Get the free New Jersey Gross Income Tax Film and Digital Media Tax Credit

Get, Create, Make and Sign new jersey gross income

How to edit new jersey gross income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey gross income

How to fill out new jersey gross income

Who needs new jersey gross income?

New Jersey Gross Income Form - How-to Guide

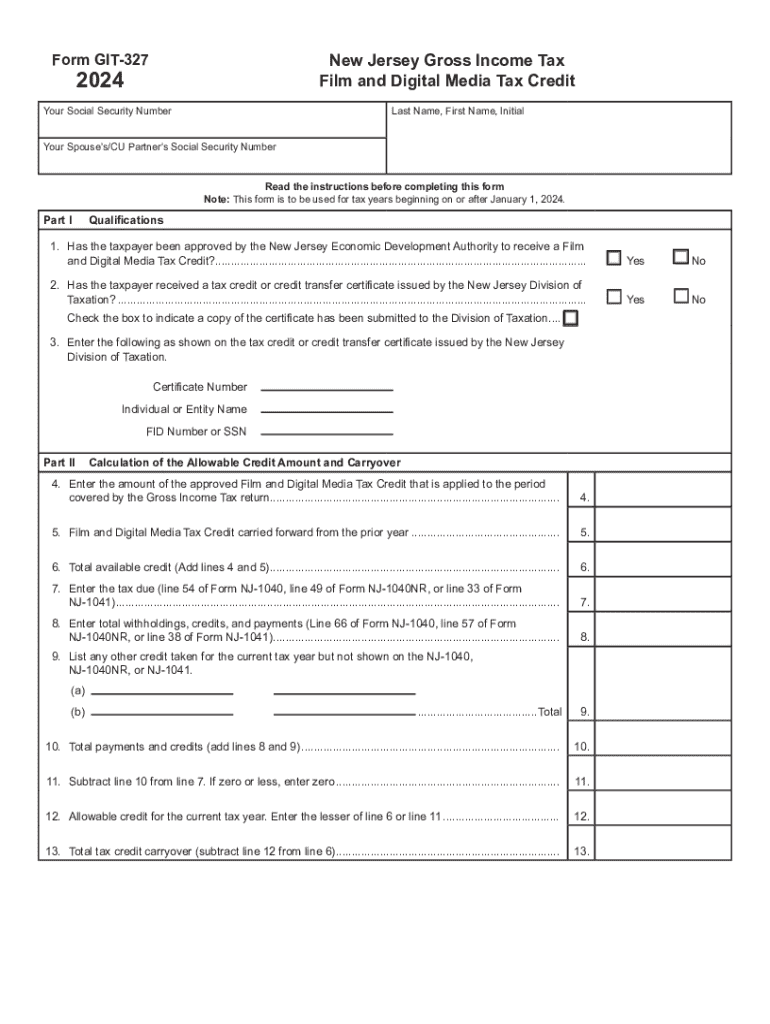

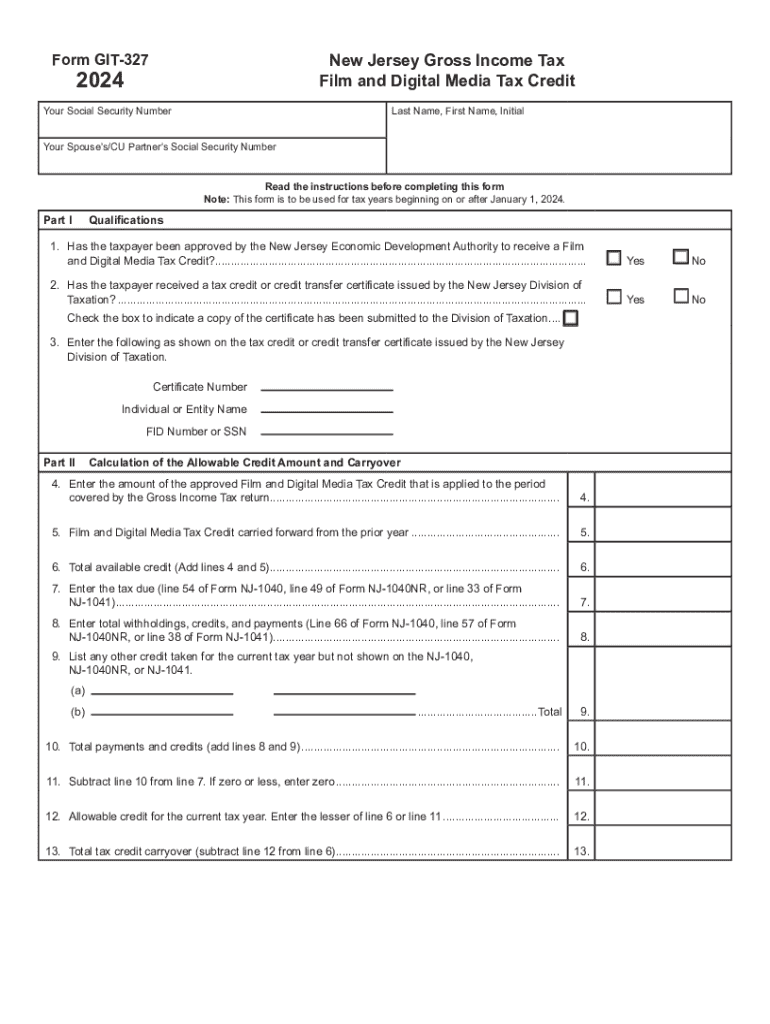

Understanding the New Jersey Gross Income Form

The New Jersey Gross Income Form is a critical document that individuals utilize to report income earned within the state for tax purposes. This form serves as a means for the New Jersey Division of Taxation to assess an individual's tax liability, reflecting total earnings from all sources. Accurate and timely completion of this form is not just a regulatory requirement but also essential for maximizing potential tax refunds and ensuring compliance with state tax laws.

Completing the New Jersey Gross Income Form is significant as it directly impacts your tax filings and potential obligations. Misreporting or failing to file can lead to penalties or lost refunds. With New Jersey's complex tax structure, understanding and accurately filling out this form is indispensable for residents and potentially, for non-residents who earn income in the state.

Who needs to complete this form?

Anyone who earns income in New Jersey must be aware of their obligations regarding the New Jersey Gross Income Form. This includes residents of New Jersey, who are generally required to report income from all sources, whether it originates from in-state or out-of-state activities. Non-residents, who gain income from New Jersey sources, must also complete the form to accurately report their earnings and comply with tax regulations.

Special considerations apply to self-employed individuals who may have additional complexities in income reporting. Additionally, certain exemptions may apply based on specific income types or thresholds, so it's advisable to review eligibility criteria carefully or consult a tax professional if unsure.

Preparing to fill out the New Jersey Gross Income Form

Before initiating the process to complete the New Jersey Gross Income Form, it is essential to gather all required documentation. Key documents include W-2 forms from employers, 1099 forms for freelance or contract work, and any documentation of additional income such as rental earnings or investment returns. Collecting these documents ensures that you have all necessary information at hand, reducing the likelihood of errors or omissions when filing.

Understanding what constitutes gross income is pivotal for filling out the form correctly. In New Jersey, gross income includes all income received in cash, property, or services that are not explicitly exempt from taxation. Common sources of income may involve wages, business profits, dividends, and pensions. Recognizing which income sources apply and any allowable deductions, such as contributions to retirement accounts or certain educational expenses, can significantly impact your taxable income.

Step-by-step instructions for completing the New Jersey Gross Income Form

To get started with completing the New Jersey Gross Income Form, you can easily access it online through pdfFiller's user-friendly platform. Simply navigate to the state tax forms section and search for the New Jersey Gross Income Form. This allows for a streamlined process of editing and filling out your document digitally, eliminating the need for paper forms.

pdfFiller provides excellent capabilities for filling out the form. In detail, here's how to proceed:

Detailed breakdown by sections of the form

In Section 1, you'll provide your personal information such as your full name, address, and Social Security number. This section establishes your identity for the state’s records. Next, Section 2 focuses on income information where you will report earnings from various sources, like wages received and self-employment income.

When you reach Section 3, it’s crucial to identify allowable deductions. Here’s a step-by-step approach to accurately calculate adjustments and apply deductions, putting your financial data against the state guidelines. Finally, in Section 4, ensure you electronically sign the form, as this validates your submission and confirms the truthfulness of the information provided.

Common mistakes to avoid

Even experienced filers can stumble into pitfalls when completing the New Jersey Gross Income Form. Misreporting income sources is a frequent error, where individuals sometimes overlook freelance income or interest from savings accounts, mistakenly assuming these don’t need to be reported. Accurate totals are crucial, so double-check your entries against your documentation.

Another common mistake involves claiming incorrect deductions. Familiarize yourself with eligible deductions before filling out the form. Lastly, failing to sign or submit the form correctly can lead to unnecessary penalties or missed deadlines. It’s essential to ensure eSignatures are properly executed using pdfFiller's integrated tools.

Utilizing pdfFiller for enhanced convenience

pdfFiller offers various tools that enhance the form-filling experience, especially for teams collaborating on submissions. With collaborative editing capabilities, teams can work together seamlessly. Individuals can share drafts and solicit feedback through comments and annotations directly on the document.

Furthermore, storing and managing your forms in the cloud ensures accessibility and security. Uploading important tax documents into pdfFiller creates a centralized location for easy retrieval, helping you stay organized and assured that you won't lose any critical information come tax season.

Post-submission process

Once you've filed the New Jersey Gross Income Form, it's essential to understand what happens next. Generally, the processing timeline can vary, but staying informed through the New Jersey Division of Taxation's resources is helpful for checking on the status of your submission.

Keeping records is just as important after submission. Maintaining copies of your submitted forms and any supporting documents is vital for future reference, particularly if the New Jersey tax authorities reach out for clarifications or conduct an audit. It’s advisable to keep these records organized and readily accessible.

In the event of follow-ups or audits, be prepared to promptly respond to inquiries from tax authorities with the requested documentation. Good record-keeping drastically simplifies this process and mitigates anxiety associated with potential audits.

Interactive tools on pdfFiller

pdfFiller incorporates interactive tools that cater to your tax-related needs. One of the standout features is the form calculator, which allows users to estimate taxes owed based on their reported gross income. This feature can be particularly useful for anticipating tax liabilities, helping you plan your finances throughout the year.

Additionally, eSigning capabilities enhance the signing process. Utilizing electronic signatures speeds up the submission process while providing legal assurance of the signatures’ validity. Integrations with other services also ensure a seamless workflow, allowing you to connect pdfFiller with accounting software to manage your finances efficiently.

Final tips and best practices

Staying informed about any changes to New Jersey tax laws is crucial for effective tax planning. Tax regulations may shift due to legislative changes, and being proactive in understanding these changes can save you from potential complications during filing.

When facing uncertainties while filling out the New Jersey Gross Income Form, do not hesitate to consult with tax professionals. They can provide tailored advice that meets your specific circumstances and ensure that you optimize your tax situation. This approach helps you navigate complexities effectively while remaining compliant with state tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new jersey gross income for eSignature?

How do I make edits in new jersey gross income without leaving Chrome?

How do I fill out the new jersey gross income form on my smartphone?

What is New Jersey gross income?

Who is required to file New Jersey gross income?

How to fill out New Jersey gross income?

What is the purpose of New Jersey gross income?

What information must be reported on New Jersey gross income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.