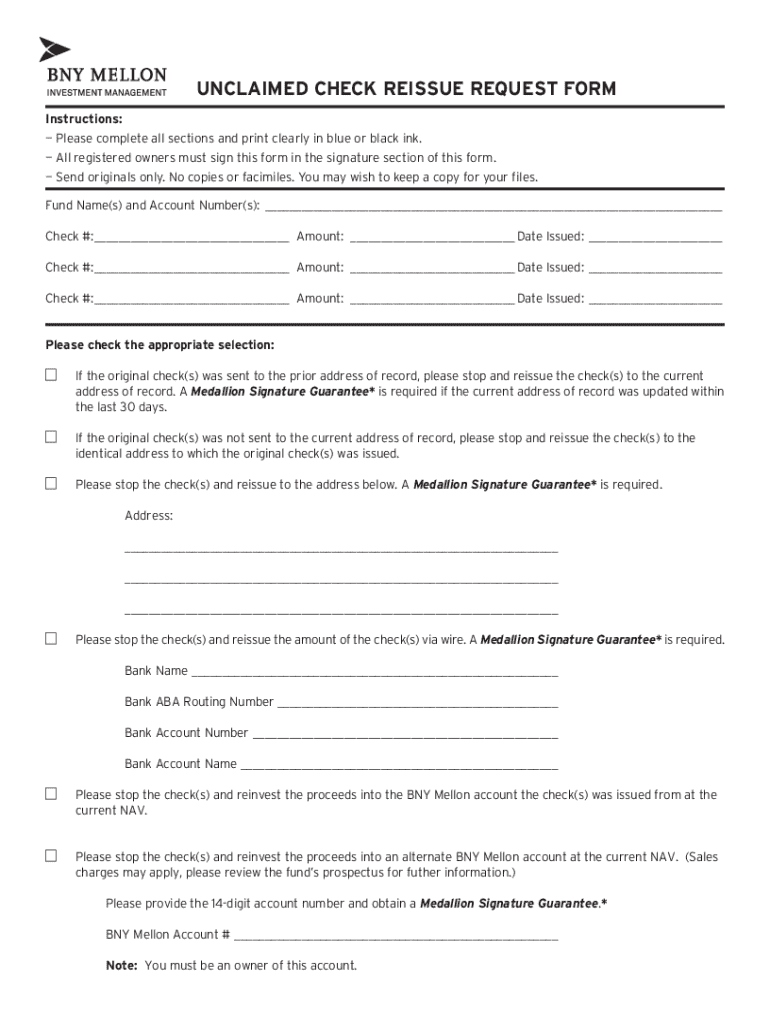

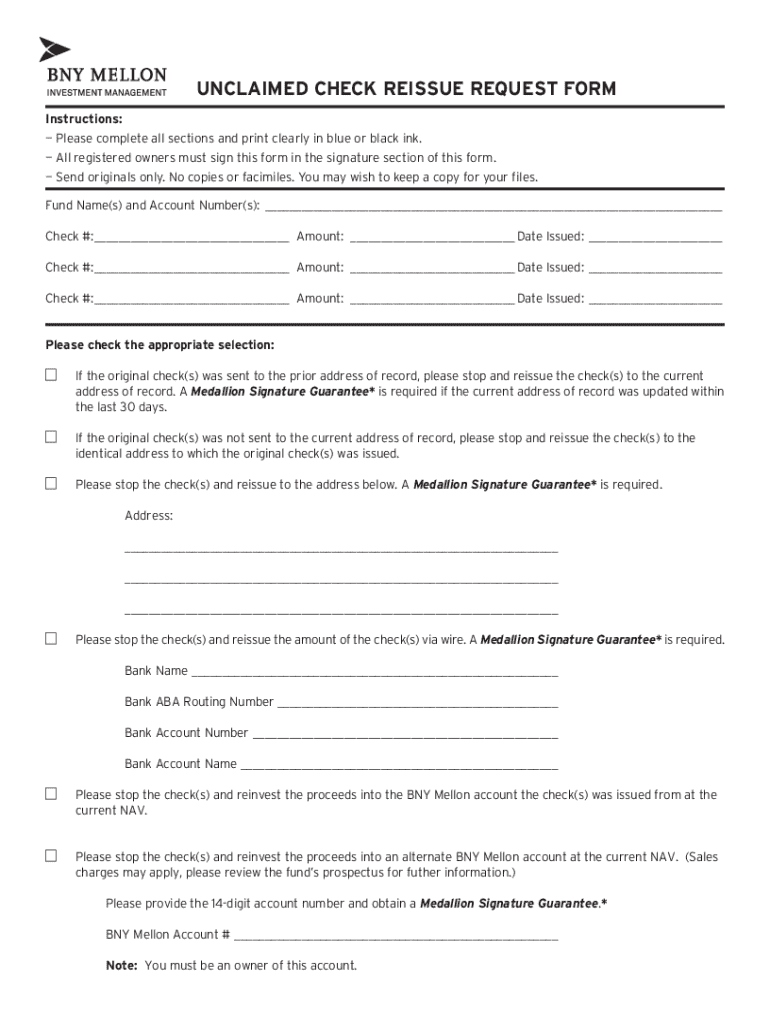

Get the free Unclaimed Check Reissue Request Form

Get, Create, Make and Sign unclaimed check reissue request

Editing unclaimed check reissue request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unclaimed check reissue request

How to fill out unclaimed check reissue request

Who needs unclaimed check reissue request?

Unclaimed Check Reissue Request Form: Your Comprehensive Guide

Understanding unclaimed checks

Unclaimed checks are financial instruments issued by entities such as employers or government agencies that remain uncashed by the recipient within a specific timeframe. When a check goes unclaimed, it is often sent to a state unclaimed property division. This can happen for several reasons, from simple oversight to significant life changes affecting the recipient’s ability to access their funds.

Reclaiming unclaimed funds is crucial, not just for financial stability but also to ensure that individuals are not losing out on money that rightfully belongs to them. The process is straightforward with the right information and documentation.

Eligibility for reissue of unclaimed checks

Eligibility to reissue an unclaimed check varies from state to state and depends on whether the claimant is an individual or an organization. Generally, anyone who can demonstrate entitlement to the funds can apply for a reissue. It's essential to familiarize yourself with specific state laws governing these checks since they dictate the necessary processes and available assistance.

Documentation required typically includes personal identification, such as a government-issued ID, and proof of ownership of the funds in question, such as a pay stub or invoice.

Reissuing an unclaimed check

The process to request a reissue of an unclaimed check involves several important steps to ensure a smooth transaction. It begins by determining the issuer of the check, which may include an employer, a government agency, or another entity. Once the issuer is identified, claimants can collect the required documentation to support their request.

Completing the request form accurately is crucial. Look for sections that require your personal details, check details, and proving your identity as the recipient. Don’t forget to consult the relevant state laws or issuer guidelines on form filling.

Tracking your reissue request

After submission, tracking your request can help you stay informed about its status. Many issuers provide confirmation of receipt for electronic submissions, allowing you to follow up if necessary.

Common issues and solutions

When dealing with unclaimed checks, several common issues may arise during the reissue process. Understanding these can save time and effort when preparing your application.

FAQs about unclaimed check reissues

Many questions arise during the unclaimed check reissue process, and knowing the answers can provide clarity and assurance as you navigate this task.

Additional tips

Proactive management of your financial documents can prevent the unclaimed check scenario from occurring. By keeping informed and organized, individuals can minimize delays in receiving their money.

Support and assistance

If issues arise concerning your unclaimed check, reaching out to appropriate customer support is crucial. Reliable support channels can guide you through the complexities involved in reissue requests.

Legal aspects of unclaimed checks

Understanding the legal landscape governing unclaimed checks helps individuals navigate the reissue process more effectively. Key laws outline how and when unclaimed property laws come into effect, offering protections for rightful owners.

Integrating technology in document management

In today's digital age, leveraging cloud-based solutions for document management becomes essential for keeping track of important financial documents. Platforms such as pdfFiller enable users to manage their forms effectively, enhancing productivity.

Closing the loop

After your request for an unclaimed check reissue is submitted, don’t forget the importance of following up. Continuous engagement with the process not only ensures you receive your funds promptly but also helps maintain records in an organized manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my unclaimed check reissue request directly from Gmail?

Can I create an electronic signature for signing my unclaimed check reissue request in Gmail?

How do I fill out the unclaimed check reissue request form on my smartphone?

What is unclaimed check reissue request?

Who is required to file unclaimed check reissue request?

How to fill out unclaimed check reissue request?

What is the purpose of unclaimed check reissue request?

What information must be reported on unclaimed check reissue request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.