Get the free Maryland Form 502inj 2024 Injured Spouse Claim Form

Get, Create, Make and Sign maryland form 502inj 2024

How to edit maryland form 502inj 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form 502inj 2024

How to fill out maryland form 502inj 2024

Who needs maryland form 502inj 2024?

Comprehensive Guide to Maryland Form 502INJ 2024 Form

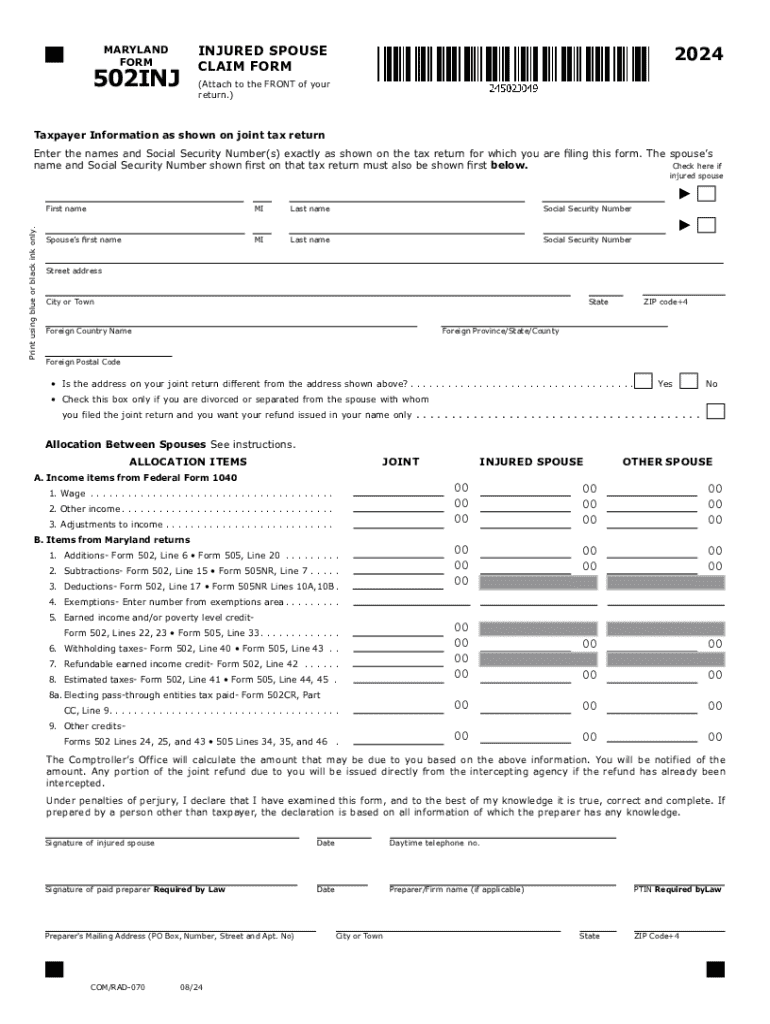

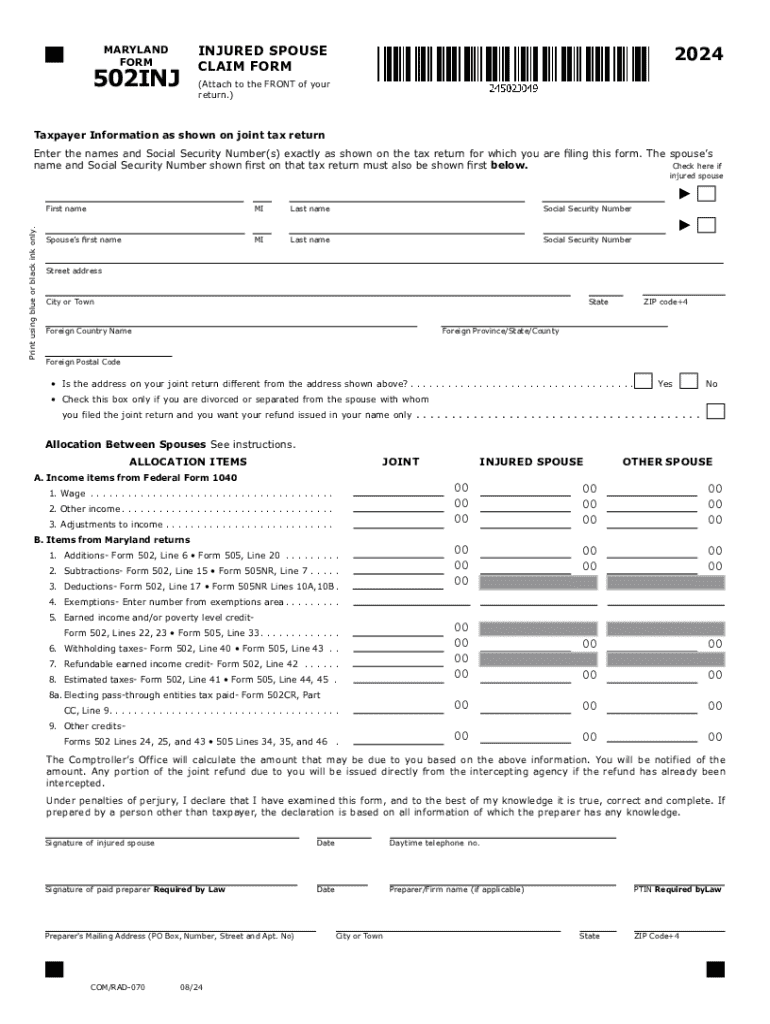

Overview of Maryland Form 502INJ

Maryland Form 502INJ, the Injured Spouse Claim Form, is an essential document for couples filing joint tax returns when one spouse has tax debts. This form protects the innocent spouse from losing their portion of a tax refund due to the other spouse's financial obligations to the state. With the tax year 2024, several key updates ensure ease and clarity in the process, reflecting Maryland's commitment to fair taxation.

Understanding the need for Form 502INJ

An Injured Spouse is typically defined as the spouse not responsible for the tax debts that prompted the need for Form 502INJ. This often applies in scenarios where tax refunds are intercepted due to one partner’s financial issues, such as back taxes or child support obligations. By claiming the Injured Spouse status, the innocent spouse can seek a fair distribution of their joint tax refund, minimizing the financial impact of their partner's debts.

Step-by-step instructions for filling out Maryland Form 502INJ

Filling out the Maryland Form 502INJ correctly is crucial for the seamless processing of your claim. Here’s a brief walkthrough of the necessary steps:

1. **Personal Information**: Include the names and Social Security numbers of both spouses. If applicable, add previous addresses to complete the record.

2. **Income Reporting**: Report your earned income alongside any other pertinent income sources. Accuracy here is vital to ensure appropriate refund allocation.

3. **Allocating Deductions and Credits**: Identify any allowable deductions. Understanding how to allocate credits between spouses is essential for fair calculations.

4. **Refund Claims**: Detail the required information to successfully claim your eligible refund, highlighting the importance of correct refund allocation.

5. **Signature Requirements**: Ensure both spouses sign the form. Note the differences between electronic and written signatures to avoid processing delays.

Common pitfalls when filling out Maryland Form 502INJ

Avoiding common mistakes can hasten the approval process for your Form 502INJ. One key mistake is inaccurate reporting of income and deductions, which can lead to processing delays or rejection of the claim. Additionally, failure to include essential signatures may invalidate your submission, leaving you without your rightful refund.

Managing your Maryland Form 502INJ submission

After diligently completing Form 502INJ, the next step is submission. For the 2024 tax year, taxpayers can submit the form either online through Maryland's tax portal or via traditional mail. Utilizing electronic filing can expedite the processing time considerably.

Once submitted, tracking your application is simple. Use Maryland's online tools to check the status of your tax return, providing peace of mind during processing.

Helpful tools and resources for completing Form 502INJ

Utilizing tools designed for document management can streamline your experience with Maryland Form 502INJ. pdfFiller offers interactive features that enable you to edit, sign, and collaborate on forms easily.

Frequently asked questions about Maryland Form 502INJ

It's common for taxpayers to have questions regarding the use of Form 502INJ. For instance, what if you and your spouse are separated? In such cases, filing Form 502INJ is still advisable, as it can protect your right to the joint refund.

Additional tax filing considerations

While filing Form 502INJ is crucial for claiming your rightful refund, understanding related Maryland tax forms can provide a broader picture of your tax obligations. Ignoring Form 502INJ’s filing could result in lost refunds and potential complications in future tax assessments.

Leveraging pdfFiller for your document needs

pdfFiller provides a robust solution for managing Maryland Form 502INJ and other tax documents effectively. The platform’s cloud-based nature ensures that your documents are accessible from anywhere, making it much more convenient to work on your taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit maryland form 502inj 2024 from Google Drive?

How do I edit maryland form 502inj 2024 in Chrome?

How do I complete maryland form 502inj 2024 on an iOS device?

What is maryland form 502inj?

Who is required to file maryland form 502inj?

How to fill out maryland form 502inj?

What is the purpose of maryland form 502inj?

What information must be reported on maryland form 502inj?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.