Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

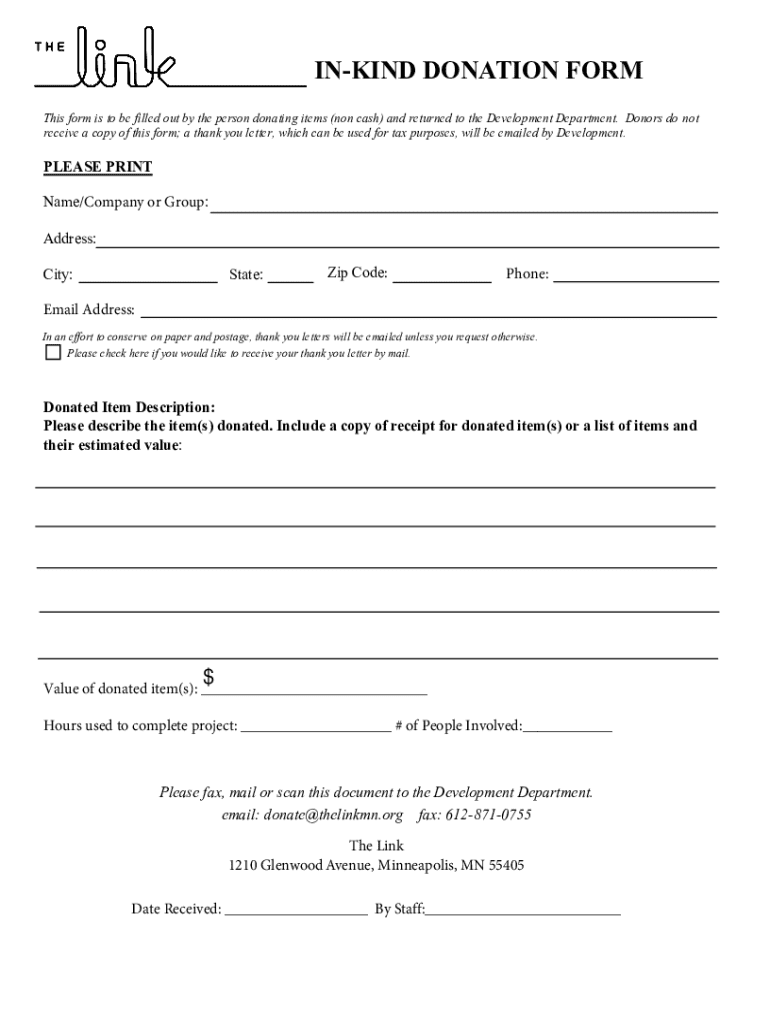

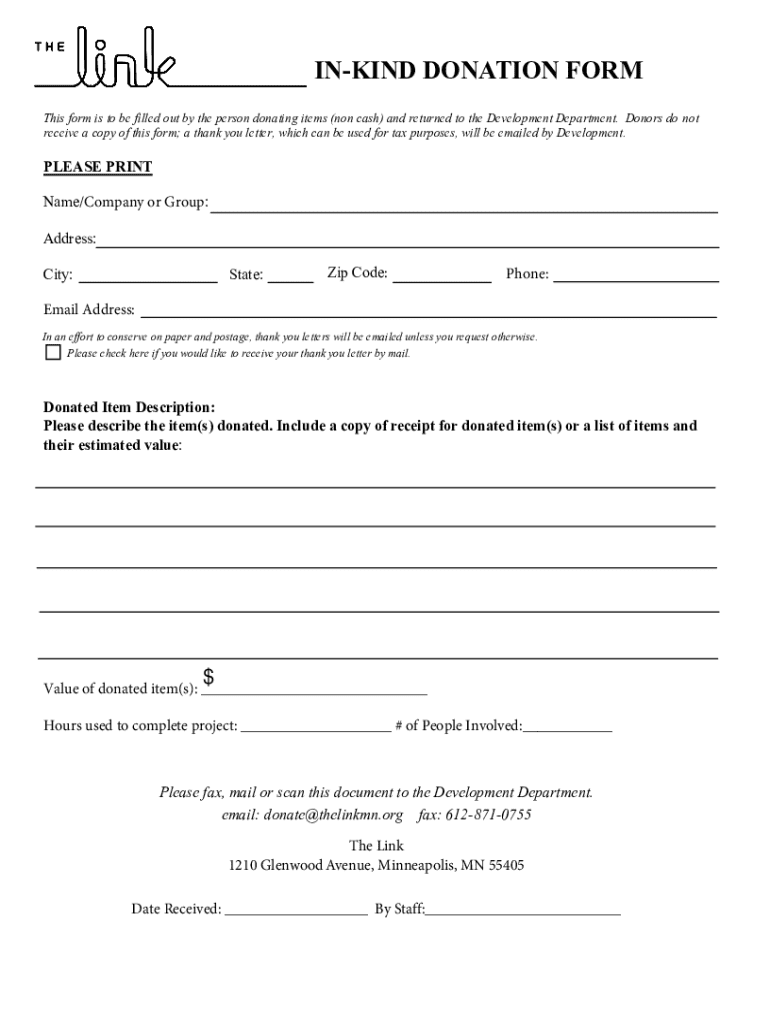

How to fill out in-kind donation form

Who needs in-kind donation form?

Comprehensive guide to in-kind donation forms

Overview of in-kind donations

In-kind donations are non-monetary contributions that individuals and organizations provide to nonprofits. These contributions can range from goods and services to expertise that assists charitable organizations in achieving their missions. Understanding the significance of an in-kind donation form is essential, as it streamlines the process, ensuring that all contributions are documented properly for both accountability and recognition.

Benefits of using the in-kind donation form

Using the in-kind donation form provides various benefits for donors and recipients alike. First, it creates a formal record of the donation, which can be crucial for tax purposes. Donors may potentially claim deductions based on the fair market value of their contributions, making it financially beneficial. Simultaneously, organizations can maintain precise inventory records and acknowledge donor contributions publicly, enhancing community engagement.

Types of in-kind donations

In-kind donations come in multiple forms, broadly categorized into three types: goods donations, expertise donations, and service donations. Goods donations often include tangible items such as food, clothing, and supplies. Expertise donations encompass professional skills and services—like legal or marketing assistance—while service donations refer to volunteer hours contributed to support nonprofit operations or events.

Why donors choose in-kind contributions

Donors are often drawn to in-kind contributions because these donations can yield significant tax benefits, particularly if the items donated are appreciated assets. Beyond potential tax deductions, in-kind donations engender a deeper connection between the donor and the organization, reinforcing community ties. Furthermore, local organizations benefit immensely, fostering vibrant communities and addressing pivotal needs effectively.

How to use the in-kind donation form

The in-kind donation form serves as a key tool for both donors and nonprofits. It helps to clarify the purpose of the donation and includes essential sections. Using pdfFiller, individuals can easily access, fill, and manage these forms from anywhere, ensuring a hassle-free donation experience while keeping documentation organized.

Step-by-step instructions

Tips for a successful in-kind donation

To optimize your in-kind donation, ensure that all items are of good quality and usable to the recipient organization. When estimating the value, consider the fair market value and consult resources or professionals if necessary. Additionally, always acknowledge donations with a personal thank you or recognition to establish a rapport and express gratitude towards your donors.

Common questions about in-kind donations

Real-world examples of in-kind donations

Organizations often share success stories regarding in-kind donations. For instance, a local food bank may highlight how a community business's bulk food donation helped feed hundreds of families during a crisis. Donors frequently express how fulfilling it is to see the direct impact of their contributions, encouraging ongoing support and engagement.

Resources for donors

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pdffiller form?

Can I sign the pdffiller form electronically in Chrome?

Can I create an electronic signature for signing my pdffiller form in Gmail?

What is in-kind donation form?

Who is required to file in-kind donation form?

How to fill out in-kind donation form?

What is the purpose of in-kind donation form?

What information must be reported on in-kind donation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.