Get the free Proposed Rules for Fnma Operations

Get, Create, Make and Sign proposed rules for fnma

Editing proposed rules for fnma online

Uncompromising security for your PDF editing and eSignature needs

How to fill out proposed rules for fnma

How to fill out proposed rules for fnma

Who needs proposed rules for fnma?

Proposed rules for FNMA form: A comprehensive guide

Understanding FNMA forms

FNMA forms, short for Federal National Mortgage Association forms, are standardized documents used in mortgage transactions and loan applications. They capture essential information about borrowers, property details, and loan specifications. The accuracy and completeness of FNMA forms are crucial for faster processing and ensuring compliance with federal regulations.

These forms serve as an essential link between borrowers and lenders, facilitating the evaluation and approval process for residential loans. With the proposed rules for FNMA forms, the intent is to streamline operations, enhance data integrity, and improve the overall efficiency of mortgage lending.

Understanding the proposed rules is vital for all stakeholders, including borrowers, lenders, and real estate professionals, as these changes can significantly affect how transactions are conducted and processed.

Key changes in proposed rules

The proposed rules for FNMA forms include several major changes aimed at modernizing and improving the mortgage process. These adjustments will directly impact how borrowers submit information and how lenders process applications. The key changes comprise revisions to application submission guidelines, new verification processes for borrower information, updated appraisal standards, and more stringent loan processing timelines.

Each of these changes is designed to enhance transparency, reduce errors, and ensure that all parties involved are adequately informed throughout the lending process. This efficiency is not only vital for expediting loan approvals, but it also plays a role in maintaining compliance with industry regulations, which has become increasingly critical in today's market.

Detailed insights into specific proposed rules

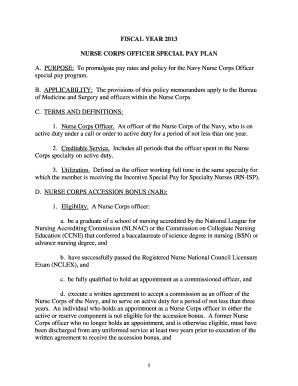

Rule 1: Application submission guidelines

Under the proposed rules, electronic submission of FNMA forms will be mandatory. This change requires all stakeholders to adapt to digital documentation, enhancing efficiency and reducing the likelihood of physical paperwork errors. Borrowers will need to familiarize themselves with the online submission process, which includes user-friendly platforms designed to streamline the experience.

Moreover, each application must adhere to a set timeline for submission and review, minimizing waiting periods for both parties. These timelines will help maintain efficiency within the lending process, ensuring timely responses to borrowers.

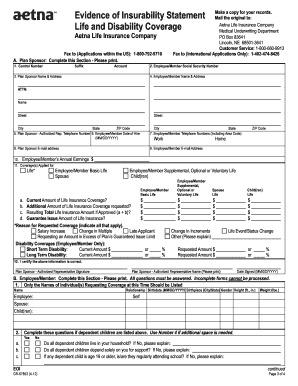

Rule 2: Verification of borrower information

The proposed rules also emphasize updated procedures for income verification. Lenders will be required to implement more robust processes to confirm a borrower’s income and creditworthiness. This change aims to reduce the risk of fraudulent applications and ensure that borrowers can afford the loans they are applying for.

As a result, underwriters will need to adjust their practices accordingly, using new methodologies for analyzing borrower information. This focus on due diligence will be beneficial, especially in preventing future defaults.

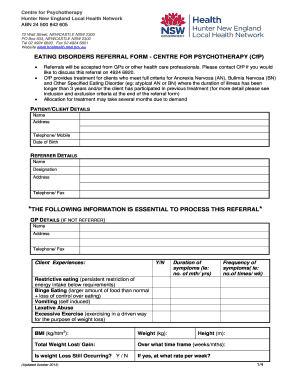

Rule 3: Appraisal and property assessment standards

New standards for appraisers will be introduced, focusing on consistency and accuracy in property valuation. This change seeks to address concerns regarding inflated property values, which can occur in certain markets. Appraisers will need to follow stricter guidelines to ensure that property valuations reflect true market conditions.

Additionally, changes in the property appraisal process will streamline procedures to ensure timely assessments, which are crucial for maintaining loan processing speeds.

Rule 4: Loan processing timelines

Lastly, the proposed rules stipulate expected timelines for processing FNMA loans, laying out clear expectations for both lenders and borrowers. This transparency aims to reduce anxiety for borrowers who often find themselves in the dark during the loan approval process.

Failure to adhere to outlined timelines can lead to consequences, including potential penalties for lenders, ultimately contributing to a more efficient market overall.

Interactive tools and resources

To help users navigate the proposed rules for FNMA forms effectively, pdfFiller provides various interactive tools and resources. These include downloadable FNMA form templates, which offer real-life examples conforming to the new guidelines. Utilizing these templates ensures that users are compliant with the latest requirements.

Additionally, pdfFiller offers sample scenarios illustrating the integration of new rules, allowing users to visualize the application of these changes. Tools such as loan cost estimators and timeline calculators also empower users to better manage their financial planning and expectations during the application process.

Filling out FNMA forms

Properly completing FNMA forms is essential for a smooth loan processing experience. Start by gathering all necessary documentation, such as income statements, tax documents, and identification. Failing to provide complete information can lead to delays or even denials of applications.

Common mistakes to avoid include entering incorrect personal information or failing to provide supporting documents. Users should cross-check entries for accuracy and adhere to guidelines as outlined in the proposed rules. To increase accuracy, it's advisable to utilize tools provided by pdfFiller, which streamline the editing and e-signing processes.

Managing changes effectively

For teams involved in mortgage lending, staying updated on the proposed rules for FNMA forms is crucial. Implementing strategies such as regular training sessions and workshops can ensure that staff are well-informed about any changes. Utilizing educational resources available through pdfFiller can also enhance knowledge and compliance among team members.

Continuous education not only helps staff remain compliant but also empowers them to provide better service to borrowers, thereby creating a more streamlined lending experience.

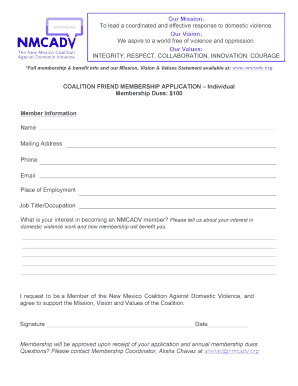

Collaborating with key players

Effective collaboration among borrowers, lenders, and appraisers is more important than ever under the proposed rules. Best practices include establishing clear communication channels and utilizing digital platforms where all parties can access relevant documents and updates. This reduces misunderstandings and expedites the overall process.

Incorporating technology, such as online project management tools, improves collaboration. For instance, a case study of a successful adaptation to new rules highlights how an emerging lender implemented a shared platform to manage real-time updates on FNMA forms, significantly enhancing communication and efficiency.

Regulatory bodies and oversight

The enforcement of FNMA rules resides primarily in the federal regulatory framework, which oversees compliance and market stability. Agencies like the Federal Housing Finance Agency (FHFA) play a significant role in implementing these regulations, ensuring that lenders adhere to industry standards.

With regulatory changes always in flux, understanding the effect of these rules on market trends is essential for industry professionals. Staying adaptable and well-versed in current regulations will allow teams to navigate shifts in the landscape effectively.

Future outlook for FNMA forms

Looking ahead, the proposed rules for FNMA forms may have lasting effects on the real estate market. With an emphasis on transparency and efficiency, these changes can lead to increased borrower confidence and a more robust lending environment. Emerging trends indicate a shift towards even greater digitalization in document management, allowing for better accessibility and quicker processing.

Industry professionals should prepare for an evolving landscape that embraces new technologies, which can enhance the safety and reliability of mortgage transactions.

FAQs on FNMA proposed rules

Many borrowers and lenders have common questions about the implications of the proposed rules for FNMA forms. Queries may include how electronic submissions will affect processing times or what documentation is required under the new guidelines. Clarifications on specific scenarios are essential to ensure that all parties understand their roles and responsibilities.

Providing a clear FAQ section can help to address these concerns and offer timely answers to pressing questions in the mortgage process.

Engagement and feedback mechanism

Engaging stakeholders in the proposed rules for FNMA forms is vital for a well-rounded implementation. Opportunities for feedback allow lenders, borrowers, and real estate agents to voice their opinions and contribute to the refinement of these regulations. Stakeholder engagement is crucial, especially as markets evolve and new challenges arise.

Creating channels for ongoing feedback fosters a collaborative environment where best practices can be shared and adapted.

Stay informed: Updates and notifications

Subscribing for the latest updates on proposed rules for FNMA forms is a proactive approach to maintaining compliance. Having access to real-time modifications ensures that both borrowers and lenders stay informed about changes that could affect their transactions.

By staying informed, key players in the lending process can better adapt to new rules and leverage improved guidelines to enhance their services and offerings in the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the proposed rules for fnma in Gmail?

How do I fill out the proposed rules for fnma form on my smartphone?

How can I fill out proposed rules for fnma on an iOS device?

What is proposed rules for fnma?

Who is required to file proposed rules for fnma?

How to fill out proposed rules for fnma?

What is the purpose of proposed rules for fnma?

What information must be reported on proposed rules for fnma?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.