Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out transient occupancy tax monthly

Who needs transient occupancy tax monthly?

Understanding the transient occupancy tax monthly form

Understanding transient occupancy tax (TOT)

Transient occupancy tax (TOT) is a tax levied on guests who stay at lodging facilities, such as hotels, motels, and other short-term rentals. This tax is usually calculated as a percentage of the room rate and is collected by property owners. The funds collected from TOT play a crucial role in supporting local economies, funding tourism promotion, public safety, and infrastructure development. For property owners and managers, understanding the associated compliance requirements is vital to avoid penalties.

What is the “bed tax”?

Often referred to as the 'bed tax', the transient occupancy tax is designed to capture revenue from short-term stays at lodging facilities. The term 'bed tax' can be misleading as it applies to a variety of accommodations beyond just beds, including vacation rentals and shared lodging spaces. The total tax applies only to the portion of rent that exceeds a certain amount, and it varies by jurisdiction.

The bed tax is typically calculated based on the cost of the stay — usually a percentage added to the nightly rate. The most notable difference between TOT and other local taxes is that TOT specifically targets the rental and hospitality sectors, thereby ensuring that visitors contribute to the local economy. Unlike sales tax, which is applied to all purchases, bed tax is exclusive to tourism-related services.

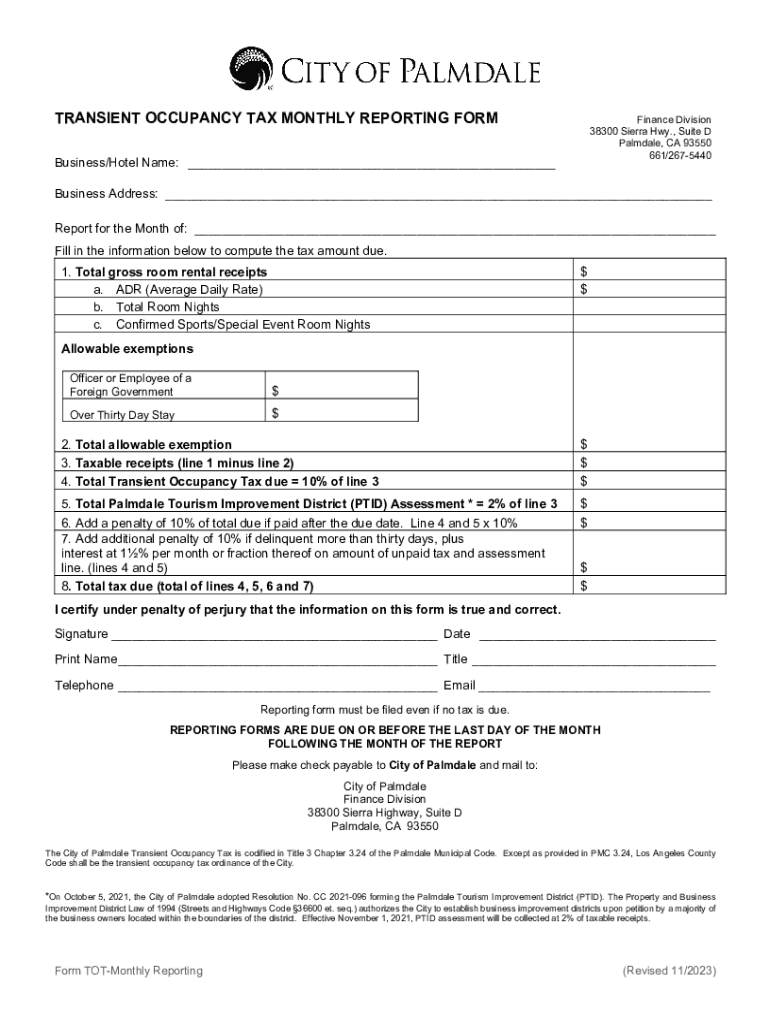

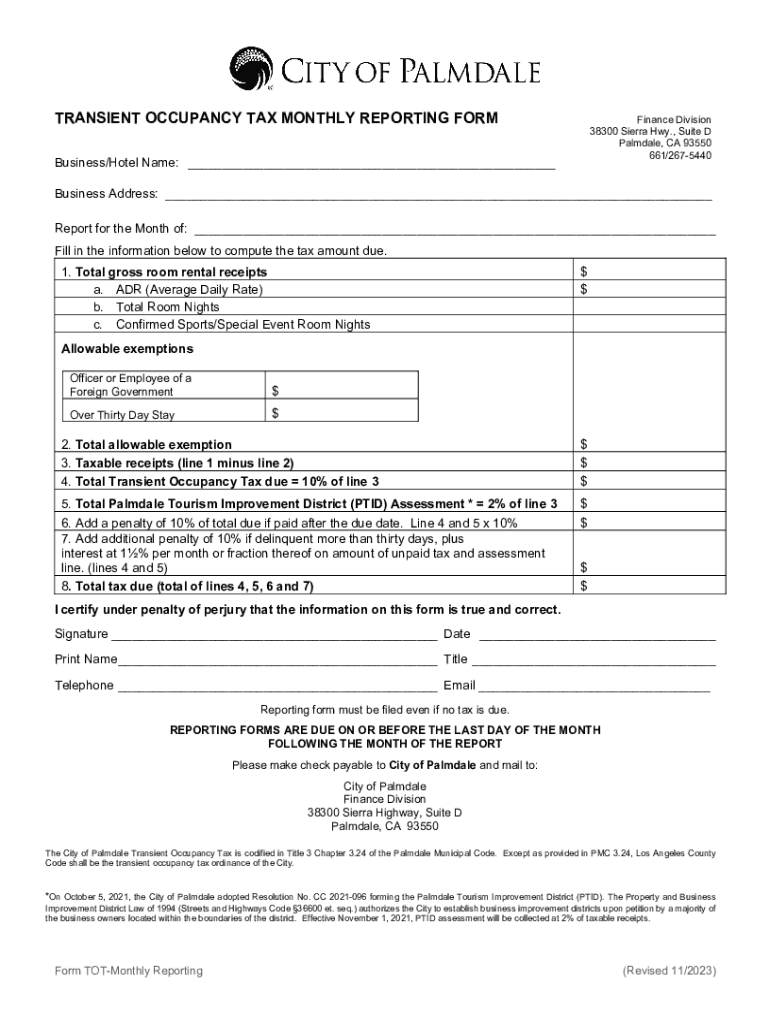

Key components of the transient occupancy tax monthly form

The transient occupancy tax monthly form requires specific information from property owners to ensure accurate tax assessment. Proper completion of this form is crucial for compliance and avoiding fines. The required information usually includes details about the property, occupancy statistics, revenue calculations, and tax payments.

Completing the transient occupancy tax monthly form

Completing the transient occupancy tax monthly form can seem daunting, but following a structured approach can make it manageable. Start by accessing the form through pdfFiller to ensure you have the most current version. Accuracy in entering data is critical to reflect your property details accurately.

Ensuring that all figures are accurate helps avoid pressure points later in the compliance process. It’s prudent to review the form a second time to catch any possible errors beforehand.

Managing and submitting the form

Once the transient occupancy tax monthly form is completed, the next step involves submitting this information to your local tax authority. Each jurisdiction has specific deadlines for these submissions, typically set at the end of each month. Timely submission is important to avoid late fees or penalties.

After submission, keep an eye out for any confirmation of receipt from your local agency. Maintaining thorough records of your submissions is vital for future reference, especially in case of audits or discrepancies.

Frequently asked questions (FAQs)

Understanding the nuances of the transient occupancy tax monthly form often raises numerous questions. Addressing common inquiries can provide clarity to property owners.

Official notices and publications

Local tax authorities often publish official notices and updates regarding transient occupancy tax. This can include changes in tax rates, deadlines, and forms. Staying informed will ensure that property owners and managers remain compliant with the latest rules affecting TOT, fostering a smoother reporting process.

Related forms and applications

Navigating the process of transient occupancy tax may require attention to various forms and applications. Here are some commonly related forms you might encounter:

Business activities that require a county business license

Property owners who engage in short-term rentals must often obtain a county business license. This requirement varies by jurisdiction but serves as a critical compliance measure. Understanding the local regulations is key as this affects how and when you can operate your rental business legally.

Contact information and support resources

For specific questions regarding transient occupancy tax, property owners should direct inquiries to their local tax office. Maintaining an up-to-date contact list can be invaluable. Additionally, pdfFiller support can assist users facing challenges related to form completion or submission.

Updates and announcements

Staying updated on changes affecting the transient occupancy tax landscape is crucial for property owners. Regular announcements concerning tax rates, filing processes, or new regulations can profoundly impact your responsibilities as a property manager and affect your financial planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pdffiller form?

How do I make edits in pdffiller form without leaving Chrome?

How do I edit pdffiller form on an iOS device?

What is transient occupancy tax monthly?

Who is required to file transient occupancy tax monthly?

How to fill out transient occupancy tax monthly?

What is the purpose of transient occupancy tax monthly?

What information must be reported on transient occupancy tax monthly?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.