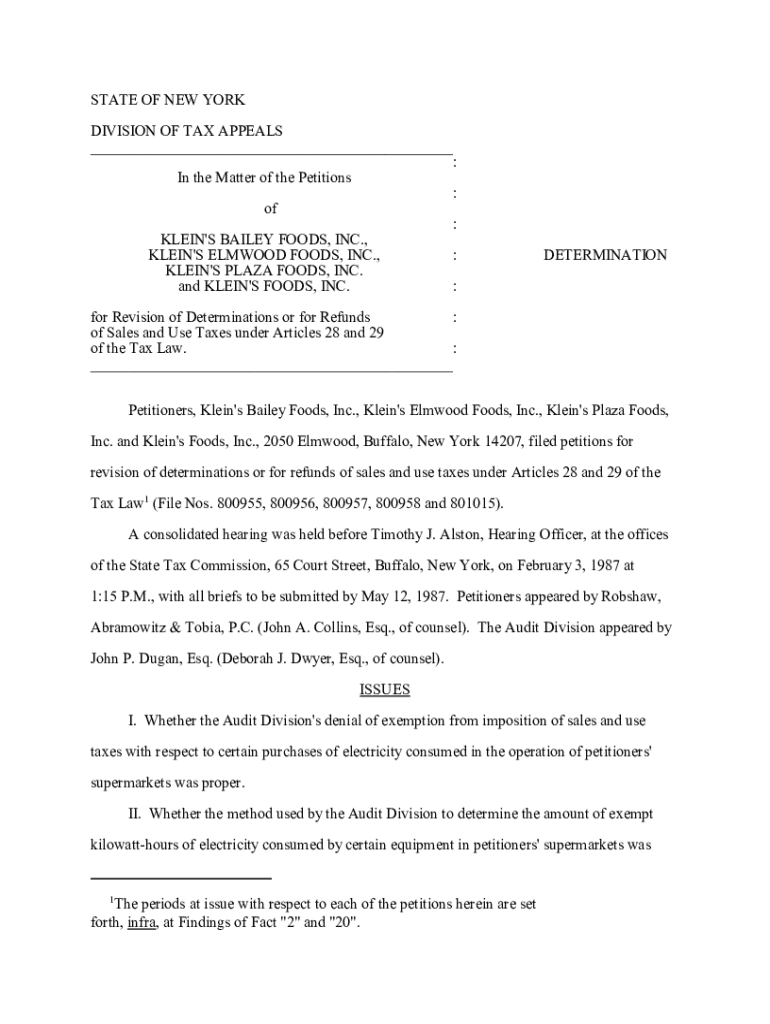

Get the free Klein's Foods Tax Determination

Get, Create, Make and Sign kleins foods tax determination

How to edit kleins foods tax determination online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kleins foods tax determination

How to fill out kleins foods tax determination

Who needs kleins foods tax determination?

Comprehensive Guide to the Kleins Foods Tax Determination Form

Understanding the Kleins Foods Tax Determination Form

The Kleins Foods Tax Determination Form is a crucial document used by individuals and businesses within the food service industry to delineate their tax obligations. This form not only assists in accurately reporting taxable income but also ensures compliance with local, state, and federal tax regulations. By effectively managing these tax obligations, food businesses can focus on their core operations while maintaining financial health.

For many businesses in the food sector, the form serves as a vital tool for tax planning and assessment. It simplifies the otherwise complex task of tax reporting, making it a fundamental component of financial management strategies. This guide will delve into its use, importance, and how to navigate its complexities successfully.

When and why you need the Kleins Foods Tax Determination Form

There are several situations where the Kleins Foods Tax Determination Form becomes necessary. Particularly, during tax assessment periods, it is crucial for ensuring that all income and expenses are accurately reported, thus reflecting the true financial status of the business. If there are any significant changes in business structure, such as a merger or acquisition, or changes in ownership, the form is essential to re-evaluating tax liabilities.

Using the Kleins Foods Tax Determination Form can also provide a variety of benefits. Firstly, it ensures compliance with tax regulations, helping businesses avoid potential fines and penalties that can arise from misreporting information or failing to file timely. Moreover, the proper use of this form can lead to significant tax savings by correctly identifying eligible deductions and exemptions.

Detailed insights into the form structure

The Kleins Foods Tax Determination Form comprises various sections that must be completed accurately to ensure successful processing. Each section has a specific focus, and failing to fill these out can lead to delays or issues with tax compliance. The main components typically include Personal and Business Information, Financial Information, and Tax Calculations.

Understanding the common terms associated with the form is equally critical for effective completion. Familiarity with terminology such as 'taxable income,' which refers to income subject to taxation, and 'exemptions,' which are specific instances where income is not taxed, can help streamline the process.

Step-by-step guide: How to fill out the Kleins Foods Tax Determination Form

Preparing to complete the Kleins Foods Tax Determination Form requires gathering necessary documents and information. This can include previous tax returns, business financial statements, and any documentation regarding income sources. Once you have all required documents, it simplifies the filling process significantly.

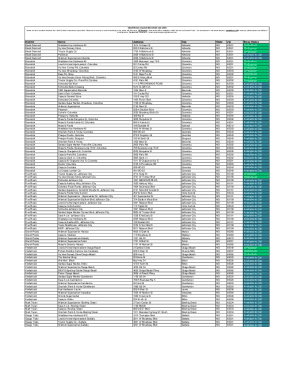

Filling out the form typically progresses through three main sections. First is the Personal and Business Information section, where identifying details are entered. Next, the Financial Information section requires you to report all income, expenses, and deductions, ensuring accuracy to avoid discrepancies. Finally, you will calculate the taxes owed, or any eligible credits that your business may benefit from. Be mindful of common mistakes, such as incorrect calculations or omitting necessary information, both of which can lead to complications.

Editing and customizing your form

Once the initial version of the Kleins Foods Tax Determination Form is completed, it’s often necessary to make edits or customize the document further. Utilizing PDF editing tools like those available on pdfFiller can greatly enhance this process. With an intuitive interface, pdfFiller allows users to modify existing entries easily, add text, and facilitate all necessary changes without starting from scratch.

To expedite the editing process, take advantage of features such as auto-fill options for recurring information, which can save time. Also, ensure that any edits you make maintain clarity and professionalism to uphold validity, especially in formal tax documents where precision is paramount.

Signing the Kleins Foods Tax Determination Form

Adding a signature to the Kleins Foods Tax Determination Form is crucial for its legal validity. The act of signing confirms that the information provided is accurate and acknowledges your responsibility for the reported figures. Any discrepancies post-signature can lead to legal responsibilities, fines, or penalties.

With pdfFiller, adding an electronic signature is uncomplicated and secure. The platform's signature features guide users step-by-step, ensuring compliance with legal standards. Additionally, eSignatures provided through pdfFiller include security measures that verify the identity of the signer, promoting a controlled and secure signing process.

Managing your tax documentation effectively

Proper organization and management of your tax documentation, including the Kleins Foods Tax Determination Form, are foundational to effective financial planning. Employing best practices for document management can simplify retrieval during audits or tax assessments. This includes categorizing documents by year, type, and importance to prevent missing vital tax paperwork.

Collaboration is also essential, especially in team settings. Using cloud-based solutions like pdfFiller, teams can share and collaborate on tax documents in real time, enhancing communication and ease of access. This ensures that all stakeholders are informed and can contribute to the accuracy of the form before submission.

Additional tools and resources available on pdfFiller

pdfFiller offers an array of interactive tools that enhance user experience, particularly for managing the Kleins Foods Tax Determination Form. With templates readily available, users can streamline the documentation process, ensuring consistent formatting and accuracy. The platform also supports cloud storage, allowing documents to be stored securely while remaining easily accessible from anywhere.

Additionally, pdfFiller provides valuable user support. Their customer service team can assist with any issues or troubleshooting needs, offering a lifeline for users navigating the complexities of tax documentation. Leveraging these features can significantly enhance the efficiency of managing tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify kleins foods tax determination without leaving Google Drive?

How do I edit kleins foods tax determination on an iOS device?

How do I complete kleins foods tax determination on an iOS device?

What is kleins foods tax determination?

Who is required to file kleins foods tax determination?

How to fill out kleins foods tax determination?

What is the purpose of kleins foods tax determination?

What information must be reported on kleins foods tax determination?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.