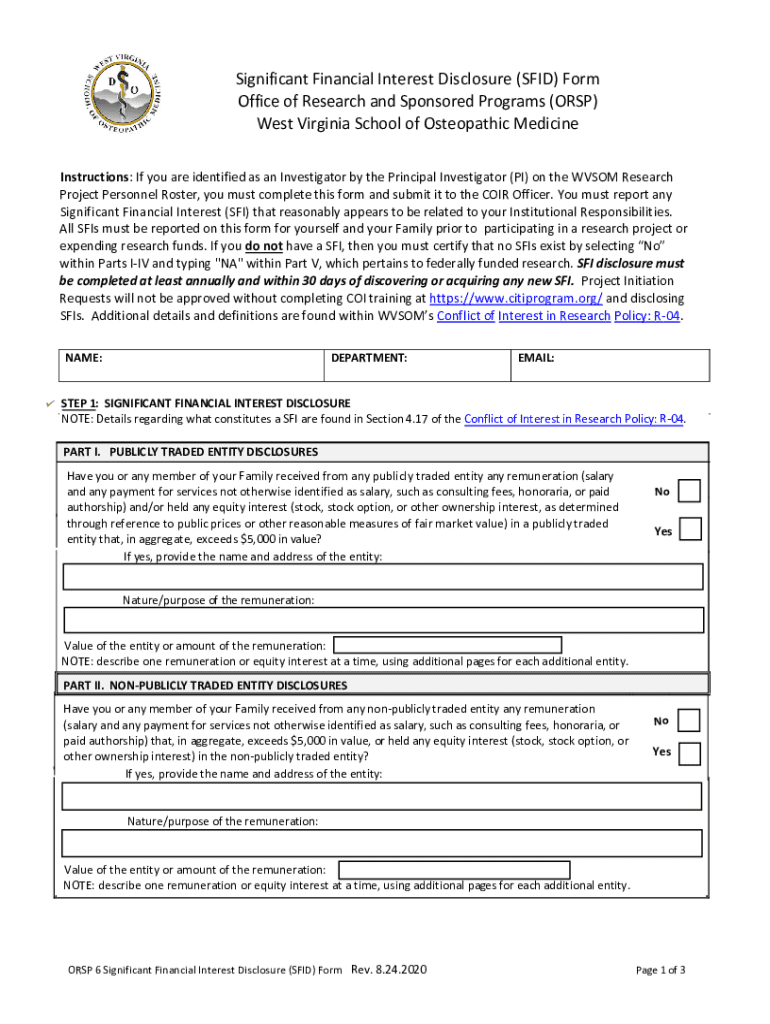

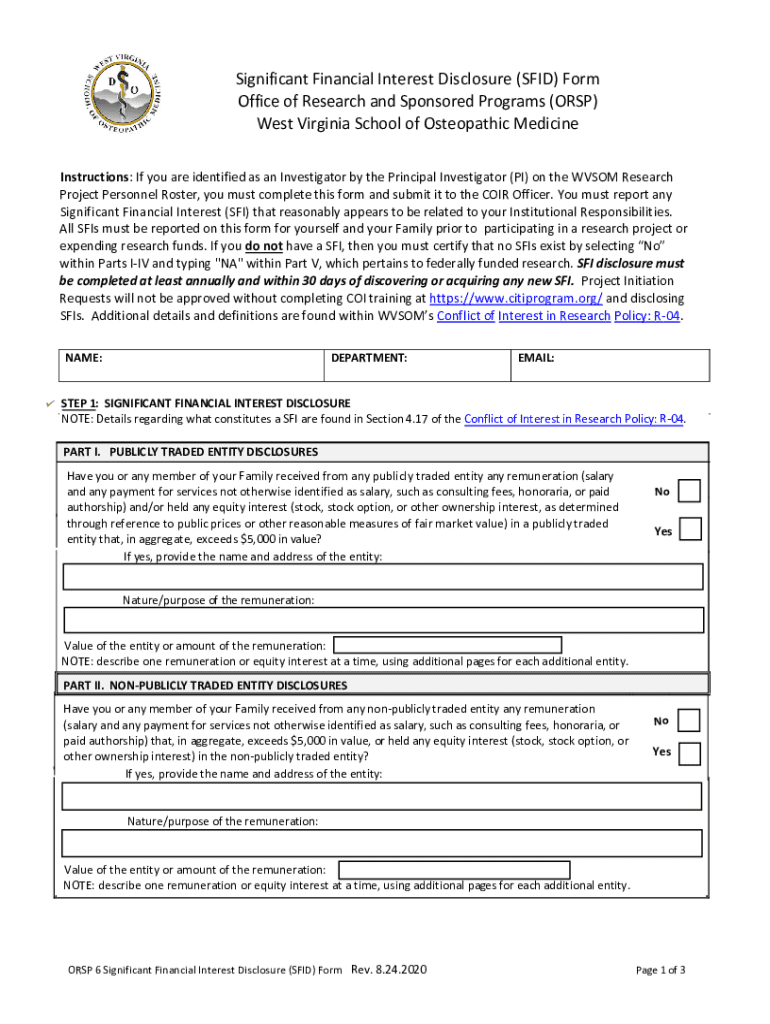

Get the free Significant Financial Interest Disclosure (sfid) Form

Get, Create, Make and Sign significant financial interest disclosure

Editing significant financial interest disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out significant financial interest disclosure

How to fill out significant financial interest disclosure

Who needs significant financial interest disclosure?

Understanding the Significant Financial Interest Disclosure Form

Understanding significant financial interest (sfi)

A significant financial interest (SFI) refers to any financial interest or stake that could potentially influence, or be perceived to influence, a researcher’s integrity, objectivity, or responsibilities. This concept is critical in academic and research settings, where the credibility of findings and the trust of the community are paramount. Disclosing SFIs ensures that the research maintains its integrity, allowing for unbiased results and fostering innovation. SFI disclosures play a crucial role in dispelling conflicts of interest, as they give institutions and funding bodies insight into potential conflicts that may arise from external financial relationships.

Disclosures mitigate risks associated with research biases, enabling funding agencies and peer reviewers to assess the credibility of the work being presented. When researchers declare their significant financial interests, they uphold the tenets of transparency and ethical research practices, thus enhancing public trust in scientific findings.

Who is required to disclose?

Individuals who are involved in research, scholarship, and innovation are typically required to disclose their significant financial interests. This includes not only principal investigators but also co-investigators, students, and certain institutional personnel who participate in or contribute to research activities. The specific roles subject to disclosure can vary; however, those directly involved in the conduct or funding of research must be transparent about their financial relationships.

Institutions often set their requirements for compliance, urging all members of a research team to be diligent about reporting any significant financial interest. For example, many universities in the United States have adopted clear policies that mandate disclosures before submitting grant applications and protocols to institutional review boards (IRBs). Ensuring compliance not only guards the institution against potential legal ramifications but also fosters a culture of accountability and ethical research.

What must be disclosed?

The types of financial interests that qualify as significant include, but are not limited to: stock holdings, consulting fees, royalties, and any intellectual property rights that an individual may possess. Each of these categories holds the potential to influence research and findings. For instance, ownership of stock in a company that could benefit from the research outcome or receiving consulting fees can create conflicts that jeopardize the integrity of the research process.

It’s also important for researchers to know which situations are excluded from disclosure requirements; these often include small ownership stakes in publicly traded companies or travel reimbursements from a research sponsor. Understanding the guidelines set by an institution plays a crucial role in determining what must be disclosed. Failure to disclose significant financial interests can greatly affect the integrity of the research, possibly leading to the retraction of studies, loss of funding, or academic penalties.

Timeline for disclosure submission

Institutions typically require annual disclosures from researchers regarding their significant financial interests, with specific key dates set for submission. Beyond these scheduled disclosures, certain situational triggers necessitate ad-hoc disclosures, which may include new financial relationships, changes in existing interests, or the initiation of new research activities. It is crucial to remain vigilant; delays in submission can lead to serious consequences, including potential funding disruptions and jeopardizing the reputation of both the research team and the institution.

Keeping a calendar with disclosure reminders or utilizing compliance management tools can help researchers meet these deadlines. Regular communication with institutional compliance offices ensures that teams are informed about any changes to policies or requirements.

How to make disclosures

Filling out the significant financial interest disclosure form can be streamlined with proper preparation and organization. Initially, researchers should gather all necessary documentation related to their financial interests. Using platforms like pdfFiller can greatly facilitate this process, allowing users to fill out, edit, and manage forms electronically from anywhere. The user-friendly interface of pdfFiller makes it easy to access the necessary disclosure templates and guides.

To ensure complete and accurate disclosures: ...

Utilization of disclosure information

Institutions play a critical role in utilizing disclosure information for compliance purposes. They assess submitted SFIs to manage potential conflicts of interest, ensuring researchers do not engage in inadvisable practices that could compromise the integrity of their research. Furthermore, transparency surrounding these disclosures has a profound impact on obtaining funding and grants, as external organizations often require robust disclosure policies as part of their guidelines for financial support.

Ensuring that researchers maintain clear communication about their financial interests helps uphold the institution's reputation and fosters public trust. When scientists are open about their financial relationships, it increases the integrity of their conclusions, as external parties can make informed decisions based on full disclosure.

Common challenges in the disclosure process

Despite the importance of disclosures, researchers often encounter challenges throughout the process. One primary challenge is accurately identifying what constitutes a significant financial interest, leading to unintentional non-disclosure or incomplete reporting. Navigating institutional policies can also be complex, particularly in larger organizations where policies may differ or be updated frequently.

Misunderstandings about disclosure requirements can compound these issues, leaving researchers uncertain about their obligations or consequences of non-disclosure. To address these challenges, institutions must provide clear guidelines, accessible resources, and regular training sessions on compliance with the significant financial interest disclosure form.

Preparing for your disclosure submission

Before submitting your significant financial interest disclosure, it’s vital to prepare thoroughly. Using a worksheet or checklist can help organize your financial interests, making it easier to disclose relevant information accurately. Some essential questions to consider include: ...

Reflecting on these questions will guide you in understanding the relevancy of your financial interests and ensuring that your submission is comprehensive.

Step-by-step guide for filing your disclosure

Filing your significant financial interest disclosure form can be straightforward when you follow these steps: ...

By adhering to these steps, researchers can facilitate a smoother process, ensuring compliance and integrity in their research activities.

Support for navigating the disclosure process

While navigating the disclosure process can be complex, tools and resources are available to assist researchers. pdfFiller offers interactive tools that simplify disclosure management, ensuring that forms are accessible and editable in a cloud-based environment. Additionally, institutional compliance offices can provide personalized assistance, answering specific questions and clarifying any uncertainties regarding disclosure requirements.

Researchers are encouraged to reach out to their compliance offices for guidance and utilize the FAQs provided through institutional websites, which can offer quick clarifications on common issues. Engaging with these resources maximizes understanding of the disclosure process and helps individuals fulfill their obligations responsibly.

Case studies and real-world examples

Examining successful disclosure practices across various institutions showcases the positive impacts of transparency. One notable example includes a university that implemented mandatory training for faculty and staff on SFI disclosures, resulting in significantly fewer compliance issues and a boost in research funding. Concurrently, institutions that failed to manage disclosures properly faced retractions of high-profile studies and loss of grant money, emphasizing the necessity for thorough disclosure policies.

These case studies highlight important lessons; proper disclosures not only maintain research integrity but also facilitate sustained relationships with funding bodies that value transparency. As research increasingly relies on external support, cultivating a culture of responsibility regarding disclosures is essential for long-term success.

Future of financial disclosure in research

The landscape of financial disclosures is evolving rapidly, with current trends indicating stricter regulations and an increase in institutional accountability. Institutions are also leaning towards adopting cloud-based solutions, like pdfFiller, to manage disclosures more effectively, ensuring that researchers can easily access, submit, and update forms in real-time.

As technology continues to evolve, the role of secure digital management solutions will become increasingly vital in maintaining compliance. Future regulations are likely to emphasize real-time reporting and the integration of automated processes to facilitate disclosures. Staying informed and adapting to these changes will be paramount for researchers and institutions alike, as they navigate the complexities of significant financial interest disclosures in the coming years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit significant financial interest disclosure from Google Drive?

How do I fill out significant financial interest disclosure using my mobile device?

How do I complete significant financial interest disclosure on an Android device?

What is significant financial interest disclosure?

Who is required to file significant financial interest disclosure?

How to fill out significant financial interest disclosure?

What is the purpose of significant financial interest disclosure?

What information must be reported on significant financial interest disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.