Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out trustees deed

Who needs trustees deed?

A comprehensive guide to the trustee’s deed form

Understanding the trustee’s deed

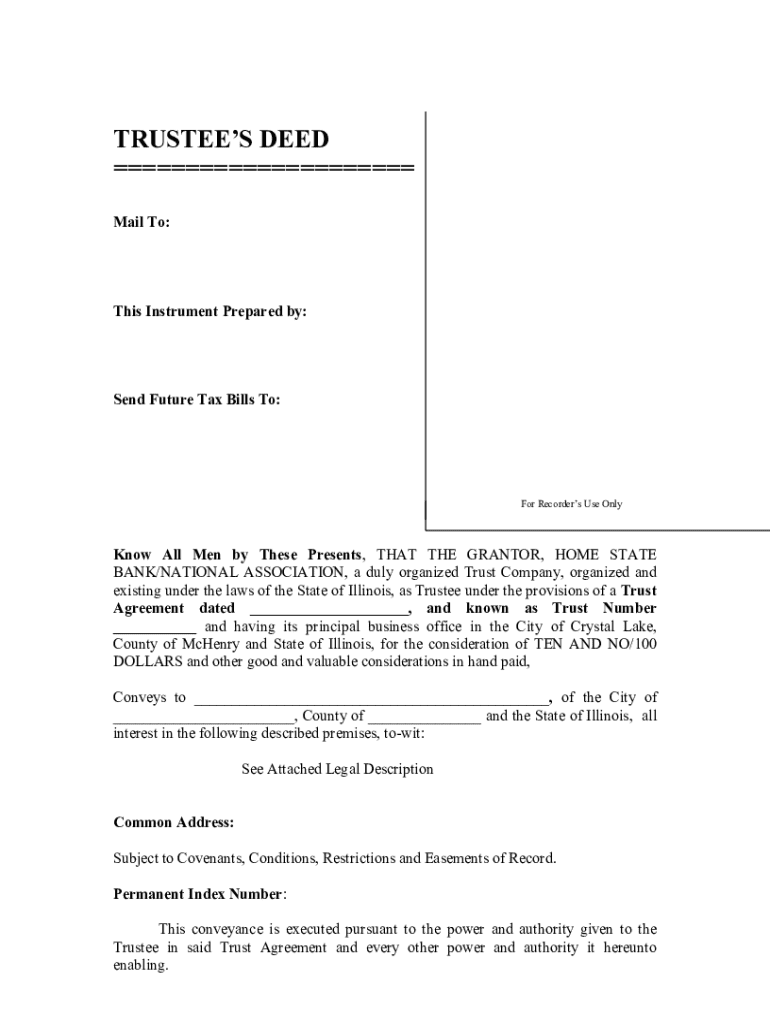

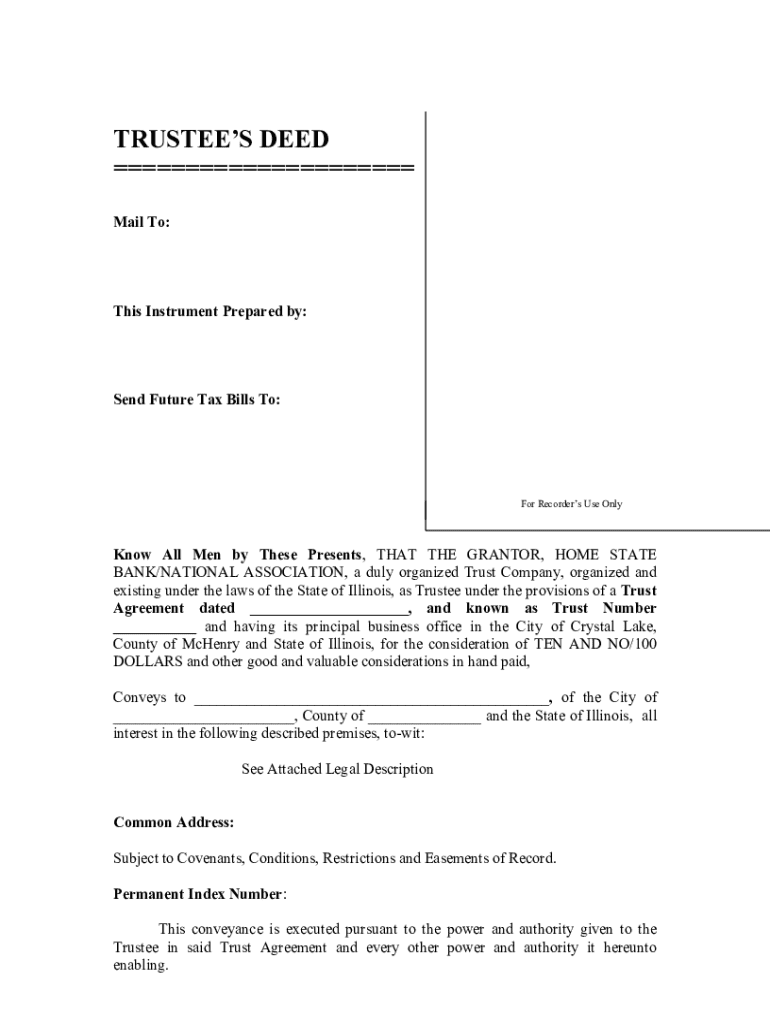

A trustee's deed is a legal document utilized to transfer property held in trust to a beneficiary or another party. The primary purpose of this deed is to formalize and document the transfer of ownership from the trustee, who manages the property, to an authorized individual or entity as stipulated in the trust agreement. This document is crucial in the real estate domain, ensuring transparency and legal backing for transactions involving trust property.

Key elements of a trustee's deed include the names of the trustor (the person who established the trust), the trustee, and the beneficiary, as well as a detailed description of the property being transferred, including its legal description, address, and boundaries. Additional features may involve conditions or stipulations under which the property is transferred, reinforcing the importance of accuracy in the form's completion.

When to use a trustee’s deed

Trustee's deeds are often employed in various scenarios involving property ownership changes. One common use case is during real estate transfers, where the property is held in a trust and subsequently sold or conveyed to a beneficiary. Additionally, these deeds are crucial in estate settlements, such as when a deceased individual's assets, including real estate, are distributed according to their wishes articulated in the trust documents.

Furthermore, financial transactions involving trusts—like securing loans using trust-held properties as collateral—also necessitate the use of a trustee’s deed. It’s essential to note that the legal implications of utilizing a trustee’s deed can be significant, including tax considerations and the need for proper recording with local governments to enforce the deed's validity.

Pre-filling considerations

Before filling out the trustee's deed form, it is crucial to gather all necessary documentation to ensure accuracy and compliance. Firstly, individuals will need to provide valid identification for all parties involved in the transaction, particularly the trustee. Additionally, having access to the trust agreement documents is vital as these will outline the scope of the trustee’s authority and any specific provisions affecting the property transfer.

Furthermore, detailed information about the property, including prior title deeds and legal descriptions, should be available. Keep in mind that regulations regarding the trustee’s deed can vary significantly from state to state, making it essential to understand local laws governing property transfers to avoid legal complications.

Step-by-step guide to filling out the trustee’s deed form

Filling out the trustee's deed form requires careful attention to detail. Start with the trustor’s information, including name and address. Next, include the trustee’s information, ensuring that the person’s authority as stipulated in the trust agreement is clear. When describing the property, provide its legal description and any pertinent details to ensure clarity on what property is being transferred.

Transfer details should indicate the nature of the transfer, specifying whether it is a sale, gift, or another type of transaction. Finally, signatures from the trustee and designated witnesses, along with notarization, may also be required to validate the deed. Be extra cautious to maintain accuracy and legibility throughout the form to avoid delays or rejections.

Editing and collaborating with the trustee’s deed form

Utilizing tools like pdfFiller can significantly streamline the process of editing and collaborating on your trustee's deed form. The platform offers interactive features that make it easy to fill out, sign, and share documents. Users can easily add text, signatures, and notary stamps to finalize their documents without printing them out.

This collaborative environment allows multiple parties to access the document simultaneously, enabling real-time feedback and revisions. Imagine working with your attorney or co-trustees seamlessly, ensuring that everyone is on the same page and that the completed deed meets all legal requirements.

Signing the trustee’s deed

Understanding the legal aspects of signing a trustee's deed is critical, especially with the increasing acceptance of electronic signatures. eSigning provides a convenient way to finalize documents without the need for physical presence, which can suit busy professionals. However, it is essential to ensure the eSigning platform is compliant with state laws to guarantee the deed's enforceability.

For those requiring multiple signatures, ensure that all parties are given access to the document on the pdfFiller platform, where they can sign in their respective areas. This method preserves a sense of order and clarity in the signing process, hence reducing the risk of errors or missing signatures.

Managing your completed trustee’s deed

Once your trustee’s deed is completed and signed, proper management of the document is vital. Securely storing the deed is essential, as it serves as a legal proof of ownership transfer. Utilize pdfFiller to save and organize your document in a cloud storage solution, allowing access from anywhere. This feature is especially useful for trustees who may find themselves handling multiple properties or documents simultaneously.

Moreover, if you need to make future changes or corrections to the deed, pdfFiller's updating capabilities make it easy to modify the document as necessary, maintaining the integrity of the information while ensuring compliance with any updated requirements.

Troubleshooting common issues

While filling out the trustee’s deed form can be straightforward, various common errors may arise during the process. Typical pitfalls include overlooked signatures, incomplete fields, or inaccuracies in property descriptions. To mitigate these issues, take the time to review the completed form thoroughly before finalizing it.

Should any issues persist, especially regarding signatures or the integrity of the documents, pdfFiller offers troubleshooting support to help address and resolve problems swiftly. Moreover, resources are available for legal consultations if complex issues arise, ensuring you have the required assistance for a smooth process.

Advanced topics related to trustee’s deed

In addition to the trustee's deed form, understanding related forms and documents is crucial for navigating property transfers effectively. For instance, differentiating between a trustee's deed and other property transfer forms, such as warranty deeds or quitclaim deeds, is vital in choosing the right document for your needs. Each type serves unique purposes and has different legal implications that can affect how ownership is transferred.

Furthermore, individuals should be familiar with other legal documents impacting trusts, such as the revocation of trusts or deeds of trust, which can also influence property transactions. Clarifying common misconceptions about trustee's deeds, along with expert answers to frequently asked questions, can help demystify the process and empower users to handle their real estate dealings competently.

Legal considerations and compliance

Navigating the complexities surrounding trustee's deeds requires an understanding of the relevant laws governing such documents. Varying significantly by jurisdiction, these laws dictate how trustee's deeds must be executed, recorded, and enforced. Thus, familiarity with these legal frameworks is essential for ensuring compliance and avoiding potential pitfalls during the property transfer process.

Engaging in legal consultation remains paramount, especially when dealing with significant assets or complex trust structures to mitigate risks related to improper use or errors on the deed. Consequences for mistakes can range from delays in property transfers to severe legal battles, making due diligence an indispensable step in managing your real estate interests.

Testimonials and user experiences with pdfFiller

Users have expressed how pdfFiller has streamlined their document management processes, particularly concerning the trustee's deed. Case studies reveal positive experiences where individuals successfully managed their trust-related property transactions using pdfFiller’s comprehensive tools. Feedback often highlights the platform's ease of use, particularly in ensuring compliance and accuracy when filling out complex forms, making it a go-to solution for many.

Individuals appreciate how features like real-time collaboration and secure storage have minimized confusion and safeguarded sensitive information, while together ensuring that their documentation processes are efficient and legally sound. These user experiences reinforce the value of utilizing a digital platform like pdfFiller in managing a trustee's deed.

Accessing assistance and support

When dealing with legal documents like a trustee's deed, having access to reliable support is crucial. pdfFiller offers excellent customer service for users who need assistance filling out forms or navigating through their document management process. Whether you require real-time support for immediate questions or guidance on more complex issues, pdfFiller is equipped to offer the assistance needed.

Additionally, the platform features community forums where users can exchange tips and insights on handling various forms. This resource can prove invaluable, especially for those encountering similar issues or seeking to optimize their use of the tool.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

How can I send pdffiller form for eSignature?

How do I complete pdffiller form on an Android device?

What is trustees deed?

Who is required to file trustees deed?

How to fill out trustees deed?

What is the purpose of trustees deed?

What information must be reported on trustees deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.