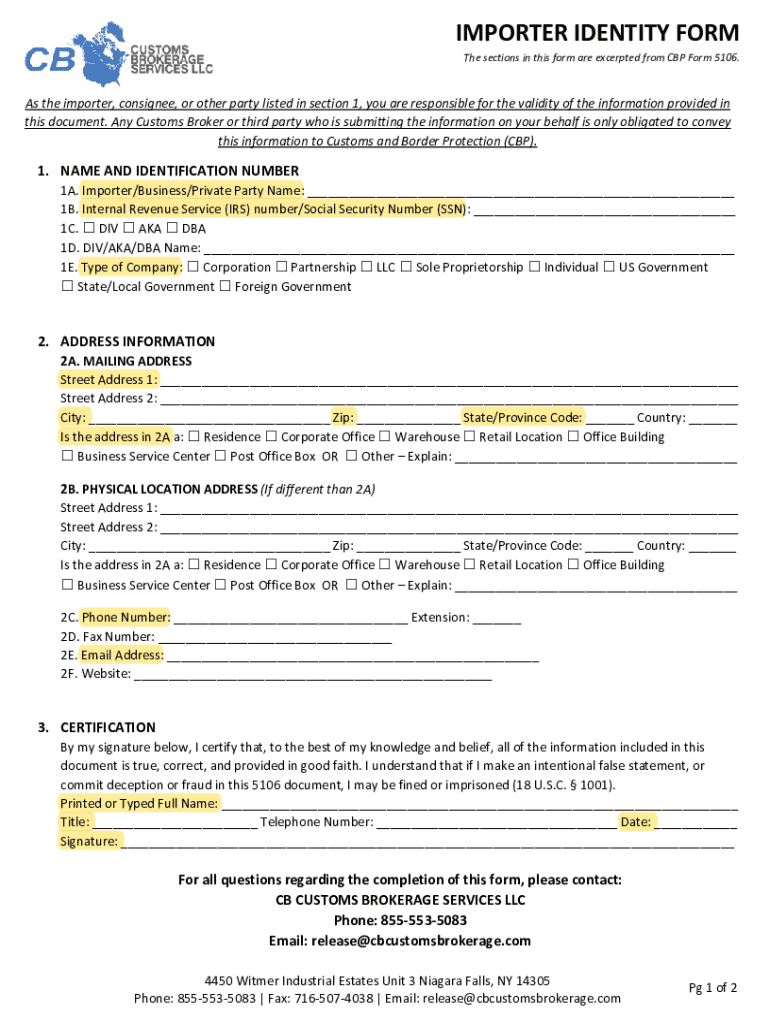

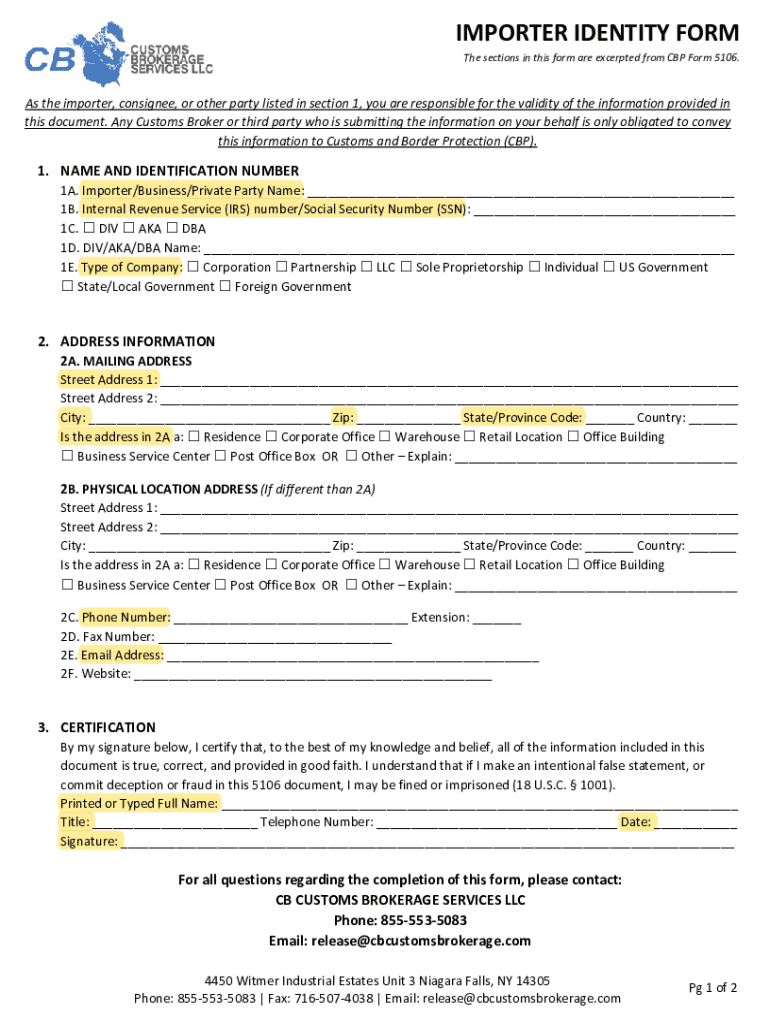

What is the importer identity form?

The importer identity form is a detailed document required by U.S. Customs and Border Protection (CBP) that identifies parties engaged in importing goods into the United States. Its primary purpose is to provide necessary information to customs authorities, ensuring compliance with various regulations and legal frameworks governing international trade.

This form plays a critical role in international trade as it helps in verifying the identity of importers, protecting national security, and preventing illegal activities. With the increasing complexities in global trade, understanding and accurately completing this form is vital for anyone involved in importing goods.

Understanding the need for the importer identity form

Filling out the importer identity form is not just procedural; it has significant legal implications. Without this form, your shipments may face delays or even rejections during customs clearance. Compliance with regulations ensures smooth processing, reducing the risk of penalties or further investigations.

The form is crucial for managing not just the compliance aspect but also the shipping efficiency related to your business. It speeds up customs clearance, which in turn streamlines the entire importing process, allowing you to focus on other aspects of your business.

Essential information required on the importer identity form

To ensure accurate processing, certain key data elements must be included in the importer identity form. This includes the importer’s name, contact details, and business structure, which provides customs authorities with a clear picture of the entity responsible for the importation.

Additionally, tax identification numbers are required for verification and taxation purposes. This information is critical not only for legal compliance but also for facilitating seamless cargo movements through customs.

How to accurately complete the importer identity form

Completing the importer identity form accurately is crucial for avoiding delays and potential issues with customs. Start by gathering all necessary documentation, including identification numbers and your business details. Access the form through the CBP portal or via designated legal channels.

When filling out the form, ensure you complete all required fields. After completing the process, a thorough review for accuracy is essential. Pay special attention to tax identification numbers, as errors here can lead to significant complications.

How to submit the importer identity form

The submission of the importer identity form can be done online or via postal service, depending on your preference and circumstances. Online submissions are typically faster, as they are processed through the CBP's secure portal. Ensure you are aware of any potential fees associated with your submission.

For paper submissions, include all necessary documents and fees and mail them to the designated address. Understand the expected processing times for each method; usually, online submissions are processed more swiftly than paper forms.

Importer identity form: real-life examples

Practical examples can shine a light on the importance of accurately filling and submitting the importer identity form. For instance, consider a sample completed form. Annotating this form provides insights into how individuals and businesses typically fill out the necessary fields.

Moreover, case studies reveal common challenges faced by new importers, such as missing information or incorrect tax identification numbers leading to delays in clearance. These instances emphasize how properly completing the importer identity form can significantly enhance the customs clearance process.

FAQs about the importer identity form

Addressing common concerns about the importer identity form helps demystify the process. Frequently, questions revolve around updating your details, such as what happens when a business address changes. It's essential to know how to manage these adjustments to stay compliant.

Additionally, clarifications on new requirements and what to do if faced with non-compliance notices can save time and stress. Understanding procedural intricacies ensures that businesses remain proactive instead of reactive.

Leveraging pdfFiller to manage your importer identity form

Managing your importer identity form is simplified significantly with pdfFiller's suite of features. Users can easily edit, sign, and store forms from a single, cloud-based platform, ensuring accessibility from anywhere and streamlined collaboration among team members.

pdfFiller’s editing tools make filling out forms intuitive and straightforward. The electronic signing process is not only quick but also legally binding, which is increasingly important in today’s regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send importer identity form for eSignature?

How do I edit importer identity form in Chrome?

Can I edit importer identity form on an Android device?

What is importer identity form?

Who is required to file importer identity form?

How to fill out importer identity form?

What is the purpose of importer identity form?

What information must be reported on importer identity form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.