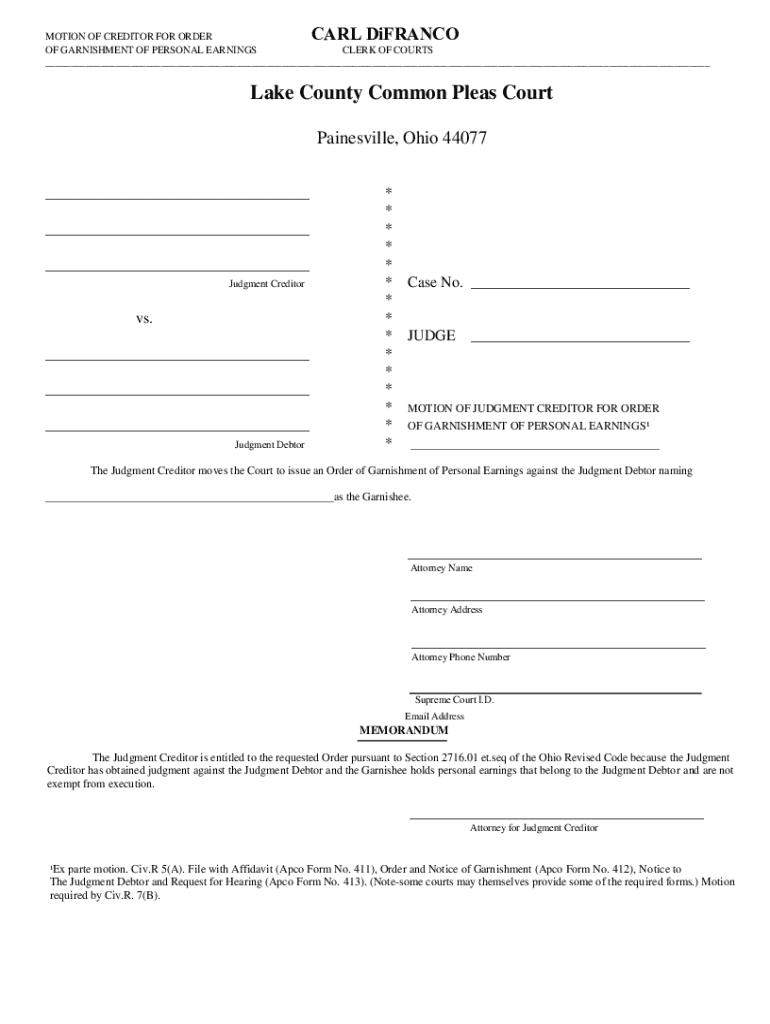

Get the free Motion of Creditor for Order of Garnishment of Personal Earnings

Get, Create, Make and Sign motion of creditor for

Editing motion of creditor for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motion of creditor for

How to fill out motion of creditor for

Who needs motion of creditor for?

Motion of creditor for form: A comprehensive how-to guide

Understanding the motion of creditor

A motion of creditor is a formal request submitted by a creditor in the context of bankruptcy proceedings. Its primary aim is to assert claims against a debtor's estate and ensure repayment to the creditor. Understanding the nuances of this motion is crucial for creditors, especially in navigating the complexities of bankruptcy law.

In bankruptcy proceedings, creditors fall into various categories—secured, unsecured, and priority creditors. Each type has distinct rights and processes that influence how they can file their motions and seek repayment.

The legal framework

The legal landscape surrounding bankruptcy is governed by specific federal laws, such as the Bankruptcy Code. This framework outlines the rights of creditors and the procedures they must follow. A motion of creditor is typically motivated by the need to protect these rights effectively.

Key terminology includes 'motion of creditor' (the formal request), 'creditor’s claim' (the amount owed), and 'objection to discharge' (a challenge to a debtor’s ability to erase their debts). Understanding these terms can significantly aid creditors in effectively navigating the bankruptcy process.

Preparing the motion of creditor

Preparation is crucial for submitting a motion of creditor. Creditors must gather specific information and documents supporting their claims to ensure a successful filing. These may include a detailed account of the debt, evidence of its validity, and any relevant communications with the debtor.

Adhering to legal standards and providing comprehensive evidence are essential to avoid common mistakes that could lead to the motion being dismissed.

Filling out the motion form

Filling out the motion of creditor form requires careful attention to detail. Each section of the form should be completed accurately to avoid delays or rejections. Begin by focusing on the personal information section, ensuring that all details are correct.

For accurate completion, it’s also good practice to review sample forms to understand how to present your claims effectively. Utilizing interactive tools available on pdfFiller can help streamline this process.

Filing the motion

After preparing your motion, the next step is to file it correctly. Depending on your jurisdiction, there are specific locations and methods for filing. Most courts allow electronic filing, but some may still require in-person submissions.

Correctly filing your motion ensures that it is reviewed without unnecessary delays. Reviewing local filing rules can make a significant difference in processing speed.

Notifying relevant parties

Once the motion is filed, notifying all relevant parties is both a legal requirement and a best practice. This typically includes the debtor, any co-debtors, and other creditors involved in the case.

Utilizing templates for notification letters can streamline this process and ensure compliance with legal obligations.

Responding to objections

In bankruptcy cases, debtors may file objections against motions. It's crucial to anticipate common grounds for these objections and prepare strategies to counter them effectively. Understanding the debtor's perspective can help you build a stronger case.

Preparation is key, as being well-prepared can significantly improve your chances of a favorable outcome.

Court hearing for a motion of creditor

When your motion is heard in court, you will be required to present your case to the judge. Understanding the court procedures beforehand can help alleviate anxiety and facilitate a smooth process.

Staying calm and presenting your case logically can influence the judge’s decision favorably.

Post-hearing procedures

After the court hearing, the motion may be approved or denied. Understanding the possible outcomes is crucial for planning your next steps accordingly. If the motion is approved, it may pave the way for debt recovery.

Keeping thorough records not only aids in future actions but also maintains a clear history of the proceedings.

Utilizing pdfFiller for document management

Managing documents related to the motion of creditor process can be streamlined using pdfFiller. This cloud-based platform allows users to edit PDFs, eSign, and collaborate seamlessly.

Leveraging these tools can enhance your efficiency in document management, especially in complex processes like filing a motion of creditor.

Key takeaways for creditors

Navigating the motion of creditor process can be complex, but adhering to best practices can make a significant difference. Ensuring compliance with legal standards, accurately documenting claims, and utilizing resources effectively are fundamental steps.

By understanding the process and utilizing the right tools, creditors can navigate bankruptcy proceedings more effectively and increase their chances of successful claims.

Frequently asked questions (FAQs)

As creditors embark on the journey of filing a motion, several common queries often arise. Addressing these FAQs can help clarify any uncertainties and improve preparation.

Utilizing thorough FAQs can guide creditors in avoiding pitfalls and preparing effectively for filing their motions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get motion of creditor for?

Can I edit motion of creditor for on an Android device?

How do I complete motion of creditor for on an Android device?

What is motion of creditor for?

Who is required to file motion of creditor for?

How to fill out motion of creditor for?

What is the purpose of motion of creditor for?

What information must be reported on motion of creditor for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.