Get the free K7 Key Person Insurance- Proposal Form

Get, Create, Make and Sign k7 key person insurance

How to edit k7 key person insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out k7 key person insurance

How to fill out k7 key person insurance

Who needs k7 key person insurance?

K7 Key Person Insurance Form: A Comprehensive Guide

Understanding key person insurance

Key person insurance is a vital financial safeguard that protects businesses against the potential loss of a significant contributor, often referred to as the 'key person.' This type of insurance is typically taken out on the life of an executive or employee whose absence could adversely impact company performance.

The primary purpose of key person insurance is to mitigate financial risks associated with losing an invaluable employee. In the unfortunate event of the key person's death or disability, the insurance payout provides the business with funds to cover immediate financial needs, find a replacement, and stabilize operations.

Key person insurance is particularly indispensable for startups and small businesses, where the impact of losing a key personnel can be catastrophic. Additionally, companies seeking loans, investors, or partnerships often find that having this safety net can be beneficial in negotiations.

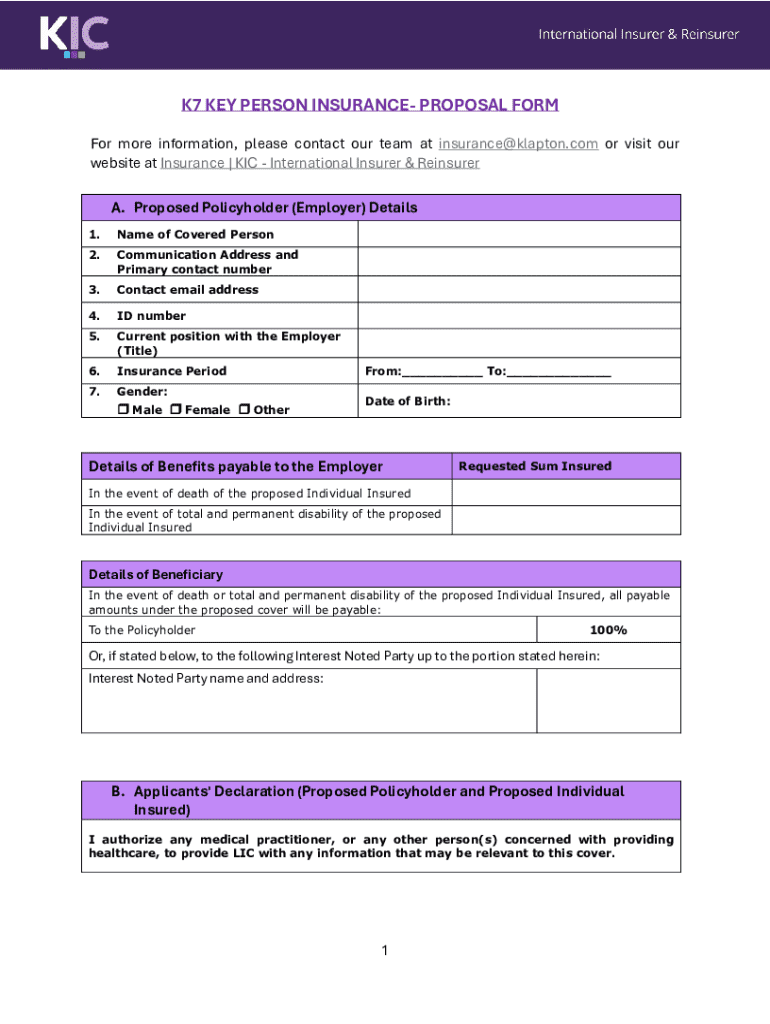

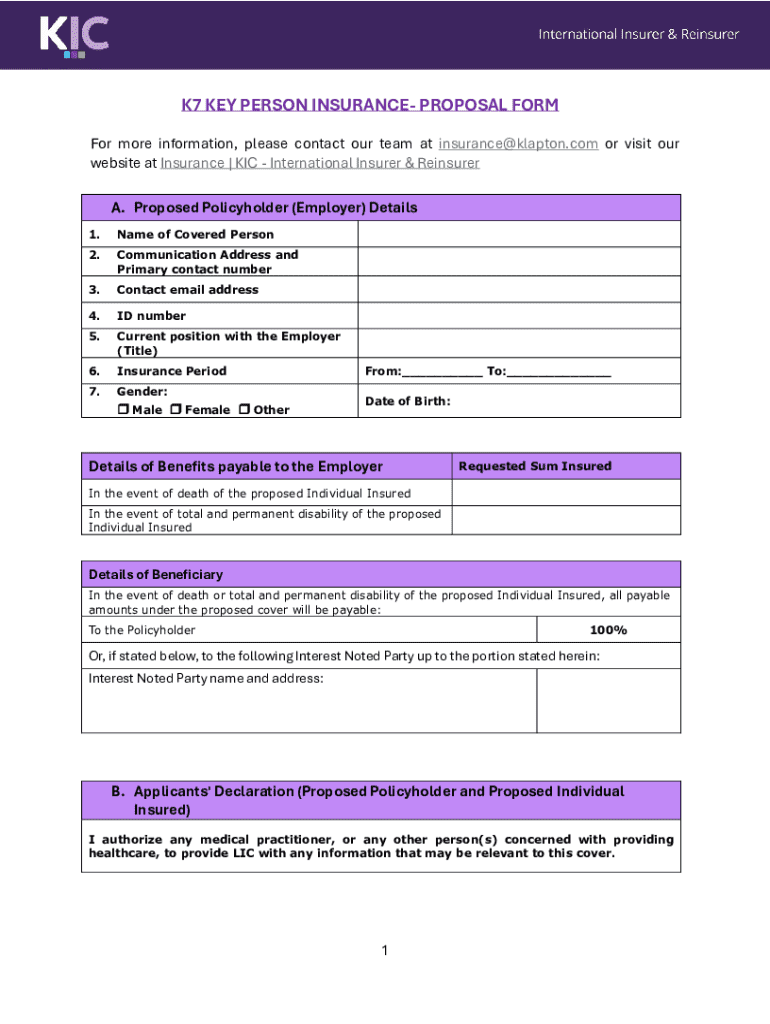

Overview of the K7 key person insurance form

The K7 key person insurance form is a crucial document embedded within the process of acquiring key person insurance. It serves as the foundational basis for underwriting the insurance policy and capturing essential details about the key person, the business, and the coverage desired.

Accuracy in the K7 form is imperative. Incorrect or incomplete information could lead to delays in processing or even denial of the policy. This form ensures that the insurance provider has a comprehensive understanding of the financial impact the loss of the key person would have on your business.

The K7 key person insurance form is not merely paperwork; it forms a contract between business owners and insurance providers, detailing the expectations and obligations involved.

Preparing to complete the K7 key person insurance form

Preparation is key when filling out the K7 key person insurance form. It’s crucial to gather all necessary documentation and information beforehand to avoid any delays in submission. Start by collecting your business’s financial statements, details regarding the key person, and recent business valuation reports.

Having these documents ready will not only streamline the process but will also ensure that the data is accurate and reliable. Incomplete forms can result in processing delays or complications in obtaining the required insurance.

Avoid common mistakes such as providing outdated financial data or neglecting to include necessary supporting documents. Working collaboratively with your financial team can help ensure accuracy and cohesion in the data collected.

Step-by-step guide to filling out the K7 key person insurance form

Filling out the K7 key person insurance form may seem daunting at first. However, breaking it down into manageable sections can simplify the process and enhance accuracy. Below is a step-by-step guide for each section of the form.

For each section, providing accurate information and ensuring clarity is essential. Using visual aids or templates can greatly enhance understanding and streamline the process, especially for first-time fillers.

Editing and reviewing the form

After filling out the K7 key person insurance form, reviewing and editing it is crucial for ensuring all provided information is precise and current. Best practices include reading through the form multiple times and, if possible, having additional team members review it as well.

Using collaboration tools can facilitate this process by enabling teammates to comment and suggest changes on a shared platform. Also, ensure that all information reflects the most recent data available, as outdated information can lead to complications during underwriting.

Submitting the K7 key person insurance form

Submitting the K7 key person insurance form requires careful consideration of the method chosen. Submission methods typically include online platforms or traditional offline mail systems. Choose the method that best suits your team’s needs and technology comfort.

Once submitted, the form enters a review process. During this time, underwriters will evaluate the information provided to determine the terms of the insurance policy. Following up post-submission is crucial to ensure that all documents have been received and to clarify any additional questions that may arise.

Managing your key person insurance policy

Once you've successfully submitted the K7 key person insurance form and received your policy, it's important to establish an ongoing management plan. This includes understanding how to amend your policy whenever necessary, as changes in your business landscape or key personnel can require adjustments to your coverage.

Keeping documents organized, especially using platforms like pdfFiller, will aid in tracking updates and maintaining compliance. Regular reviews of your policy conditions and coverage amounts are recommended — ideally on an annual basis or whenever a significant change occurs within your business.

FAQs on K7 key person insurance form

Having a clear understanding of the K7 key person insurance form can alleviate concerns and facilitate smoother transactions. Below are answers to common questions.

Case studies: Real-world applications of key person insurance

Understanding the real-world applicability of the K7 key person insurance form can help illuminate its impact and importance. Businesses from startups to established firms have experienced the protective benefits of key person insurance.

For example, a small tech startup secured key person insurance for its lead developer, who was critical given the company's reliance on their specialized skills. Following an unexpected medical event affecting the lead developer, the insurance policy's payout allowed the business to hire a temporary contractor, ensuring project timelines were maintained without a significant loss in revenue.

pdfFiller tools for document management

Leveraging pdfFiller's robust document management features can ease the often cumbersome process of filling out and managing your K7 key person insurance form. The platform offers tools that add efficiency to every step, from completing the form to sharing it for e-signatures.

With automated features allowing for easy edits, user-friendly templates, and collaborative options, pdfFiller significantly reduces the manual effort involved. The cloud-based document management provides real-time access to your forms, ensuring your team can stay updated no matter where they are.

Personalizing your K7 key person insurance experience

Every business has its unique challenges and needs, which is why personalizing your K7 key person insurance experience is vital. Many insurance providers offer customizable options that cater to varying business structures, risk levels, and financial situations.

Understanding and selecting the right coverage ensures that your key person insurance is tailored for the specific risks associated with your staff. Businesses can negotiate terms that fine-tune coverage amounts, enabling better financial security tailored to their operational realities.

Final thoughts on the K7 key person insurance form

Managing key person insurance can seem daunting at first, but with the right guidance and tools, it becomes a streamlined process. The K7 key person insurance form plays a crucial role in securing your business against unforeseen circumstances, and taking proactive steps to fill it out and manage the resulting policy can enhance your company's resilience.

Utilizing platforms like pdfFiller simplifies the experience, allowing business owners and teams to focus on running their organizations rather than getting bogged down in paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute k7 key person insurance online?

How do I make edits in k7 key person insurance without leaving Chrome?

How do I edit k7 key person insurance on an Android device?

What is k7 key person insurance?

Who is required to file k7 key person insurance?

How to fill out k7 key person insurance?

What is the purpose of k7 key person insurance?

What information must be reported on k7 key person insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.