Get the free Mortgage Revenue Bond Program Post-closing Review Checklist

Get, Create, Make and Sign mortgage revenue bond program

Editing mortgage revenue bond program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage revenue bond program

How to fill out mortgage revenue bond program

Who needs mortgage revenue bond program?

Understanding the Mortgage Revenue Bond Program Form

Understanding mortgage revenue bond programs

Mortgage revenue bonds (MRBs) are tax-exempt bonds issued by state or local government entities to finance housing for low- and moderate-income homebuyers. The primary purpose of these bonds is to provide accessible financing options that enable individuals to purchase homes at lower interest rates. By leveraging tax exemptions, these bonds make homeownership more affordable, contributing significantly to housing finance.

The importance of mortgage revenue bond programs in the housing market cannot be overstated. They not only provide critical liquidity to the housing sector but also stimulate local economies by fostering homeownership. By offering below-market interest rates, MRBs make it feasible for many families to enter the housing market, promoting community stability and growth.

In essence, the program operates by bundling funds raised through the issuance of bonds and using those funds to offer loans to qualified homebuyers. Typically, these loans come with favorable terms, lowering the barriers for homeownership across various demographics.

Eligibility criteria for mortgage revenue bond programs

To qualify for a mortgage revenue bond program, potential homebuyers must meet certain eligibility criteria, primarily concerning their income and the properties they wish to purchase. These criteria are designed to ensure that assistance goes to those who need it most, particularly low- and middle-income households.

Income limits and median income guidelines

Property criteria

Properties purchased under the MRB program must meet specific qualifications. The aim is to ensure that the housing benefits provided support affordable options that align with the program’s objectives.

Types of mortgage revenue bond programs available

Multiple state-specific mortgage revenue bond programs allow individuals in various regions to benefit from low-interest loans. Each state tailors its MRB program to address local housing needs, making this a versatile tool for potential homeowners.

State-specific programs

While the benefits of these programs can be substantial, there may also be limitations, such as caps on loan amounts and restrictions on the types of properties. Understanding these parameters is vital for prospective applicants.

Participation and funding processes

To participate, homeowners need to follow specific application procedures, typically managed through state housing finance agencies. These organizations handle the funding process and ensure funds are allocated fairly and in accordance with the program’s goals.

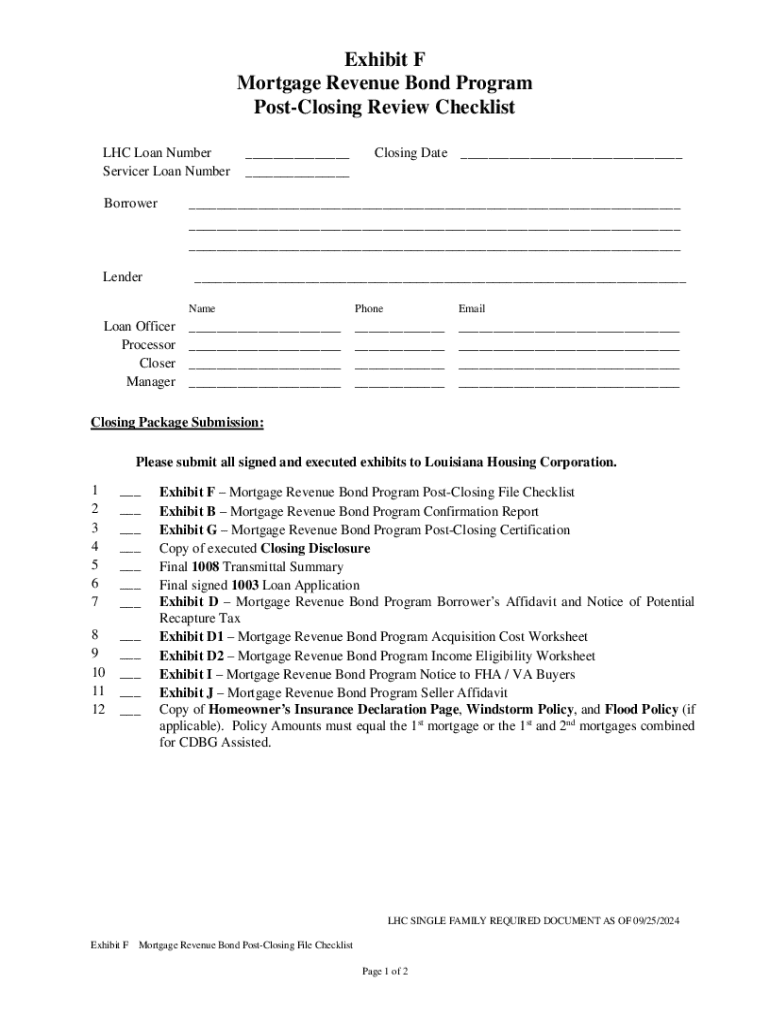

Step-by-step guide to completing the mortgage revenue bond program form

Completing the mortgage revenue bond program form is a critical step in securing financing. Below, we outline a systematic approach to filling out this essential document effectively.

Where to find the form

Detailed instructions for each section of the form

Common mistakes to avoid while filling out the form

Many applicants make errors that can hinder the processing of their application. Common pitfalls include failing to proofread for errors or leaving sections incomplete. Always double-check to ensure all information is correct and fully detailed.

Editing and managing your mortgage revenue bond program form

Once you've completed your mortgage revenue bond program form, effective editing and management are essential for a successful submission. Utilizing tools like pdfFiller can streamline the process significantly.

Using pdfFiller for document editing

Saving and sharing your completed form

Frequently asked questions about mortgage revenue bond programs

As applicants delve into the mortgage revenue bond program form, they often have questions concerning the process and outcomes. Here, we address some of the most common queries.

Success stories and testimonials

Real-life stories can offer a glimpse into how the mortgage revenue bond program transforms lives. Here, we share testimonials from families who have benefited.

Case study: A New Jersey family’s journey

A family from New Jersey recently navigated the MRB program with considerable success. With a combined income just within the eligible limit, they managed to secure funding that allowed them to purchase their first home. The favorable loan conditions provided them with an opportunity that otherwise would have been unattainable.

Testimonials from successful applicants

Numerous testimonials echo the sentiment that mortgage revenue bonds have not only provided better financing options but have also fostered a sense of community. Many families report improved stability in their lives, attributing their newfound security to the accessibility of the MRB program.

Tools and resources for applicants

Applying for a mortgage revenue bond program can be simplified with the right tools available on the pdfFiller platform. Taking advantage of these resources can greatly enhance your experience.

Interactive tools available on pdfFiller platform

Contact information for assistance with the form and program

For further assistance, pdfFiller supports users through various communication channels, ensuring that help is readily available. Additionally, local housing authorities often provide direct support to prospective applicants, making it easier to navigate the complexities involved with the mortgage revenue bond program.

Navigating further steps after submission

Once your mortgage revenue bond program form has been submitted, there are important additional steps to follow. Knowing what to expect can ease your transition into homeownership.

Follow-up procedures post-application

Regular follow-up with the housing agency can keep you informed on your application's status. Being proactive can often facilitate a smoother process. If any additional documentation is needed, having a direct line of communication can help resolve issues swiftly.

Managing your mortgage after acceptance

Loan servicing

Once accepted, understanding your loan servicing options is crucial. Ensure you know the terms of your loan, including payment schedules and any potential penalties for late payments.

Resources for homeownership support

Post-acquisition, various resources exist to support homeowners—ranging from financial education workshops to advisory services that help you maintain your home and mortgage efficiently.

Contact information

Finding the right support can significantly impact your experience with the mortgage revenue bond program. pdfFiller offers comprehensive assistance, including dedicated support teams for users navigating the document landscape. Furthermore, establishing contact with local housing authorities can also provide invaluable assistance tailored to your specific geographical context.

pdfFiller support

For any queries concerning document management or assistance with the mortgage revenue bond program form, pdfFiller's customer support is available to help you every step of the way.

Local housing authority contacts

Connecting with your local housing authority can facilitate insights unique to your area, offering guidance tailored to the local housing market and programs available for homebuyers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mortgage revenue bond program?

Can I create an electronic signature for signing my mortgage revenue bond program in Gmail?

Can I edit mortgage revenue bond program on an Android device?

What is mortgage revenue bond program?

Who is required to file mortgage revenue bond program?

How to fill out mortgage revenue bond program?

What is the purpose of mortgage revenue bond program?

What information must be reported on mortgage revenue bond program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.