Get the free Municipal Bonds and the Federal Securities Laws

Get, Create, Make and Sign municipal bonds and form

Editing municipal bonds and form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal bonds and form

How to fill out municipal bonds and form

Who needs municipal bonds and form?

Municipal Bonds and Form: A Comprehensive Guide

Understanding municipal bonds

Municipal bonds, often referred to as 'munis,' are fixed-income securities issued by states, cities, or other governmental entities to finance public projects. These projects can include building schools, highways, or hospitals, thereby contributing to the community's infrastructure. Investors in municipal bonds essentially lend money to the issuer for a predetermined period, receiving periodic interest payments and the return of the principal at maturity.

Key features of municipal bonds

Municipal bonds possess several distinct features that make them appealing to investors. Understanding these features is essential for making informed investment decisions. Interest rates on municipal bonds can vary significantly based on the type of bond and market conditions. Typically, interest payments can be structured as fixed or variable rates, affecting cash flow over time.

Maturity dates also play a crucial role, influencing both investment strategy and risk. Some bonds have shorter maturities which might cater to investors looking for quicker gains, while others extend over decades, appealing to those seeking long-term revenue.

Tax benefits are another significant consideration. Most municipal bonds are exempt from federal taxes, and many are also exempt from state and local taxes, depending on the investor's place of residence. This tax exemption can enhance the after-tax yield for investors, making municipal bonds a popular option for those in higher tax brackets.

Risks involved with municipal bonds

Although municipal bonds are often regarded as a safe investment, they are not without risks. Credit risk, or the danger of the issuer defaulting, poses a concern. Investors need to evaluate the creditworthiness of the issuing authority, as downgrades can lead to loss of value.

Market risk is another critical factor; if interest rates rise, bond prices typically fall, leading to potential losses for investors who wish to sell before maturity. Additionally, liquidity risk can affect investors’ ability to sell their bonds easily in the secondary market, particularly for bonds that are not widely traded.

Navigating the form requirements

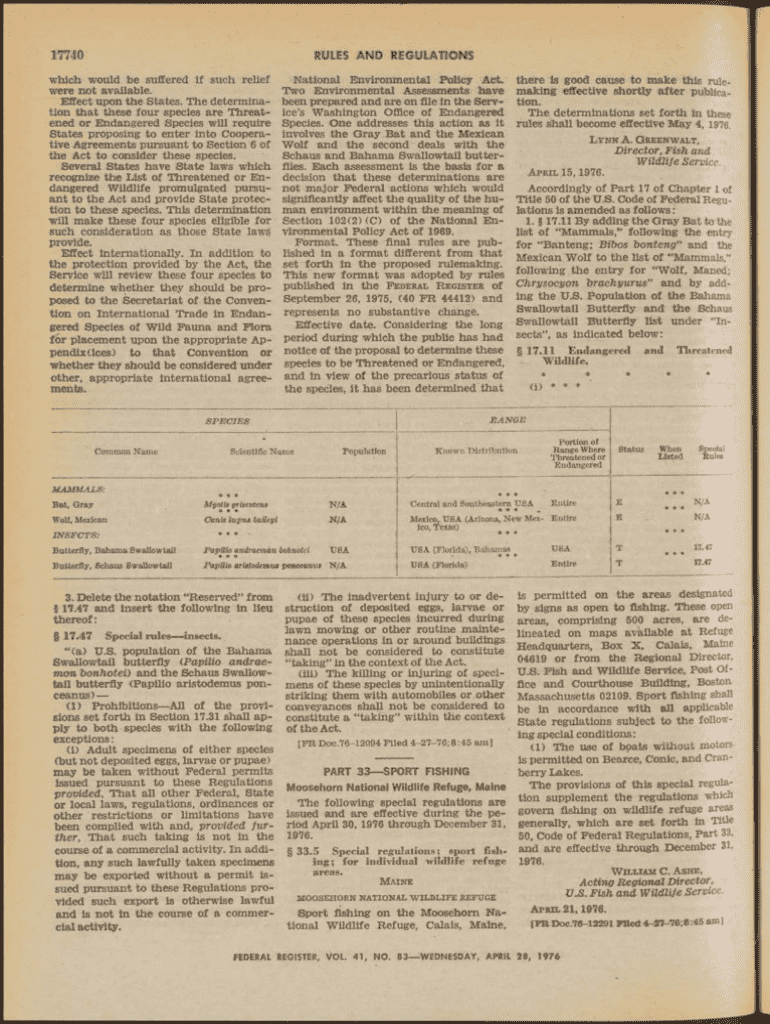

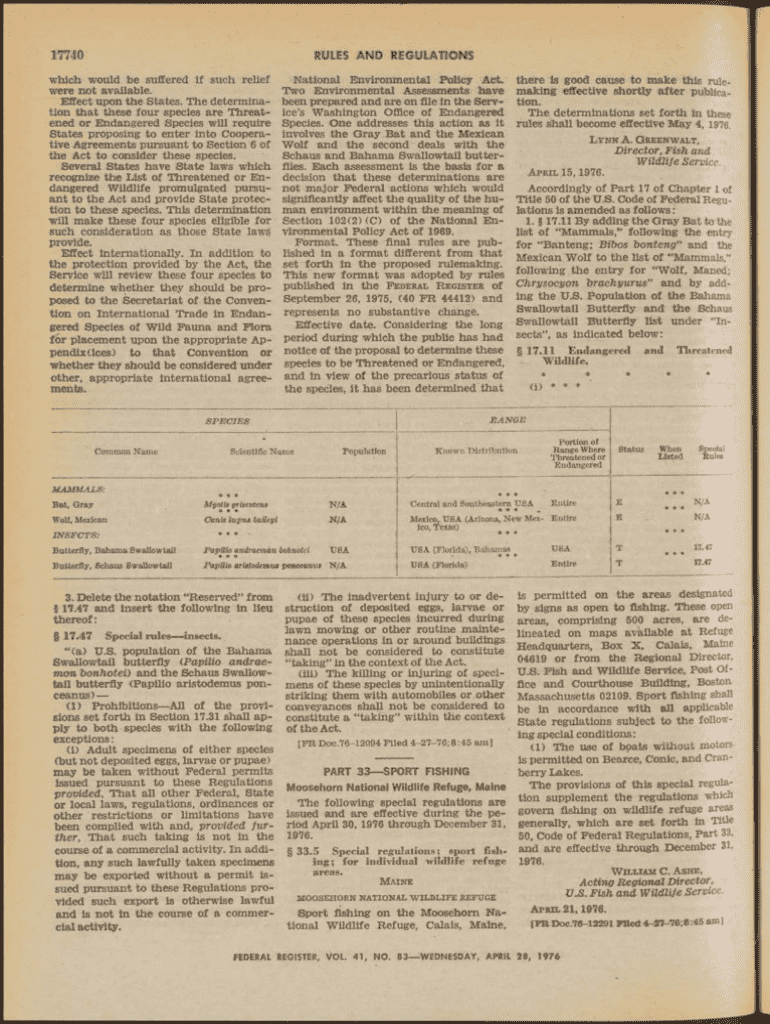

Investing in municipal bonds involves navigating a variety of forms and documents that are essential for both investors and issuers. Common forms include the Application for Bond Purchase, Official Statement, and Continuing Disclosure Certificates. Each serves a critical function in the investment process.

Essential information is required on these forms to ensure proper processing. Investors typically need to include personal identification and pertinent financial details, along with specific information about the bonds, such as the type, amount, and purpose of the funding, in order to comply with legal and regulatory standards.

Detailed instructions for filling out municipal bond forms

Filling out municipal bond forms accurately is crucial to avoid processing delays and ensure compliance. Begin with the preparation phase: gather all necessary documents, including identification and financial statements, and determine your selection criteria based on investment goals.

When completing the application form, pay attention to each section. Common mistakes include misreporting information or omitting required details. Investors should double-check sections for accuracy before submission. Currently, submissions can be made either electronically through online platforms or via paper forms, but deadlines must be adhered to closely to avoid missing investment opportunities.

Interactive tools for managing municipal bond investments

Utilizing interactive tools can enhance the experience of managing municipal bond investments. Investment calculators are vital for estimating potential returns based on varying interest rates and maturity dates. By inputting specific parameters, investors can gain insights into possible outcomes.

Bond comparison tools allow investors to evaluate and contrast different municipal bonds based on features such as yield, risk levels, and maturity schedules. Monitoring tools can also assist in keeping track of bond performance and market changes, helping investors make timely decisions.

Reporting and compliance

Annual reporting requirements are essential for bond issuers to maintain transparency with investors and compliance with regulations. These reports typically outline the financial health of the issuer and the performance of the underlying projects funded by the bonds. Key deadlines must be observed to avoid penalties.

For investors, filing requirements for municipal bonds include documenting interest earned and its tax implications. Maintaining accurate records serves as a safeguard during tax season and ensures compliance with Internal Revenue Service regulations.

Support and resources

Navigating the complexities of municipal bonds can be daunting, but several resources are available for assistance. The Municipal Securities Rulemaking Board (MSRB) is a valuable source of information, offering guidance and resources for both investors and issuers.

Investors should also consider local or state resources that provide information tailored to regional offerings and requirements. Staying updated with newsletters and legal updates regarding changes in municipal bond regulations can further empower investors and help them stay compliant.

Conclusion and future implications

Emerging trends in municipal bonds illustrate a dynamic market that adapts to economic shifts and policy changes. Factors such as interest rate fluctuations, governmental fiscal policies, and infrastructural demands will continue to influence the attractiveness of these investments.

For long-term investors, balancing municipal bonds with other asset classes can lead to a resilient investment strategy. Understanding the complexities of municipal bonds and filling out the required forms accurately are foundational steps toward successful investment outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete municipal bonds and form online?

How do I make edits in municipal bonds and form without leaving Chrome?

How do I fill out municipal bonds and form on an Android device?

What is municipal bonds and form?

Who is required to file municipal bonds and form?

How to fill out municipal bonds and form?

What is the purpose of municipal bonds and form?

What information must be reported on municipal bonds and form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.