Get the free Normal Retirement Application

Get, Create, Make and Sign normal retirement application

Editing normal retirement application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out normal retirement application

How to fill out normal retirement application

Who needs normal retirement application?

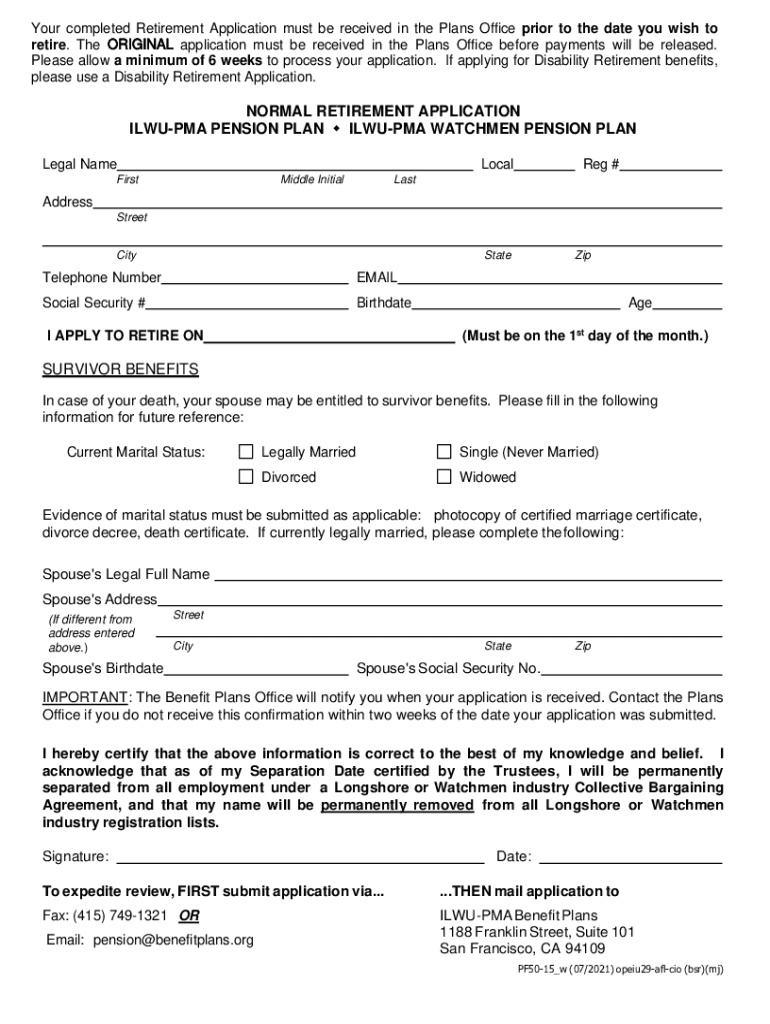

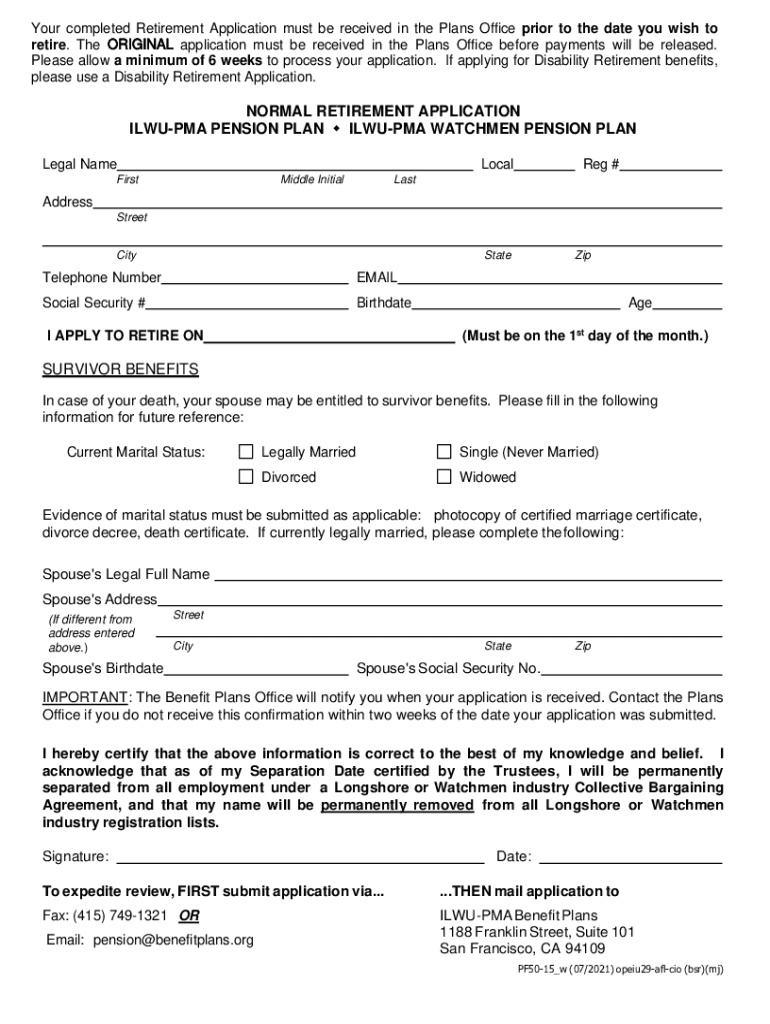

Navigating the Normal Retirement Application Form: A Comprehensive Guide

Overview of normal retirement application

A normal retirement application form serves as a pivotal document for those approaching the end of their employment due to age or length of service. This form is essential in officially notifying an employer or retirement plan administrator about an individual’s intent to retire. It ensures that the right benefits are calculated and distributed promptly, ultimately playing a crucial role in retirement planning.

Beyond its functional purpose, the normal retirement application is a guide that encapsulates the journey of one’s career and the transition into retirement. Its importance resonates not only with individuals but also with administrative teams that manage these applications. Accuracy in filling out this application can significantly ease the transition process for retirees.

Key eligibility requirements

Before proceeding with the normal retirement application, it’s vital to understand the eligibility criteria that dictate whether you can apply. Typically, eligibility hinges on a combination of age and service.

Preparing to complete the normal retirement application form

Completing the normal retirement application form requires careful preparation. Ensuring that you have all necessary documents on hand can significantly streamline the process.

To organize these documents effectively, consider creating a checklist. This practice can ensure that no critical information is overlooked while filling out your application.

Understanding the application process

The application process for normal retirement can seem daunting, but breaking it down into manageable steps can make it more approachable. Generally, you should follow these essential steps to navigate through the process smoothly.

Each method of submission offers its own benefits. Online submissions are typically faster, while mailing ensures physical documentation but may take longer for processing.

Detailed breakdown of the normal retirement application form

Understanding the sections of the normal retirement application form is crucial to ensuring completeness and accuracy.

Section-by-section guide to the application form

A thorough understanding of these sections can prevent mistakes that might delay the approval of your application.

Interactive tools for filling out the form

Taking advantage of digital tools can significantly increase your efficiency in completing the normal retirement application form. Services like pdfFiller provide robust features for editing and signing your application.

Signing and submitting the application

Once you've completed your normal retirement application form, the next critical step is signing it and submitting it through your chosen method. The significance of an electronic signature cannot be overstated in this age of digital documentation.

eSigning options

Using tools like pdfFiller, you can eSign your application swiftly. The process is both simple and legally binding, making it a preferred option for many retirees.

Submitting your completed application is the final step in ensuring you receive your retirement benefits. After submission, confirming receipt is essential.

Best practices for submission

Establishing a checklist to verify that all portions of your application are complete can save you from unnecessary delays. After submitting, track its status to ensure that it has been officially received.

FAQs about the normal retirement application

As with any significant life change, questions and concerns about the normal retirement application are common. It's vital to address these to navigate this process smoothly.

Common concerns and misconceptions

By staying informed and proactive, you can minimize the risk of complications during your retirement application process.

Troubleshooting common issues

Even with careful preparation, issues may arise during the application process. Knowing how to troubleshoot these problems can help you navigate the process more easily.

Managing your retirement application status

After submission, staying engaged with your application status can provide peace of mind. Most plans offer ways to track the status of your application.

Tracking your application

With pdfFiller, you can easily monitor the state of your application online, which can keep you informed about any needed next steps.

Amending your application

Sometimes, you may need to make changes to your application after submission. Understanding this process is essential for ensuring that your information remains accurate.

Additional resources for retirement planning

Understanding the full scope of retirement benefits can greatly enhance financial security in retirement. After submitting your application, familiarize yourself with the potential benefits you can expect.

Understanding retirement benefits

After your application is processed, you will become eligible for retirement benefits calculated based on your earnings and years of service. It’s also wise to explore any other forms related to continued support you might need.

Resources for financial planning post-retirement

Navigating finances post-retirement is crucial for maintaining a comfortable lifestyle. Various financial planning tools can help manage your retirement savings effectively.

Importance of staying informed

The world of retirement planning constantly evolves, making it vital to stay well-informed about current policies and changes in benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the normal retirement application form on my smartphone?

Can I edit normal retirement application on an iOS device?

How do I fill out normal retirement application on an Android device?

What is normal retirement application?

Who is required to file normal retirement application?

How to fill out normal retirement application?

What is the purpose of normal retirement application?

What information must be reported on normal retirement application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.