Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding the campaign finance receipts expenditures form

Understanding campaign finance

Campaign finance plays a critical role in elections, impacting the way candidates fund their campaigns and the overall integrity of the electoral process. Defined as the financing of political campaigns, it encompasses contributions from individuals, organizations, and Political Action Committees (PACs). Ensuring transparency and accountability in campaign finance is essential to maintaining trust in democratic systems.

Receipts and expenditures are the two sides of campaign finance. Receipts refer to the funds raised by candidates, while expenditures represent the money spent on campaign activities. Each of these components must be meticulously documented and reported, as they are closely regulated by election laws and regulations.

Legal regulations surrounding campaign finance vary by jurisdiction, but they generally include limits on contributions and detailed reporting requirements. Understanding these regulations is crucial for candidates and campaign managers to avoid infractions and penalties.

The role of campaign finance receipts and expenditures form

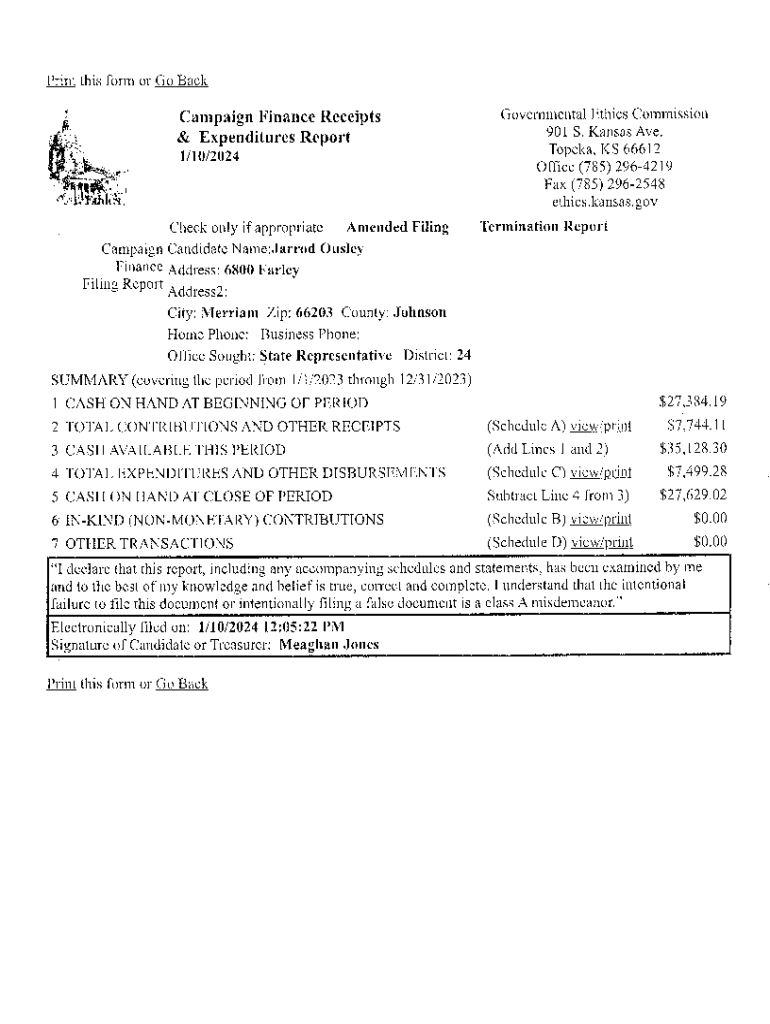

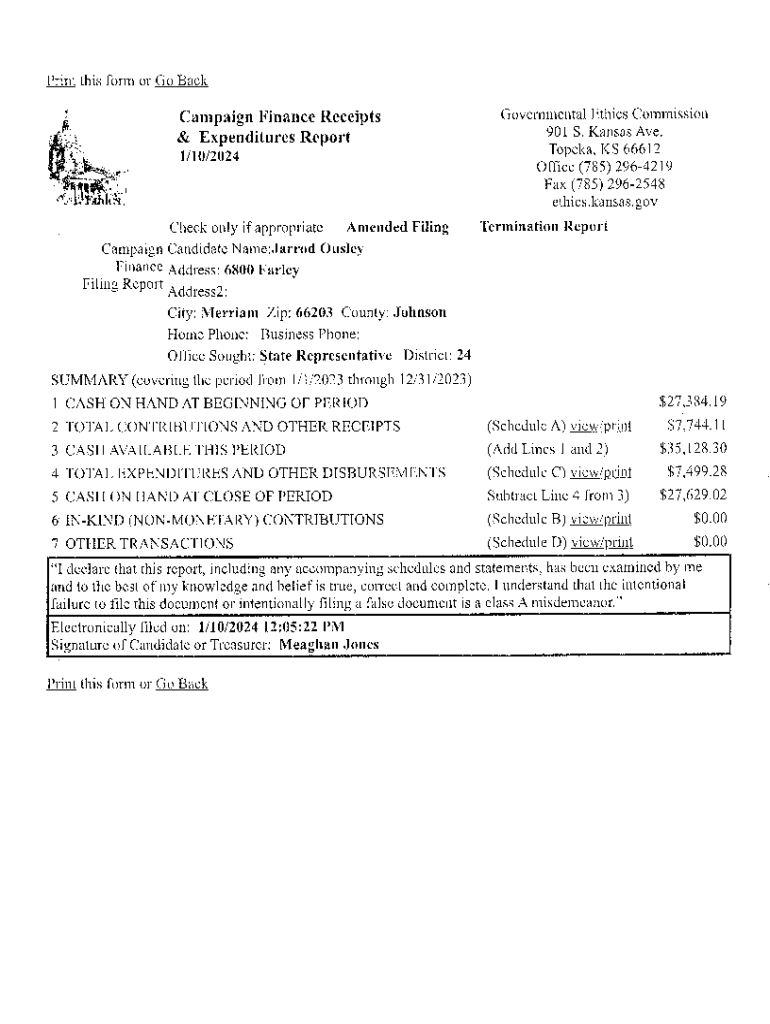

The campaign finance receipts expenditures form serves a pivotal role in the political campaign process. Its primary objective is to record all financial contributions received and expenditures made by a candidate or campaign committee. This form is not just a bureaucratic requirement but a vital tool for ensuring the integrity of the electoral process.

Candidates, campaign committees, and certain organizations are required to file this form, depending on their jurisdiction and the regulations governing their campaigns. The frequency of filing can vary from state to state, ranging from quarterly submissions to more frequent filings closer to election dates. Understanding the specific deadlines related to these filings is equally important, as failing to meet them can lead to fines and penalties.

Key components of the receipts and expenditures form

The campaign finance receipts expenditures form is structured to detail both receipts and expenditures transparently. Breaking down receipts is one of the essential components, as it reflects the types of contributions. Typically, contributions can be classified into three main categories: individual contributions, corporate contributions, and in-kind contributions.

Each category comes with its own reporting requirements to ensure transparency. Expenditures, too, must be clearly categorized; types include advertising expenses, salaries, and various services contracted for campaign activities. Proper tracking and reporting of these expenditures are crucial to comply with campaign finance laws.

Step-by-step guide to filling out the form

Filling out the campaign finance receipts expenditures form can seem daunting, but a systematic approach makes the process manageable. Here’s a step-by-step guide to assist candidates and their teams.

Step 1: Gather necessary information

Start by collecting all relevant financial records. This includes contributions received and documented expenses. Complete contributor information, such as names, addresses, and contribution amounts, should be compiled. Also, ensure you have detailed accounts of expenditures including dates, amounts, and the purpose of the spending.

Step 2: Inputting contributions

When inputting contributions into the form, categorize each type correctly—whether they are individual, corporate, or in-kind. Be aware of common mistakes, such as inaccurate reporting of contribution amounts or failing to disclose all contributors. Double-checking your entries can save significant headaches later.

Step 3: Documenting expenditures

While documenting expenditures, distinguish between reportable and non-reportable expenses. Accurate entry guidelines dictate that all significant expenditures for campaign activities should be reported. Regularly review and reconcile your expenditures against bank statements to ensure accuracy.

Step 4: Double-checking and validation

Before finalizing the form, it’s crucial to double-check all data for accuracy. Errors in campaign finance reporting can lead to serious consequences. Utilize tools for verification that can assist in organizing and validating the information before submission.

Interactive tools and resources for managing campaign finances

In today's digital age, various interactive tools streamline the management of campaign finances. Using pdfFiller for filling out the campaign finance receipts expenditures form offers immense advantages. This platform enables users to edit and customize PDF forms easily, making it straightforward to manage financial documentation.

Additionally, it provides eSigning and sharing capabilities, allowing for efficient collaboration among campaign team members. Cloud-based document management features help ensure that all your documents are securely stored and easily accessible from anywhere.

Collaborative tools for team management

Collaboration is key in managing campaign finances effectively. pdfFiller's collaborative tools allow team members to share and review documents securely. This ensures that everyone is on the same page when tracking campaign contributions and expenditures, fostering accountability and transparency within the team.

Common challenges and solutions

Navigating the complexities of campaign finance reporting can present various challenges. One common issue is the sheer volume of documentation required, making it easy to miss deadlines or misreport financials. Simplifying the process through automation and using organized digital filing systems can dramatically reduce these pitfalls.

What to do if you miss a deadline? It's vital to act promptly by filing missing reports as quickly as possible and notifying the appropriate office. Additionally, should you need to amend previously submitted forms, this process can typically be undertaken by resubmitting corrected documents alongside an explanation of the amendments.

Understanding the implications of filing errors

Accurate reporting on the campaign finance receipts expenditures form is not just a bureaucratic obligation; it has real consequences. Errors in these filings can lead to potential penalties, including fines and restrictions on future fundraising efforts. In severe cases, candidates may face legal ramifications or damage to their reputations.

Best practices for avoiding mistakes include regular audits of financial documents by dedicated team members and utilizing automated tools that reduce human error. Moreover, consulting with a financial advisor who specializes in campaign finance can equip candidates with additional safeguards against common pitfalls.

Conclusion before filing: final checks

Before submitting the campaign finance receipts expenditures form, ensure that all information is complete and accurate. Take the time to review all contributions and expenditures reflected on the form. Failing to do so can lead to unnecessary complications down the line.

Key review points include checking for inconsistencies, verifying contributor information, and ensuring that all expenditures are recorded correctly. Post-filing, it's important to maintain clear records and documentation of all transactions in the event of an audit or inquiry.

FAQs about campaign finance receipts and expenditures form

Many individuals and teams have questions about the campaign finance receipts expenditures form. Understanding common queries can simplify the filing process and clarify any uncertainties.

By addressing these and other common questions, candidates can approach the campaign finance receipts expenditures form with greater confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts expenditures to be eSigned by others?

How do I edit campaign finance receipts expenditures straight from my smartphone?

How do I fill out the campaign finance receipts expenditures form on my smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.