Get the free M&g Isa Application

Get, Create, Make and Sign mg isa application

How to edit mg isa application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mg isa application

How to fill out mg isa application

Who needs mg isa application?

Comprehensive Guide to the &G ISA Application Form

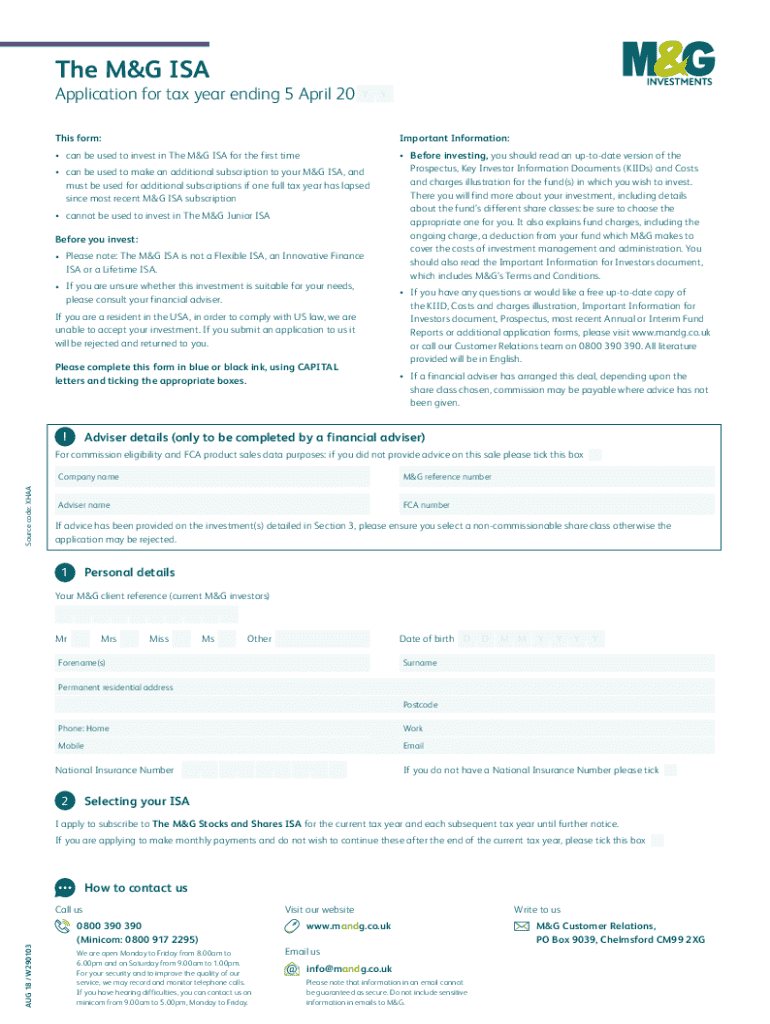

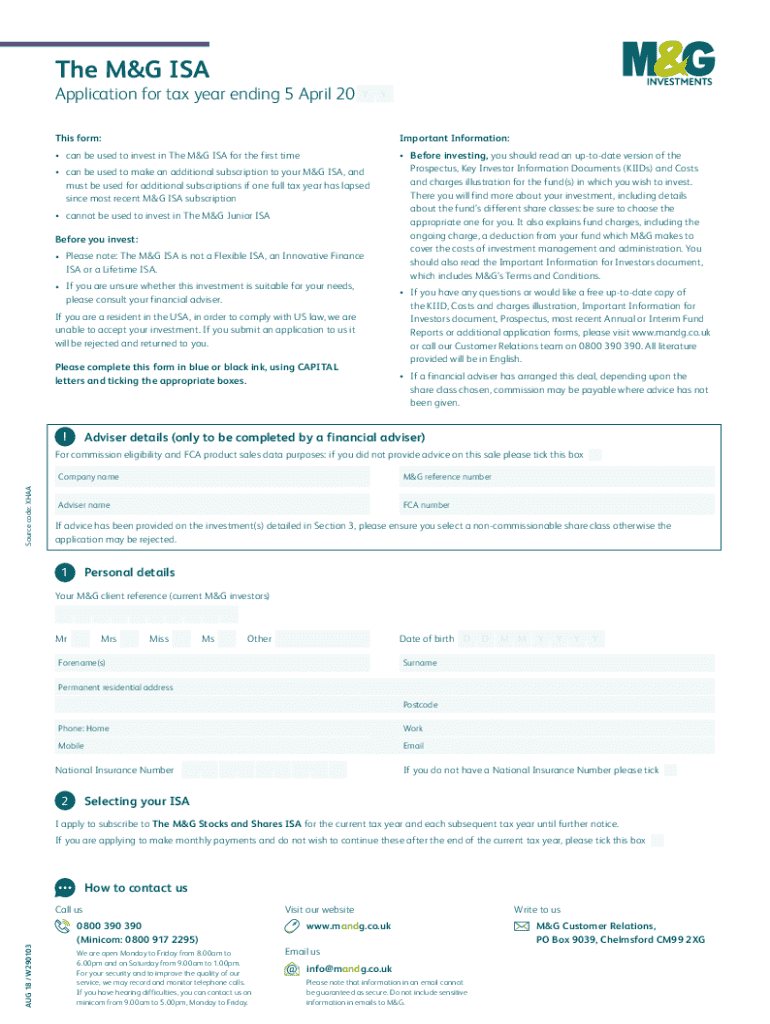

Understanding the &G ISA application form

A M&G ISA (Individual Savings Account) offers investors a tax-efficient way to grow their savings. The key advantages of this savings vehicle include the potential for capital growth, dividend income, and the absence of tax on any gains made. By utilizing an M&G ISA, individuals can benefit from the investment opportunities provided by M&G’s diverse range of financial products. Critical to accessing these benefits is the M&G ISA application form, which streamlines the process of setting up an ISA account.

The application form is essential not only for initiating an investment but also for ensuring compliance with regulatory requirements. Completing this form allows investors to specify their personal details, investment preferences, and any associated declaration, making it a fundamental document in the journey toward securing a financially stable future.

Who should use the &G ISA application form?

The M&G ISA application form is tailored to a variety of potential investors. Primarily, it is suitable for individuals aged 18 or over, who are residents of the UK for tax purposes. Anyone looking to maximize their savings through investments should consider this form, as it opens the door to various investment options from M&G.

In addition to individual investors, teams looking to manage collective investments can also utilize the M&G ISA. This can include group investments among friends or family. Moreover, both first-time investors and seasoned investors transferring their existing funds are encouraged to fill out this application form to explore M&G’s investment opportunities.

How to fill out the &G ISA application form

Filling out the M&G ISA application form is straightforward, provided you have the necessary information at hand. Here’s a step-by-step guide:

To avoid common mistakes, double-check all entries for accuracy, especially your National Insurance number and any numerical figures. You can access and download the form directly from M&G’s website, streamlining your initial setup. For those preferring digital alternatives, pdfFiller offers tools for seamless editing and signing, helping you maintain the integrity of your application.

Editing the &G ISA application form online

After filling out the M&G ISA application form, you might find the need to edit some details. Using pdfFiller allows for easy modifications regardless of where you are. You can add annotations or notes directly onto the form, facilitating better collaboration. For example, if you suddenly require changes to your financial details due to shifting investment strategies, pdfFiller’s interactive features enable swift adjustments.

This ease of editing is particularly beneficial for teams managing joint investments or individuals who want to ensure their application reflects the most current investment proposals. Ensuring your application is accurate before submission can prevent delays in processing.

Signing the &G ISA application form

You have multiple options for signing the M&G ISA application form. Electronic signatures via pdfFiller are convenient and legally recognized, making them an ideal choice for digital applications. Modern regulations ensure that eSignatures carry the same weight as traditional signatures, so you can submit your investments without unnecessary paperwork.

In most investment applications, including the M&G ISA, attaching your electronic signature solidifies your consent and acknowledgment of all terms presented in the document, further enhancing security in your financial dealings.

Submitting your &G ISA application form

Once your M&G ISA application form is complete and signed, you are ready to submit it. Best practices dictate that you send your application via the method outlined by M&G, whether by email or post. If emailing, ensure that all documents are properly formatted and clearly legible; use file formats that are easy for recipients to handle.

After submission, it's crucial to keep track of your application. M&G typically provides a timeline, so check back on preset intervals to understand its status. If you have any concerns or find discrepancies, reaching out to customer support would be the next step.

Frequently asked questions about the &G ISA application form

As you navigate the M&G ISA application form process, various questions might arise. Understanding common queries can alleviate concerns:

Related documents and tools

In conjunction with your M&G ISA application form, you may encounter several other documents and tools that are essential for managing your ISA effectively. This includes tax forms and other investment-related documents that require attention.

Additionally, interactive tools for tracking your ISA investments are available on the M&G and pdfFiller platforms, allowing you to monitor your performance and adjust strategies as necessary.

Exploring &G investment solutions

M&G offers various types of ISAs designed to meet different investment objectives. From stocks and shares ISAs to cash ISAs, each product comes with unique features intended to provide investors with options that best suit their financial goals. Understanding these differences is critical to optimizing your investment strategy.

Furthermore, pdfFiller complements M&G’s investment process by facilitating easy document management. From filling out application forms to tracking investment statuses all in a single, cloud-based platform, users can enhance their overall investment experience.

Tips for maximizing your ISA benefits

To get the most out of your M&G ISA, consider these strategic practices:

Utilizing these practices will ensure that you not only maximize your returns but also align your investments with your long-term financial aspirations.

Additional support options

If you require further assistance with the M&G ISA application form or have questions regarding your investments, M&G’s customer service offers a variety of support options. They provide contact information to speak directly with an advisor, as well as an online support center featuring FAQs and troubleshooting resources.

In addition, pdfFiller also has customer support available for those needing help with their document management and editing tools, ensuring that every aspect of the application process is covered.

Legal information and compliance

When applying for a M&G ISA, it's important to understand the legal requirements and tax implications associated with your investment. Compliance with the UK Financial Conduct Authority's regulations ensures that you remain within the framework of the law while enjoying the benefits of your ISA.

Moreover, being aware of the tax implications, including the current tax-free allowance, helps you make informed decisions. Regular updates from M&G can provide clarity on these regulations and changes within the financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mg isa application directly from Gmail?

How can I get mg isa application?

How do I edit mg isa application online?

What is mg isa application?

Who is required to file mg isa application?

How to fill out mg isa application?

What is the purpose of mg isa application?

What information must be reported on mg isa application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.