Get the free Limited Liability Company Articles of Organization

Get, Create, Make and Sign limited liability company articles

Editing limited liability company articles online

Uncompromising security for your PDF editing and eSignature needs

How to fill out limited liability company articles

How to fill out limited liability company articles

Who needs limited liability company articles?

Everything You Need to Know About Limited Liability Company Articles Form

Understanding limited liability companies (LLCs)

A limited liability company, or LLC, is a versatile business structure that combines the liability protection of a corporation with the tax advantages and simplicity of a partnership. LLCs are favored by entrepreneurs for their operational flexibility. This structure allows profits and losses to flow directly to members, avoiding the double taxation typically seen with corporations. As such, it's crucial to understand the key characteristics of LLCs and their practical benefits.

One significant advantage of forming an LLC is limited liability protection. This means that members are not personally liable for the company's debts and obligations, safeguarding their personal assets. Additionally, LLCs provide flexible taxation options, allowing members to choose between being taxed as a sole proprietor, partnership, or corporation. Enhanced credibility is another perk; having LLC after your business name can make a company more appealing to customers and partners.

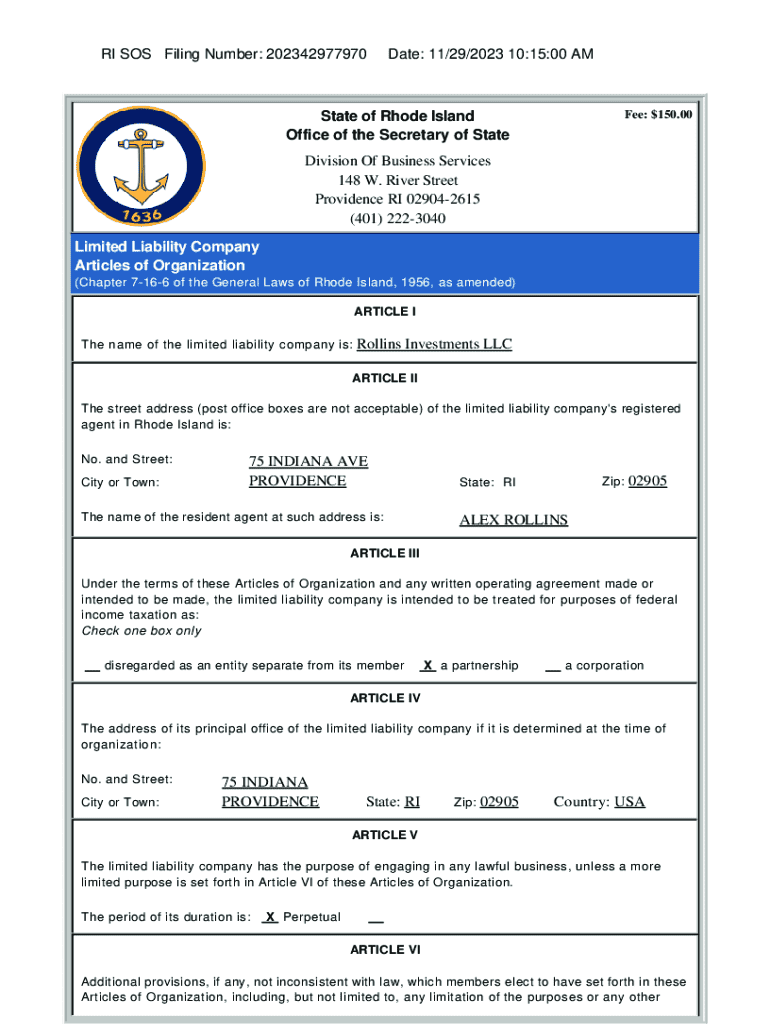

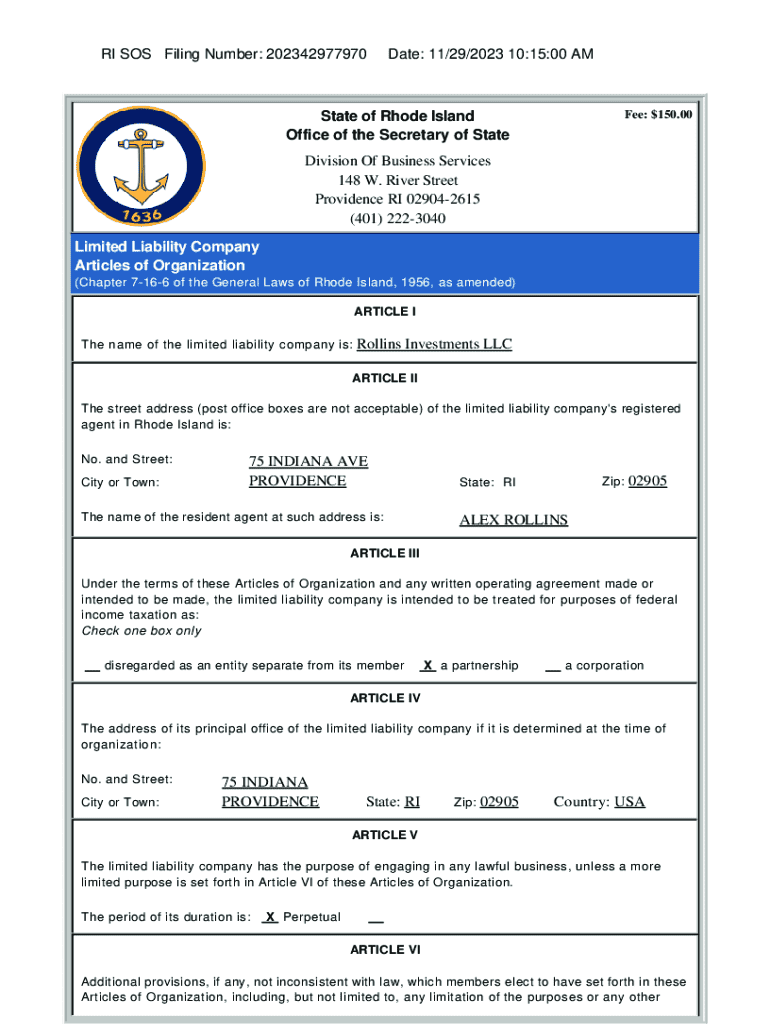

Overview of articles of organization

Articles of organization are the formal documents necessary for establishing an LLC. Filing these articles with the state not only helps legitimize your business but ensures compliance with local regulations. The importance of these articles cannot be overstated, as they serve as the foundational legal document that outlines the structure and function of your LLC.

Essential components typically include the business name, which must be unique and compliant with state regulations, and the principal office address where the business is located. Information about the registered agent—who is responsible for receiving legal documents on behalf of the is also required. Lastly, specifying the duration of the LLC is crucial, whether it is a perpetual entity or for a specified period.

Statutory requirements for formation

Forming an LLC involves understanding various statutory requirements that vary by state. Each state has its own rules regarding the filing process and necessary documentation, making it essential for aspiring LLC owners to familiarize themselves with state-specific provisions.

Common compliance requirements include deciding whether the LLC will be member-managed or manager-managed, typically indicated in the articles of organization. It is also advisable to include indemnification clauses to protect individuals from personal liability for acts performed in their official capacities for the LLC.

How to complete your articles form

Completing your limited liability company articles form accurately is a critical step towards establishing your LLC. Here’s a step-by-step guide to help you navigate this process smoothly.

To avoid common mistakes, always ensure your business name is available and not in use by another entity. Double-check the compliance of your registered agent with state laws, as failure to comply can delay the process. Additionally, consider using tools like pdfFiller to fill out your form—its built-in validation checks help you catch errors before submission.

Filing your articles of organization

Once your limited liability company articles form is completed, the next step is filing it with the appropriate state agency. This can often be done through various means depending on the state. Online submission is the most efficient route, typically offering expedited processing.

You can also opt for mail-in submission, providing a hard copy of your documents, or visit the agency in person for walk-in submission. It's crucial to understand the anticipated processing times as well as any associated fees, which often vary by state. States typically charge a filing fee, and if you are in a hurry, optional expedited processing fees may apply.

Post-filing considerations

After your articles of organization have been filed and officially approved, there are critical initial steps to take as a new LLC owner. First among these is obtaining an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes, opening a business bank account, and hiring employees.

Ongoing compliance is equally vital. Many states require regular reporting, annual filings, and renewals to maintain good standing. Tracking these requirements will save you from unexpected penalties and ensure the business remains in compliance with local laws.

Utilizing pdfFiller for document management

When it comes to managing LLC documentation, pdfFiller offers an array of features designed to streamline processes. The eSignature capabilities allow you to sign documents electronically, eliminating the hassle of printing and scanning. Moreover, the document editing and collaboration features mean you can work with team members in real time, making it vastly easier to ensure all input is consolidated smoothly.

Utilizing a cloud-based solution like pdfFiller not only provides access from anywhere but also ensures secure document storage. You can save your completed articles of organization and other important documents in one place, making future retrieval simple and efficient.

Additional tools and resources for management

Beyond articles of organization, various essential forms and certificates are part of effective LLC management. Operating agreement templates help in outlining the management structure and responsibilities, while amendment forms allow for legal modifications to the original articles when necessary. Should you decide to dissolve your LLC, a dissolution form would also be required.

Additionally, pdfFiller provides educational resources such as webinars and tutorials targeted at new LLC owners. Their community forum can also be a valuable space to share knowledge and seek guidance from experienced entrepreneurs in the field.

Frequently asked questions

Many individuals navigating the formation of their LLC encounter similar questions. Common inquiries include how to ensure compliance with state regulations and what follows after filing the articles of organization. It's vital to be proactive in troubleshooting issues that may arise, such as potential rejected filings due to errors or missing information.

Moreover, if you encounter difficulties using pdfFiller or have specific inquiries related to filling out the limited liability company articles form, their customer support is readily available to assist. Engaging with support services can significantly simplify your experience during this process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send limited liability company articles to be eSigned by others?

How do I make changes in limited liability company articles?

Can I edit limited liability company articles on an Android device?

What is limited liability company articles?

Who is required to file limited liability company articles?

How to fill out limited liability company articles?

What is the purpose of limited liability company articles?

What information must be reported on limited liability company articles?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.