Get the free Business Corporation Annual Report

Get, Create, Make and Sign business corporation annual report

How to edit business corporation annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business corporation annual report

How to fill out business corporation annual report

Who needs business corporation annual report?

Business Corporation Annual Report Form: A Comprehensive How-to Guide

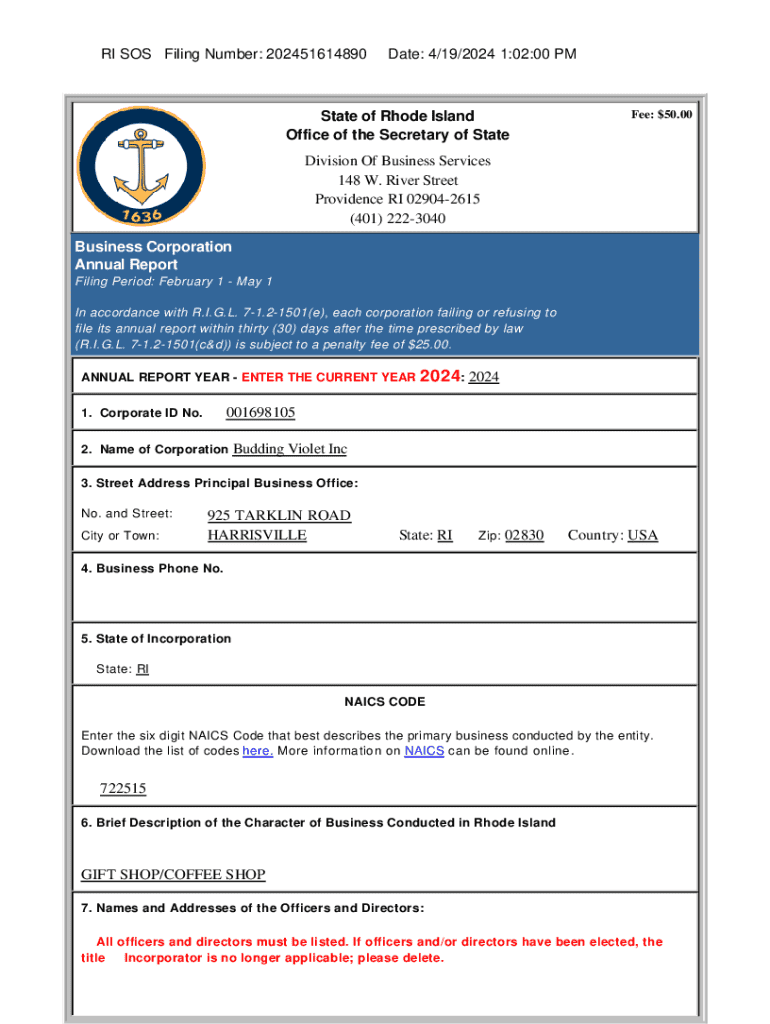

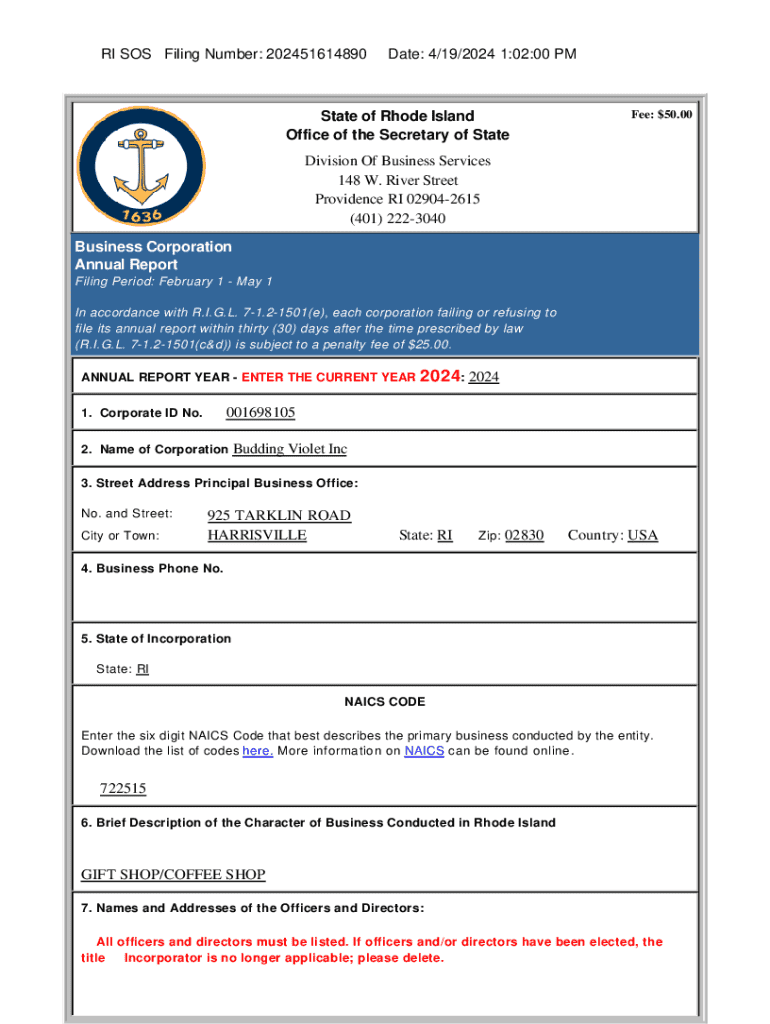

Understanding the business corporation annual report

An annual report is an essential document that summarizes a company's performance and financial health over the past year. For businesses, the annual report serves multiple purposes: it provides a detailed overview of the company’s activities, allows for transparency with stakeholders, and meets legal filing requirements in many jurisdictions. Comprised of several key components, an effective annual report typically includes financial statements, management discussions, and future outlooks.

The importance of filing an annual report cannot be overstated. Legally, it is a requirement in many U.S. states for corporations to submit this document annually. Failure to do so can result in penalties, including fines or loss of corporate status. On a broader scale, filing an annual report enhances a business's credibility, demonstrates accountability, and fosters trust among investors, customers, and employees.

Who needs to file an annual report?

Most corporations are required to file an annual report to ensure compliance with state laws. This includes traditional for-profit corporations that are incorporated and LLCs (Limited Liability Companies). Non-profit organizations may also have specific annual reporting requirements, though these can vary significantly by state.

Understanding exemptions is crucial for many business owners. Certain types of businesses, such as some small businesses or inactive corporations, may be exempt from filing an annual report. Additionally, each state has its own variations of exemption criteria, so it’s vital to research local laws to determine if your business qualifies.

Annual report filing requirements

When preparing to file a business corporation annual report form, it’s important to know what information you will need. Commonly required details include basic business information such as the company name, registered office address, and name of the registered agent. Furthermore, most reports require a summary of financial data including balance sheets and income statements, as well as previous year comparisons.

Certain sectors may have additional reporting needs based on industry standards. For example, industries that deal with public assets, healthcare, or financial services often have stricter reporting requirements that provide further insight beyond basic financials. This emphasizes the need for businesses to be aware of both general and sector-specific submission requirements.

How to complete your business corporation annual report form

Completing the business corporation annual report form can be streamlined by following a structured process. First, gather all required information. This may involve pulling together financial statements, documents related to business activities, and other required data. Organizing this documentation in advance can save time and prevent errors during the filling process.

Next, choose your filing method. Online filing is typically faster and allows for real-time confirmation of submission, while paper filing may be necessary for specific requirements in some states. Each method has its pros and cons; online may be more efficient, but paper filing can provide tangible records.

Key deadlines for filing annual reports

Filing deadlines for annual reports vary by state but are typically set annually on the company's anniversary date or at the end of the calendar year. It is essential for business owners to monitor these due dates closely to avoid missing crucial deadlines, which could incur penalties.

Consequences of late filing can be severe, often involving late fees, penalties, or even administrative dissolution of the corporation in extreme cases. Understanding the potential repercussions clearly underscores the importance of adhering to the established schedule for filing.

Avoiding common mistakes in filing

One of the leading causes of issues with annual report filings is misreporting or omitting critical information. Simple mistakes like entering the wrong company address or neglecting to update the registered agent can lead to unnecessary delays or additional fines. A thorough review of all components of the annual report prior to submission is crucial.

To prevent errors, consider employing a checklist that includes all necessary fields and data points to confirm accuracy. These measures help ensure everything is in order before you hit 'submit.'

What to do if you miss the filing deadline

If you miss the filing deadline for submitting your business corporation annual report form, take immediate action by preparing to file the report as quickly as possible. Most states allow for late submissions but may impose additional fees or penalties. Understanding your state's specific processes for late filing can help ease the situation.

In the event that you face fines, ensure you review your options. Some states allow for contesting minor penalties, so being proactive and informed can significantly lessen the impact of late filings.

Utilizing pdfFiller for your annual report needs

In navigating the complexities of the business corporation annual report form, pdfFiller offers a range of features that enhance the editing and filing experience. Users can enjoy streamlined collaboration, central storage of documents, and easy completion of forms. The platform also allows for eSigning which simplifies the approval process, ensuring you can move forward with submissions rapidly.

Through various interactive tools, pdfFiller enables users to manage their documents efficiently. Utilizing tailored templates ensures compliance based on state-specific requirements while helping businesses stay organized during the reporting season.

Navigating state and local variations

An essential consideration when completing an annual report is the variation in requirements across different states. Each state may have distinct forms, submission guidelines, and deadlines. It is vital for business owners to familiarize themselves with their state’s specific reporting demands to avoid penalties.

pdfFiller addresses these diverse needs by providing tailored templates that match state-specific requirements, allowing users to effortlessly adapt their filings to meet varying legal standards.

Future preparations and legal considerations

To facilitate future annual filings, it is beneficial to establish a calendar for annual report due dates and set reminders for collection of necessary documents ahead of time. Best practices also include keeping a checklist for expected changes throughout the year that may affect reporting, such as significant business transactions or changes in corporate structure.

Legal trends around annual reporting can evolve, affecting compliance requirements. Keeping updated with regulations, perhaps through resources like pdfFiller's dedicated customer support, can safeguard against the risk of non-compliance.

Additional features in the pdfFiller platform

pdfFiller not only facilitates document management but also provides unparalleled customer support to assist users in navigating the complexities of their annual reports. From live chat options to comprehensive tutorials, users can easily access resources to clear any doubts.

Moreover, pdfFiller connects users with a broader network and a community of business forms, offering other relevant templates and forms that might enhance their operational efficiencies. This interconnectedness reinforces the platform's ability to serve as a comprehensive solution for business management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business corporation annual report in Gmail?

How do I edit business corporation annual report in Chrome?

How do I complete business corporation annual report on an Android device?

What is business corporation annual report?

Who is required to file business corporation annual report?

How to fill out business corporation annual report?

What is the purpose of business corporation annual report?

What information must be reported on business corporation annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.