Get the free New Mexico Independent Contractor Agreement

Get, Create, Make and Sign new mexico independent contractor

How to edit new mexico independent contractor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new mexico independent contractor

How to fill out new mexico independent contractor

Who needs new mexico independent contractor?

Understanding the New Mexico Independent Contractor Form: A Complete Guide

Overview of independent contractors in New Mexico

In New Mexico, independent contractors play a crucial role in the economy, offering flexibility and specialized skills across various industries. An independent contractor is characterized as a self-employed individual who provides services to clients under specific terms without being subject to the control of the hiring party in terms of how the work is conducted.

Understanding your classification as an independent contractor versus an employee is essential. Misclassification can lead to legal implications and financial repercussions for both contractors and businesses. Key differences include tax obligations, benefits eligibility, and the degree of control exercised by the employer.

Understanding the New Mexico independent contractor form

The New Mexico independent contractor form is a vital document that outlines the agreement between a contractor and a client. It serves several crucial purposes, including defining the scope of work, payment terms, and responsibilities of both parties. This clarity helps prevent misunderstandings that can arise in business agreements.

Legally, using this form can provide significant protection for both independent contractors and clients. It establishes clear expectations, protecting the rights of the contractor while ensuring the client receives the services as agreed. For instance, the form can delineate payment schedules, project timelines, and deliverables.

Who needs the New Mexico independent contractor form?

Various individuals and businesses can benefit from utilizing the New Mexico independent contractor form. Freelancers, consultants, and even businesses hiring temporary workers need this form to formalize their agreements. Common situations include IT consultants working on software projects, graphic designers creating marketing materials, or repair services provided by an independent technician.

By using the form, independent contractors can establish a professional relationship with clients, ensuring they have clear terms in writing. This not only fosters professionalism but also serves to protect their interests in case of disputes or misunderstandings. Moreover, properly documented agreements can enhance credibility and lead to more work opportunities.

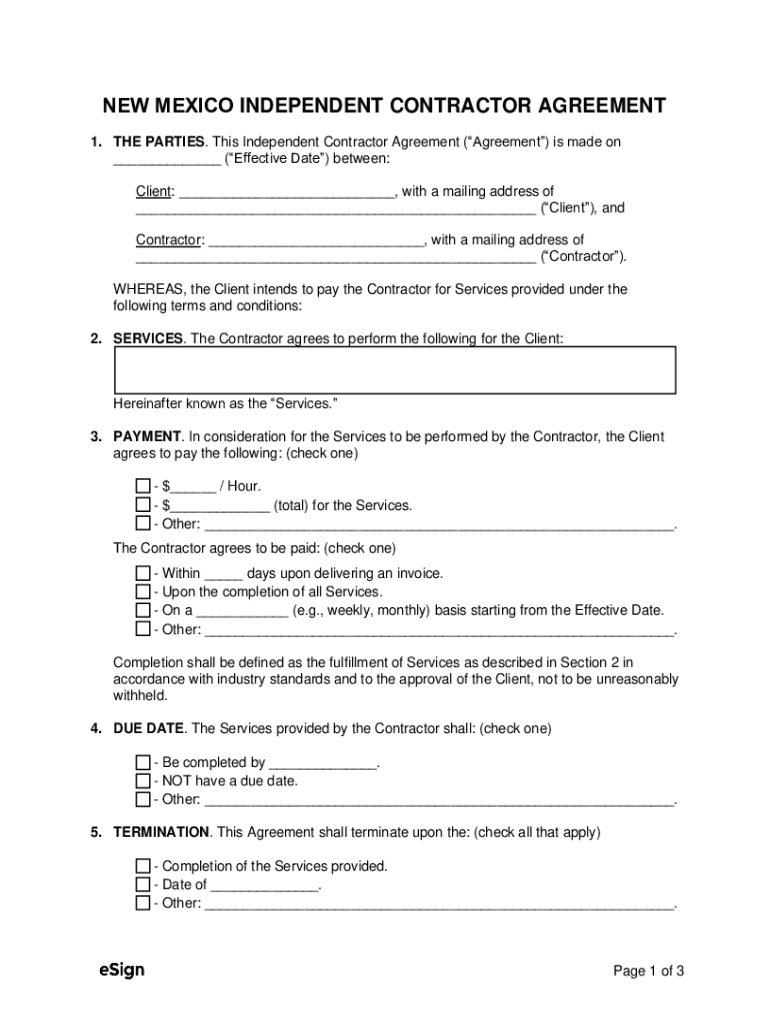

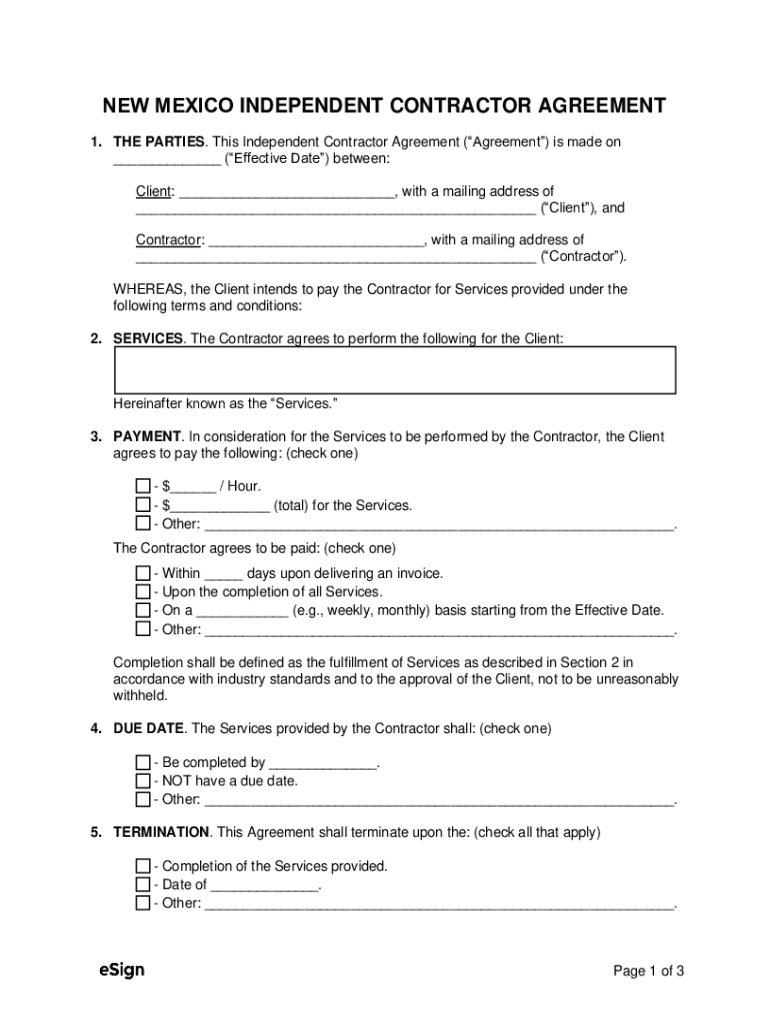

Components of the New Mexico independent contractor form

The New Mexico independent contractor form typically includes several essential sections that facilitate clear communication and understanding between the parties involved. These include:

Optional clauses, such as confidentiality agreements or non-compete clauses, can also be included. Additionally, incorporating clear legal language ensures that both parties fully understand their rights and responsibilities.

Step-by-step instructions for filling out the form

Filling out the New Mexico independent contractor form requires careful attention to detail. Here’s a concise breakdown of the essential information needed:

Key considerations are vital when completing the form. Ensure that each party has access to the document, understand every term included, and verify all legal requirements applicable to your agreement. Common mistakes to avoid include failing to sign the form, leaving sections blank, or using ambiguous language that can lead to misinterpretation.

Editing and customizing your independent contractor form

Once you have the basic template of the New Mexico independent contractor form, you might want to customize it to suit specific projects or needs. Utilizing tools like pdfFiller makes this process straightforward and user-friendly.

With pdfFiller, you can easily edit any section of the form, add additional clauses or language specific to your project, and save it for future use. This flexibility ensures that you can adapt the form for multiple clients or projects without starting from scratch each time.

Legal considerations in New Mexico

Navigating the legal landscape in New Mexico regarding independent contractors requires awareness of specific state laws. The state adheres to strict guidelines established by the IRS regarding independent contractor classification. Misclassification can result in penalties and back taxes.

Proper documentation is essential for compliance. Keep detailed records of contracts, correspondence, and payments to substantiate the independent contractor relationship should any legal issues arise. Familiarizing yourself with New Mexico’s employment laws will provide a solid foundation for protecting your rights.

Signing and validating the independent contractor form

Once the New Mexico independent contractor form is completed, signing it is essential to finalize the agreement. With pdfFiller, users have access to electronic signing options, which not only streamline the process but also enhance efficiency.

Electronic signatures are valid in New Mexico, provided that both parties consent to use them. Best practices for secure signature collection include verifying the identity of the signers and ensuring they have received the final draft of the form before signing, thus maintaining transparency and integrity within your agreement.

Managing independent contractor agreements

Effective management of independent contractor agreements is crucial for maintaining good relationships and ensuring project success. Organizing and storing forms electronically using platforms like pdfFiller allows easy retrieval and collaboration, making it easier to track changes and communications.

Tracking payments and deliverables helps ensure that contractors and clients are on the same page. Consider utilizing project management tools tailored for freelancers that allow easy communication and shift management to maintain smooth operations throughout the project lifecycle.

FAQs about the New Mexico independent contractor form

Many questions arise related to the use of the New Mexico independent contractor form. For example, what happens if you don’t use the form? Without a written agreement, parties may find themselves in disputes regarding the scope of work and payment terms. This could result in miscommunication, leading to potential legal issues.

Another common query is whether the form can be used for multiple projects. Yes, it can be adaptable for different projects; simply amend the project details section accordingly. Handling disputes related to independent contractor agreements can also be streamlined with detailed, written documentation as it serves as a reference point.

Additional tips for successful independent contractor relationships

Fostering successful independent contractor relationships hinges on building strong lines of communication. Regular check-ins prevent miscommunication and maintain momentum throughout the project's timeline. Setting clear expectations and boundaries upfront helps to eliminate misunderstandings.

Additionally, being open to feedback and responsive to concerns enhances the working relationship. The goal is to create a productive environment where both parties feel valued and empowered to express their expectations.

Tools and resources for independent contractors

Independent contractors in New Mexico can greatly benefit from various tools and resources available online. Useful templates found on pdfFiller can simplify the process of contract creation, ensuring compliance and thoroughness for every agreement.

Moreover, online courses and workshops aimed at skill development cater to independent contractors looking to refine their expertise. Networking opportunities, both local and virtual, allow contractors to build connections that can lead to new opportunities and collaborations.

Interactive features available on pdfFiller

Utilizing pdfFiller comes with interactive features designed to enhance the user experience. Live chat support is available for users needing assistance while completing forms, ensuring that help is just a click away.

The comprehensive help center and tutorials available on the platform guide users in navigating the document creation process seamlessly. Additionally, user feedback options encourage users to rate their experience, ultimately improving the platform for future users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new mexico independent contractor from Google Drive?

Can I create an electronic signature for the new mexico independent contractor in Chrome?

How do I complete new mexico independent contractor on an iOS device?

What is new mexico independent contractor?

Who is required to file new mexico independent contractor?

How to fill out new mexico independent contractor?

What is the purpose of new mexico independent contractor?

What information must be reported on new mexico independent contractor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.