Get the free Psbank Home Loan Application Form

Get, Create, Make and Sign psbank home loan application

Editing psbank home loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out psbank home loan application

How to fill out psbank home loan application

Who needs psbank home loan application?

Comprehensive Guide to the Psbank Home Loan Application Form

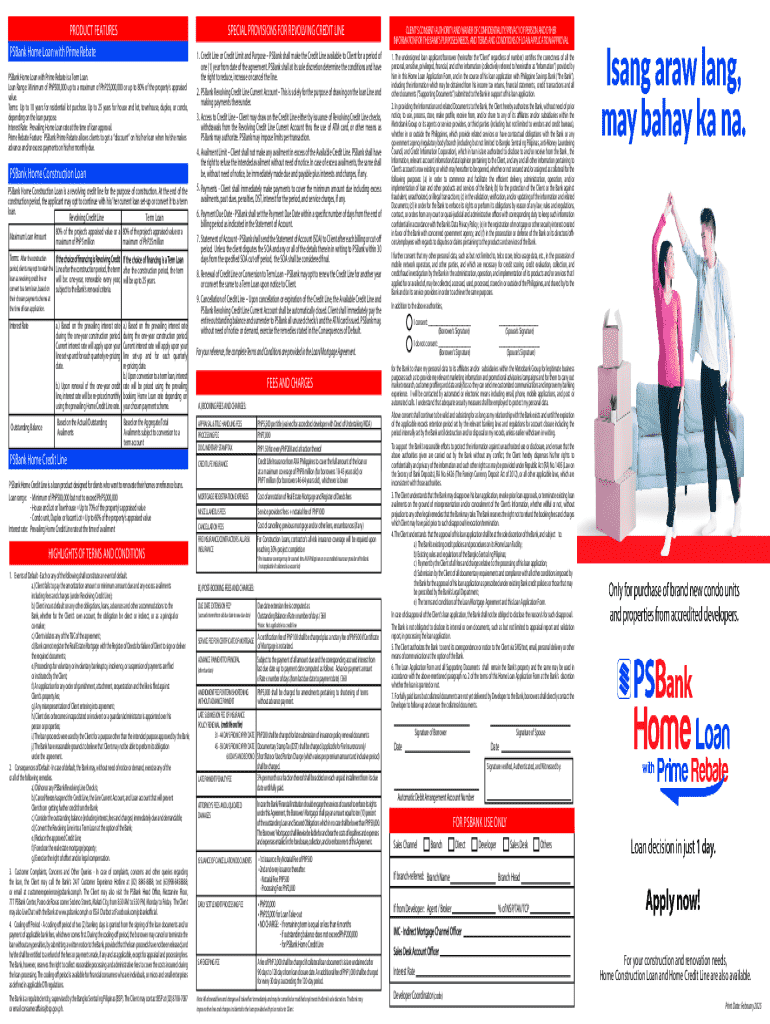

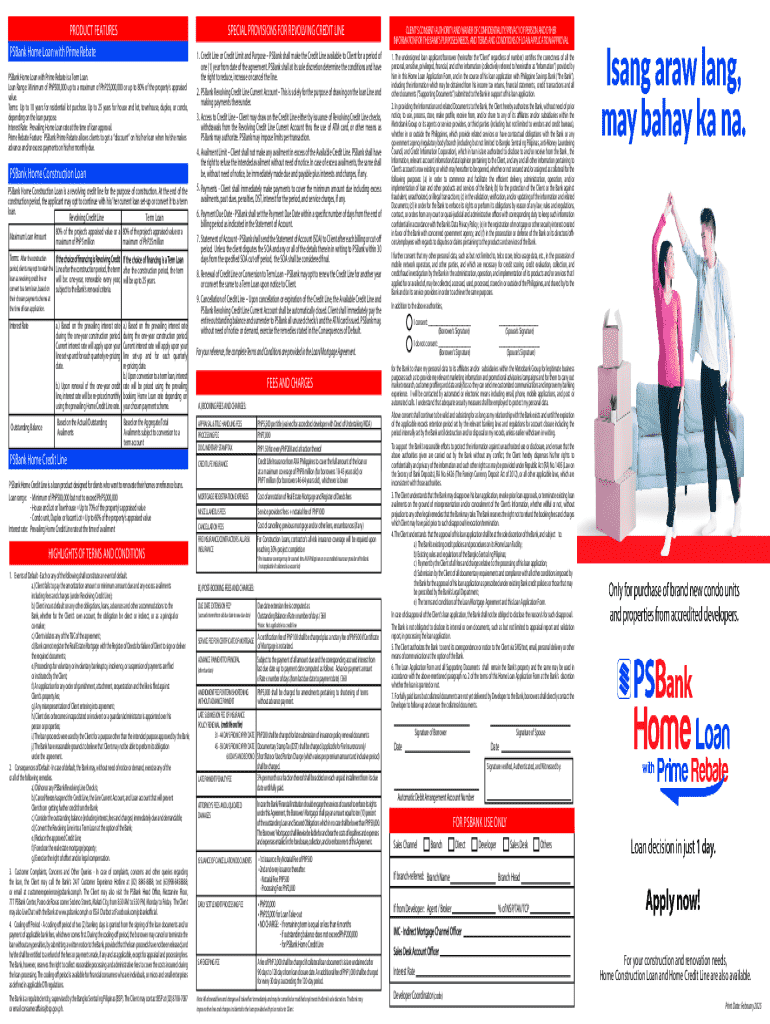

Overview of the Psbank Home Loan Application Form

The Psbank Home Loan Application Form is a crucial document for anyone looking to secure financing for purchasing a home. This form serves as the primary foundation for the formal application process, allowing borrowers to detail their financial position, property details, and loan requirements.

A well-prepared application is essential for improving your chances of approval, as it allows lenders to effectively assess your eligibility. Using platforms like pdfFiller can immensely aid in managing, editing, and submitting this form with ease, ensuring all components are meticulously completed.

Key features of the Psbank Home Loan Application Form

The Psbank home loan application form comprises various detailed sections that require specific information from the applicant. This includes personal identification data, financial backgrounds, and necessary documentation to support the loan request.

It is structured in a user-friendly way, making it easier for applicants to provide all required details. This organization includes sections for the applicant's employment history, income, and existing debts. Adhering to formatting guidelines is crucial, as minor errors in detail can lead to delays and complications in the application process.

Step-by-step instructions for filling out the Psbank home loan application form

Completing the Psbank home loan application form involves a systematic approach to ensure all requisite details are captured without errors. Start by gathering necessary information, as an organized application is often the key to swift approval.

Begin with gathering your personal details such as your full name, address, and a valid ID. Then, compile your financial background, which includes your employment history, annual income, and any ongoing liabilities.

Gather necessary information

Completing each section of the form

Identify the home you wish to purchase. Fill in the property address and purchase price accurately. When indicating what type of loan you are seeking, consider your budget and future financial plans.

Once each section is filled out, review all information before submission to ensure accuracy. Since minor errors can lead to significant delays in the loan processing, care must be exercised in this step.

Be sure to cross-verify all the provided information to avoid common mistakes, such as typos or missing data. Errors in your financial details can lead to cumbersome back-and-forth communication with the lender.

Editing and customizing the Psbank home loan application form online with pdfFiller

Once you have the Psbank home loan application form, utilizing pdfFiller allows you to manage and edit it securely and conveniently online. To begin, simply upload the form to the pdfFiller platform, where you can access various user-friendly editing tools.

Editing tools available on pdfFiller include text addition and removal, annotation features, and more. This makes it simple to customize your application form to reflect your requirements accurately. After editing, users can save their changes and download the completed form, ensuring they're ready for secure submission.

Signing and sending the Psbank home loan application form

After finalizing the home loan application, the next step involves signing and sending it. PdfFiller provides seamless eSigning options that allow applicants to add their electronic signatures directly to the application.

To do so, simply follow the platform's intuitive steps to insert your eSignature. Once signed, the completed application can be securely sent via email to Psbank or printed for traditional mailing.

Frequently asked questions regarding the Psbank home loan application form

Navigating the home loan application process can raise several questions. Addressing common inquiries can help demystify this crucial step.

Who should consider using the Psbank home loan application form?

The Psbank home loan application form is designed for a variety of users in the real estate market. This includes potential homeowners seeking financing options to fulfill their dream of owning property, and it’s also invaluable for real estate agents who assist clients in applying for home loans.

Furthermore, financial advisors guiding clients through the purchasing process will find this form essential when helping individuals understand their financing options and requirements. Ensuring that all parties involved have a clear understanding of the process can significantly streamline the home-buying journey.

Related forms and documents

Alongside the Psbank home loan application form, there are various other relevant documents that borrowers may need to gather. These could include income verification forms, credit reports, and other paperwork that lenders often require.

PdfFiller houses additional templates and forms that can be linked for easy access, facilitating a more organized approach to the entire home loan application process.

Utilizing pdfFiller for document management

PdfFiller offers a comprehensive suite of features for document management beyond simple editing and signing. Users can create a collaborative workspace where team members can work on documents together in real-time.

Cloud storage options ensure that all documents are securely stored and easily accessible from anywhere. This facility is especially useful for both individuals and teams working in real estate, as it streamlines communication and the document handling process.

Best practices for home loan applications

To enhance your chances of a successful application, it's vital to adopt best practices throughout the application journey. Start with thorough financial planning. Ensure you have an up-to-date credit report and tailor your loan request to align with your financial picture.

Also, maintain open communication with your lender and ensure you provide all required documentation in a timely manner to avoid unnecessary hold-ups. Paying attention to detail and following loan application protocols will not only help in smoother approval but also give you confidence in your financing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit psbank home loan application online?

How do I make edits in psbank home loan application without leaving Chrome?

How do I fill out the psbank home loan application form on my smartphone?

What is psbank home loan application?

Who is required to file psbank home loan application?

How to fill out psbank home loan application?

What is the purpose of psbank home loan application?

What information must be reported on psbank home loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.