Get the free Mutual Fund Enrolment Form

Get, Create, Make and Sign mutual fund enrolment form

Editing mutual fund enrolment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund enrolment form

How to fill out mutual fund enrolment form

Who needs mutual fund enrolment form?

Your complete guide to the mutual fund enrolment form

Understanding mutual funds

Mutual funds are investment vehicles that pool money from multiple investors to buy securities like stocks, bonds, or other financial assets. This collective investment approach allows individual investors to access diversified portfolios without requiring substantial capital. The importance of mutual funds stems from their ability to democratize investing, offering an effective way to build wealth over time by spreading risk across various assets.

Investing in mutual funds comes with several advantages, including professional management by financial experts, ease of purchase and redemption, and regulatory oversight ensuring transparency and safety. Additionally, mutual funds cater to different investor needs through various types, such as equity funds, debt funds, hybrid funds, and index funds, each designed to meet unique risk profiles and investment goals.

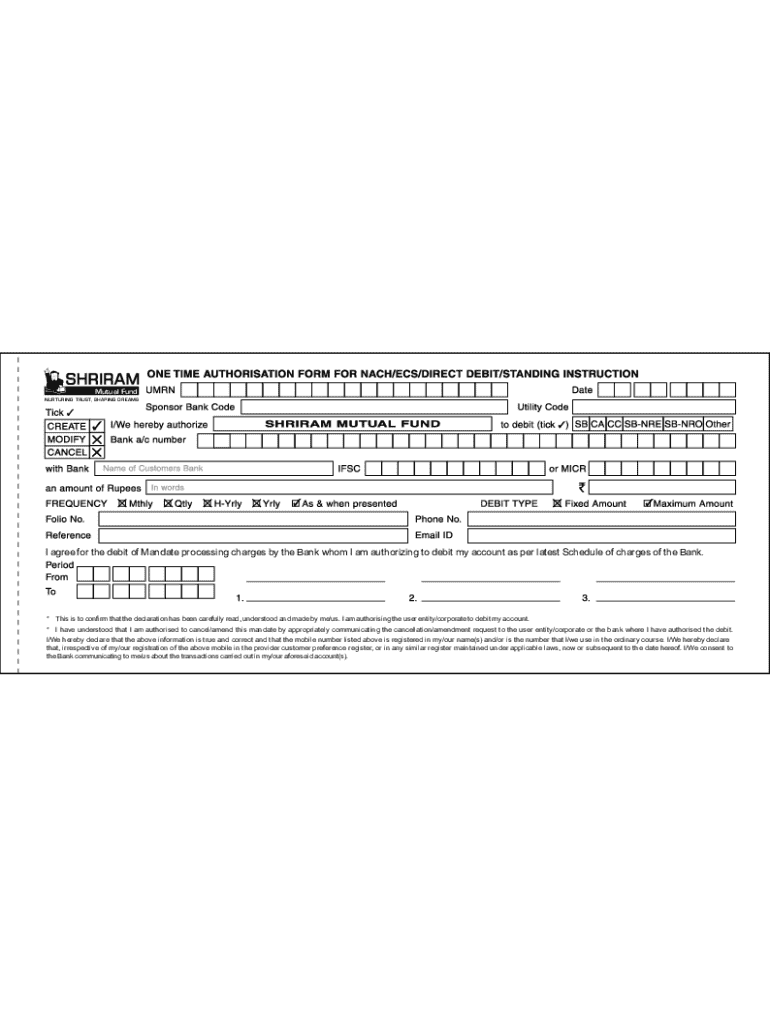

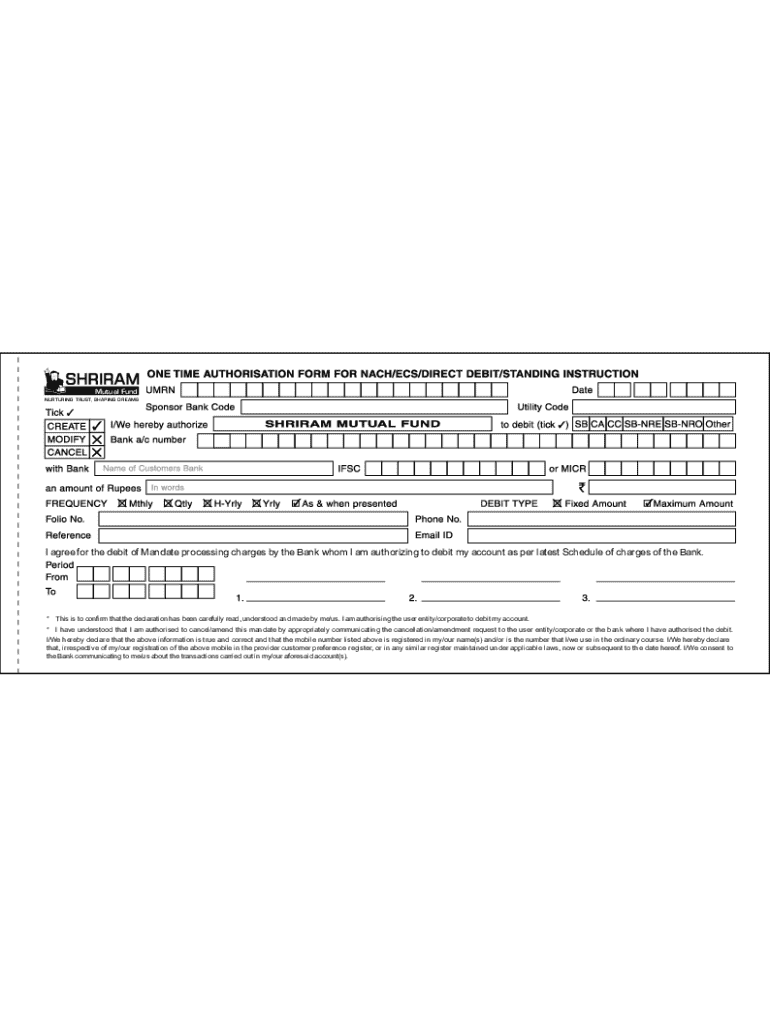

Overview of the mutual fund enrolment form

The mutual fund enrolment form serves as a crucial document for investors wishing to participate in mutual funds. This form not only collects essential information about the investor but also establishes a contractual relationship between the investor and the mutual fund company. Understanding its purpose is fundamental for a smooth investment journey.

Key information typically required on the enrolment form includes personal details, investment preferences, risk tolerance, and tax-related data. Despite the straightforward process, many individuals harbor misconceptions regarding its complexity or believe they need extensive financial knowledge to complete it accurately.

Getting started with the mutual fund enrolment form

Accessing the mutual fund enrolment form has never been easier. Most mutual fund companies provide digital versions of their enrolment forms on their websites. Moreover, platforms like pdfFiller simplify this process by offering accessible, online form solutions that can be filled out directly from any device—be it a desktop, mobile, or tablet.

Additionally, pdfFiller enhances user experience with robust document management tools. Investors can easily edit and save their enrolment forms, enabling them to return to incomplete submissions or make changes as needed before finalizing their investment.

Step-by-step guide to filling out the enrolment form

Filling out the mutual fund enrolment form can be straightforward if approached step-by-step. The first section typically requires personal information, including name, address, contact number, and date of birth. Accuracy is crucial here as it affects communication and record-keeping.

Next is the investment preferences section where you can indicate your preferred types of mutual funds based on your investment goals. Following this is the risk tolerance assessment, allowing the fund manager to align your investment accordingly. Tax information is also essential, as funds require a Tax Identification Number (TIN) to comply with regulatory obligations.

For a seamless entry, double-check the information provided and ensure all sections are complete to avoid delays in processing.

Editing the mutual fund enrolment form

One of the advantages of using pdfFiller is its user-friendly editing tools. Investors can modify their enrolment forms even after initial completion. Whether it's adding new information or correcting previous entries, pdfFiller allows you to keep documents accurate and updated.

Make sure to review specific fund requirements to ensure compliance. Missing information may lead to rejection of the enrolment, so always keep the guidelines provided by the mutual fund company handy while editing.

eSigning the enrolment form

In today's digital age, electronic signatures (eSignatures) hold significant importance. They ensure the authenticity and integrity of your submission. With pdfFiller, it's simple to eSign the mutual fund enrolment form—just follow the guided prompts to apply your signature electronically.

Security is paramount; pdfFiller implements stringent measures to protect your eSignature, ensuring that your documents remain secure during and after the signing process.

Submitting the mutual fund enrolment form

Once the mutual fund enrolment form is completed and eSigned, it's time for submission. pdfFiller simplifies this by allowing electronic submission directly through the platform. Users can quickly send the completed form to their respective mutual fund company with just a click.

Alternatively, if you prefer conventional methods, many companies still accept forms via mail or fax. Following submission, expect a confirmation notice from your chosen mutual fund, detailing the next steps and providing an overview of your investment.

Managing your mutual fund account

Managing your mutual fund account effectively is crucial for long-term success. Through platforms like pdfFiller, users can easily track their investments, assess performance, and make necessary adjustments based on changing financial goals or market conditions.

In addition, pdfFiller offers various resources for ongoing mutual fund education, such as articles and webinars that help investors stay informed about market trends and investment strategies.

Frequently asked questions

Investors often have questions surrounding the mutual fund enrolment process. Common queries include the timeframe for form processing, how to amend submitted information, and the implications of various investment options.

If you encounter issues while filling out the enrolment form, consult the troubleshooting tips available on the pdfFiller platform, which can guide you through common problems and ensure a smoother experience.

Interactive tools and resources

Investing wisely involves understanding your potential returns and risk tolerance, and pdfFiller offers valuable interactive tools. Investment calculators can help you estimate your potential returns based on various scenarios, while risk assessment questionnaires assist in determining your investing approach.

For further education, pdfFiller provides links to additional resources that cover the fundamentals of mutual funds and strategies for effective investing.

Related products and additional services

When considering mutual funds, it’s vital to explore other investment products to make well-informed decisions. pdfFiller allows users to compare mutual funds with alternatives such as stocks, bonds, and ETFs, enhancing your understanding of investment choices.

Furthermore, associated services like tax document management and financial planning tools are available on pdfFiller, assisting you in navigating the complexities of investing while keeping everything organized.

Contact support for assistance

If you need help with the mutual fund enrolment form, pdfFiller offers various customer support channels. You can reach out through chat, email, or phone, ensuring that your concerns are handled promptly and efficiently.

The support team is well-equipped to guide you through filling out forms, troubleshooting issues, or answering queries related to mutual funds, helping you take confident steps toward investing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my mutual fund enrolment form in Gmail?

How do I fill out mutual fund enrolment form using my mobile device?

Can I edit mutual fund enrolment form on an Android device?

What is mutual fund enrolment form?

Who is required to file mutual fund enrolment form?

How to fill out mutual fund enrolment form?

What is the purpose of mutual fund enrolment form?

What information must be reported on mutual fund enrolment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.