Get the free Coverdell Education Savings Account Application & Adoption Agreement

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Understanding the Coverdell Education Savings Account Form

Understanding Coverdell Education Savings Accounts (ESAs)

A Coverdell Education Savings Account (ESA) is a tax-advantaged savings plan designed to help families save for educational expenses. Established under the Taxpayer Relief Act of 1997, these accounts are intended to ensure that funds accumulated for education are not taxed, granting a valuable opportunity for growing your investment without tax burden until withdrawn.

Key benefits of a Coverdell ESA include tax-free withdrawals for qualified education expenses and the ability to transfer funds freely to another eligible family member without triggering tax penalties. This makes Coverdell ESAs a favorable choice for parents and guardians aiming to maximize their children's educational opportunities.

Who qualifies for a Coverdell ESA?

To open a Coverdell ESA, individuals must meet specific eligibility requirements. Primarily, the account must be established by a beneficiary who is under 18 years of age, or one who is a special needs beneficiary. In addition to age constraints, there are income limits for contributors. For the 2023 tax year, the contribution limits begin to phase out for individuals with a modified adjusted gross income (MAGI) of $95,000 for single filers and $190,000 for married couples filing jointly.

Beneficiaries can utilize these platforms more effectively if they qualify under the income stipulations set by the IRS. Families earning above specified limits are still able to open accounts but at a reduced contribution maximum. Hence, it’s essential to be informed about the limits to ensure compliance and maximize benefits.

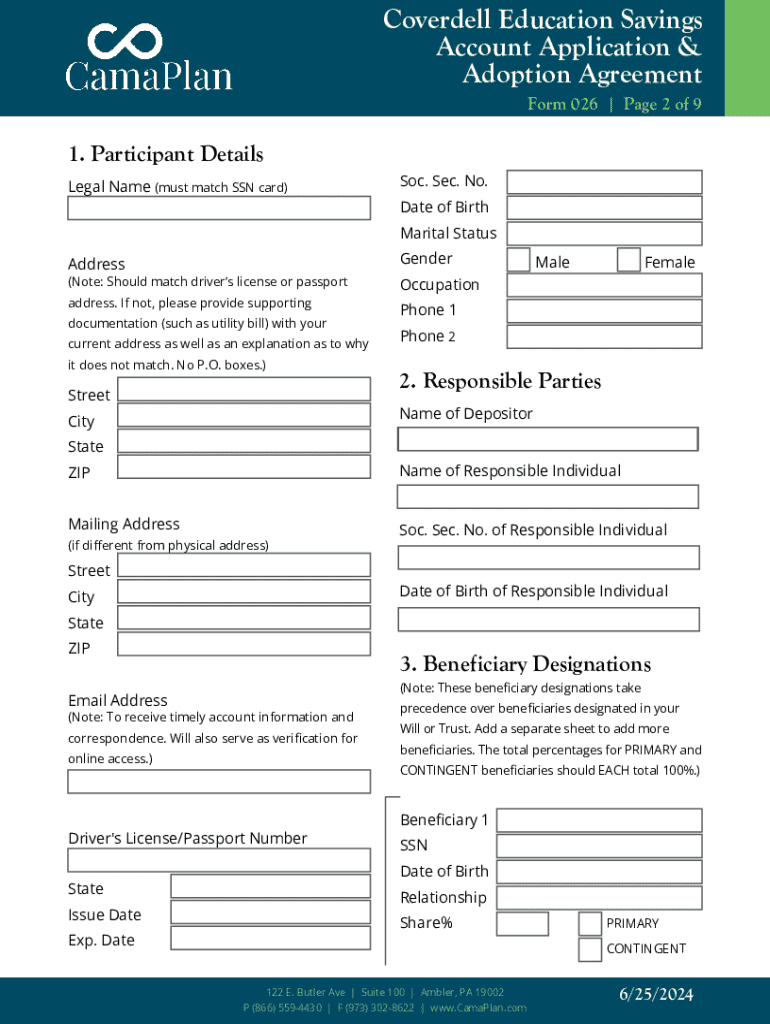

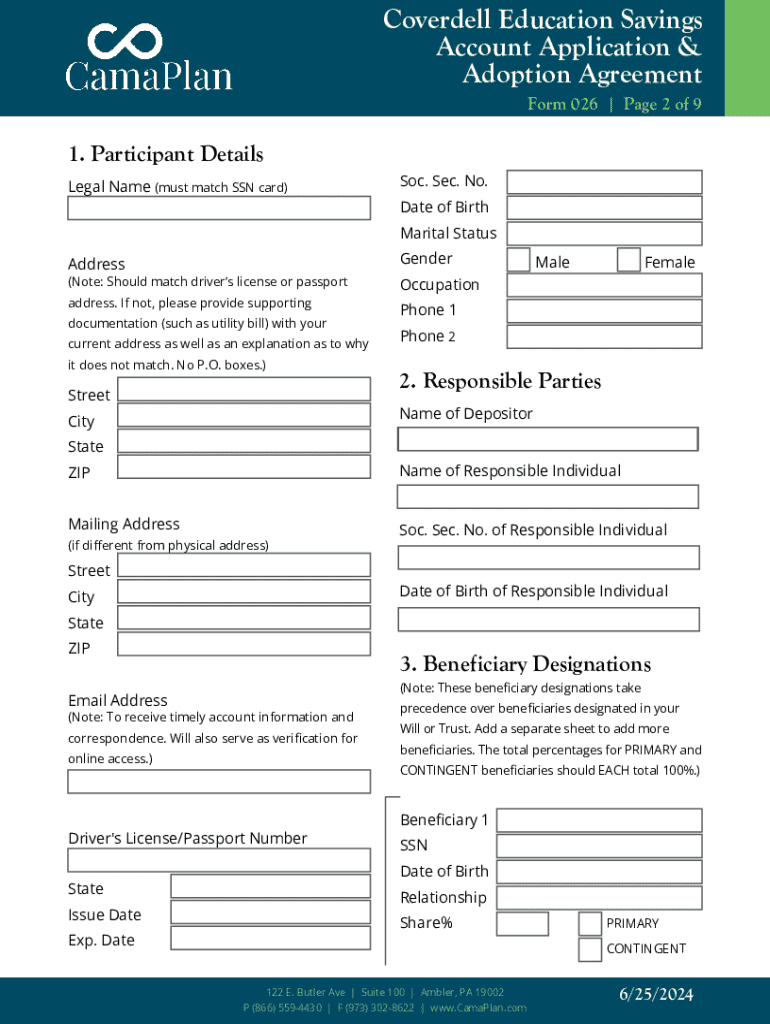

Overview of the Coverdell ESA Form

The Coverdell ESA form is a crucial document in managing education savings accounts. This form serves as the official record for contributions made and distributions taken, providing a clear trail of funds utilized for education purposes. Completing this form correctly is vital because submitting inaccurate or misleading information can lead to penalties and taxes that diminish the benefits associated with these accounts.

The form itself comprises several components that require careful attention. Users must provide personal identification details, record yearly contributions, and delineate any distributions taken from the account. Understanding key terms associated with the form, such as 'qualified expenses' and 'beneficiary', ensures that users complete it with greater accuracy and confidence.

Step-by-step guide to filling out the Coverdell ESA form

Filling out the Coverdell ESA form can be straightforward if you prepare adequately. Start by gathering all necessary documentation, including both your and the beneficiary's social security numbers, your income details, and any records of contributions. Organizing this information simplifies the process significantly.

Here’s a step-by-step walkthrough:

Common mistakes to avoid when completing the Coverdell ESA form

Even the most straightforward forms can present challenges. To ensure your Coverdell ESA form is filled out accurately, it helps to have a checklist of key points to verify. Review each section carefully before submission, and double-check entries against your documents to avoid common issues.

Typical errors often arise from simple data entry mistakes, such as transposing numbers in social security or account numbers. Eligibility issues can also be problematic if income limitations are not understood. Fixing mistakes post-submission can be time-consuming and may incur delays.

Submitting your Coverdell ESA form

Once you have completed the Coverdell ESA form, it's time to submit it. Users have options for submission: online or via traditional paper filing. Online submission often accelerates processing times, while paper filing remains an option for those who prefer to submit physical forms.

Upon submission, expect confirmation from the financial institution managing the Coverdell ESA. Processing times can vary, typically lasting anywhere from a few days to several weeks. During this period, be sure to maintain records of your submission in case any follow-up action is needed.

Managing your Coverdell ESA after form submission

After successfully submitting your Coverdell ESA form, diligent management of the account is crucial. Keeping track of contributions and distributions is fundamental to ensuring that funds are utilized effectively. Regularly reviewing your account also allows adjustments to be made as necessary — a vital step in maximizing your investment.

Understanding your withdrawal options remains equally important. Funds in a Coverdell ESA can be withdrawn for qualified education expenses, possessing flexibility that caters to various educational needs. By staying informed and proactive, you can successfully navigate the complexities of your Coverdell ESA.

Resources for further assistance

Staying informed about your Coverdell ESA can seem daunting, but numerous resources are available to assist. The IRS frequently publishes guidance on Coverdell ESAs, clarifying common concerns. Understanding terms related to your form and how they apply to your situation will give you confidence in managing your account.

For users looking to manage their documents efficiently, pdfFiller offers essential features to edit and facilitate all aspects of form management. From editing to e-signing capabilities, pdfFiller empowers users with a comprehensive document management solution that aligns perfectly with managing your Coverdell ESA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send coverdell education savings account for eSignature?

How do I edit coverdell education savings account online?

Can I create an eSignature for the coverdell education savings account in Gmail?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.