Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign Finance Receipts Expenditures Form: A Comprehensive Guide

Understanding campaign finance forms

Campaign finance forms play a critical role in the electoral process, providing transparency and accountability over fundraising and spending activities. Ensuring compliance with these regulations is essential, as non-compliance can lead to significant legal consequences and fines. These forms serve not only as a record for campaign activity but also as mechanisms to inform the public about how much money is flowing in and out of a political race.

In essence, campaign finance receipts refer to all the contributions a campaign receives, while expenditures encompass all the spending done by the campaign. Familiarizing yourself with key terminology like 'contributions' (funds received from individuals or organizations) and 'expenses' (money spent on campaign activities) is crucial for correctly completing these forms. Understanding these basics lays the groundwork for effectively managing your campaign finance documentation.

Types of campaign finance forms

Campaigns vary significantly in structure and strategy, hence the necessity for diverse types of campaign finance forms. Individual candidate committees, Political Action Committees (PACs), and party committees each have specific forms tailored to their unique funding and expenditure patterns. Knowing which form applies to your campaign is vital for ensuring compliance.

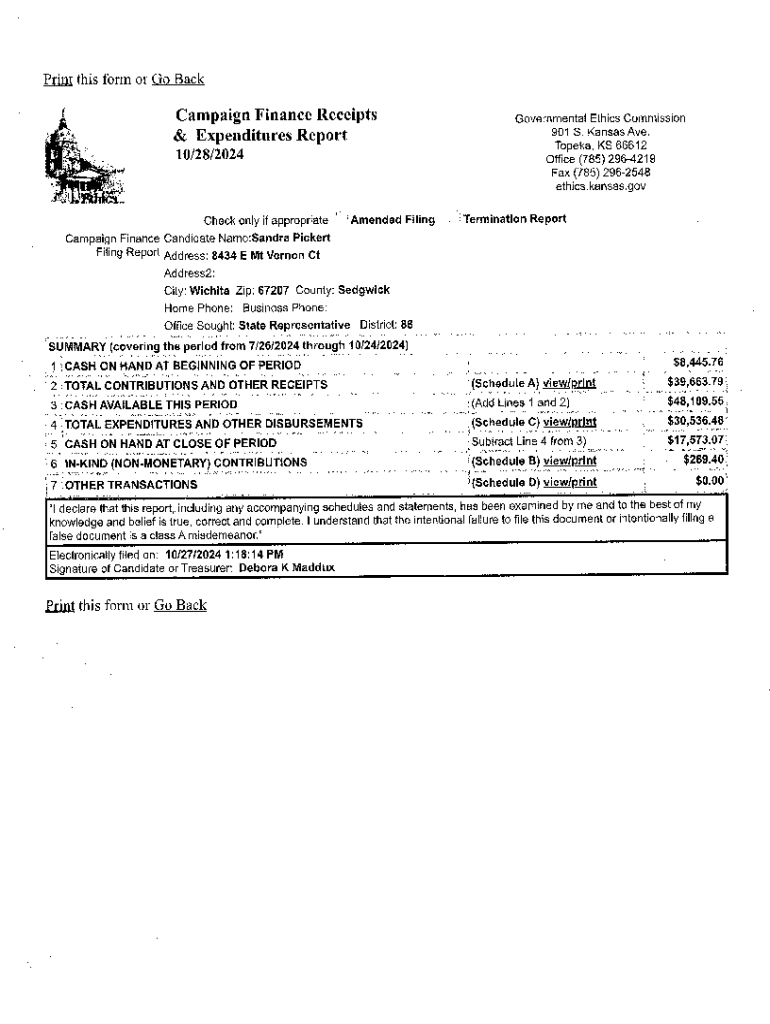

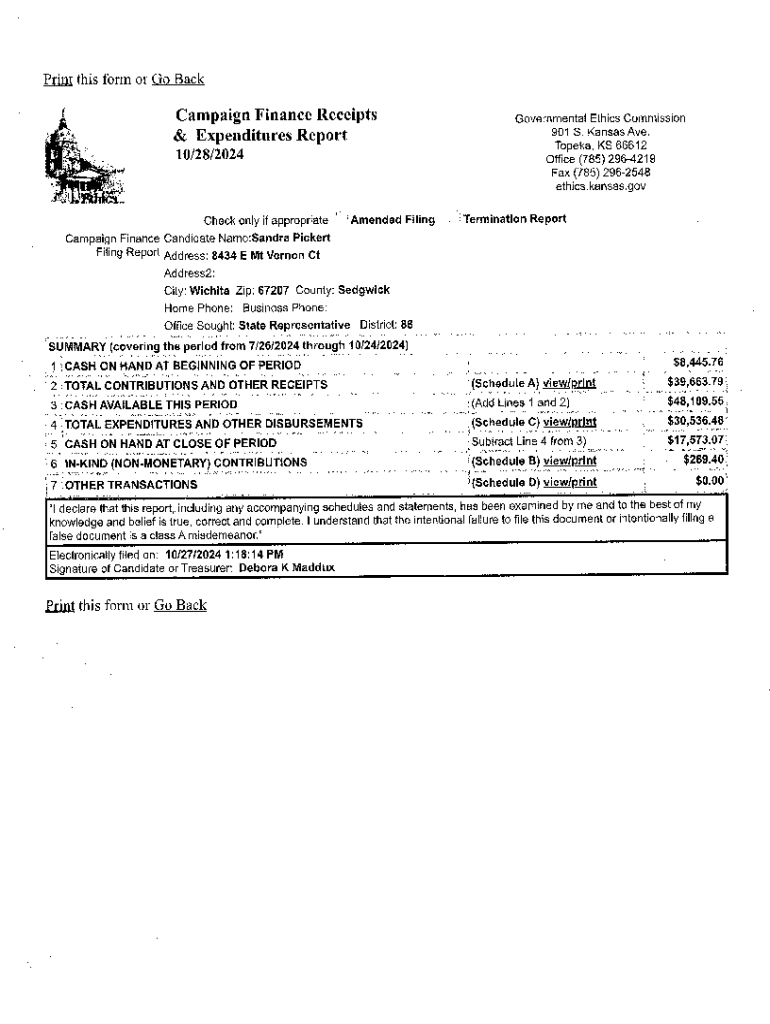

The campaign finance receipts expenditures form

The campaign finance receipts expenditures form summarizes all the financial activity of a campaign, capturing donations received and funds expended. Its primary purpose is to provide a clear and concise overview that aligns with state and federal regulations, allowing investigative bodies and the public to assess the financial viability and ethics of the campaign.

When filling out this form, various critical details must be included. You'll need to provide the full name and contact information of the committee, indicate the reporting period, and specify relevant election details. It's crucial to accurately convey a summary of all receipts and expenditures to maintain the integrity of the financial reporting process.

Step-by-step instructions for filling out the form

Preparation is key when tackling the campaign finance receipts expenditures form. Before diving into the form, gather all relevant documentation, including bank statements, records of donations, and lists of expenses incurred during the reporting period. This streamlining process helps ensure accuracy and completeness.

Once you've gathered your documentation, you can systematically fill out each section of the form. Start with the personal information section, entering details such as your committee's name and address. In the receipts section, clearly report contributions from various sources, and in the expenditures section, document all expenses in detail. Be mindful of common mistakes, such as leaving information incomplete or misreporting data, which can lead to compliance issues down the line.

Interactive tools for form management

pdfFiller streamlines the process of managing and filling out campaign finance forms through its robust interactive features. With document editing capabilities, users can easily modify any section of the form, ensuring that any changes are accurately reflected. Furthermore, pdfFiller facilitates electronic signatures and collaboration, making it easier for teams to work together while remaining compliant with campaign finance regulations.

Additionally, pdfFiller's integration with other financial tools allows campaign teams to track and analyze their financial data efficiently. By maintaining comprehensive records in one cloud-based platform, users can ensure that all information is accessible and manageable, enhancing transparency in their campaign finance practices.

Filing and maintaining compliance

Filing deadlines for the campaign finance receipts expenditures form are often dictated by election schedules and regulations, making it imperative for campaign teams to stay on top of deadlines. Timely submissions help avoid penalties and ensure that your campaign is on the right side of the law. Both electronic and paper filing methods are typically available, but electronic submissions are generally more efficient and easier to manage.

Ongoing documentation management is equally important. Keeping meticulous records of all financial transactions is crucial for future audits or reviews. Employing calendar reminders and task management systems can help ensure that no deadlines are overlooked, ultimately supporting the integrity of your campaign's financial practices.

Special cases and additional forms

There are specific exemptions and special circumstances that campaigns may encounter, such as claims of exemption from filing or no-activity reports. Understanding these special cases can be vital in navigating campaign finance regulations effectively. The Claim of Exemption from Filing allows campaigns that meet certain criteria to avoid the rigorous reporting typically required.

Additional forms, such as the Disclosure Form in EFS Paper Version or the Statement of Identity Form, can enhance transparency for campaigns. Utilizing these forms can help reinforce the credibility of your campaign's financial reporting and further demonstrate compliance with regulatory standards.

Best practices for campaign finance management

Accurate reporting is a cornerstone of successful campaign finance management. Regularly updating and reviewing your financial records can significantly reduce errors and improve compliance rates. Implementing a systematic approach to track contributions and expenditures makes it easier to maintain an organized financial framework as the campaign progresses.

Collaboration among team members is also essential in maintaining accuracy and transparency. By coordinating financial efforts, everyone involved can share insights and ensure that all records are accurate and comprehensive. Leveraging tools like pdfFiller to centralize document management can facilitate better collaboration, helping to minimize the risk of misreporting during the financial reporting process.

Staying updated on campaign finance regulations

Campaign finance regulations are ever-evolving, making it crucial for campaign teams to stay informed about legislative changes that may impact their reporting obligations. Resources like the Federal Election Commission (FEC) website and local election offices can provide timely updates about any regulatory shifts. Establishing a routine to review these resources ensures that your campaign remains compliant and avoids any potential issues.

Engaging with professional services, such as legal or financial experts, can further aid in navigating the complexities of campaign finance laws. These professionals can offer tailored advice and assist with any challenging scenarios your campaign may face, ensuring a more seamless compliance experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts expenditures directly from Gmail?

How can I edit campaign finance receipts expenditures on a smartphone?

How do I edit campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.